Dogecoin Meme Coin Price Outlook: Crypto Whales Scoop Up 250 Million DOGE Tokens

Jakarta, Pintu News – The price of Dogecoin appears to be weakening and moving in the red, hovering around $0.095 on Monday as of this writing, after dropping more than 7% in the past week.

On-chain data shows that some whales took advantage of the latest price drop to add to their DOGE holdings, indicating reduced selling pressure and signaling potential price stabilization in the short term.

From a technical perspective, the momentum indicator shows that the weakening has begun to subside, thus opening up opportunities for recovery if DOGE is able to break back through the resistance area on the lower trend line.

Dogecoin whales buy 250 million tokens

Supply Distribution data from Santiment supports a bullish outlook for Dogecoin, as some whales were seen buying up the dog-themed meme coin when the price dropped in recent days.

Read also: 3 Major Token Unlocks to Watch in the Second Week of February 2026!

The data shows that whales holding between 100,000 to 1 million DOGE tokens (red line), as well as 10 million to 100 million DOGE tokens (blue line), have accumulated a total of 250 million DOGE since Thursday.

During the same period, whales who held between 1 million and 10 million DOGE (yellow line) actually offloaded around 110 million tokens. This indicates that the first group of whales capitalized on the momentum of the price drop to collect Dogecoin at a discount.

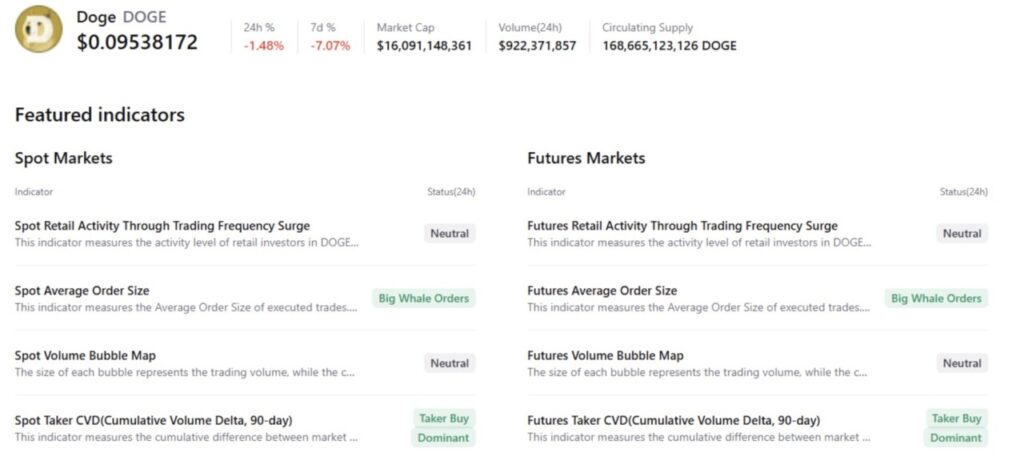

Summary data from CryptoQuant is also in line with this positive outlook, as DOGE spot and futures markets show large whale orders and dominance of buying, signaling a potential price recovery ahead.

Dogecoin Price Forecast: DOGE Returns to the Lower Boundary of the Falling Wedge Pattern

Dogecoin’s price fell more than 7% last week, bottoming out around $0.080, slightly above the weekly support area of $0.078, before finally bouncing on Friday to retest the previously broken trend line.

Read also: Dogecoin Price Hovering at $0.09 Today: Can DOGE Reach $0.11?

Over the weekend, DOGE was again held as resistance around that trend line. On Monday as of this writing, DOGE is trading in the $0.095 area. If DOGE manages to break and print a daily close above this trend line, the price recovery could potentially continue towards the February highs in the $0.110 range.

However, traders need to remain vigilant as the DOGE’s primary trend is still bearish, so the short-term upside is at great risk of being just a dead-cat bounce – i.e. a brief rebound within a larger downtrend.

The Relative Strength Index (RSI) indicator is at 32, bouncing back from the oversold zone and signaling the easing of selling pressure. Even so, the sellers’ dominance is still strong as the RSI needs to move above the neutral level of 50 for the recovery rally to be considered more convincing.

Meanwhile, the Moving Average Convergence Divergence (MACD) lines appear to be approaching each other, with the red histogram bars thinning below the neutral level, signaling a weakening of bearish momentum.

If DOGE resumes its downtrend, the price could potentially slip back to Friday’s low at $0.080. A close below that level could open up further downside room towards the next weekly support around $0.078.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- FX Street. Dogecoin Price Forecast: Whale accumulate as bearish momentum fades. Accessed on February 10, 2026