Bitcoin Holds Around $69,000 Today — Could BTC Really Hit $150,000 by 2026?

Jakarta, Pintu News – Bitcoin is hovering around $69,000 after experiencing a correction of around 46% from its October 2025 record high of $126,000. However, on-chain data and institutional fund flows indicate a potential recovery towards the $85,000-$150,000 range by the end of 2026.

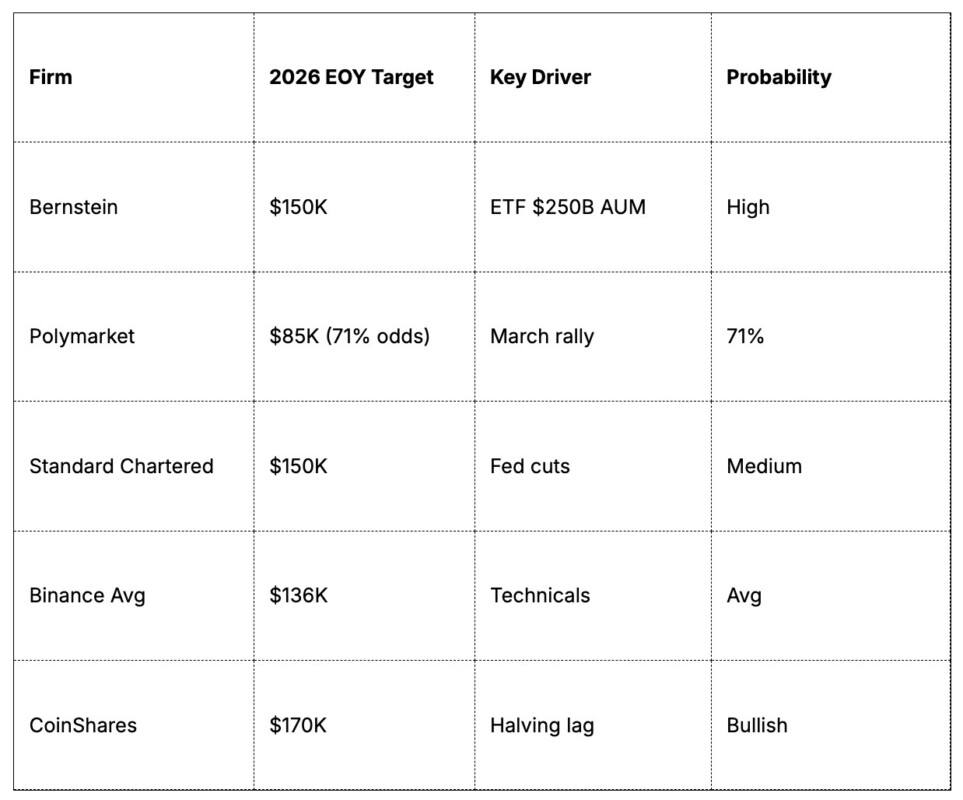

Bernstein analysts call this scenario the “weakest bear case in Bitcoin’s history,” driven by the maturing development of ETFs and post-halving supply dynamics. So, how will Bitcoin price move today?

Bitcoin Price Drops 1.56% in 24 Hours

On February 11, 2026, the price of Bitcoin was recorded at $69,016, equivalent to around IDR 1,162,731,284, marking a 1.56% decline over the past 24 hours. During this period, BTC slipped to a low of IDR 1,145,135,738 and reached a high of IDR 1,181,847,530.

At the time of writing, Bitcoin’s market capitalization is approximately IDR 23,134 trillion, with 24-hour trading volume to around IDR 732.42 trillion.

Read also: Robert Kiyosaki Declares Bitcoin Superior to Gold for Long-Term Diversification

Whale Positioning: Realized Price is the Key to Support

CryptoQuant highlights that whales holding 100-1,000 BTC have a realized price of around $62,000, well below the current spot price. This means that many of them are at a loss on paper, but are yet to show signs of capitulation (panic selling).

Net position change for this group returned to positive in January (+12,000 BTC), after adjusting for exchange operational “noise” that previously made distributions look larger than they were.

Meanwhile, long-term holders (coins that have not moved for 155+ days) have added about 320,000 BTC to their holdings since the low point in November, according to Glassnode data cross-verification, which resembles the pre-bull run phase in 2021.

This resilience is in line with the MVRV Z-Score at 1.8 (neutral zone) and the SOPR indicator rising back above 1.0, signaling that the capitulation phase has most likely passed.

Institutional ETF Flows: Triggers for Accelerating Supply Shock

Bitcoin spot ETFs recorded net inflows of $4.2 billion in Q1 2026 (with BlackRock IBIT accounting for about $2.8 billion).

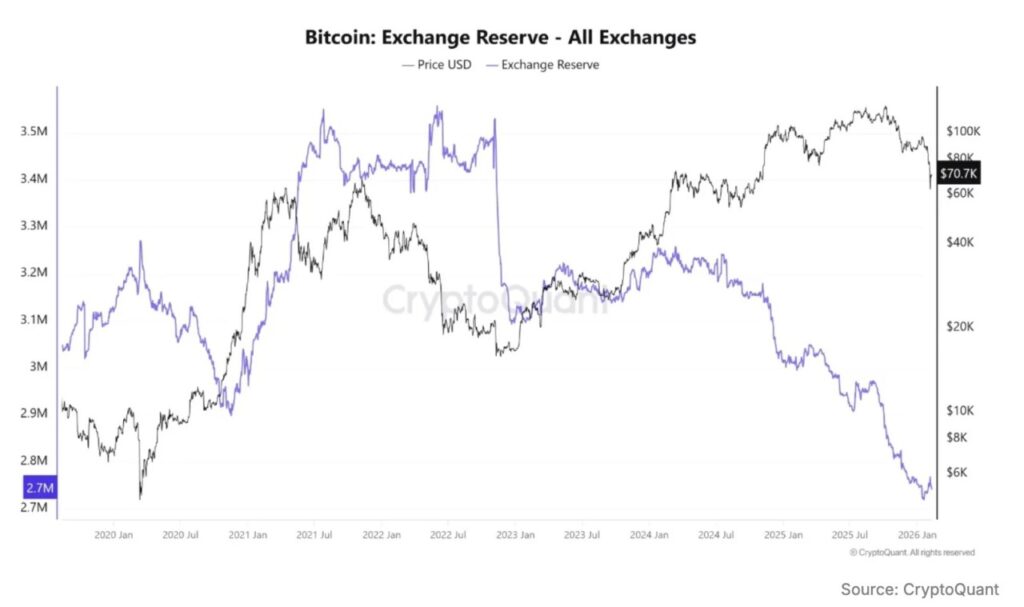

According to CryptoQuant, an average of about 40,000 BTC is absorbed per day. Since December, Bitcoin reserves on exchanges fell 15% to 2.3 million BTC, the fastest pace of decline since the launch of the ETF.

Bernstein projects ETF assets under management (AUM) could reach $250 billion by the end of the year (up from $120 billion), which will further tighten the supply side amid the still-felt halving effect (with daily issuance of only around 450 BTC).

Read also: 3 Major Token Unlocks to Watch in the Second Week of February 2026!

On the corporate side, various companies (outside of MicroStrategy) added 1,142 BTC (worth about $78 million) in the past week, bringing the total corporate holdings up to 715,000 BTC, or about 3.4% of the total supply.

Analyst Projections and Probability Breakdown

Key catalysts: Fed pause (chance of June rate cut around 60%), US Clarity Act (50% probability of passing in the Senate), as well as country FOMO factor (Germany selling, El Salvador adding to holdings).

Technical Setup and Risks

On the technical side, BTC’s daily chart shows RSI at 28 (oversold zone), with a golden cross still in the process of forming between EMA 50 and EMA 200. The key support is in the range of $60-62K (corresponding to realized price + 200-week MA), while the main resistance area is at $75K (with 54% probability according to Polymarket), followed by the next target at $85K.

The MVRV ratio is currently at around 1.8 (neutral), while the Puell Multiple is at 0.85 which indicates that it is still undervalued.

Risks: potential outflows from ETFs (with a precedent of $2 billion outflows in January), recession risk (about 25% chance), and possible regulatory delays. Nonetheless, the risk skew is still to the upside, with a potential move towards $100K+ if reserves on exchanges continue to shrink.

The sharp decline in Bitcoin reserves on exchanges according to CryptoQuant – the fastest since the 2023 banking crisis – when paired with the resilience of the whales, puts Bitcoin at an average price scenario of $120K-$150K in 2026, with an extreme scenario (stretch target) of up to $200K if supported by positive winds from macro factors.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpaper. Bitcoin Price Prediction: Bernstein Calls $150K by 2026. Accessed on February 11, 2026