5 Santiment Signals When Crypto Markets Plummet

Jakarta, Pintu News – Crypto market capitalization is down more than 20% since the beginning of the year, sparking debate on whether prices are nearing a bottom or still continuing in a bearish trend. Amid high volatility, cryptocurrency investors are questioning when is the right time to buy as prices fall. Analytical platform Santiment released five key indicators to help read potential market reversals more objectively.

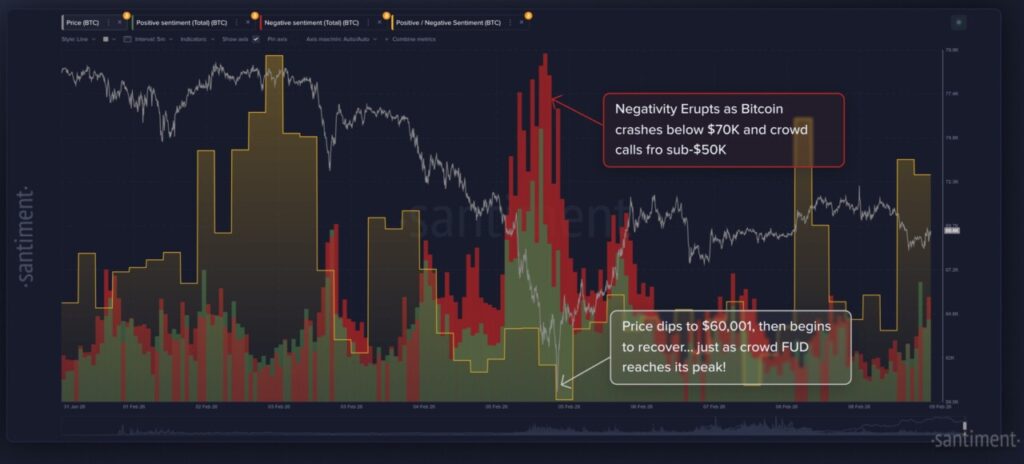

Negative Sentiment Explosion

Santiment notes that spikes in extreme negative sentiment on social media often appear close to market bottoms. When fear, uncertainty, and doubt (FUD) narratives dominate discussions around Bitcoin and other crypto assets, prices have typically experienced sharp declines.

For example, when BTC touched USD 60,001 or around Rp1,008,377,406, the price then rebounded by around 19% in less than 24 hours. Santiment said that public panic often coincides with buying opportunities, although it does not guarantee an instant reversal.

Narrative Change from “Dip” to “Crash”

The phrase “buy the dip” often comes up during market corrections. However, this indicator is considered less strong because a rebound can occur before retail investors completely give up.

More important is the change in language to extreme terms such as “crash”. The dominance of the crash narrative signals fear-based capitulation, which in previous cycles appeared close to market turning points.

Also read: 10 Ways to Get Bitcoin for Beginners 2026

Spike in Bearish Words

Buzzwords such as “selling”, “down”, or claims that the asset is heading towards zero usually spike when investor confidence weakens. This trend reflects widespread selling pressure in the cryptocurrency market.

When the majority of market participants become extremely pessimistic, the room for additional pressure often narrows. Historically, this phase often comes ahead of price stabilization.

30-Day MVRV Ratio

Santiment also highlights the 30-day Market Value to Realized Value (MVRV) ratio. This indicator shows whether recent buyers are at a profit or loss.

When MVRV enters the “strongly undervalued” zone, it means that many short-term investors are losing money. Such conditions have preceded crypto price recoveries in previous cycles.

Also read: 5 Ways to Buy Crypto Stocks

Importance of Time Context

Santiment emphasizes that the definition of “dip” depends on the timeframe. Small movements can be significant for day traders, but less relevant for weekly or long-term investors.

A data-driven approach is considered more objective than mere intuition. Nevertheless, many analysts warn that the broader bearish trend may not be completely over.

Conclusion

Santiment’s five signals show that extreme panic, changing social narratives, bearish keyword trends, and low MVRV can indicate a crypto buying opportunity. However, these indicators do not guarantee a price reversal. Investment decisions should still be tailored to your strategy, risk tolerance, and fluctuating market conditions.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. When Is the Right Time to Buy the Crypto Dip? Santiment Highlights 5 Key Signals. Accessed February 14, 2026.

- Featured Image: Generated by AI