Bitcoin Price Slips to $67,000 as Whale Dumps $172 Million in BTC

Jakarta, Pintu News – Bitcoin is currently recording more losses than gains for its holders. Investors who bought near the recent highs are now selling at a loss, and the flow of new capital into the market has turned negative.

Then, how will the Bitcoin price move today?

Bitcoin Price Drops 0.26% in 24 Hours

On February 12, 2026, Bitcoin was trading at around $67,565, or approximately IDR 1,139,820,666, after slipping 0.26% over the previous 24 hours. During that period, BTC fell to a low of IDR 1,110,371,691 and climbed as high as IDR 1,152,909,613.

At the time of writing, Bitcoin’s market capitalization is about IDR 22,718 trillion, while its 24-hour trading volume has increased by 25% to roughly IDR 925.74 trillion.

Read also: Ethereum Price Falls to $1,900 Today: ETH’s “Big Money” Support Starting to Weaken?

Bitcoin Records More Losses

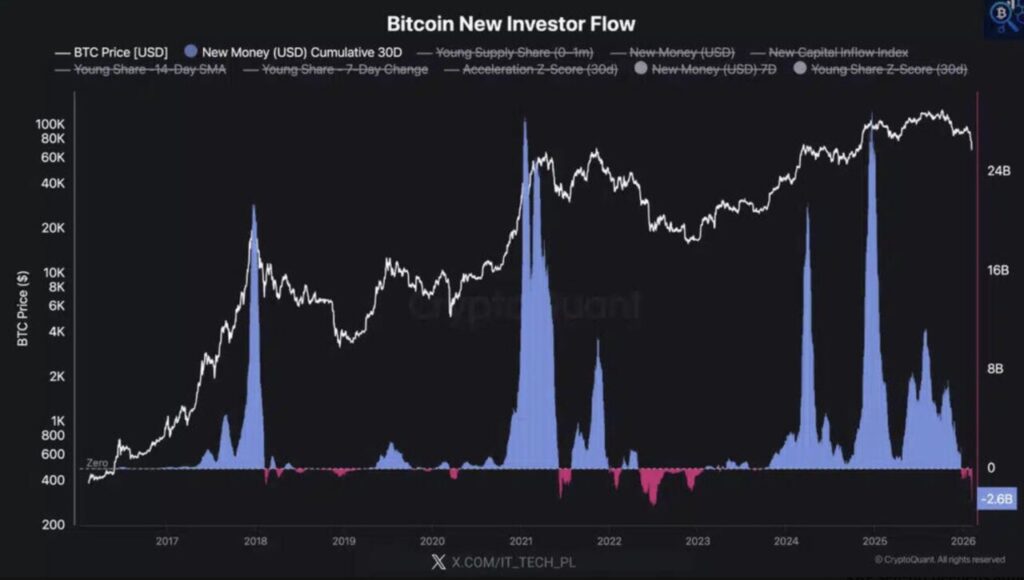

In the last 30 days, approximately US$2.6 billion of net capital exited Bitcoin. In stronger market conditions, falling prices usually attract new buyers. But right now, the number of incoming buyers is not large enough to withstand the selling pressure.

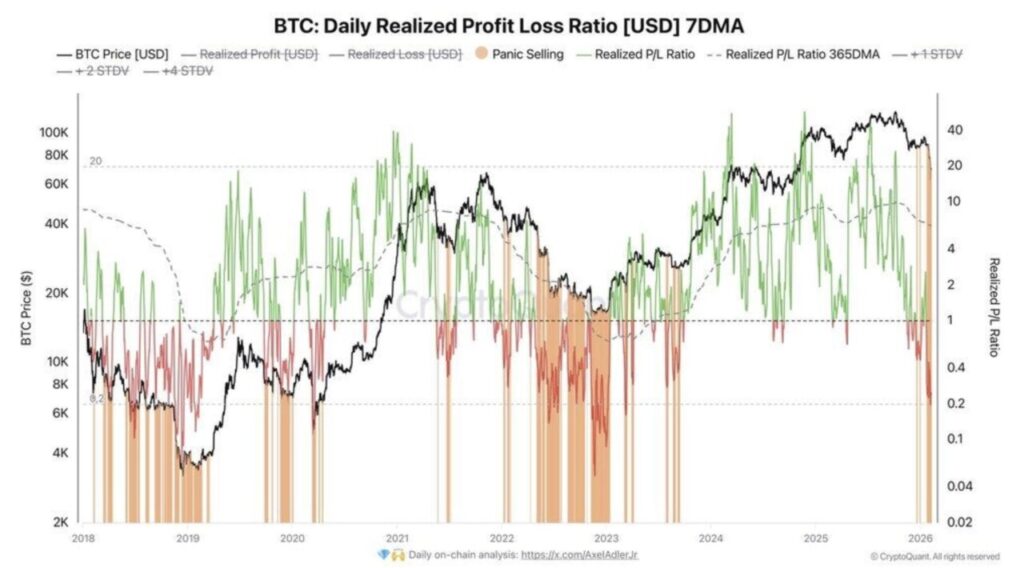

The realized profit-loss ratio – a metric that compares how much profit holders lock in to how much loss they realize – is hovering around 0.25 as of this writing. A figure below 1.0 indicates that losses are being covered faster than profits.

A figure as low as 0.25 means that losses far outweigh profits. Sellers are currently controlling price movements, and the confidence of Bitcoin holders has fallen sharply.

The absence of new capital flows adds another pressure. Fresh funds that usually come from new or existing buyers generally help to cushion corrections and prevent prices from falling too deeply too quickly. Without inflows, any price drops get less “resistance”, making the overall market feel heavier by the day.

When Fear Peaks, Markets Often Approach Lows

A recent report examined what typically happens to the Bitcoin price when online conversations are filled with words like “crash”, “sell”, and other bearish terms. The results were consistent: extreme fear in public conversations tends to emerge when the price is near a short-term bottom, not after it has fallen much deeper.

The MVRV metric – which compares a coin holder’s most recent purchase price to the current market price – helps gauge how deep the losses are. When a large portion of Bitcoin holders are at a loss, the pressure to sell usually diminishes over time. Investors who do intend to sell at a loss generally exit first.

Researchers note that the current conditions are similar to the pattern that emerged near the short-term bottom in previous cycles. Whether the decline will continue deeper or find support at current levels depends largely on whether or not new capital flows will return.

Read also: XRP Price Prediction: Consolidation After Sell-off, Market Confidence Starting to Fade?

A Whale Sells BTC Worth $172 Million

Bitcoin fell to a local low of $66,529 and failed to break the $70,000 level again. On February 11, BTC was trading around $66,975, down 3.11% in 24 hours and 12.61% in the past week. This drop comes after a prolonged period of selling pressure that began when Bitcoin was unable to hold above $97,000 a few weeks ago.

One transaction in particular is attracting a lot of attention. On-chain monitoring platform Lookonchain reported a whale depositing 2,500 BTC – worth about $172.56 million – to Binance.

This wallet started accumulating Bitcoin when the price was hovering around $81,000 about two weeks earlier, with the last purchase recorded just 13 hours before the deposit was made.

Once BTC fell back below $70,000, the owner moved holdings to exchanges and reduced his exposure. The speed of the change in position – from aggressively buying to selling in the span of just two weeks – illustrates the decreased confidence in the price recovery in the short term.

Since the rejection in the $97,000 area, the whales’ selling pressure on the price has been in the range of 3% to 10%, indicating a consistent and measurable negative pressure whenever large holders offload their coins. This pattern has so far shown no signs of reversing.

Sellers Control the Market When Inflows and Technical Signals Align

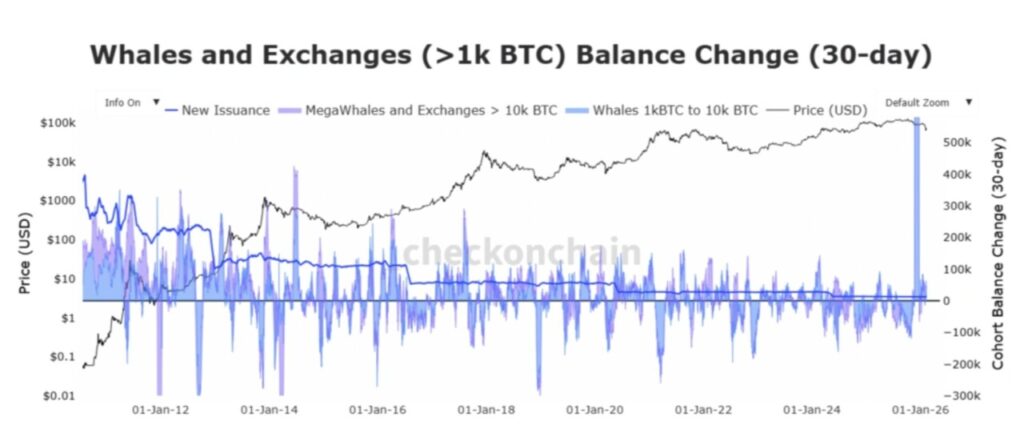

The whale that deposited $172 million worth of BTC was not an isolated case. Data from Checkonchain shows that the whale and mega-whale groups combined sold around 37,000 BTC in just one day, while their total BTC balance on exchanges – which a week earlier was around 63,000 BTC – recorded a decline.

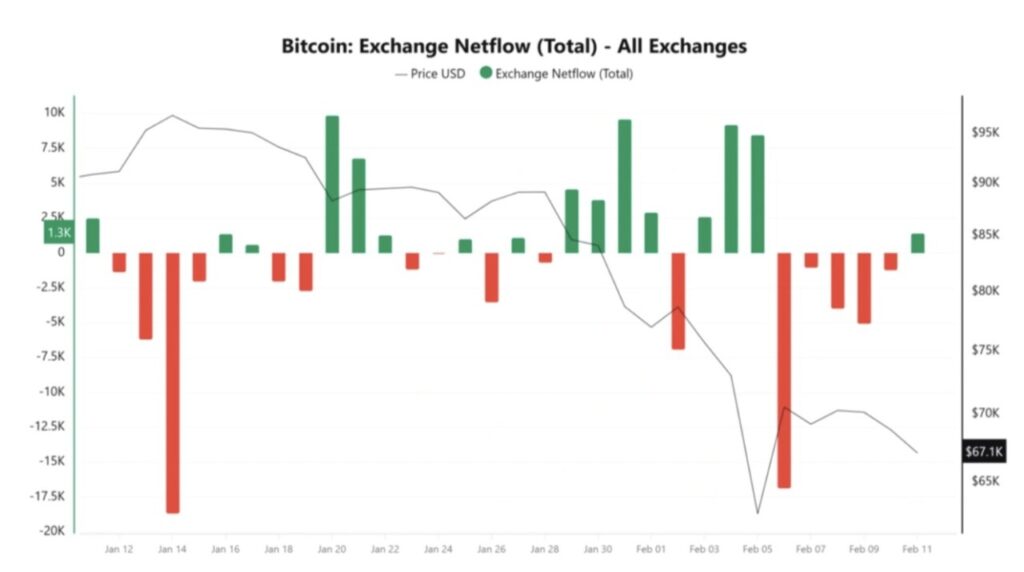

According to CryptoQuant, Exchange Netflow rose to +1,300 BTC, with total inflows reaching 6,600 BTC at the time of writing. Positive netflow means more holders are moving their coins to exchanges – a signal consistently associated with the intention to sell on the spot market.

Historically, such inflow spikes tend to add downward pressure on prices in the short term, and the current data confirms the pattern once again.

Buyer activity has not been able to become a counterweight. Sellers’ strength rose to 93, while buyers’ strength stood at -7. This means that demand from the buyer side is not enough to absorb the continuous supply from large holders and retailers. This imbalance leaves the market without a solid “floor” of new buying flows.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price via Pintu Market.

Enjoy an easy and secure crypto trading and crypto gold investment experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- FX Street. Bitcoin registers more losses than profits – And that pattern may signal a floor is near. Accessed on February 12, 2026