Sherlock Analysts Reveal Reasons Why Bitcoin to Rp1.2 Billion Could Be on the Decline

Jakarta, Pintu News – The price movement of Bitcoin is currently in a consolidation phase that is very decisive for the next market direction. In the midst of recovery efforts towards higher levels, renowned analyst Sherlock gave a stern warning through the X platform that investors should not get caught up in momentary euphoria. A phenomenon known as the bull trap is predicted to be lurking in certain price areas, where a rise that looks sweet to retail investors could actually be a painful turning point due to pressure from large holders.

The Rp1.2 Billion Capital Wall that stood in the way

Sherlock analysis highlights that Bitcoin’s (BTC) rise to the $72,000 to $76,000 range (approximately Rp1.21 Billion to Rp1.28 Billion) could be a “killing zone” for profit hunters. This warning is based on massive holdings data from the firm Strategy, which holds around 714,644 BTC at an average price of $76,052. When the price hits that area, their position, which is currently losing around $5.7 billion, will return tobreakeven.

Psychologically, the initial capital level is often the zone where large holders consider reducing their risk exposure. Although the Strategy has repeatedly stated that it will not sell, the concentration of 3.4% of the world’s total supply in the hands of a single entity creates fear of massive selling pressure. This area is considered a trap as many retail investors may consider it the start of a new rally, when it could be the point where liquidity exits the market in a big way.

Also Read: Warren Urges Fed and Treasury to Reject Crypto Billionaire Bailout, Afraid to Favor Trump?

Spot Bitcoin ETF Pressure and Investor Capital 2025

In addition to the capital burden of the Strategy, Sherlock also points to the Spot Bitcoin ETF managed fund as another potential source of selling pressure. Currently, there are approximately 1.28 million BTC held in the ETF fund with an estimated average entry price between $84,000 and $90,000 (Rp1.41 Billion – Rp1.51 Billion). Since the end of 2025, ETFs have recorded net outflows of over $6 billion, indicating a shift in sentiment at the institutional level.

Data shows that about 63% of wealth invested in Bitcoin (BTC) currently has a capital cost above $88,000. This means that most buyers throughout 2025 are still stuck in a losing position. If the price of Bitcoin rises close to their capital level, the urge to “bail out” by selling the asset will be very high. Sherlock emphasizes that any rise towards these capital levels risks becoming a bull trap if it is not supported by a truly strong volume of new demand.

Bitcoin Today: Holding at the Level of Rp1.1 Billion

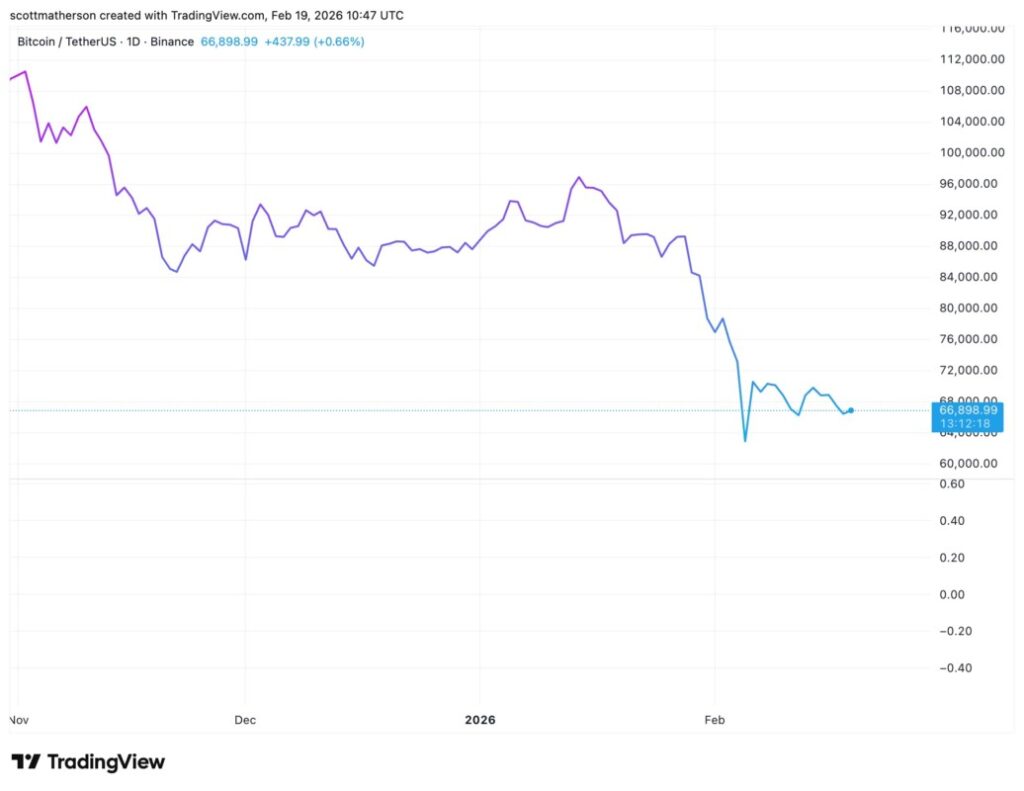

In trading today, February 20, 2026, Bitcoin (BTC) is observed to be consolidating in the price range of $66,980 or around Rp1,131,091,260. The price continues to move in a narrow range after failing to make a daily close above $70,000 consistently. The market is currently in a wait-and-see position waiting for important macroeconomic data such as the release of the Core PCE Index which is predicted to greatly affect the movement of the US dollar and risk assets.

Analyst Scott Matherson added that the uncertainty of price direction keeps long-term holders on their toes but in no rush to capitulate. Despite the threat of a drop to $20,000 according to Peter Schiff, support from the weekly golden cross in the $66,000 area is expected to be a strong base of support. For you, it is important to stay disciplined and not fall prey to FOMO(Fear of Missing Out) as the price approaches the Rp1.2 Billion “danger zone” area to avoid falling victim to the liquidity trap in the cryptocurrency market.

Also Read: Tron (TRX)’s Glory in 2026: King of Transactions and Digital Payment Infrastructure

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Scott Matherson. Don’t Fall For The Bitcoin Trap: Analyst Explains Why Recovery To $76,000 Is Not A Good Thing. Accessed February 20, 2026.