Analysis of the 5 Most Popular DeFi Altcoins in 2025

Decentralized Finance is a major innovation that is transforming how people interact with money and investments by offering open financial services without intermediaries such as banks. This sector continues to grow rapidly, attracting both retail and institutional investors.

As the crypto market heads toward a potential bullish rally, several DeFi altcoins such as AAVE, LINK, ENA, PENDLE, and EIGEN are gaining attention and becoming increasingly popular, thanks to their strong fundamentals and technological innovation. In this article, we’ll take a closer look at the 5 most popular DeFi altcoins in 2025.

Article Summary

- 💣 The DeFi crypto market is valued at $120.31 billion, with a daily trading volume of around $24.71 billion.

- 👻 Aave controls nearly 70% of all lending deposits on the Ethereum network, making it the dominant protocol.

- ⛓️ Chainlink reported an annual revenue of $14,152, with a total cumulative revenue of $1.55 million.

- 🚀 Ethena’s TVL reached $14.686 billion, more than doubling from $6 billion in June 2025.

- 📈 Crypto analysts observe that PENDLE’s price is currently moving within a rising channel.

- 🐋 Whale holdings of EIGEN now total 4.85 million tokens.

Why Are DeFi Altcoins Becoming More Popular?

As of September 24, the total market value of DeFi cryptocurrencies reached $120.31 billion, with a daily trading volume of around $24.71 billion, according to data from CoinMarketCap. These figures reflect the growing interest in DeFi altcoins, which offer profit potential far beyond that of traditional financial services.

Additionally, as of September 24, 2025, DefiLlama reported that the Total Value Locked (TVL) across DeFi platforms had reached $151.723 billion—only about 16% below its all-time high in November 2021. This suggests a strong rebound and positive performance from the DeFi sector since the previous market cycle.

Interestingly, 2025 marks a turning point for institutional investors, who were previously hesitant to engage with the DeFi sector due to regulatory concerns and technical complexities. Fireblocks, a leading custodial service provider, reported a $60 billion surge in DeFi activity since the beginning of the year. This growth has been fueled by rising interest in tokenized assets and permissioned liquidity pools—structures that are more compatible with institutional needs.

JPMorgan, through its Kinexys Digital Assets platform, has also begun leveraging DeFi protocols to settle intra-day repo transactions. This serves as a strong signal that blockchain technology is gaining broader acceptance as a legitimate financial tool among institutions.

On the regulatory front, the United States has taken a significant step forward with the GENIUS Act, which establishes a legal framework for stablecoins, including reserve requirements and enhancements to AML/KYC protocols. This legislation provides the legal clarity institutions need and directly encourages the use of Ethereum within the stablecoin and DeFi ecosystems.

As regulatory frameworks become clearer and more countries begin to adopt global standards, institutional barriers to entry into the DeFi space are gradually disappearing. This opens up new opportunities for future growth in the sector.

Analysis of the 5 Most Popular DeFi Altcoins

As the decentralized finance (DeFi) ecosystem continues to evolve, several DeFi altcoins have managed to stand out thanks to robust technology, strong community support, and real-world utility. The following five altcoins have emerged as highlights in 2025, showing significant growth potential both in terms of adoption and investment value.

1. AAVE: Pioneer of Lending Protocols

Aave is one of the most innovative crypto lending protocols in the DeFi space. As a decentralized and non-custodial money market protocol, Aave allows users to lend and borrow crypto assets without intermediaries, operating within a transparent and trustless ecosystem.

One of its revolutionary features is the flash loan—a collateral-free loan that must be repaid within a single transaction—as well as flexible interest rates that adjust dynamically to market conditions.

Latest AAVE Metrics

Recent data from DeFiLlama shows that Aave continues to solidify its position as one of the most dominant DeFi protocols in the market. As of now, Aave’s Total Value Locked (TVL) has reached $39.77 billion, reflecting strong adoption and growing user trust in its lending ecosystem.

Historical TVL charts reveal an explosive growth trend throughout 2025, surpassing previous peaks set in 2021 and 2022. This surge highlights the increasing inflow of liquidity into the protocol—from both retail users and institutional players.

From a revenue standpoint, Aave has also delivered impressive performance:

- Annual fees generated reached $1.198 billion, indicating high transaction activity on the platform.

- Annual revenue totaled $163.84 million, with a large portion distributed to token holders and user incentives.

The 24-hour trading volume of the AAVE token also remains strong at $486.48 million, while its market cap stands at $4.222 billion.

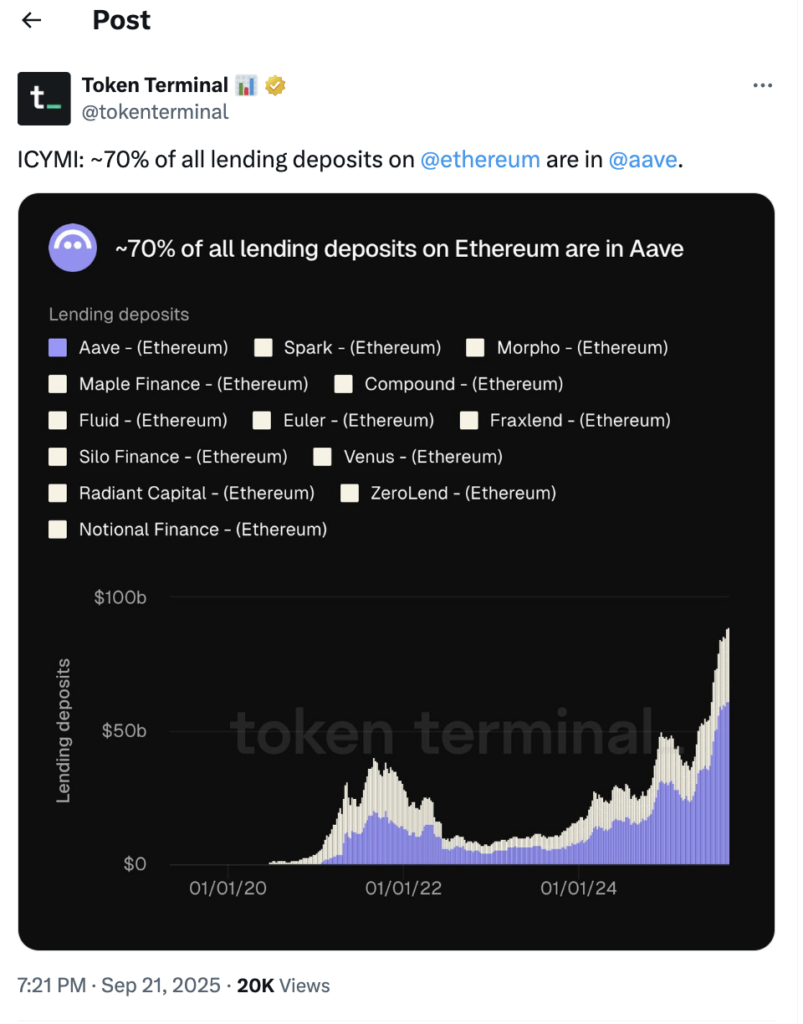

Furthermore, according to the latest data from Token Terminal, Aave now controls nearly 70% of all lending deposits on the Ethereum network, making it the leading protocol in one of the most competitive sectors of the crypto industry.

Visual data illustrates that Aave’s deposit growth closely mirrors the overall expansion of the crypto lending market. Despite competition from protocols such as Compound, Morpho, Spark, and Fraxlend, Aave continues to capture the largest share of circulating liquidity. As of September 2025, total lending deposits on Ethereum have exceeded $100 billion, with Aave absorbing the majority of that capital.

AAVE’s Growth and Adoption

In 2025, Aave has begun actively exploring the tokenization of real-world assets (RWA), capturing institutional interest through its new initiative, “Horizon.”

Horizon is designed to bridge the gap between traditional finance (TradFi) and decentralized finance (DeFi). As the trend of real-world asset tokenization gains momentum—offering greater liquidity, lower costs, and 24/7 transaction capabilities—the demand for on-chain assets has surged.

In response, Horizon’s first product will allow institutions to use tokenized money market funds (MMFs) as collateral to borrow stablecoins like USDC and GHO.

In addition, publicly traded companies such as BTCS (listed on Nasdaq) have announced their use of Aave to earn yield on their ETH holdings. Even the Ethereum Foundation has been reported to have borrowed GHO stablecoins through the Aave protocol. According to reports, Aave’s total deposits have reached $56.72 billion—placing it on par with some of the 50 largest banks in the United States.

With its dual strategy—offering innovative features like flash loans for retail users while driving institutional adoption through RWA tokenization and lending products—Aave is positioning itself as the “DeFi bank” ready to attract a wide spectrum of capital. This balanced approach has made Aave one of the most popular projects of 2025.

AAVE Analysis from Crypto Traders on X

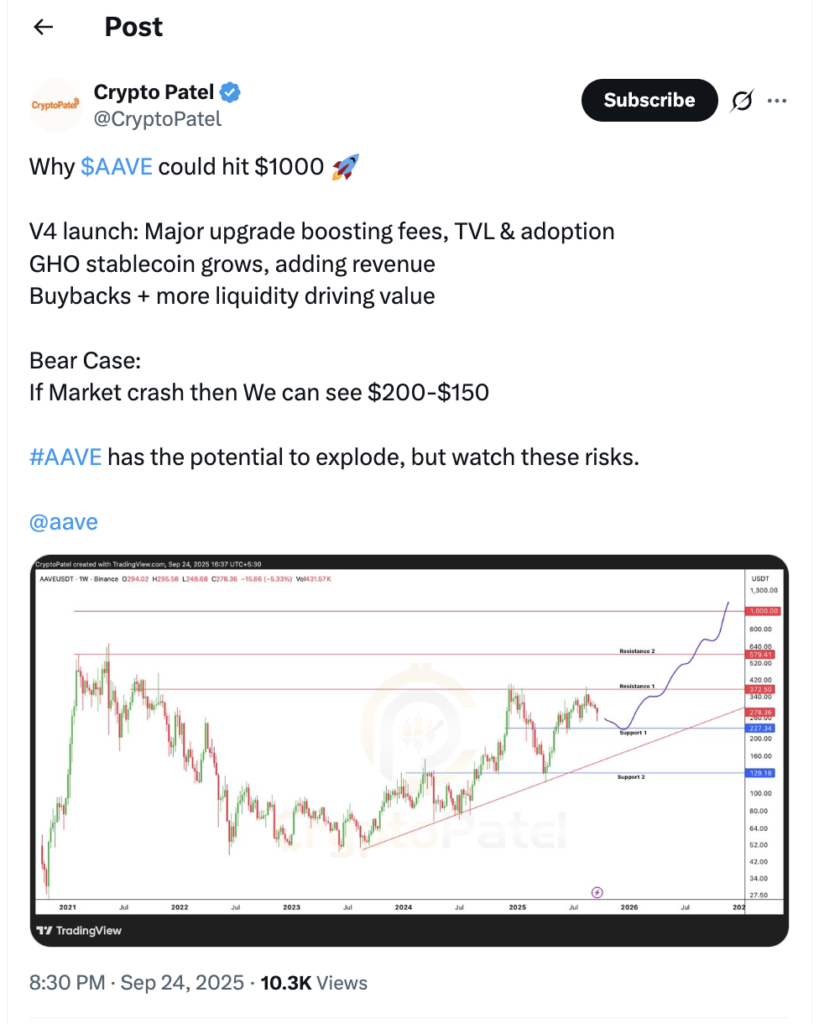

In a recent post and chart analysis on X, crypto analyst Patel outlined a bullish scenario in which AAVE could potentially surge to $1,000, provided that several key catalysts unfold as expected.

He highlighted three major factors that could trigger a significant price rally:

- Launch of Aave V4 The upcoming version of the Aave protocol is expected to boost revenue, increase Total Value Locked (TVL), and attract a larger user base.

- Growth of the GHO Stablecoin The more users mint and hold the GHO stablecoin, the more revenue the protocol is likely to generate.

- Buyback & Liquidity Strategy Aave has implemented a strategy to use part of its revenue to buy back AAVE tokens and add liquidity to the market.

In his latest weekly chart analysis, Patel pointed out that AAVE is currently trading within a key support and resistance range:

- Major support lies between $150 and $200

- The next resistance levels are around $420 and $680

If AAVE successfully breaks through these resistance zones, Patel sees the potential for the price to move toward the $1,000 area in the next market cycle.

2. Chainlink (LINK): The Data Bridge for DeFi

Chainlink operates through a decentralized network of nodes known as oracle nodes. These nodes are responsible for fetching data from external sources—such as APIs or IoT devices—and delivering it to smart contracts on the blockchain. This enables smart contracts to interact with real-world data in a secure and accurate manner.

In recent years, the decentralized finance (DeFi) space has grown rapidly, offering a wide range of financial services without intermediaries. However, one of the major challenges in DeFi has been the lack of reliable access to real-world data. This is where Chainlink plays a crucial role.

Chainlink acts as a bridge between blockchains and the outside world, allowing DeFi applications to securely and transparently access off-chain data. For example, DeFi lending platforms can use Chainlink to access accurate, real-time crypto price feeds, enabling them to set fair and transparent loan terms for all users.

Latest Chainlink Metrics

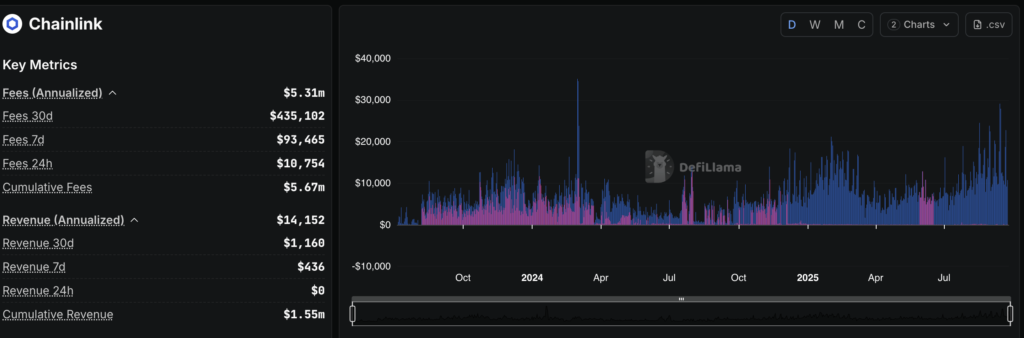

According to recent data from DeFiLlama, Chainlink has shown consistent performance in terms of fees and revenue, supported by growing adoption and usage of oracles across the DeFi ecosystem.

- As of now, annualized fees for Chainlink have reached approximately $5.31 million, with cumulative total fees amounting to $5.67 million.

- Over the past 30 days, Chainlink generated $435,102 in fees—reflecting strong network activity.

- In the past 7 days, it brought in $93,465, and in the last 24 hours, $10,754—showing steady growth in usage.

In terms of revenue, Chainlink has recorded:

- Annual revenue of $14,152,

- Cumulative total revenue of $1.55 million,

- With $1,160 earned over the past 30 days, and $436 over the past 7 days—demonstrating daily fluctuations, though the long-term trend remains positive.

Chainlink’s Institutional Adoption in 2025

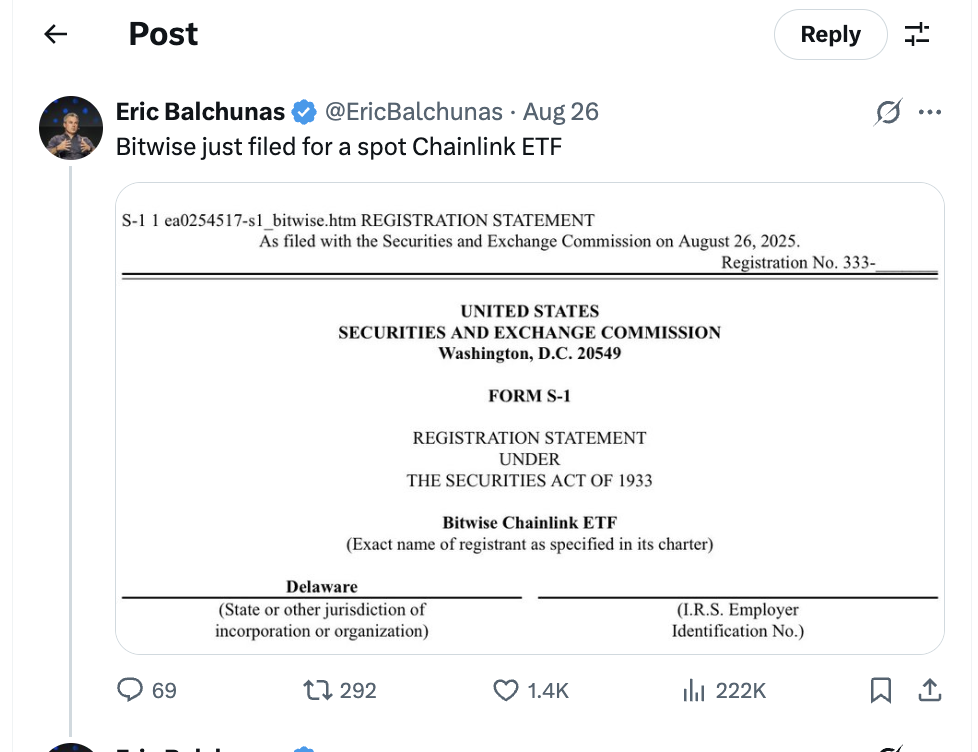

In August 2025, asset manager Bitwise officially filed an S-1 registration form with the U.S. Securities and Exchange Commission (SEC) to launch the Bitwise Chainlink ETF. According to the filing, the ETF will work with Coinbase Custody Trust Company to securely hold the LINK tokens it acquires.

Meanwhile, asset manager Grayscale is also working to convert its Grayscale Chainlink Trust (LINK) into an ETF. In its application, Grayscale noted that the ETF would be listed and traded on NYSE Arca (New York Stock Exchange).

The momentum doesn’t stop there. U.S.-based investment firm Caliber became one of the first public companies to officially include Chainlink (LINK) in its treasury portfolio. In a press release, Caliber stated that this move is aligned with its Digital Asset Treasury Strategy and Policy, which was approved by its board of directors.

A portion of Caliber’s treasury funds will be allocated to purchasing LINK tokens, with the goal of benefiting from long-term value appreciation and staking incentives from the Chainlink network. This move is expected to strengthen the company’s balance sheet and provide an additional stream of cash flow.

In addition, SBI Group—a Japanese financial conglomerate managing over $200 billion in assets—has entered a strategic partnership with Chainlink to accelerate the adoption of blockchain and digital assets globally. The collaboration focuses on leveraging Chainlink’s Cross-Chain Interoperability Protocol (CCIP) to enable secure, private, and regulation-compliant cross-chain transfers of real-world assets (RWAs) like real estate and bonds, especially across Japan and the broader Asia-Pacific region.

LINK Analysis from Crypto Traders on X

Crypto analyst Axel Bitblaze shared a bullish outlook for LINK in his latest technical analysis. In a weekly chart posted on X, he highlighted that LINK has successfully reclaimed the crucial $20 level, which previously acted as a major resistance zone. Regaining this level confirms a continuing uptrend in LINK’s price action.

The next key challenge for LINK is to break through the resistance zone between $30 and $34. If this level is decisively breached and flipped into new support, LINK could enter a price discovery phase—a market condition where the price surpasses its previous all-time high and moves into uncharted territory.

From a technical perspective, the chart also shows healthy short-term consolidation above the $22 support line, signaling potential for a significant breakout toward the $30+ range. The steady upward trend, supported by a pattern of higher lows, further validates this bullish narrative.

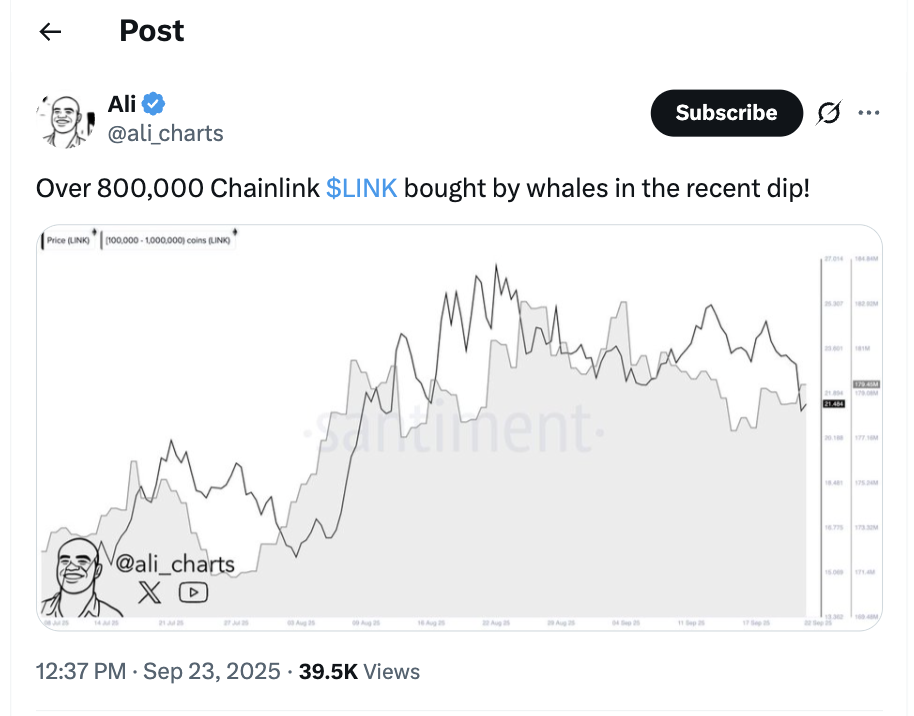

Meanwhile, crypto analyst Ali Martinez reported that large holders accumulated over 800,000 LINK during the recent market pullback. Martinez also noted that approximately 5.5 million LINK have been withdrawn from exchanges.

This exchange outflow typically reflects a strong holding sentiment, as assets moved to private wallets are generally intended for long-term storage rather than immediate selling.

3. Ethena (ENA): The Leading Stablecoin Protocol

Ethena has emerged as one of the most compelling projects in the decentralized finance (DeFi) sector in 2025. What sets it apart is its unique architecture for synthetic dollars, powered by the USDe stablecoin and its innovative yield product known as the “Internet Bond.” This approach aims to redefine the concept of yield within the DeFi ecosystem.

The combination of its innovative structure and a focus on yield efficiency has attracted significant institutional interest, while also fostering a strong community around the protocol’s long-term vision. As a result, Ethena is increasingly recognized as a project pushing the boundaries of innovation in decentralized finance.

Latest Ethena Metrics

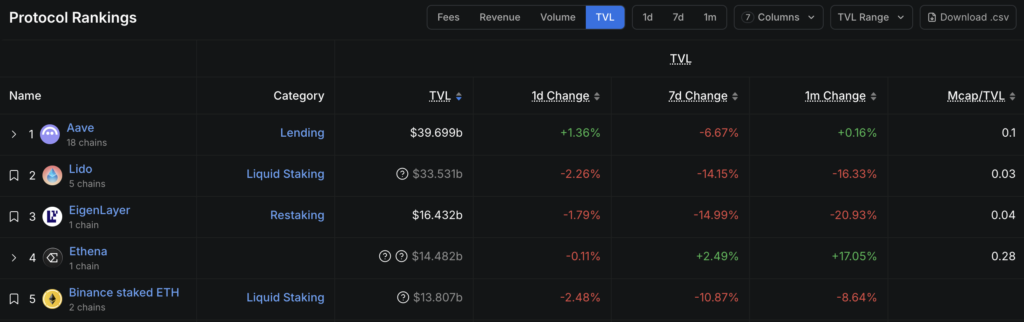

According to the latest DeFi protocol rankings, Ethena is the only one among the top five protocols to record positive growth in Total Value Locked (TVL) over both the 1-week and 1-month timeframes.

- Over the past 30 days, Ethena’s TVL surged by +17.05% to reach $14.482 billion, outperforming major protocols like Aave, Lido, and EigenLayer, all of which posted declines during the same period.

- On a weekly basis, Ethena also posted a +2.49% gain, while its closest competitors experienced sharp drops of over -10%.

Furthermore, Ethena’s MarketCap/TVL ratio currently stands at 0.28, significantly higher than that of its peers (Aave: 0.10, Lido: 0.03, EigenLayer: 0.04). This suggests a more optimistic market valuation of Ethena’s market cap relative to its TVL, reflecting investor confidence in the protocol’s long-term potential.

Ethena 2025 Roadmap

On January 3, 2025, Ethena Labs released its latest roadmap, outlining a series of major initiatives. Among the most notable is the upcoming launch of a Telegram-based app for payments and savings, powered by its yield-generating stablecoin sUSDe. The goal is to deliver a neobank-like experience directly within a messaging platform.

Users will be able to send, spend, and save sUSDe directly inside Telegram, with seamless mobile payment support through Apple Pay integration. According to Ethena Labs, yield-bearing dollar stablecoins like sUSDe represent “the most important savings asset in the world to preserve wealth”—and are the only crypto products (besides Bitcoin) with the potential to reach one billion users.

- Aiming to Compete with Tether

Ethena’s 2025 roadmap sets a bold vision: to become a serious contender to Tether, not just as a stablecoin issuer but as the foundational infrastructure for the on-chain financial system—under a unified ecosystem called Ethena Network.

Developers will be able to build DeFi applications directly on top of this infrastructure, with sUSDe at the core. The ecosystem’s native token, sENA, plays a key role in the network’s value accrual model, which is designed similarly to BNB in the Binance ecosystem.

- Two Flagship Applications: Ethereal and Derive

The roadmap also introduces two major apps being built on the Ethena Network:

- Ethereal: A spot and perpetual exchange built specifically for sUSDe, operating on an application-specific blockchain, complete with native rewards and liquidity support from Ethena.

- Derive: A derivatives protocol focused on options products, with sUSDe as the primary collateral. The upcoming Derive token launch is expected to further accelerate adoption.

- The Dollar as DeFi’s Backbone

Ethena emphasizes the role of the U.S. dollar as the backbone of on-chain capital flows—whether for payments, settlement, or as the foundational asset for DeFi products such as lending and derivatives.

To further this vision, Ethena plans to roll out a suite of sUSDe-based financial products in the coming quarter, including:

- A perpetual trading platform

- A prediction market

- GambleFi (gamified finance tools)

- Undercollateralized lending protocols

These initiatives underscore Ethena’s ambition to become the central engine of DeFi’s next generation.

ENA Analysis from Crypto Traders on X

In his latest technical analysis, trader Nebraskangooner highlighted a bearish signal for ENA (Ethena) after the token failed to reclaim a key breakdown level that would have triggered a potential long setup.

The chart shows that ENA has undergone a full retrace of its previous rally, falling below the former breakout zone that had once served as a crucial support base for the bullish trend.

This breakdown indicates that the bullish market structure has collapsed. The previous support zone has now flipped into resistance, reinforcing a short-term bearish sentiment. Nebraskangooner referred to the current setup as “game over“, signaling that the upside potential is very limited without a new technical or fundamental catalyst.

ENA’s decline toward the $0.60 level also brings it close to its 200-day EMA (Exponential Moving Average), which now serves as a critical level to watch moving forward.

4. PENDLE: The Future of Yield Tokenization

Pendle has established itself as a leading protocol for yield trading in the DeFi space. The platform allows users to lock in or speculate on future yield by splitting yield-generating assets into two components: the Principal Token (PT) and the Yield Token (YT).

Following a period of rapid growth throughout 2024—driven by trends like liquid staking and points farming—Pendle is now entering a new phase, marked by:

- Dominance in stablecoin yield

- A major upgrade through the launch of a new system called “Boros”

- Cross-chain expansion to broaden accessibility and liquidity

Now entering its fourth year, Pendle is solidifying its position as a key player in the on-chain DeFi sector. With its TVL surpassing $11 billion once again, the protocol is poised to maintain its leadership in 2025 through continued innovation and growing adoption.

Latest PENDLE Metrics

The Pendle DeFi platform has delivered outstanding performance in 2025, with Total Value Locked (TVL) reaching $11.92 billion. TVL charts from DeFiLlama show exponential growth since early 2024, with a sharp acceleration in recent months—indicating rising adoption and investor confidence in the protocol.

Key Financial Metrics:

- Annual fees: $72 million

- Annual revenue: $70.53 million

- Revenue distributed to holders: $56.42 million

- Annual earnings (net profit): $41.76 million

Market & Activity Stats:

- 30-day DEX volume: $7.079 billion

- Market capitalization: $808.07 million

- PENDLE token price: $4.76

Pendle 2025 Roadmap

In February 2025, Pendle signaled a major expansion push by announcing a series of strategic initiatives aimed at unlocking the next phase of growth within the DeFi ecosystem.

1. Launch of Boros (Q4 2025)

According to Pendle’s official blog post, Boros is the protocol’s newest product line targeting the massive $150 billion/day perpetual swaps market. Its core feature is providing fixed-rate interest rate hedging for funding rates—for example, on pairs like TRUMP/USDT perpetuals.

Protocols like Ethena could use Boros to lock in yield on their positions, making it a powerful tool for both speculation and risk management.

2. Expansion of Citadels (2025)

Citadels is an initiative focused on onboarding institutional users and non-EVM networks into the Pendle ecosystem. Key components include:

- Integration with non-EVM chains such as Solana and TON, enabling one-click fixed yield access.

- Partnerships with TradFi institutions to offer KYC-compliant yield products, tailored for regulated environments.

- Development of Sharia-compliant financial products to tap into the global $3.9 trillion Islamic finance market.

3. V2 Enhancements (Ongoing)

The ongoing upgrades to Pendle V2 include:

- Permissionless pools, allowing the community to launch custom yield markets.

- Dynamic fees, designed to optimize LP (liquidity provider) returns during periods of fluctuating interest rates.

- Governance flexibility through vePENDLE, enabling smaller token holders to participate more meaningfully in protocol decision-making.

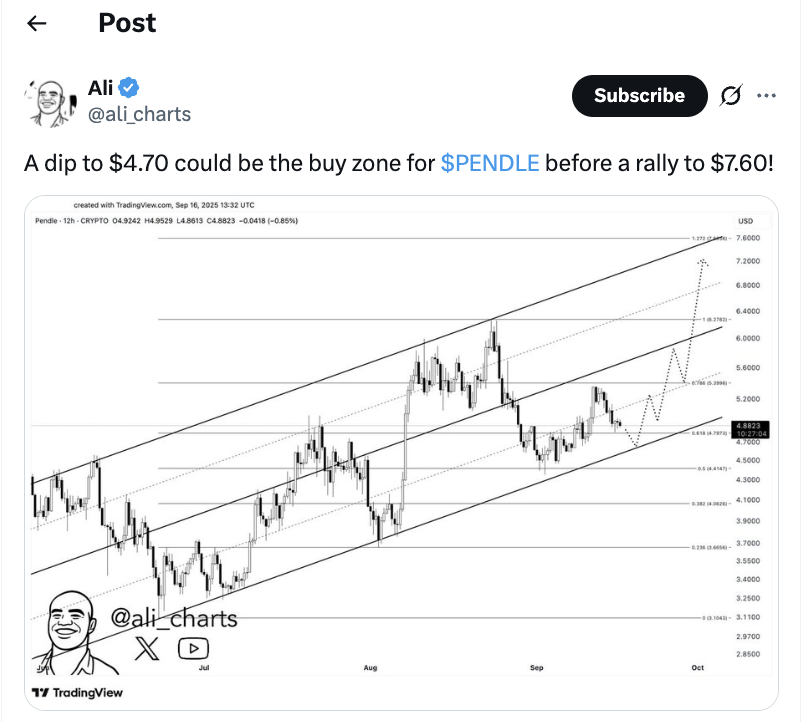

PENDLE Analysis from Crypto Traders on X

Crypto analyst Ali shared a chart on platform X suggesting that the recent pullback in PENDLE’s price to around $4.70 could represent a strategic entry point ahead of a potential rally toward $7.60.

According to Ali’s chart, PENDLE is currently trading within a rising channel that has defined its price structure over the past several weeks:

- The lower boundary of the channel acts as dynamic support

- The mid-line and upper boundary serve as progressive resistance levels

If the price pulls back to $4.70, this level aligns with:

- The lower trendline of the rising channel (dynamic support)

- A horizontal support zone from previous price swings

- A cluster of technical retracement levels, such as Fibonacci zones

This confluence of support makes $4.70 an attractive area—offering clearer stop-loss placement and a more controlled risk profile. Should buyers step in at this level, Ali outlines the following potential price action:

- Initial bounce toward $5.20 (the mid-line of the channel), with a likely consolidation phase at that level.

- If momentum continues and price breaks above the mid-line, the next resistance zone lies near $6.40.

- With further bullish pressure, PENDLE could target the upper boundary of the channel around $7.60.

However, if the $4.70 support fails, a drop to lower support zones may occur, invalidating the current structure and altering the trading setup.

5. EigenLayer (EIGEN) – Restaking & Security Layer

EigenLayer is an Ethereum-based protocol that introduces the concept of restaking, allowing users to reallocate their staked ETH or Liquid Staking Tokens (LSTs) to enhance the security of other protocols.

Through EigenLayer, stakers can earn additional rewards by participating in restaking activities, while other protocols can leverage Ethereum’s existing validator set—eliminating the need to build their own security infrastructure from scratch.

In essence, EigenLayer transforms Ethereum’s trust network into a commoditized service, allowing new projects to bootstrap security and reduce incentive costs by utilizing trusted Ethereum validators instead of recruiting their own.

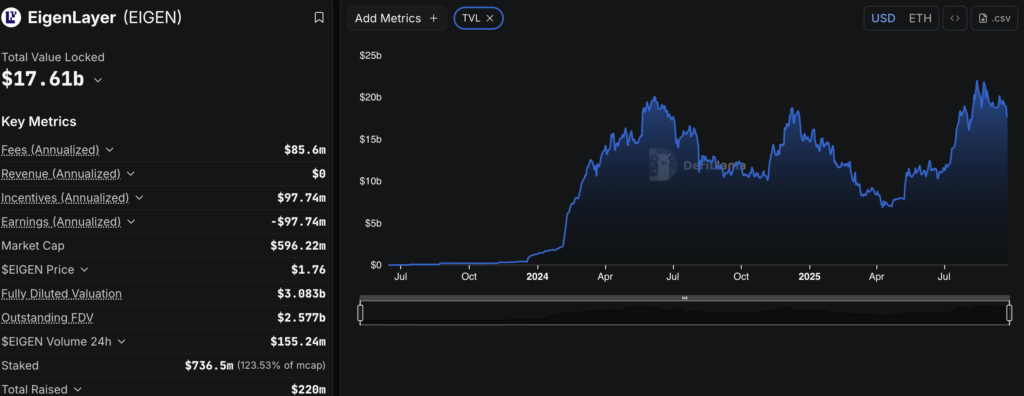

Latest EigenLayer Metrics

According to DeFiLlama (as of Sept 24), EigenLayer has recorded a Total Value Locked (TVL) of $17.61 billion, placing it among the largest protocols in the DeFi space. Despite experiencing a sharp correction from mid-2024 to early 2025, the protocol has shown strong recovery—indicating both resilience and sustained investor interest.

Financial Performance & Activity

- Annualized Fees: $85.6 million

- Annualized Revenue: $0

- Annualized Incentives: $97.74 million

- Annualized Earnings: –$97.74 million

Market & Token Data

- EIGEN Price: $1.76

- Market Cap: $596.22 million

- 24-Hour Trading Volume: $155.24 million

Following the Federal Reserve’s interest rate cut of 25 basis points on September 17, EIGEN became one of the top crypto assets being accumulated by whales, according to a report by BeInCrypto.

As of September 18, on-chain data from Nansen revealed a significant increase in EIGEN holdings by whales—up 6.05%, reaching a total of 4.85 million EIGEN tokens.

Meanwhile, mega-whales also increased their positions by 0.1%, now holding approximately 1.13 billion EIGEN. This surge in accumulation is likely driven by lower interest rates, prompting investors to seek higher-yield alternatives outside of traditional savings—such as DeFi platforms like EigenLayer, which specialize in yield generation through restaking mechanisms.

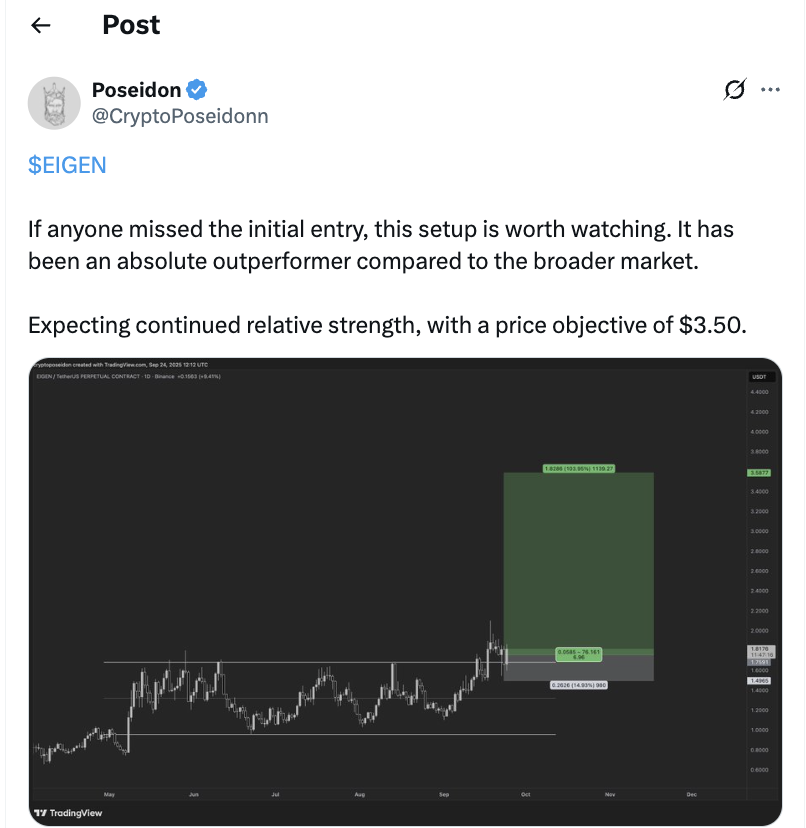

EIGEN Analysis from Crypto Traders on X

In a recent post on X, crypto analyst Daan Crypto Trades highlighted the strong performance of $EIGEN, which has seen a significant rally and is currently displaying a solid technical structure. The bullish sentiment has been further supported by news of a strategic collaboration with a major Japanese corporation.

The partnership involves NTT Digital, the Web3 arm of NTT, Japan’s largest telecommunications company. NTT Digital is now running EigenDA on EigenCloud, bringing enterprise-grade infrastructure into the verifiable cloud ecosystem.

This collaboration signals growing institutional adoption of both restaking and verifiable cloud technologies—two of EigenLayer’s core pillars.

On the technical side, Daan’s chart shows that $EIGEN has broken above a key resistance zone around $1.65 and is now approaching a potential target above $2.10—representing a ~28% upside from the breakout. The 200-day EMA and 200-day MA are now acting as dynamic support levels, further reinforcing the current bullish structure.

Meanwhile, in a separate post on X, crypto analyst Poseidon also pointed to bullish potential for $EIGEN, noting that the token has outperformed the broader crypto market in recent sessions.

Poseidon acknowledged that while some investors may have missed the initial entry point, the current setup remains compelling. According to his technical analysis, EIGEN has recently broken out of a horizontal consolidation phase and is demonstrating sustained relative strength.

He has set a price objective of $3.50, suggesting a significant upside from the current level (around $1.76 at the time of analysis). This projection is based on a clean breakout pattern and the broader market trend, which currently supports further upside.

Future Outlook for DeFi Altcoins

Regulatory Trends Shaping DeFi

Regulation is one of the key factors that will determine the future of DeFi altcoins. In Europe, the Markets in Crypto-Assets (MiCA) regulation has been in effect since late 2024, providing a legal framework for crypto assets, including stablecoins.

Meanwhile, in the United States, a major shift occurred on April 10, 2025, when President Trump signed a bill repealing mandatory reporting rules for DeFi platforms that had been previously proposed by the IRS.

The U.S. Securities and Exchange Commission (SEC) is also considering an “innovation exemption”—a proposed policy that would allow DeFi projects to operate while comprehensive regulations are still being developed, with the goal of encouraging innovation.

In an interview with Fox Business, SEC Chairman Paul Atkins stated that the agency is preparing to introduce new regulatory processes in the coming months:

“We are working toward implementing an innovation exemption—and we aim to have it in place before the end of the year,” he said.

This innovation exemption would serve as a temporary carve-out within the broader regulatory framework. It would give crypto companies regulatory relief from existing securities laws, allowing them to launch new products under lighter oversight. During this transitional period, the SEC plans to design more tailored and appropriate regulations specifically for the crypto and DeFi sectors.

In short, future regulatory developments appear to be moving toward clarification and adaptation rather than outright bans. This could open up significant opportunities for compliant and transparent DeFi projects to thrive under clearer legal conditions.

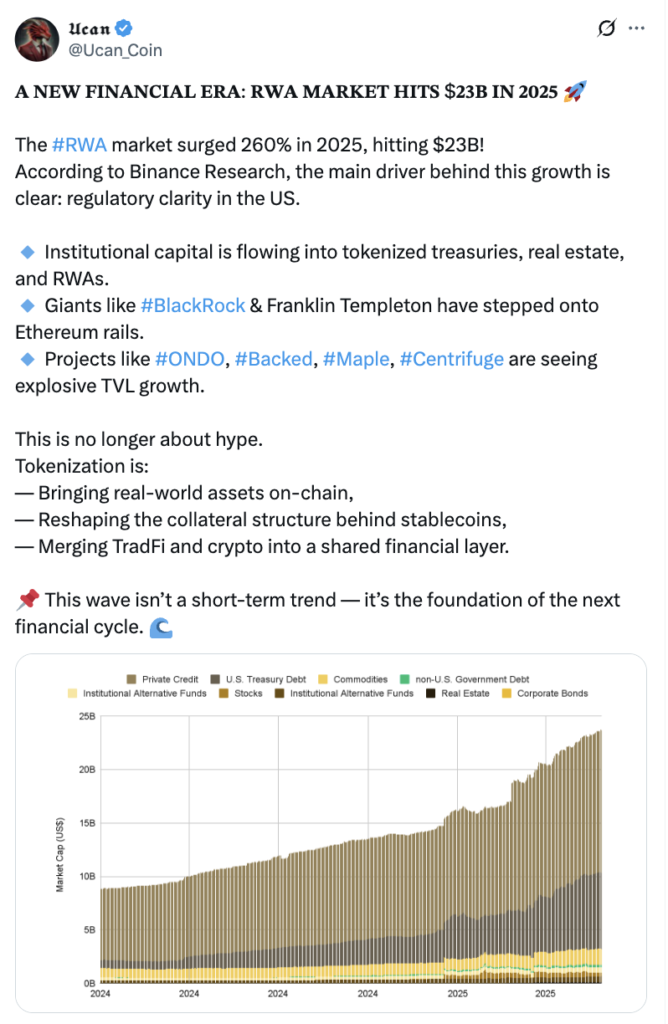

Potential Integration with the Real World

One of the most promising aspects of DeFi is the tokenization of real-world assets (RWA)—including property, bonds, securities, and traditional financial instruments—which can now be represented digitally on the blockchain.

In June 2025, an analysis by Binance Research highlighted a significant surge in both the DeFi and RWA sectors. In May, the DeFi sector grew by 19%, driven by product innovation and a rise in Total Value Locked (TVL).

However, the biggest surprise came from the tokenized real-world asset sector. In the first half of 2025, the RWA market surged by 260%, reaching a valuation of $23 billion. Currently, this growth is largely fueled by private credit (58%) and U.S. government bonds (34%).

Furthermore, a recent research paper proposed a cross-chain framework that would allow real-world assets to move across blockchains without needing re-verification on each chain—a development that could form the backbone of seamless DeFi-TradFi integration.

With RWA integration, DeFi altcoins are no longer limited to crypto-native trading use cases—they are evolving into bridges between traditional finance and decentralized systems.

Market Growth Projections: 2025–2030

The global DeFi market outlook remains highly optimistic. According to a report by Grand View Research, the DeFi market was valued at $20.48 billion in 2024, and is projected to reach $231.19 billion by 2030, growing at a CAGR of 53.7% from 2025 to 2030.

In contrast, a more conservative estimate from Mordor Intelligence forecasts the DeFi market to be worth $51.22 billion in 2025, expanding to $78.49 billion by 2030, representing a CAGR of approximately 8.96%.

If regulatory clarity improves and institutional adoption continues to grow, DeFi altcoins could evolve from experimental projects into foundational pillars of the global financial infrastructure.

Start Investing in DeFi Altcoins on Pintu

After learning about some of the most popular DeFi altcoins in 2025, the next step is to start investing in the world of cryptocurrency. On Pintu, you can explore not only DeFi altcoins but also a wide range of other crypto assets—from meme coins to Real-World Assets (RWA), as well as Layer-1 and Layer-2 networks. All of this is available on a user-friendly platform that’s perfect for beginners, while also offering robust tools for experienced investors to build a well-structured crypto portfolio.

Here’s how to buy crypto assets on Pintu:

- Go to the Pintu homepage

- Navigate to the Market page

- Search for and select the crypto asset you’ve analyzed

- Enter the amount you’d like to purchase, and follow the next steps to complete your transaction

Conclusion

Throughout 2025, the DeFi sector has seen rapid growth, with significant increases in TVL, DEX trading volume, and institutional adoption. Projects like Pendle experienced a TVL surge to $13.5 billion, driven by the launch of Boros and its dominance in the yield trading space. Ethena stood out through the integration of its USDe stablecoin on Binance and an aggressive token buyback strategy. Meanwhile, Aave solidified its leadership with the release of V4, the expansion of GHO, and a strong token repurchase plan that reinforced the protocol’s fundamentals.

At the same time, EigenLayer gained traction through its restaking mechanism and strategic partnerships with major companies like NTT Digital, signaling increasing enterprise-level adoption. Chainlink continues to serve as critical infrastructure for DeFi and RWA, supported by whale accumulation and growing institutional interest.

With regulatory support becoming more favorable—such as the proposed “innovation exemption” from the SEC—and a 260% surge in the tokenized real-world asset sector, the future of DeFi altcoins looks increasingly promising as the backbone of the on-chain financial system.

*Disclaimer: All articles from Pintu Academy are intended for educational purposes only and do not constitute financial advice.

References:

- Abdulkarim Abdulwahab. Global Crypto Regulation 2025: Key Laws Reshaping Stablecoins, Exchanges & Cross-Border Compliance. Accessed on September 24, 2025

- Adrian Sava. Institutional Adoption of DeFi: A New Catalyst for On-Chain Growth. Accessed on September 24, 2025

- Arnold Kirimi. Analyst Projects Chainlink Price Prediction of $180 as Whales Buy 800000LINK. Accessed on September 24, 2025

- BeInCrypto. 3 Altcoins Crypto Whales Are Buying After Fed’s Rate Cut Decision. Accessed on September 24, 2025

- Boluwatife Afe. Top Analyst Predicts AAVE Price Could Hit $1,000 if These Key Catalysts Play Out. Accessed on September 24, 2025

- Coingape. LINK Rebounds As Bitwise Files For First Spot Chainlink ETF. Accessed on September 24, 2025

- CoinStats. Top 7 DeFi Tokens Set to Explode in the Next Crypto Bull Run! Accessed on September 24, 2025

- CoinTribune. DeFi Market Nears All-Time High as Lending, RWAs, and Stablecoins Drive Growth. Accessed on September 24, 2025

- Cryptopolitan. BTCS uses Aave loans to buy more ETH, now among top 10 Ether holders

- Markets. Understanding Chainlink’s Role in DeFi. Accessed on September 24, 2025

- Paul. Nasdaq-Listed Caliber to Launch First Public Chainlink Treasury, Stock Price Up 80%. Accessed on September 24, 2025

- Rene Peters. Is This Where Pendle Price Bottoms Out Before the Next Rally? Accessed on September 24, 2025

- Sean Lee. Surveying The Landscape Of Institutional DeFi. Accessed on September 24, 2025

- Temitope Olatunji. Analyst Reveals Why Ethena (ENA) Could Become a Top 5 Crypto. Accessed on September 24, 2025

Share

Table of contents

Related Article

See Assets in This Article

LINK Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-