APY and APR in Crypto: Definition and How to Calculate It

Various crypto investment products offer more attractive returns or interest than conventional investment products. However, when we want to invest or take a loan, sometimes we encountered foreign terms, for example, APY and APR. By understanding the terms and differences between APY and APR in crypto, you can maximize the interest on the investment or minimize the interest paid when taking a loan.

Article Summary

- 💰 APY and APR in crypto are used to calculate interest on investment and credit products. Both significantly affect how much you will earn or have to pay when saving crypto assets or lending crypto assets.

- 💵 The difference is, APY takes into account compound interest, while APR does not.

- 📈 With compound interest, the amount of return that investors get is more because the interest is calculated from the principal plus the previously earned interest. So, in addition to the interest paid on the principal amount, the reward will continue to increase due to the interest that has accumulated over time

What is APY?

Annual Percentage Yield or APY is the actual rate of return earned within one year from an investment that considers compound interest. Annual percentage yield (APY) is a method for calculating the number of money investors earn from financial market accounts during a year.

💡 APY crypto is a cryptocurrency savings interest where investors can deposit their crypto assets with investment companies and receive a rate of return over a certain period of time. From the borrower’s perspective, APY is the percentage of annual interest that must be paid.

Investment companies generally have a number of crypto profit-sharing programs or features offered to investors, such as the Earn feature on the Pintu app. Each program has different fees, interest rates, and types of crypto assets available. Before investing in any investment feature, investors are advised to study the program and check the credibility of the platform.

What is APY in crypto?

Meanwhile, APY in crypto is a cryptocurrency savings interest where investors can deposit their crypto assets with investment companies and receive a rate of return over a certain period of time. From the borrower’s perspective, APY is the percentage of annual interest that must be paid.

💡 The crypto APR is the annual interest rate offered to customers who lend their tokens or crypto assets for borrowers to access at investment companies or cryptocurrency exchanges.

Investors’ crypto assets will be locked for a certain period of time, and they will receive a larger fixed rate of interest. Although passive income can add value to an investor’s portfolio, they are not able to exchange locked crypto assets and crypto fluctuations can affect their income level.

Differences between APY and APR for crypto

APY and APR for crypto are two elements that are almost similar in that they are standard interest rates expressed as an annual percentage rate. However, the two have a number of differences. Some of the differences between APY and APR for crypto are outlined in the table below:

| APY | APR |

| APY takes into account compound interest | APR does not consider compound interest |

| The compounding effect makes investment growth or borrowing costs higher | Investment growth or borrowing costs are lower than APY |

| Recommended for savers/investors | Recommended for borrowers |

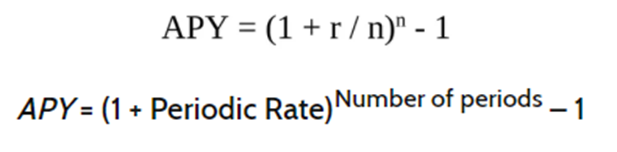

Formulas and how to calculate APY

Here is how to calculate APY in crypto:

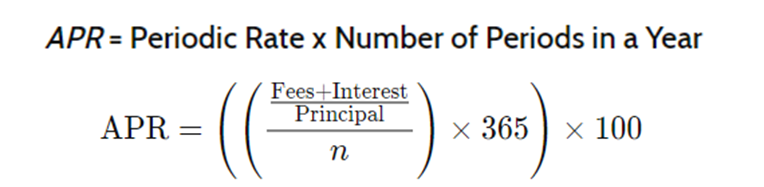

Formulas and how to calculate APR

Below is the formula to calculate APR in crypto in the following equation:

Example:

💡 An investment product offers an interest of 2% every month. If the reward offered is APR, then the return that will be obtained is 24% (2% x 12 months = 24%).

Meanwhile, if the investment product offers APY interest, with a compound interest rate of 1% per month, the interest earned is 12.68% [(1 + 0.01/12)^12 – 1 = 12.68%] per year. If you maintain the same amount of balance for one year, the interest rate will be 12.68% as a result of compounding each month.

APY on Earn feature and APR on PTU Staking feature on Pintu app

On Pintu app, you can increase your crypto assets by using the Earn feature and also the PTU Staking feature. Pintu Earn is one of the features of Pintu which can be used by users to store crypto assets and earn a certain amount of interest from the stored assets. Currently there are six crypto assets that you can invest in Pintu Earn, namely Bitcoin , Ethereum , Binance Coin , Dogecoin (DOGE), Tether , and USD Coin .

The interest rate for each crypto asset may differ from one another and may change from time to time. The type of crypto asset you get will be the same as the type of crypto asset you invest in.

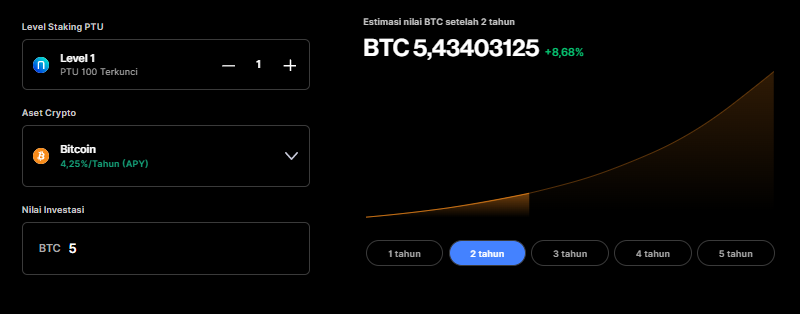

For example, if you store BTC assets in the Pintu Earn with an APY of 4.25%, then you will also earn interest in BTC as shown in the example below.

In addition to the Earn feature, you can also invest your assets in PTU Staking feature, which allows users to earn various rewards by “locking” PTU assets in Pintu. The more the number of PTU staked, the higher the reward you will get. For example, if you are staking 100 PTU tokens, then you will get an APR of 7% which you will receive every day.

Not only that, if you lock PTU as much as 500, if you save BTC in the Earn feature you will get APY of 4.25%. If you lock up 1,000 PTU tokens, you will get 4.5% APY. Check further on this page.

If you’re interested in investing in crypto assets after learning about APY and APR crypto and the differences between the two, visit Pintu, an Indonesian cryptocurrency application that has been registered with BAPPEBTI. You can also access other information about crypto at Pintu Academy.

Share

Related Article

See Assets in This Article

BTC Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-