FOMO and the Psychology of Crypto Trading

Since 2009, the Bitcoin and cryptocurrency market, in general, has gone through many cycles of growth and decline, going through various bear and bull market phases. While typically each downswing and upswing will alternate between each other, there are times such as 2018 and 2019 where it experiences a period of constant downturn.

When the price doesn’t seem to be going higher, it might be difficult to cope with worry and anxiety. Periods of considerable profits, on the other hand, might lead to overconfidence, making you vulnerable to a bull trap or rug pull on small projects. In this article, we’ll look at how emotions, psychology, and FOMO affect crypto investing.

What is FOMO?

The Fear of Missing Out, or FOMO is an acronym used to define the fear of not wanting to miss a particular event. In the context of crypto, FOMO means fear of not investing in a particular trending crypto asset. From time to time, there will be a particular asset that experiences drastic increases, many people are worried that they will lose the opportunity to get 10 times or even 100 times profits.

At times like these, the FOMO in the community will be very high. Consequently, a lot of people will enter the market and buy the asset at the wrong time and will suffer losses as the asset suffers major correction. FOMO can happen to anyone, but it often happens to new investors who are looking for quick profits and don’t pay attention to the potential future uses and implications of the technology on offer.

Of course, there is nothing wrong with buying assets that are currently popular. However, is the reason behind your purchase correct? Do you buy based solely on emotion or through a process of deep analysis?

The influence of emotions in trading and investing

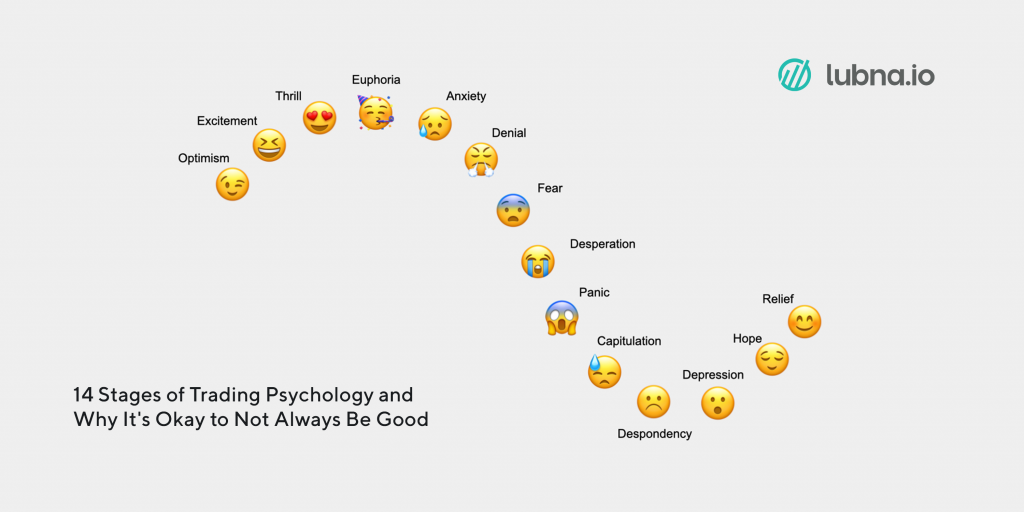

According to behavioral economics, all price movements in the market are influenced by the psychology of the market as a whole as well as individual emotions. These two things are commonly called trader psychology and crypto market psychology. In terms of market conditions, the fear and greed index is a good indicator to see the market sentiment. Emotional conditions and expectations of each individual form the market sentiment which sums up the emotions of the majority of traders.

When you want to invest in cryptocurrency, you will be affected by various emotions such as fear, optimism, or panic. Sometimes, these emotions push you to make hasty decisions that can cost you money. FOMO itself occurs because of a mixture of fear, hope, and panic that drives you to buy the asset.

block💡 One of the recent FOMO cases is the memecoin asset Squid game (SQUID) which experienced a price increase of up to 23 million percent in less than a week. Many think the Squid token will be the next dogecoin, and buy it when the price is high. As a result, many investors suffer losses because it turns out that SQUID is a rug pull scam.

Also read: What is a rug pull scam?

FOMO usually occurs when you seek information from sources that are too biased. Whether intentionally or not, the crypto community is partly responsible for creating FOMO by making unrealistic price projections for a certain asset. The spread of this information then creates a herd mentality which further causes FOMO. For new investors with little knowledge of the community and the asset, this is a textbook situation for suffering losses.

Strategies to avoid FOMO and overcome the emotional side of investing

1. Determine investment goals and targets

One of the most effective ways to avoid FOMO and the emotional experience of investing in cryptocurrency is to create an investment plan. This plan contains short, medium, and long-term goals and targets that you want to achieve. Ideally, this plan should also include a list of some of the coins that you want to gradually buy.

💡 For example, you define ETH, BTC, MATIC, and ADA as the four assets that you want to keep long-term. Meanwhile, you decide you want to buy metaverse assets like ENJ and SAND as a short-term purchase.

You can use this approach as a reference to buy assets when the market is experiencing a dip or decline. With a clear target, you will not be tempted by rumors about a coin predicted to increase by 500%.

2. Read analysis from reliable sources

The crypto community in the world is growing rapidly. Conversation groups, social media communities, and content creators contain thousands of people who talk about cryptocurrency every day. Various content with clickbait titles such as “This coin will increase by 400% next year!” or “this is the next Bitcoin!” are all over the place.

Clickbait content like this is often biased because the creators have an agenda to influence your decision. Thus, creating a sense of FOMO. You need to look for information that is conveyed in a neutral, critical manner that explains various risks to the reader. Balanced information like this won’t be easy to find but can be the difference between a feeling of FOMO and measured optimism.

3. DCA Strategy

DCA, or dollar-cost averaging, is a common strategy when investing in cryptocurrencies. With DCA, you can invest incrementally by putting the same amount in small increments over a period of time. For example, you want to invest in Bitcoin and decided to use DCA strateg by putting in 1 million IDR on the 10th every month for the next 12 months. DCA is an investment strategy that can minimize the risk of volatility of cryptocurrencies.

Also read: What is dollar-cost averaging (DCA) and how is it calculated?

However, the key to DCA is that you have to be consistent in following your plan and not be tempted by rumors or information from other people. DCA removes the emotional side of buying crypto assets because your investment process is scheduled regardless of prices and market trends.

4. Asset diversification

One of the main principles of investing in any industry is diversification. Diversification can minimize the risk of you losing all your money. By spreading your assets, you can get an even profit if several crypto assets go up at the same time. However, diversification will not give you big gains in your portfolio. Instead, it prevents you from experiencing big losses.

💡 Don’t put all your eggs in one basket!

With diversification, you won’t be stuck in a panic waiting for the green chart because the only asset you have is slowly going down. If and when you suffer losses, it will be evenly spread. This can make you more careful and calmer when making investment decisions.

Investing in cryptocurrencies

You can start buying various cryptocurrencies in the Pintu app. Through Pintu, you can buy crypto-assets and even do DCA safely and conveniently. Come on download the cryptocurrency door application on the Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Conclusion

FOMO or fear of missing out is one of the emotional aspects with detrimental effects when investing and trading in crypto assets. Fear, panic, optimism, and self-confidence are some of the emotions that shape the sentiment of the crypto market and each individual. These emotions can have a negative influence in making decisions such as panic buying BTC assets due to seeing trends on social media.

Decisions made out of panic can usually cost you money because they are not made based on data and analysis. Therefore, we need to determine various strategies that can mitigate the negative influence of emotions, especially FOMO.

References:

- Basics of Market Psychology in Crypto Trading – Superoder.io on Medium

- A Brief Introduction to Crypto Trading Psychology – Arbismart

- Crypto Market Psychology vs Your Trading Psychology- Altcointrading

- Three Ways to Successfully Invest in Crypto and Avoid the FOMO- Gitconnected on Medium

- The Importance of Trading Psychology – Investopedia

- How to Avoid Crypto FOMO (Fear of Missing Out) – Easycrypto

- From avoiding FOMO to having a plan, 5 key ways to manage a crypto down cycle – Coinbase

Share