Bridge vs. Cross-Chain Swap: What’s the Difference?

The growth of blockchain ecosystems and decentralized applications (dApps) has paved the way for users to engage in various activities without the involvement of third parties, ranging from asset exchanges and NFT purchases to utilizing decentralized finance services. However, as the number of blockchain networks continues to increase, interoperability challenges have become a major barrier. Fortunately, several solutions have emerged such as Cross-Chain Swaps and asset Bridges. In this article, we will explore both in detail, from their definitions and key differences to real-world examples of how they are used within the Web3 ecosystem.

Article Summary

- 🔎 What is a Bridge: a mechanism that enables the transfer of crypto assets from one blockchain network to another.

- ⚙️ What is a Cross-Chain Swap: a mechanism that allows users to directly exchange crypto assets across different blockchain networks.

- 📌 Experience Using Bridge and Cross-Chain Swap: in practice, Cross-Chain Swaps offer a more practical and seamless experience, including the ability to directly receive native tokens on the destination network.

What is a Bridge?

A bridge is a mechanism that enables the transfer of crypto assets from one blockchain network to another. This process is made possible through the use of smart contracts that can perform key functions such as locking assets on the source chain, minting tokens on the destination chain, and managing cross-chain data.

With a bridge, users can move assets like ETH from the Ethereum network to Arbitrum or other blockchain networks without having to sell their existing assets.

On many bridge platforms, the commonly used mechanism is lock-and-mint, where assets are locked on the source chain and their representations are minted on the destination chain. The assets that can be transferred are typically limited to tokens that have been specifically supported or configured within the bridge’s smart contract system.

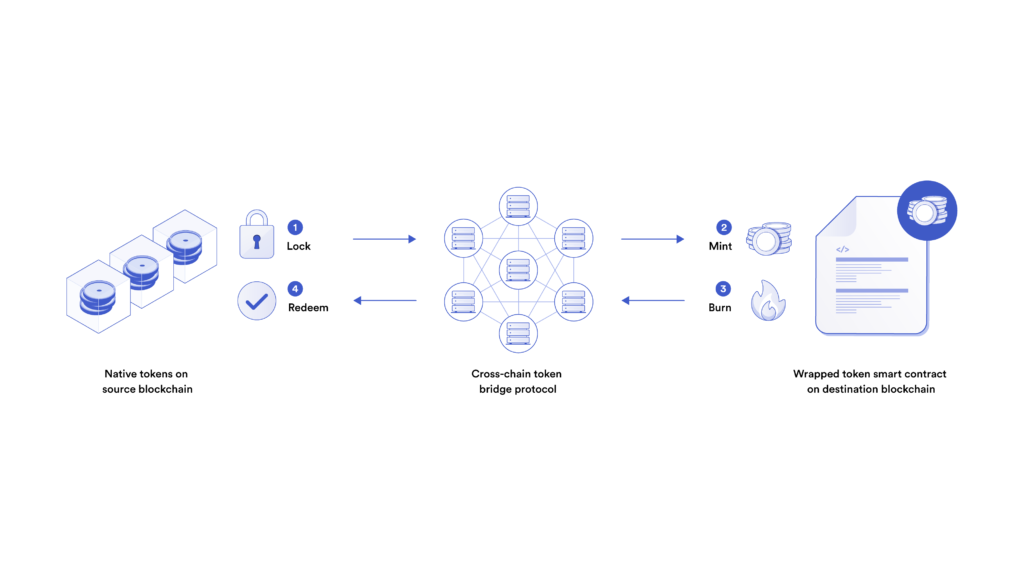

How a Bridge Works

Technically, a bridge functions as an intermediary between blockchains to relay and verify cross-chain data, especially in the process of transferring asset representations from one network to another.

For example:

- You own 1 ETH on the Ethereum network and want to move it to the Arbitrum network. This is the initial step of the bridging process, where you intend to use your asset on a different network.

- The transaction is submitted, and the bridge’s smart contract on Ethereum locks the 1 ETH. The asset doesn’t actually move; instead, it is stored or locked in a smart contract to ensure you can’t use it on both networks simultaneously.

- The bridge sends transaction verification data to the Arbitrum network, usually via a validator or relayer. This is where cross-chain communication happens, not directly between blockchains, but through the bridge system that relays transaction status.

- A smart contract on Arbitrum receives the data and mints 1 Wrapped ETH (WETH) as a representation of the ETH locked on Ethereum, with a 1:1 value.

- You receive 1 WETH on the Arbitrum network, which you can use in the Arbitrum ecosystem like any regular token.

- The burn process takes place when you want to move the 1 WETH back from Arbitrum to Ethereum. In this process, the 1 WETH you hold is burned on the Arbitrum network, allowing you to reclaim 1 ETH back on Ethereum.

What is a Cross-Chain Swap?

A Cross-Chain Swap is a mechanism that allows users to exchange crypto assets from one blockchain network to another directly. This process offers a practical alternative within the Web3 ecosystem, enabling users to swap tokens across different chains without going through a series of manual steps like bridging or switching between platforms.

Although its basic function is similar to asset trading on centralized exchanges (CEX), a Cross-Chain Swap provides a more decentralized approach and simplifies the process for users active across multiple blockchain networks.

Both bridges and Cross-Chain Swaps require transaction fees to operate. These fees are typically paid in the native token of the source network. For example, if a user wants to perform a Cross-Chain Swap from ETH on the Arbitrum network to OP on the Optimism network, they will need ETH on Arbitrum to cover the transaction fee.

How Cross-Chain Swaps Work

Cross-Chain Swaps involve a series of complex processes behind a seemingly simple interface. In general, users need to hold the native token on the source network and select the asset they wish to receive on the destination network.

Once the user initiates a transaction through a Cross-Chain Swap platform, a smart contract will lock or burn the token on the source chain and then mint a representative asset or the swapped token on the target chain.

This entire process is typically executed automatically through an integration of bridges and cross-chain DEXs. The available assets depend on the liquidity within these DEXs and the tokens supported by the bridge protocol in use. A routing mechanism helps determine the most efficient path to complete the cross-chain swap.

Differences Between Bridge and Cross-Chain Swap

At first glance, bridges and cross-chain swaps may seem similar, as both enable interaction across different blockchain networks. However, they differ fundamentally in terms of purpose, mechanism, advantages, and limitations. The full comparison is presented in the table below:

| Aspect | Bridge | Cross-Chain Swap |

| Purpose | Move assets from one network to another | Swap assets from one network to another |

| Asset Type | Usually the same asset (e.g., ETH on Ethereum > WETH on another network) | Different assets (e.g., USDC on Ethereum > BNB on BSC) |

| Mechanism | Smart contract bridge (commonly uses lock-and-mint mechanism) | Combination of bridge + cross-chain DEX (routing) |

| User Flow | Users must go through several steps: bridge first, then swap manually | Swap process happens in one step: simply choose the asset and the destination network |

| Advantages | Doesn’t require liquidity (lock-and-mint model) | Wide range of swappable assets depending on available liquidity |

| Disadvantages | Limited assets (some lock-and-mint bridge services only support specific assets configured in smart contracts) | If the asset to be swapped has low liquidity, slippage may be high |

My Experience Using Bridge and Cross-Chain Swap

As someone actively involved and enthusiastic about exploring the Web3 ecosystem, I’ve tried various Bridge and Cross-Chain Swap platforms to support my activities such as airdrop farming, DeFi, GameFi, and purchasing tokens that haven’t been listed on centralized exchanges (CEX).

Some of the platforms I’ve used include Wormhole, deBridge, and Orbit Finance. Among these, Wormhole focuses on bridging services, while deBridge and Orbit Finance offer Cross-Chain Swap features. In my experience, these three platforms are more than sufficient to support my needs when navigating across different blockchain ecosystems.

Experience Using Wormhole (Bridge)

For bridging native assets such as SOL, ETH, SUI, and HYPE, I prefer using Wormhole. The reason is simple: the transaction speed is impressive. Every transaction I’ve executed so far has been completed in under a minute.

However, there’s one notable drawback when using a bridge like Wormhole: you still need to hold the native token on the destination network to cover transaction fees.

For example, when I bridged SOL (on the Solana network) to WSOL (on the Ethereum network), I still needed to have ETH in my wallet to interact with the Ethereum network. For some users, this requirement could be a potential barrier.

Experience Using deBridge and Orbit Finance (Cross-Chain Swap)

That issue can be solved through Cross-Chain Swap platforms like deBridge and Orbit Finance. In terms of network support and ease of use, I personally prefer deBridge. It allows me to perform cross-chain swaps directly, even swapping straight into the native token on the destination network to cover transaction fees, making the process more efficient.

I usually use deBridge to purchase tokens I’m interested in. I simply copy and paste the token’s contract address and approve the transaction. If the token isn’t available directly on deBridge, I first swap into the native token of the destination chain and then buy the desired token through a DEX on that network.

Summary of Personal Experience

Overall, Cross-Chain Swap feels much more practical than simply bridging native tokens. Based on my experience, bridge fees are generally slightly lower, which makes sense given that Cross-Chain Swaps typically rely on a more complex routing system to find the best path and price for the assets being exchanged.

When using a bridge, I still need to prepare native tokens on each destination chain to cover transaction fees, which can be inefficient if I don’t already have them. With Cross-Chain Swap, the process becomes more streamlined, especially for dynamic, multi-chain activities across ecosystems.

Conclusion

Both bridges and cross-chain swaps offer users the ability to interact across different blockchain networks, but each has its own strengths depending on the context. Bridges are ideal when users want to transfer assets between networks without converting them into other tokens.

On the other hand, cross-chain swaps provide greater convenience by allowing users to swap assets, either non-native tokens or directly into the native tokens of the destination chain, for further transactions. By understanding the differences and advantages of each method, users can choose the most suitable solution to support their exploration within the ever-evolving Web3 ecosystem.

References

- “What Is a Cross-Chain Bridge?”, Chainlink, accessed on 7 August, 2025.

- “What Are Cross-Chain Swap?”, Chainlink, accessed on 7 August, 2025.

- CHAINALYSIS TEAM “Introduction to Cross-Chain Bridges”, Chainalysis, accessed on 7 August, 2025.

- “Cross-Chain”, Coinmarketcap, accessed on 7 August, 2025.

Share

Related Article

See Assets in This Article

0.0%

DEFI Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-