Solana Airdrop Strategies in 2024

At the start of every bull market, airdrops are always a topic of conversation among the crypto community. Everyone wants to get crypto assets for free, especially if the assets are from a promising project. Bull markets are always a good time for projects to airdrop due to favorable market conditions. Projects in the Solana ecosystem have started airdropping in the last few months. This article will give you several strategies to get airdrop on the Solana ecosystem.

Article Summary

- 💸 Airdrops and Bull Markets: At the beginning of every bull market, airdrops become a popular topic among the crypto community. A bull market is an ideal time for projects to airdrop, and projects in the Solana ecosystem have already started doing so.

- 💪 Principles and How to Get an Airdrop: To get airdrop, users must demonstrate consistency and capital commitment. Projects are becoming more selective in providing airdrops and the time it takes to get an airdrop is usually several months.

- 🪂 Airdrop in Solana Ecosystem: Rumors about an airdrop in the Solana ecosystem have been around since mid-2023 because there are many tokenless DeFi protocols. Pyth Network and Jito are examples of projects that have airdropped on Solana, drawing the attention of the crypto community to this ecosystem.

- 🏦 Airdrop Potential of Some Solana Protocols: Several protocols in Solana, such as MarginFi, Kamino Finance, Jupiter, Tensor, and Drift Protocol, are predicted to do airdrop.

How to Get Airdrop and Understanding The Principles

Airdrops are crypto rewards given by a project to its loyal users and community members. In the beginning, the criteria for getting an airdrop was easy because there were very few crypto users. Now you have to compete with thousands of users to get an airdrop. Therefore, projects are getting smarter and only give them to loyal users.

The two principles of getting airdrops are consistency and capital commitment. As mentioned, projects now have strict criteria for selecting users. You must make a capital commitment and consistently perform a series of activities to increase your chances of getting an airdrop.

Also, don’t expect to get an airdrop in 1 or 2 weeks as it usually takes several months. Projects also usually incorporate frequency and length of use into the allocation of airdrop tokens. Users who have been active for 1 or 2 months usually get more tokens.

So, is there no way to get airdrops for free? There is but it’s tough to do. Usually, you have to first enter the Discord group of a new project and actively participate in its campaigns and events such as AMAs and tasks. You’ll get various free NFTs and roles on Discord that will usually be considered for airdrops. However, this means you have to discover the project before anyone else.

Airdrop in the Solana Ecosystem

Rumors of an airdrop in the Solana ecosystem started as early as mid-2023. At that time, people started to realize that many new DeFi protocols were popping up in Solana and most of them are tokenless. This sparked a lot of speculation on X such as from Aylo and Dynamo DeFi. One of the big influencers on Solana, Ansem, also speculated that some protocols will airdrop.

Pyth Network and Jito are two projects that are already doing airdrops among the new generation of protocols on Solana. Jito especially brought the crypto community’s attention back to Solana. Now, many have realized the potential benefits of airdrops in Solana. Here are some Solana protocols that have the potential to provide airdrops.

Several Protocols with Airdrop Potential in Solana

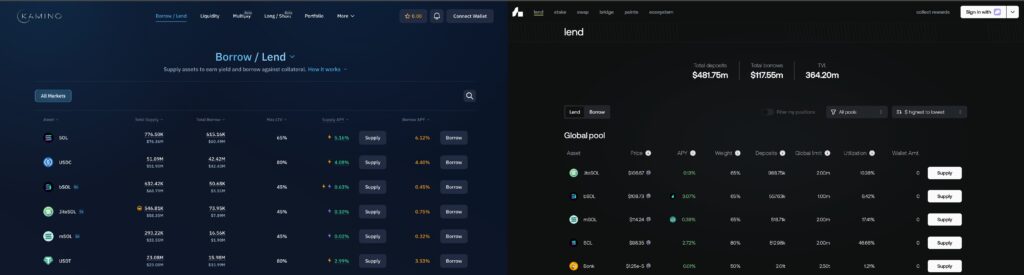

1. MarginFi and Kamino Finance

Kamino Finance and marginfi are the two largest lending protocols in Solana. Kamino has a TVL of $249 million while marginfi is $341 million (January 26, 2024). As Solana’s two largest lending protocols, many airdrop seekers in Solana cycle assets through them.

Marginfi has announced a points system since July 2023 to incentivize its users. The points program that has been running for over 6 months has made the sentiment on Twitter negative as there hasn’t been any news about an airdrop.

However, the launch of the MRGN token is likely to be in conjunction with various products to be launched such as the decentralized stablecoin YBX.

Meanwhile, Kamino Finance just announced KMN points and token program on January 19, 2024. Like marginfi, Kamino’s point system will be awarded on a contribution basis per dollar per day. However, the difference with Kamino is that users can earn additional points through multiply and leverage features.

In addition, Kamino explained that the point system will continue to run even after the KMN token is launched, which means that the airdrop will be done in more than 1 stage.

2. Jupiter DEX

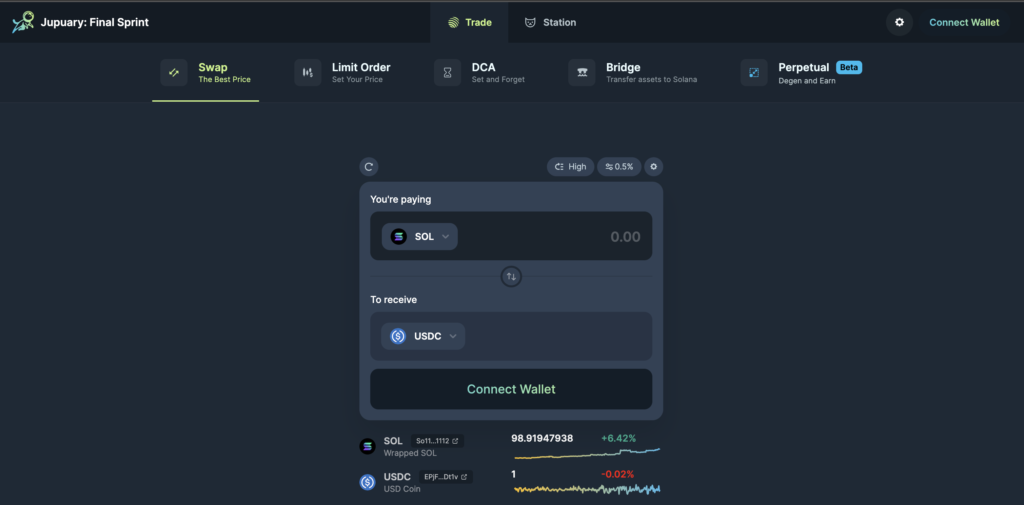

Jupiter is the largest DEX aggregator in Solana. The protocol connects users with the various DEXs in Solana and provides the most optimal exchange and trading routes. Jupiter works very similar to 1Inch on Ethereum.

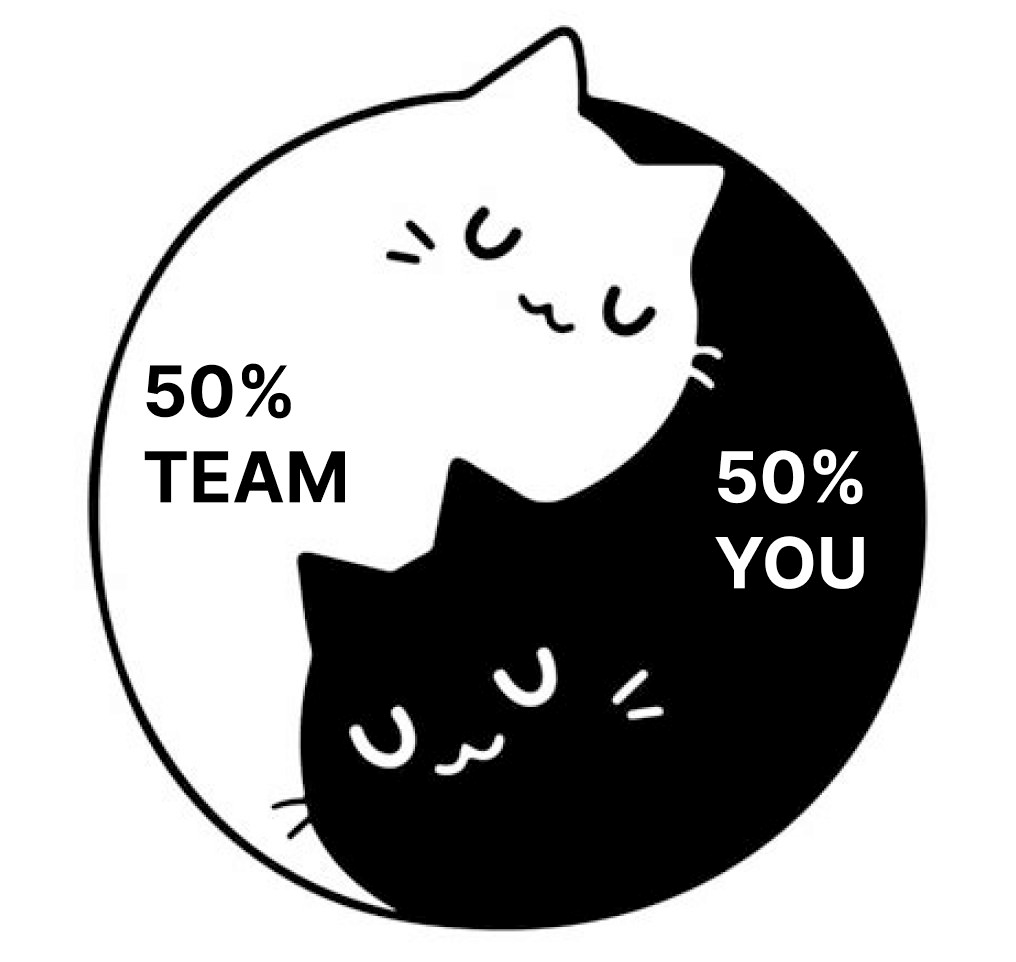

The launch of Jupiter’s JUP token is highly anticipated by many users. Moreover, Jupiter announced that the allocation of JUP tokens is 50% teams and 50% users. The total supply of JUP is 10 billion JUP and the airdrop will be divided into 4 stages.

In stage one, which will take place on January 31, 2024, 1 billion JUP will be distributed to users who trade before November 4, 2023. Jupiter has not released the detailed conditions for getting the JUP allocation but many people speculate that the main criteria are trading volume and frequency.

3. Tensor

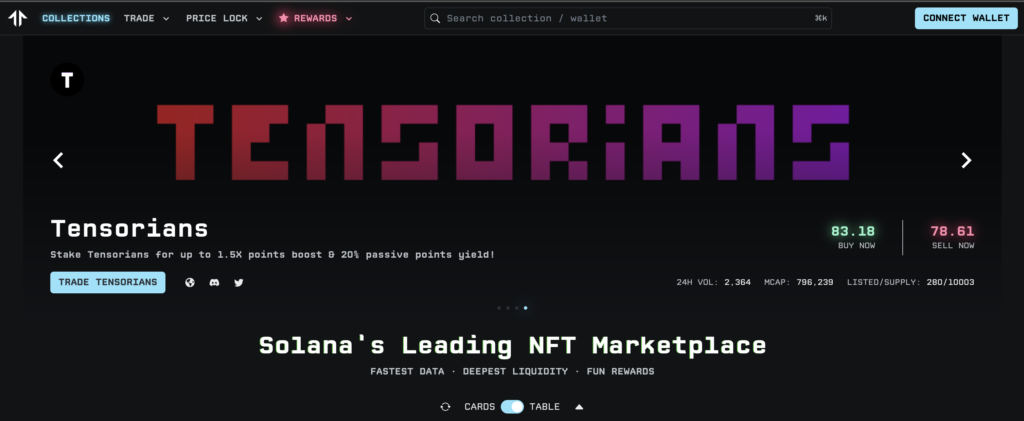

Tensor is the largest digital NFT marketplace in Solana and is only 1 year old. Despite this, Tensor has managed to overtake Magic Eden, the incumbent NFT marketplace in Solana. Tensor already has a reward system that has been running for 3 seasons. As such, everyone is speculating that this reward system will end up in a token launch, much like BLUR.

Like BLUR, you can earn points from Tensor through various activities such as selling, buying, and using the new price lock feature. In the 3rd reward season, the most points were allocated to users who used price lock.

The price lock feature is a futures-like NFT trading feature where you can either be a trader (taker) or a fund provider (maker). You will not get liquidated when using price lock as you will only lose the transaction fee you paid upfront (3.5%).

Finally, owning NFTs from the Tensorians collection and locking them to staking will multiply your points. Tensorians owners will also get an additional allocation of Tensor tokens.

4. Drift Protocol

Drift Protocol is the largest decentralized trading platform in Solana. They only announced the points system on January 23, 2024. This point system will only run for a maximum of 3 months which has sparked speculation that the Drift token will launch afterwards.

However, Drift Protocol does not go into detail about the activities that will contribute to points. Many people assume that points will be calculated through each user’s trading volume and the various features available on Drift.

The main activities that will earn you points for airdrops are spot and leveraged trading on Drift. You can also provide loans and borrow directly on Drift. In addition, you can earn interest and points through the two activities of locking assets in an insurance vault and becoming a liquidity provider or DLP (Drift Liquidity Providers).

3 Airdrop Strategies in the Solana Ecosystem

1. Jupiter Airdrop Strategy

Getting JUP token airdrops is one of the easiest things you can do. However, DEX platforms usually distribute airdrops based on the transaction volume of each account. The capital you spend will be in line with the amount of tokens you get. The initial target is to usually reach above $1000 in volume.

In addition, you should try Jupiter’s DCA and Limit Order features because there is a possibility that users who use features other than swaps get additional allocations.

Here’s the ideal strategy to get JUP tokens:

- Buy SOL on Pintu for the amount you want (in this strategy $500).

- Create 5 Solana wallets (Phantom, Solflare, or Backpack).

- Send your SOL for $100 to each wallet.

- Perform SOL-USDC swap every day for 7 days on the 5 wallets (to prevent being considered a bot).

- In the second week, swap SOL for other Solana ecosystem coins such as PYTH, JTO, etc (swap back to SOL if you don’t want to invest in other coins besides SOL).

- Every week, do at least 1 swap or try DCA and Limit Order features in Jupiter to keep your wallet status active.

- Repeat the above steps consistently.

You can customize the amount and number of wallets you want to use to find airdrops. If it's too complicated, you can do it with 1 wallet and as little as $10 or $20. The difference is that you'll need to do the above steps more frequently to achieve transaction volumes above $1000.

Currently, you have missed the opportunity to get the phase 1 JUP airdrop. However, don’t worry because the JUP airdrop will be conducted in 4 phases so there are still many opportunities to get the airdrop.

2. Kamino and marginfi strategy

Kamino and marginfi both have a point system to measure users’ airdrop allocations. One of the most popular airdrop strategies on lending platforms is looping lending of stable assets like USDC. However, this process can be a bit overwhelming if you’re new to lending platforms.

Here’s a basic strategy for getting airdrops on Kamino and marginfi:

- Buy USDC on Pintu and send it to Solana wallet.

- Go to Kamino and marginfi, connect wallets, and open the lend/borrow page.

- Provide USDC or SOL on the lend page.

- Borrow assets on the borrow page to get more points (borrow USDC if you don’t want to risk liquidation).

- Kamino only: use the multiply and leverage features for extra points (don’t do it if you are a beginner).

The steps below are only for those of you who already understand the concept of DeFi. In the looping strategy, you will get much more points but with greater risk.

- After lending USDC, borrow USDC.

- Use the USDC you borrowed to provide another USDC loan.

- Borrow back the USDC you lent.

- Do this until you are close to the maximum LTV (Loan-To-Value) ratio, ending with a lend action.

- Note that all your positions will be liquidated if USDC depegs.

3. Drift Protocol Airdrop Strategy

Drift Protocol is not only a platform for decentralized trading, it offers full features including lending and swaps. So, for those of you who don’t want to trade, you can do other activities to earn points from Drift.

Therefore, the Drift Protocol strategy will not be made as a step but as an option.

- Do decentralized trading on Drift, including leverage trading, buying spot, and doing swaps. Focus on transaction volume if you are going to do this strategy.

- The strategy of locking assets in Drift insurance fund to earn interest and points. Spread your assets to earn more points but at a higher risk.

- Lending and borrowing on Drift. You can combine this strategy with locking your assets in Drift’s insurance fund.

- Become a Drift liquidity provider or DLP. You should know that there is an impermanent loss risk in becoming a liquidity provider. You can also combine this strategy with the strategy of becoming a borrower in Drift.

@zerototom made a nice thread on how to combine activities on Drift and some protocols like Kamino to maximize the potential of getting airdrops.

Conclusion

In the crypto world, airdrops are always chased by many users, especially during bull market periods. Airdrops are an important strategy for crypto projects to build community and user loyalty. In the Solana ecosystem, large projects such as MarginFi, Kamino Finance, Jupiter, Tensor, and Drift Protocol are in the limelight because they have the potential to conduct airdrops.

As the criteria for airdrops become stricter, users need to be more active and involved in these projects to increase their chances. Strategy and long-term commitment will be key to capitalizing on airdrop opportunities in the Solana ecosystem and more broadly in the crypto world.

How to Buy SOL on the Pintu App

You can start investing in cryptocurrencies by buying them on the Pintu app. Here is how to buy SOL on Pintu:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for SOL.

- Click buy and fill in the amount you want.

- Now you are a Solana investor!

In addition, the Pintu application is compatible with various popular digital wallets such as Metamask to facilitate your transactions. Go and download the Pintu cryptocurrency app on the Play Store and App Store! Pintu is regulated and supervised by Bappebti and Kominfo.

You can also learn crypto through the various Pintu Academy articles which are updated every week! All Pintu Academy articles are for educational purposes, not financial advice.

References

- Dirt Diggler, “The Great Solana Airdrop Guide”, Substack, accessed on 24 January 2024.

- Miles Deutscher, “The biggest Solana airdrop season in history is about to commence. You have a huge opportunity to capitalize,” X, accessed on 24 January 2024.

- Gumshoe, “SOLANA AIRDROPS: A Guide Here are the top 5 airdrops I’m farming and why“, X, accessed on 25 January 2024.

- Joker, “Hurry up and become Eligible for FOUR Solana Airdrop“, X, accessed on 25 January 2024.

- ZeroToTom, “1.🧵 Solana Eco Airdrop Farming Masterclass.🫡 How to utilise @DriftProtocol“, X, accessed on 26 January 2024.

Share