How to Use Take Profit and Stop Loss

In the world of cryptocurrency trading, known for its high volatility, having a well-prepared strategy is the key to surviving and making profits. Two of the most fundamental elements of every trader’s risk management are Take Profit (TP) and Stop Loss (SL). Understanding and applying these two pillars with discipline is crucial for achieving long-term success.

This article will thoroughly explore the ins and outs of Take Profit and Stop Loss in cryptocurrency trading, starting from their basic definitions and importance, to how to determine the right levels, along with special tips to optimize their use.

Article Summary

- Definition of TP and SL: Automatic orders set by traders on a trading platform to close a position at a specific price level.

- The Importance of Using TP and SL: Helps implement measurable risk management, avoid emotional decisions, improve time efficiency, and build trading discipline.

What Are TP and SL?

Simply put, Take Profit and Stop Loss are automatic orders that traders set on a trading platform to close a position at a certain price level.

- TP is an order to automatically sell a crypto asset when its price reaches a predetermined profit level. Its purpose is to secure profits before the market potentially reverses.

- SL is an order to automatically sell a crypto asset when its price falls to a predetermined loss level. Its function is to limit potential losses and protect capital from further price declines.

These two orders work in opposite ways but share the same purpose: eliminating emotions from trading decisions and executing strategies with discipline.

Why Are TP and SL So Important?

Many beginner traders overlook the importance of TP/SL, often due to greed (hoping for bigger profits) or fear (unwillingness to realize losses). In reality, ignoring both is a surefire recipe for failure. Here are the reasons why TP/SL is so crucial:

- Measured Risk Management: TP/SL allows traders to clearly define how much profit they aim for and how much loss they are willing to tolerate in each trade. This is the essence of risk management.

- Avoiding Emotional Decisions: The crypto market can move very quickly, often triggering emotional reactions such as panic when prices drop or greed when prices surge. By setting TP/SL in advance, logic and strategy take control instead of temporary emotions.

- Automation and Efficiency: Traders don’t need to constantly monitor price movements 24/7. TP/SL orders are executed automatically by the system, even while sleeping or away from the screen. This provides peace of mind and saves time.

- Trading Discipline: Consistently applying TP/SL helps build strong trading discipline, a trait shared by all successful traders.

How to Determine TP and SL

Determining effective TP and SL levels is both an art and a science. Levels that are too tight may cause positions to close due to normal price fluctuations (noise), while levels that are too loose can lead to unnecessary losses or missed profits.

How to Determine TP

The main purpose of TP is to secure profits according to the trading plan. Here are some popular methods for setting TP:

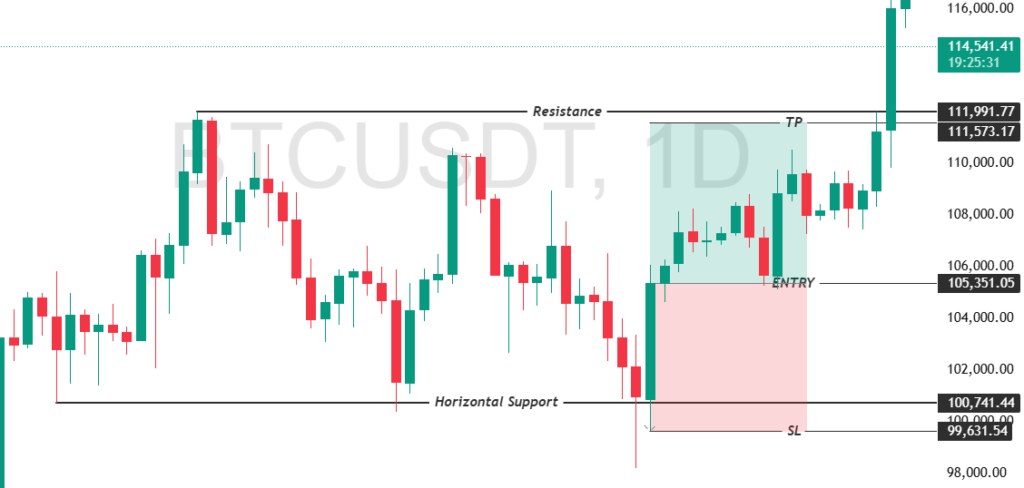

1. Using Support and Resistance Levels

- Support: Support is a price level where historical buying pressure has been strong enough to prevent the price from falling further. Placing TP slightly above a strong support level is a common strategy to ensure the order is executed before the price reverses.

- Resistance: Resistance is a price level where historical selling pressure has been strong enough to prevent the price from rising higher. Placing TP slightly below a strong resistance level is a common strategy to ensure the order is executed before the price reverses.

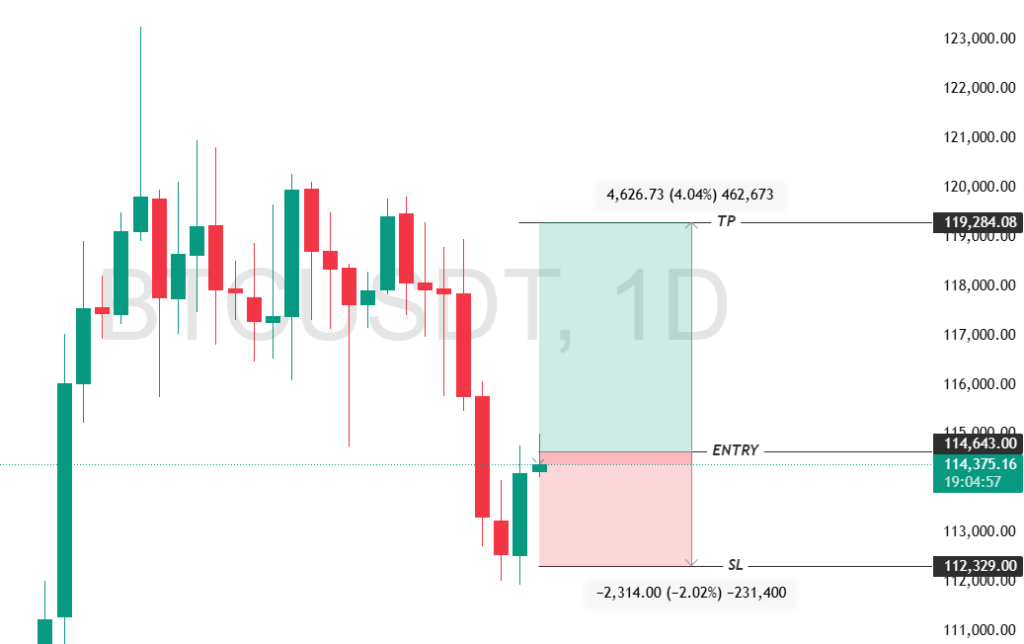

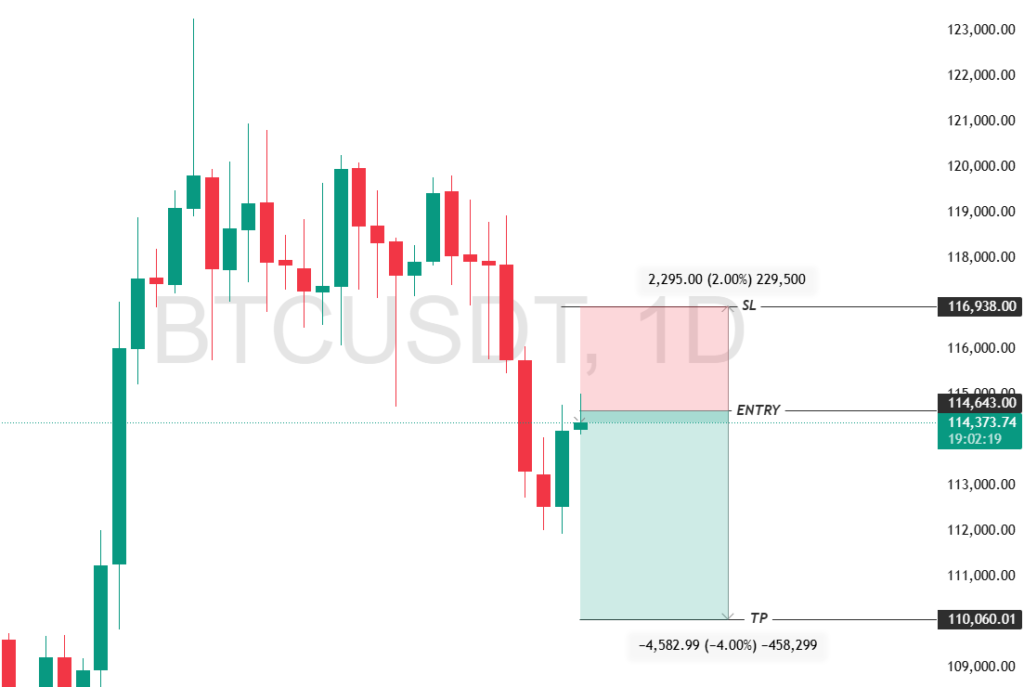

2. Based on Risk/Reward Ratio

This is the most strategic method. Before entering a position, traders should determine the ratio between potential profit and potential loss. A healthy ratio typically starts at 1:2, meaning the potential profit should be at least twice the potential loss.

- Example: If a trader enters at Rp50,000 and sets the SL at Rp47,500 (risk of Rp2,500), then with a 1:2 ratio, the TP should be placed at Rp55,000 (profit of Rp5,000).

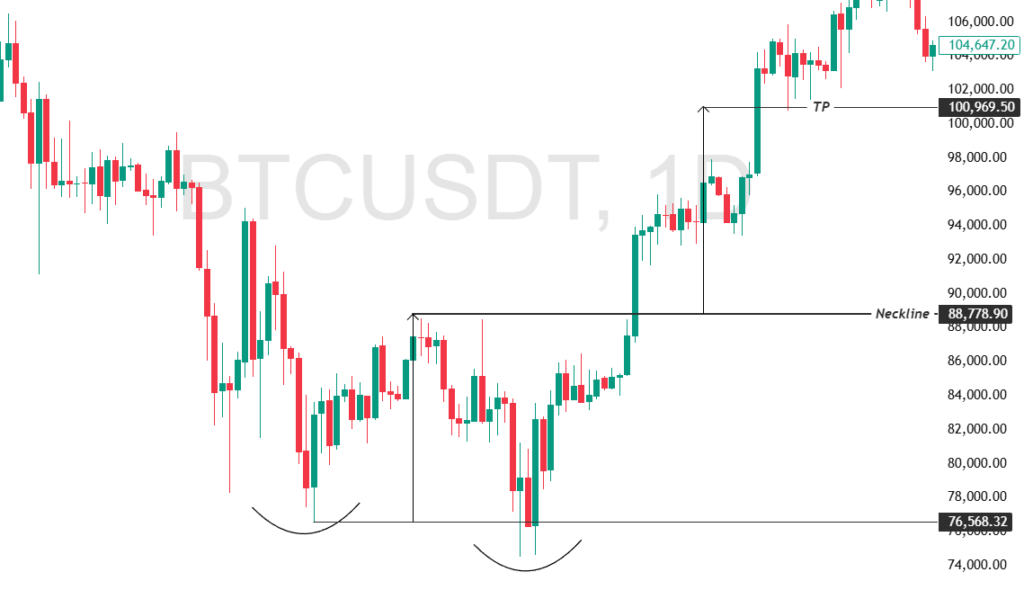

3. Using Chart Patterns

Technical analysts often use price targets derived from chart patterns (such as head and shoulders or double bottom) to project how far the price is likely to move. These levels can serve as logical TP targets.

How to Determine SL

The main purpose of SL is to protect capital. Here are some popular methods for determining SL:

1. Based on Risk Percentage

This is the simplest method. A trader determines the percentage of their total trading capital they are willing to risk on a single position. For example, if the capital is Rp10,000,000 and the risk is set at 2% per trade, the maximum loss would be Rp200,000. From there, the trader can calculate the SL price level.

2. Using Support and Resistance Levels

- Support: Support is a price level where historical buying pressure has been strong enough to prevent the price from falling further. Place the SL slightly below the support level when taking a Long/Buy position.

- Resistance: Resistance is a price level where historical selling pressure has been strong enough to prevent the price from rising higher. Place the SL slightly above the resistance level when taking a Short/Sell position.

3. Using Volatility Indicators

Indicators such as the Average True Range (ATR) can help determine SL based on current market volatility. Using a multiple of the ATR value (for example, 2x ATR) below the entry price can be a more dynamic way to set SL.

Special Tips for TP and SL

To maximize the effectiveness of TP/SL strategies, consider the following additional tips:

- Use a Trailing Stop

This is a dynamic type of SL. A trailing stop moves upward along with favorable price movements of the asset but remains fixed if the price moves in the opposite direction. This helps traders lock in profits already gained while still allowing room for the asset to continue rising.

- Don’t Adjust TP/SL Emotionally

Once traders have set their TP and SL levels based on thorough analysis, they should not be tempted to adjust them just because the market moves slightly against expectations. Stay committed to the original plan.

- Consider Partial TP

Traders don’t always have to close the entire position at a single TP level. They can set multiple TP levels, for example selling 50% of the position at TP1 and the remaining 50% at TP2. This allows them to secure partial profits earlier while still participating if the price continues to rise.

- Consider Asset Volatility

For more volatile crypto assets, setting wider SL levels may be necessary to prevent premature position closures resulting from normal market fluctuations.

- Evaluate and Adjust

No strategy is perfect. Periodically evaluate the performance of your TP/SL strategy. Are you hitting SL too often? Are your TP targets too difficult to reach? Make adjustments based on data and experience, not on emotions.

How to Use TP and SL on Pintu Futures

Make sure traders set their TP and SL prices before opening a Buy (Long) or Sell (Short) position on Pintu Pro Futures. This is important because once a position is opened, traders cannot place TP and SL limit orders simultaneously.

Steps to Set TP/SL Before Entry

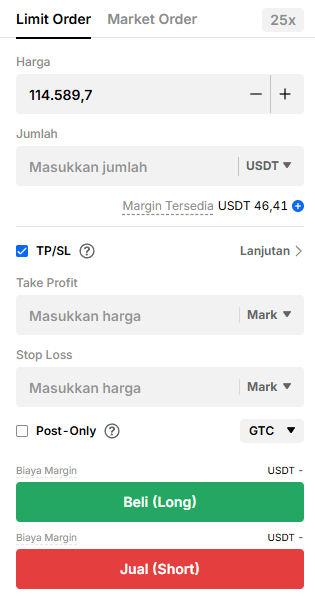

1. Choose Order Type: Limit Order

- At the top section, select Limit Order.

2. Enter Entry Price

- In the Price field, input the price you want to use for the entry position.

- Example: $114,589.7

3. Enter Order Amount

- Input the amount of funds you want to use in the Amount field (in USDT).

- Check below to see if there is enough Available Margin.

4. Enable TP/SL

- Tick the TP/SL checkbox.

- Click Continue if you want to set more details.

5. Set Take Profit and Stop Loss Prices

- Take Profit: Enter your target profit price.

- Stop Loss: Enter your maximum loss price.

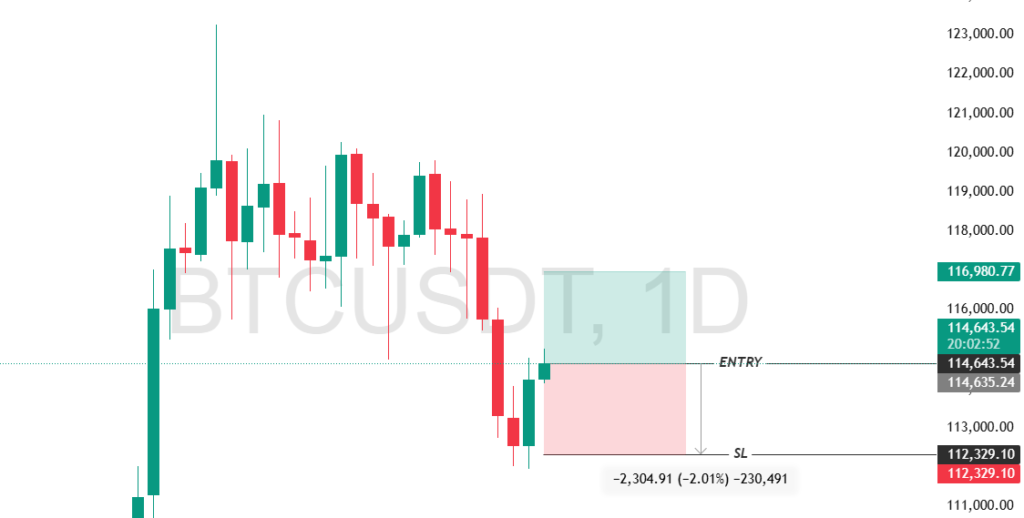

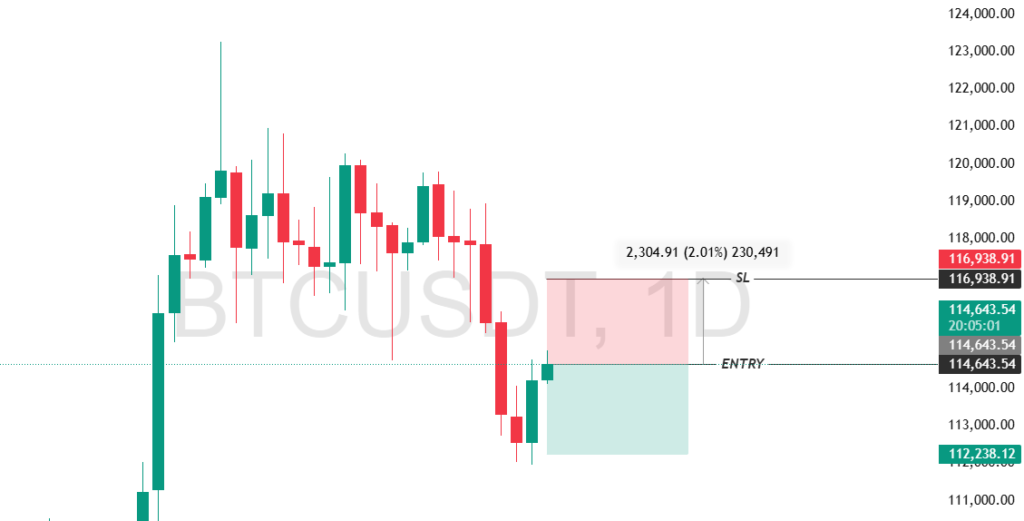

Note, make sure to adjust TP and SL prices according to the position direction:

- Long: TP > Entry Price, SL < Entry Price

- Short: TP < Entry Price, SL > Entry Price

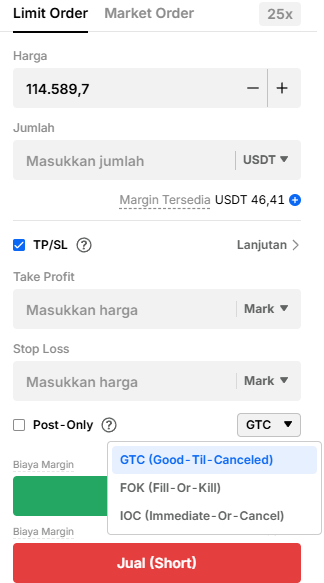

6. (Optional) Post-Only and Order Type

- Tick Post-Only if you want to ensure the order does not get matched immediately (useful for acting as a maker).

- Select the order time type:

– GTC (Good ‘Til Canceled): the order remains active until the trader cancels it.

– IOC (Immediate or Cancel): if not matched immediately, the order is partially/cancelled for the remaining amount.

– FOK (Fill or Kill): the order must be fully executed or completely canceled.

7. Choose Position Direction: Long or Short

- Click the green Buy (Long) button if you expect the price to rise.

- Click the red Sell (Short) button if you expect the price to fall.

Conclusion

By setting TP and SL, traders can build discipline in decision-making and reduce the influence of emotions. Technical analysis, such as identifying support and resistance levels, is highly useful for determining the right levels, while considering the Risk/Reward Ratio (e.g., 1:2) and market volatility ensures the strategy remains realistic. Regular evaluation is also essential to keep TP and SL aligned with the ever-changing dynamics of the market.

Disclaimer: All articles from Pintu Academy are intended for educational purposes only and do not constitute financial advice.

Share