Market Analysis 10-16 October: US Inflation Remains High, Bitcoin Tends to Sideways

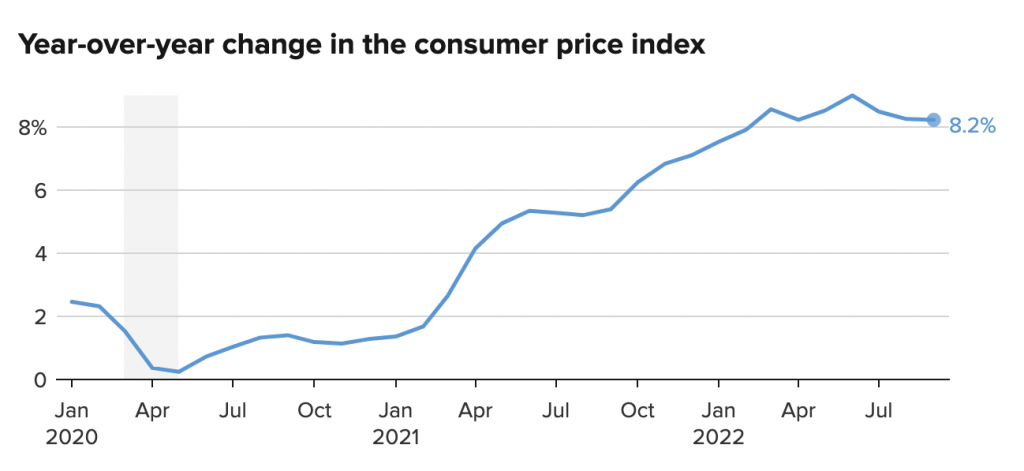

The crypto asset market is still in sideways mode as the Consumer Price Index (CPI) rose to 8.2% YoY through September. The Fed is predicted to raise interest rates by 0.75 to 1 basis points following the release of CPI data, and the market is expected to remain sideways moving ahead. Bitcoin price ran into some resistance at the multi-week trend line and the psychological price of 20.000 has been a strong resistance for Bitcoin.

This Market Analysis presents essential information that Pintu’s trader team has gathered on the cryptocurrency market over the previous week. However, you need to note that all information in this Market Analysis is intended as informational and educational content, not financial advice.

Market Analysis Summary

- 📈 The Consumer Price Index rose 8.2% YoY through September 2022. The report initially made both financial and crypto market plunged. However, those earlier losses reversed in the later trading.

- ⚠️ The Fed is most likely to raise the interest rates aggressively and expect more volatility in the market.

- 📊 Bitcoin price movement is still in sideways mode, and the psychological price of 20.000 has been a strong resistance for Bitcoin.

Macroeconomy Analysis

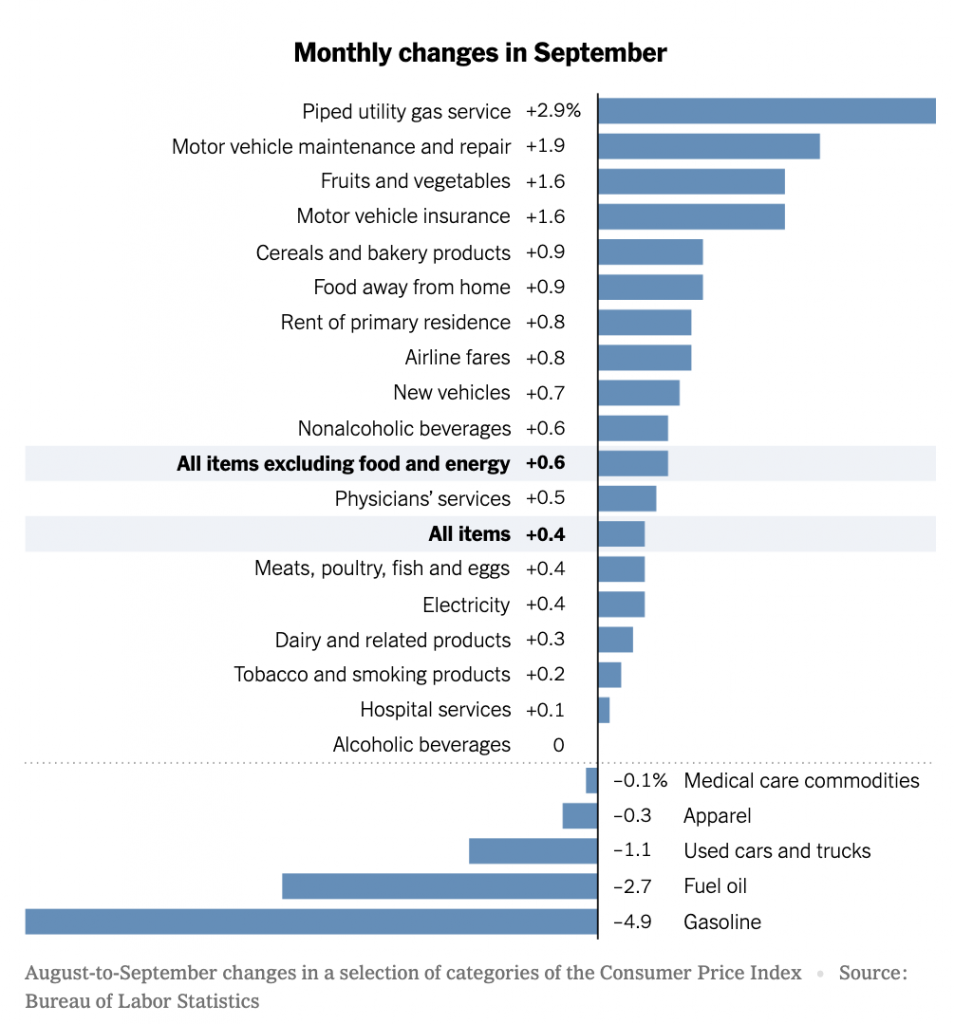

The Consumer Price Index rose 8.2% YoY through September, beating the consensus target of 8.1% and slight moderation from 8.3% the previous month. The underlying price trends by taking out both food and gasoline prices, the core index climbed by 6.6%, the biggest and fastest 12-month gain since 1982.

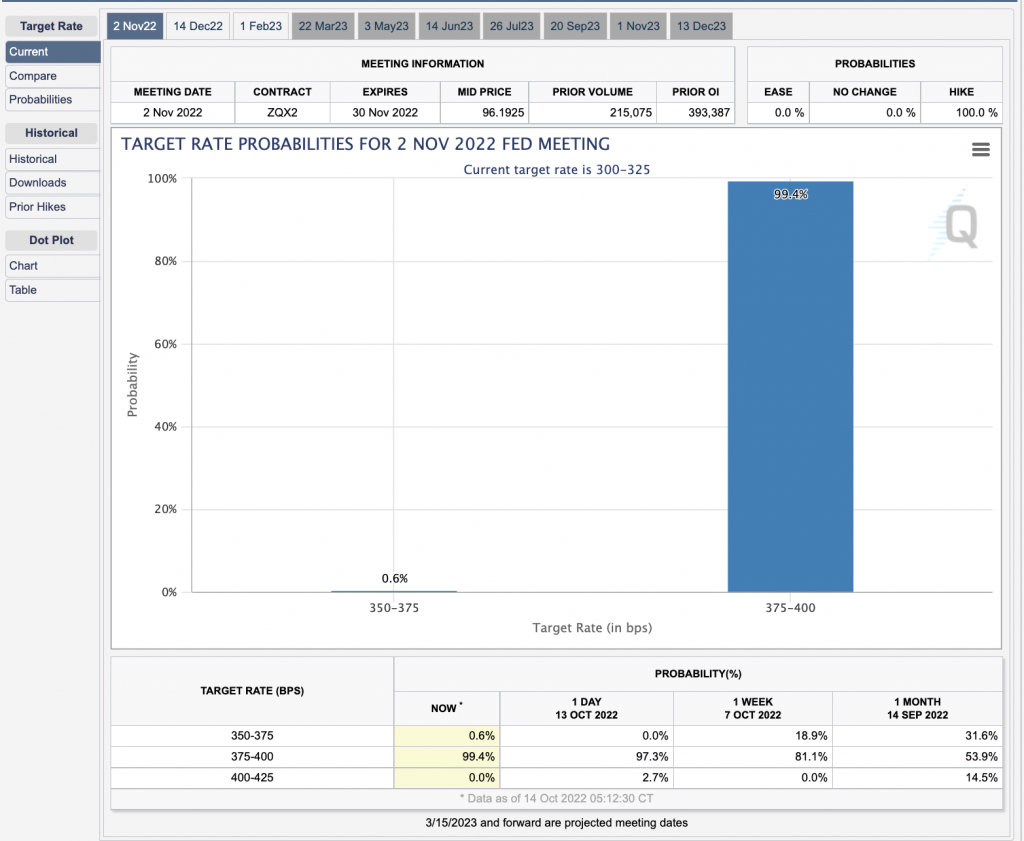

Following the data release, the probability of Fed raising its interest rate by 0.75-1 bps soared to almost 100% (from 82% before data release). Expect a big November rate increase. The Fed have raised interest rates five consecutive times this year, three of which is a 75 bps hike.

The report initially made both financial and crypto market plunged, as treasury yields moved up as traders priced in likely more aggressive interest rate hikes ahead of the Fed. However, those earlier losses reversed in the later trading. Inflation is able to run this high because consumers have had strong purchasing power; mostly held up in part of the leftover stimulus funds from covid-related spending and a labor market that’s very resilient even as the economy has slowed down dramatically. Therefore, Fed has a bigger challenge to effectively rebalance the economy.

Bitcoin Price Movement

The same goes for crypto markets. BTC and all major cryptos plunged upon CPI data release. BTC plunged to 18,160 at one point before gaining back to the 19,5k. If we look at the chart below, notice that we are still at the 21 weeks resistance line. Whether we can break this resistance line of 20k, we have to wait since BTC is still in sideways mode, and the psychological price of 20k has been a strong price origin of these sideways movement. By Saturday, we can see that BTC price ran into some resistance at the multi-week trend line drawn below. Support level at 17,500 and 16,000.

Ethereum Price Movement

ETH has followed the same course of action for the past week. Its price action has been resisted by the 21 weeks EMA line. We have yet to see strong momentum from ETH for the past 3 weeks post-ETH merge, it has fallen 22% from its pre-merge high when priced in BTC. The support level is at 1,250 and resistance level at 1.350.

On-Chain Analysis

Bitcoin Dominance has reached strong resistance at 41.8% as shown in the chart below. We have been resisted multiple times over since mid this year. Expect to have another rejection, with BTC dominating the crypto market vs ETH and other alts.

As shown in the ETH/BTC chart below, we are within the 0.38 and 0.5 Fibonacci retracement price range with the 55 weeks EMA acting as support. should we break down from the support line, expect the 0.38 Fibonacci line acting as next support.

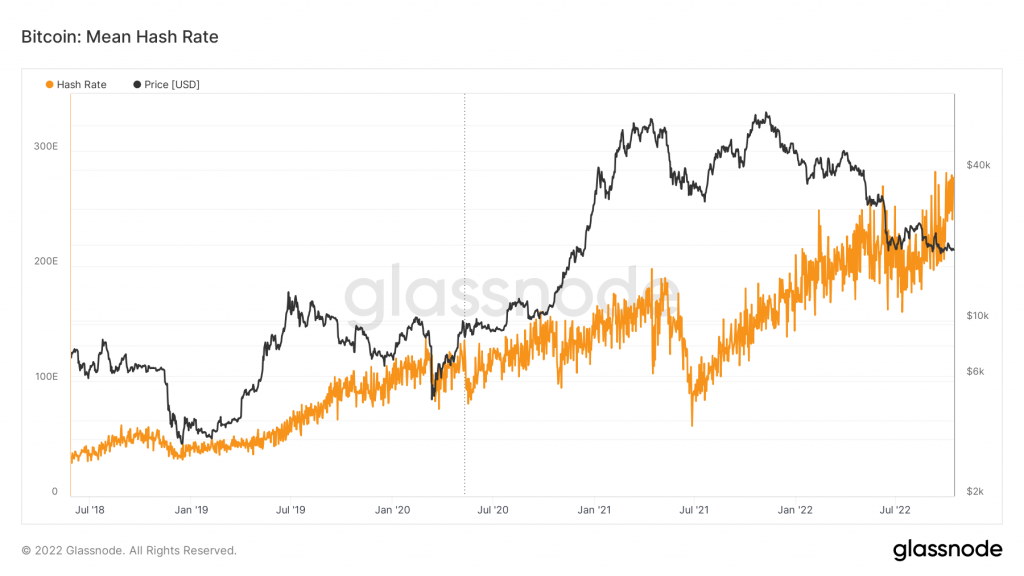

BTC hash rate has reached its highest level ever, despite its price declining. This rise in mining difficulty and hash rate caused miner’s capitulation. This rise has caused the mining difficulty to reach the highest which lowers miner’s profitability. The amount miners made from each hash rate has fallen 80% YoY. This hence led to the miners capitulation.

- 📊 Exchange: As the exchange reserve continues to rise, it indicates higher selling pressure. Net deposits on exchanges are high compared to the 7-day average. Higher deposits can be interpreted as higher selling pressure.

- 💻 Miners: Miners’ are selling holdings in a moderate range compared to its one-year average. Miner’s revenue is in a moderate range, compared to its one-year average.

- 🔗 On-chain: More investors are selling at a loss. In the middle of a bear market, it can indicate a market bottom. Long term holders’ movement in the last 7days were lower than the average. They have a motive to hold their coins. Investors are in a capitulation phase where they are currently facing unrealized losses. It indicates the decreasing motive to realize loss which leads to a decrease in sell pressure.

- 🏦 Derivatives: Long position traders are dominant and are willing to pay to short traders. Selling sentiment is dominant in the derivatives market. More sell orders are filled by takers. As open interest increases, it indicates more liquidity, volatility, and attention are coming into the derivative market. The increasing trend in open interest could support the current ongoing price trend.

Altcoin News

- 💵 Tether reduces commercial paper exposure to zero, replaces investments with T-Bills. After facing criticism for its exposure to commercial paper and, specifically, its alleged holdings of Chinese commercial paper, USDT decided to remove commercial paper from its reserves. In addition, Tether Holdings Limited had replaced those investments with United States Treasury Bills.

- 🗳️ Aave DAO Votes for Fresh Deployment on Ethereum. According to a report released by BGD Labs, a fresh deployment would have numerous important advantages, including the ability to be swiftly distributed, does not require any additional security audits, and the affordability due to falling gas prices. Meanwhile, the downside of a fresh deployment is that users will have to migrate their Aave V2 positions to Aave V3, and some integrations might be tough.

More News from Crypto World in the Last Week

- 🖼 OpenSea Streamlines NFT Launches for Artists. OpenSea, has launched SeaDrop, an open-source smart contract that allows NFT project creators to skip the tedious task of deploying their own custom smart contracts. SeaDrop handles all the technical complexities and creators gain more control as they are able to set drop times, add allow-lists, and even have tiered versions of allowlists.

- ⚠ Bitcoin Mining Reserves Are at a 12-Year Low. According to blockchain analytics firm IntoTheBlock, Bitcoin mining reserves have dropped to just 1.91 million BTC, the lowest level since February 2010. This illustrates the impact of miners selling their Bitcoin throughout the year, at times selling more in a month than they mined, to compensate for profits that have dwindled as the market has suffered.

- 🎮 $1.3 billion were raised in Q3 by blockchain games and Metaverse projects. Despite the harsh market conditions, the amount of investments in blockchain games has reached 7 billion US dollar until the end of September 2022. The number of unique active wallets in the blockchain gaming industry increased by 8% (912K) month-on-month, and its dominance remains over 48%.

Cryptocurrencies Market Price Over the Past Week

Cryptocurrencies With the Best Performance

- Quant (QNT) +22.86%

- Ethereum Name Service (ENS) +10.19%

- Maker (MKR) +8.09%

Cryptocurrencies With the Worst Performance

- Chiliz (CHZ) -16.55%

- Ape Coin (APE) -15.72%

- NEAR Protocol (NEAR) -15.02%

Reference

- Tarang Khaitan, OpenSea Streamlines NFT Launches for Artists, The Defiant, accessed on 15 October 2022.

- Stacy Elliot, Bitcoin Mining Reserves Are at a 12-Year Low—Here’s Why, Decrypt, accessed on 15 October 2022.

- Sara Gherghelas, DappRadar x BGA Games Report – Q3 2022, Dapp Radar, accessed on 15 October 2022.

- Samuel Haig. Uniswap Votes to Launch V3 on zkSync. The Defiant, accessed on 15 October 2022.

- Tarang Khaitan, Aave DAO Votes for Fresh Deployment on Ethereum, The Defiant, accessed on 15 Ocotber 2022

- Sam Bourgi, Tether reduces commercial paper exposure to zero, replaces investments with T-Bills, Coin Telegraph, accessed on 15 October 2022.

Share

Related Article

See Assets in This Article

USDT Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-