Market Analysis February 9, 2026: Institutional Investors Buy the Dip Bitcoin

The crypto market is at a crucial crossroads. The week opened with a sentiment ofExtreme Fear, but onchain data reveals an interesting anomaly: as retail panics, institutions andwhales appear to be seizing the moment to accumulate assets at low prices.

The main focus of the market is now on a series of US economic data this week, especially Inflation (CPI) and Employment data which are predicted to determine whether Bitcoin is able to maintain its foothold above the historical level of $69,000 or fall deeper.

Here is a complete analysis of this week’s market conditions, fund flows, technical analysis, and economic calendar.

Article Summary

- Bitcoin Movement Domination: Bitcoin managed to rebound and close the weekly candle above $68,967, a level that acts as the peak of the 2021 ATH bull run as well as a crucial support zone.

- Ethereum on the Verge of Uncertainty: Ethereum failed to maintain momentum and closed the weekly candle below $2,125 support.

- Solana Demand is Still High: Solana showed resilience with a strong rebound from the $51.13 – $68.20 demand area.

- Institutional Action: Bitcoin Spot ETF fund flows showed a positive net inflow on February 6, 2025, indicating potential institutional accumulation at correction levels.

- This week is a crucial week with the release of three US macroeconomic data: consumption, employment and inflation.

Bitcoin (BTC) Analysis

- Market Conditions: Bitcoin experienced significant selling pressure to hit a weekly low of $60,000.

- Signal of Hope: Despite the pressure, this morning’s weekly candle close provided some relief as the price managed to close above the 2021 ATH (All Time High) level of $68.967.

- Projection:

- Bullish: As long as the price holds above the 2021 ATH ($68,967), Bitcoin has the potential to rebound chasing the SBR(Support Become Resistance) level at $76,589.

- Bearish: If the price drops again and validates below the 2021 ATH, the potential for further decline will again test the $60,000 area.

Ethereum (ETH) Analysis

- Market Conditions: Unlike Bitcoin, Ethereum’s technical performance looks weaker. The weekly candle close is below the $2,125 level, which is a crucial support area.

- Rebound Requirement: To regain market interest, ETH needs to move back above the $2,125 level. If successful, the upside target is in the range of $2,578 – $2,773.

- Risks: If it fails to reclaim the $2.125 level, ETH risks continuing its downward trend towards the next support at $1.384 – $1.689.

Solana (SOL) Analysis

- Market Conditions: SOL’s price decline was arrested when it hit the demand area in the range of $51.13 – $68.20. The buying pressure in this area was strong enough to push the price back up.

- Consolidation Phase: The price is currently “sandwiched” in the middle, between the demand area below and the strong resistance at $113 above.

- Projection: SOL will most likely experience a consolidation phase (sideways) between these price ranges. The direction of the next trend will largely depend on where the price will breakout from this zone.

Market Psychology

Market psychology indicators show tremendous panic among investors.

- TheFear & Greed Index is currently at level 9, which is categorized as Extreme Fear.

- This figure is a drastic decline compared to last month which was still at the Neutral level (41).

- In fact, on February 6, 2026, the index touched 5, which is recorded as the yearly low so far. This indicates that market participants are currently very risk-off.

Institutional Fund Flow Analysis

The following is the movement of institutional fund flows and whales a week back showing the response to market movements through Bitcoin Spot ETF data (February 6) and Bitcoin Exchange Flow.

Bitcoin Spot ETF Netflow: Institutions Back in?

Institutional activity through the Bitcoin Spot ETF showed high volatility but ended on a positive note at the close of the trading week.

- After experiencing consecutive waves of outflows from February 3 to 5, totaling more than 16,000 BTC sold in three days, fund flows turned positive over the weekend.

- On February 6, 2026, a Net Inflow of +5.26K BTC was recorded, signaling a buy the dip action from institutional investors when prices were depressed.

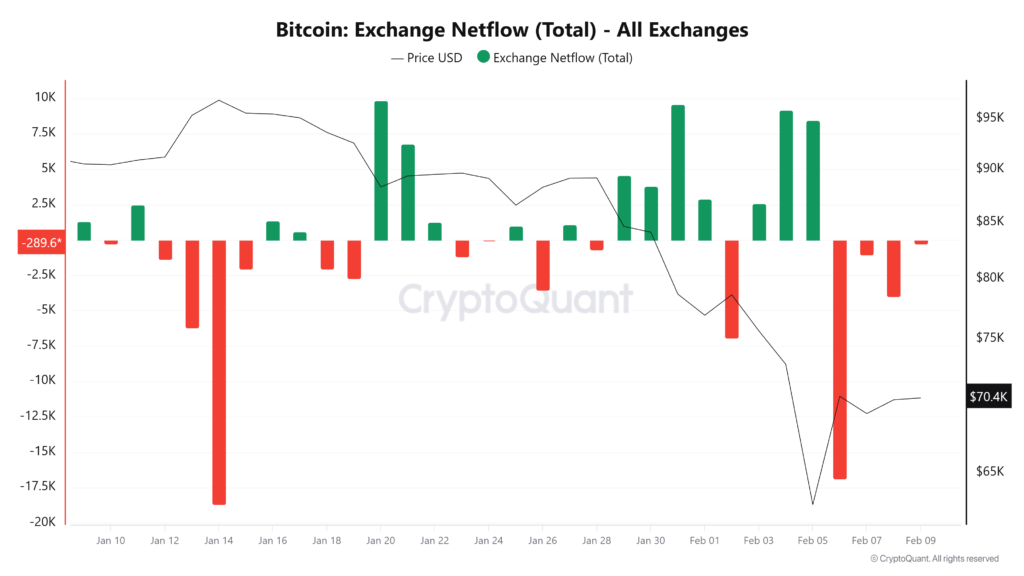

Bitcoin Exchange Netflow

Data on the movement of funds on the exchanges also shows interesting anomalies. There was a very significant outflow from the exchanges on February 5 (long red bar down), coinciding with a sharp drop in prices. This could be interpreted as a move of assets into cold storage by”whales” or long-term investors who took advantage of the low prices, despite the falling prices.

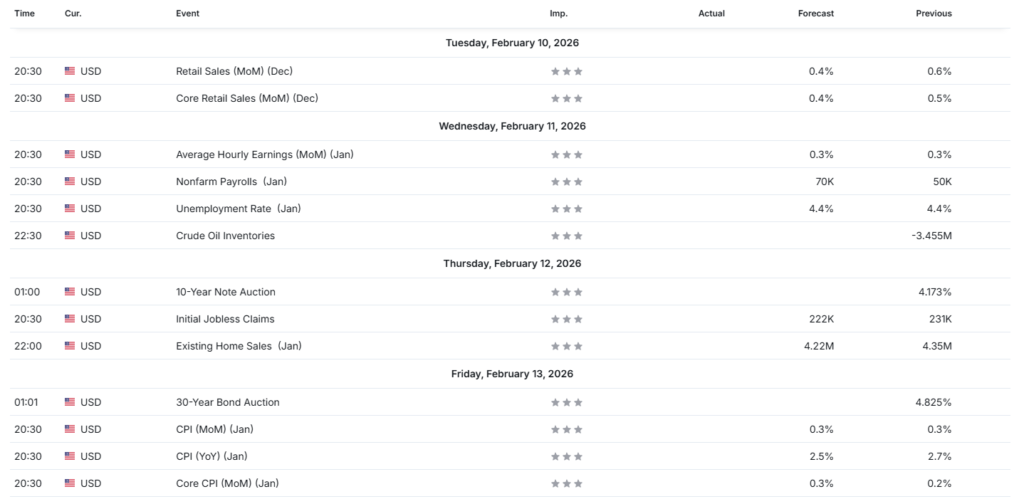

Important Economic Calendar of the Week

This week, market volatility is expected to increase sharply, especially in the mid to late week, due to a flurry of US macroeconomic data releases. Here are the key agenda items to watch:

- Tuesday, February 10 (20:30 WIB): Consumer Spending Data

- Event: Retail Sales (MoM) & Core Retail Sales.

- Projection: Expected to slow to 0.4% (previously 0.6%).

- Impact: This data will indicate the strength of US consumer purchasing power. If the actual figure comes in lower than projected, it could be interpreted as a signal of economic slowdown that may prompt the Fed to soften its policy stance (bullish for risk assets).

- Wednesday, February 11 (20:30 WIB): Labor Data (Big Event 1)

- Event: Nonfarm Payrolls (NFP) & Unemployment Rate.

- NFP projection: The labor market is predicted to improve slightly with the addition of 70K jobs (previously 50K).

- Unemployment Projection: The unemployment rate is predicted to remain at 4.4%.

- Impact: If the NFP release is much higher than expected, the US Dollar index (DXY) could strengthen and pressure Bitcoin prices. Conversely, in-line or lower data will keep rate cut hopes alive.

- Thursday, February 12 (20:30 WIB): Unemployment Claims

- Event: Initial Jobless Claims.

- Projection: Expected to decline to 222K (previously 231K).

- Friday, February 13 (20:30 GMT): Inflation Data (Big Event 2 – High Impact)

- Event: CPI (Consumer Price Index) YoY & MoM.

- YoY CPI projection: Annual inflation is predicted to decline (cool down) to 2.5% from 2.7% previously.

- Impact: This is the most crucial data this week. If actual inflation actually drops to 2.5% or lower, it will be a strong positive (bullish) catalyst for the crypto market to rebound from the “Extreme Fear” zone. However, if inflation actually rises, the selling pressure on Bitcoin could continue.

Disclaimer: All information presented in this article has been prepared for general educational and informational purposes. This content is not intended as investment advice, recommendations, solicitation to buy or sell certain crypto assets, nor the basis for financial decision making. Any investment decision is entirely the responsibility of the reader, taking into account their financial condition, investment objectives, and risk tolerance.

Share

Related Article

See Assets in This Article

NFP Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-