What Is Plasma (XPL)?

Plasma is an EVM-compatible Layer-1 blockchain designed to make dollar-backed stablecoins like USDT usable as everyday money. Its focus lies in instant settlement, ultra-low fees, and the ability to transfer value without the need to purchase native tokens first. With the ambition to become a global payment infrastructure for stablecoins, Plasma aims to deliver a simple, fast, and cost-efficient user experience.

Summary

- 💡 What is Plasma (XPL)?: An EVM-compatible Layer-1 blockchain positioned as a global infrastructure for stablecoin payments (USDT and others) with instant, low-friction settlement.

- ⚙️ How it works: Built on PlasmaBFT (pipelined sub-second finality) + Reth/EVM execution layer; developers can use Solidity, MetaMask, Hardhat, and Truffle.

- 🧰 Key features: Gasless USDT transfers via paymaster, custom gas token support, Bitcoin bridge (pBTC 1:1), and confidential payments (under research).

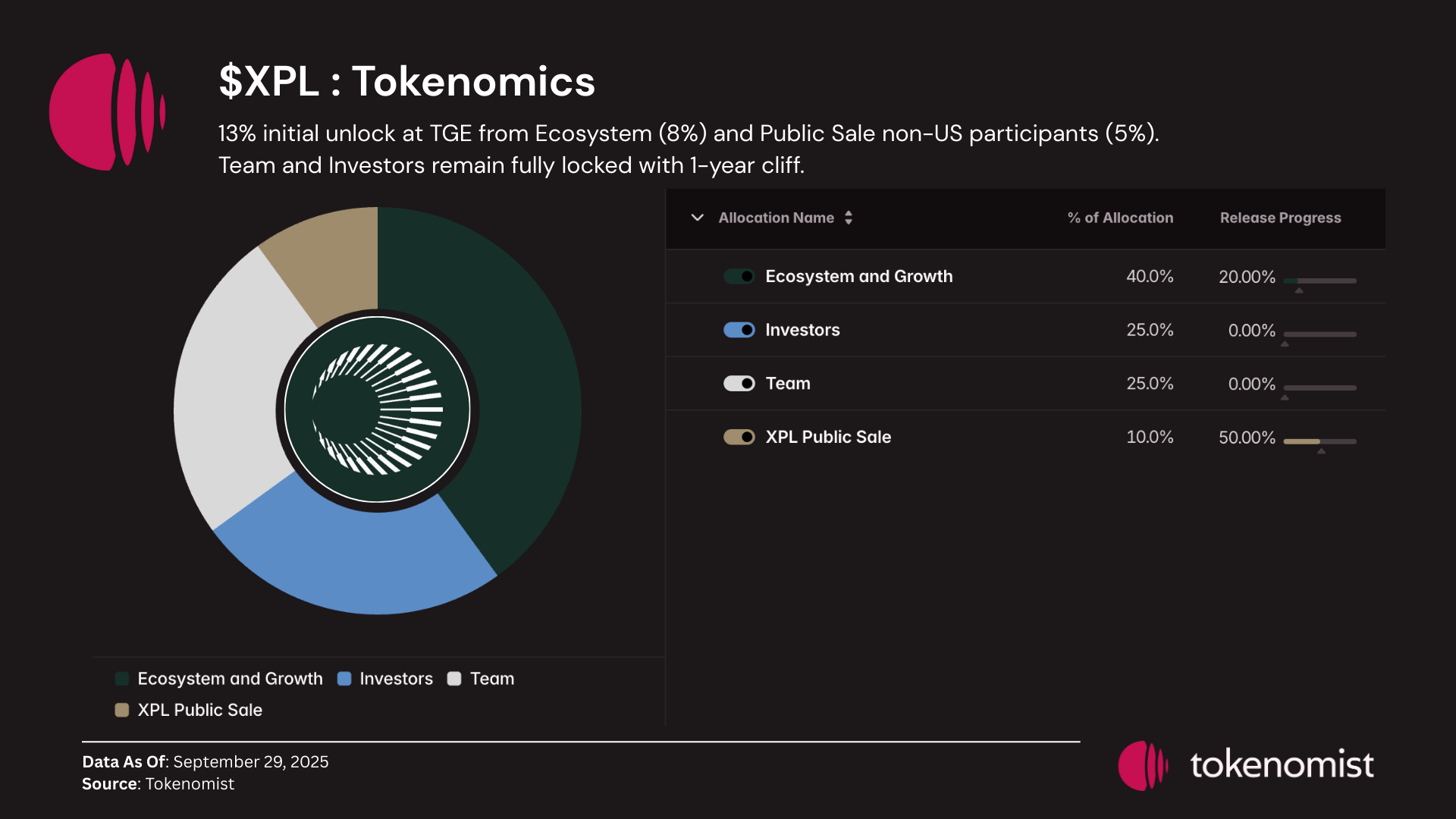

- 📈 Tokenomics & roadmap: Allocation: 40/25/25/10 (Ecosystem/Investors/Team/Public). Initial unlock (TGE) of 13%. Staged rollout (mainnet beta → BTC bridge → core features → tooling) + Plasma One (physical/digital debit card for stablecoins in development).

About Plasma (XPL)

Plasma is a Layer-1 blockchain purpose-built for global stablecoin payments. It enables zero-fee USDT transfers, supports custom gas tokens (allowing users to pay gas in other assets), and provides a native Bitcoin bridge for using BTC within smart contracts. Its PlasmaBFT consensus ensures high throughput and near-instant finality, while full EVM compatibility allows developers to migrate or build on-chain applications from Ethereum easily.

Unlike general-purpose blockchains such as Ethereum or Solana , Plasma focuses specifically on payment usability and real-world transactions. It’s optimized for merchants, remittances, and fintech integrations—delivering fast, low-cost transactions for everyday usage.

How Plasma Works

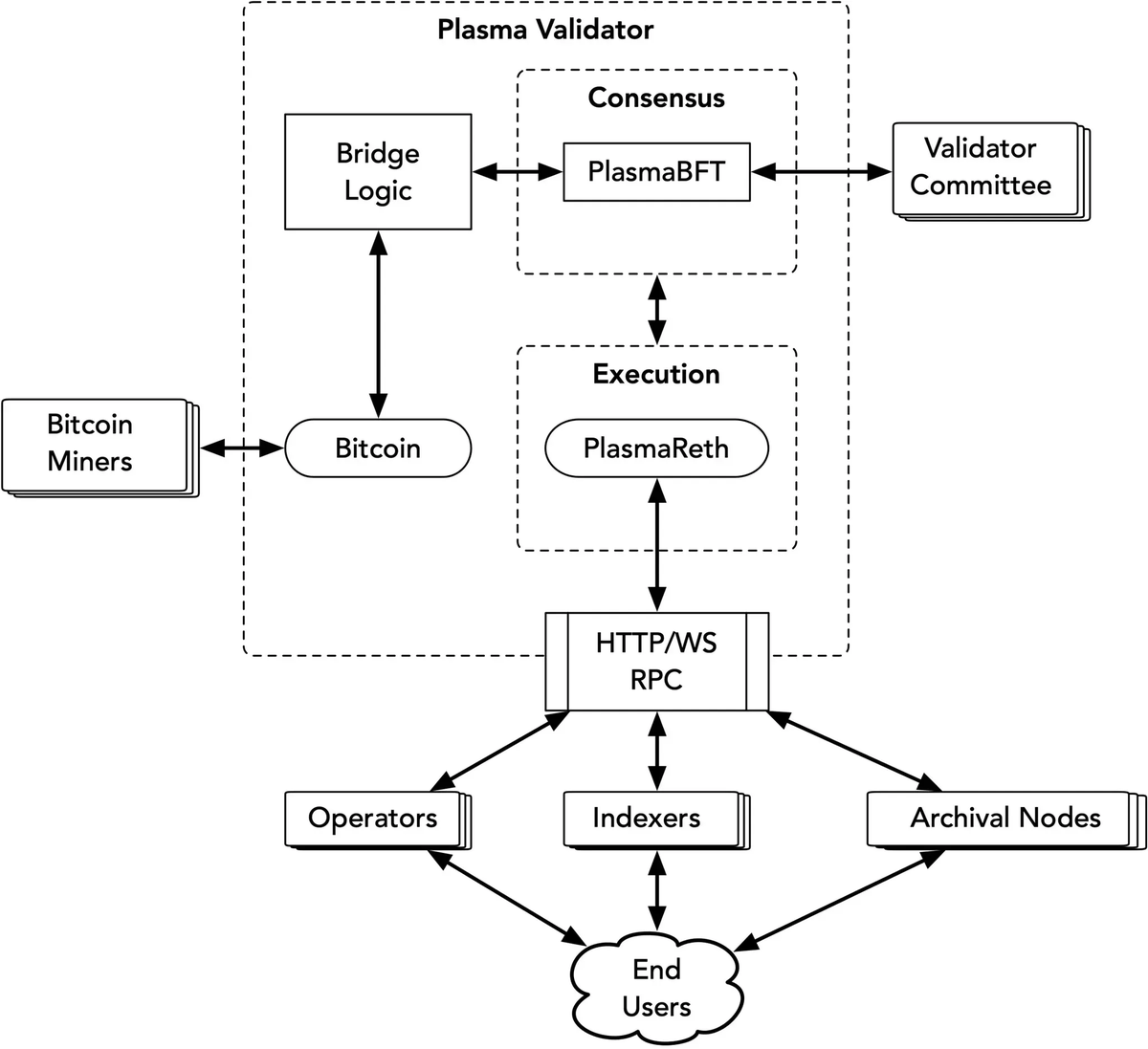

Plasma combines PlasmaBFT for ultra-fast transaction sequencing and finality with a Reth-based EVM execution layer written in Rust.

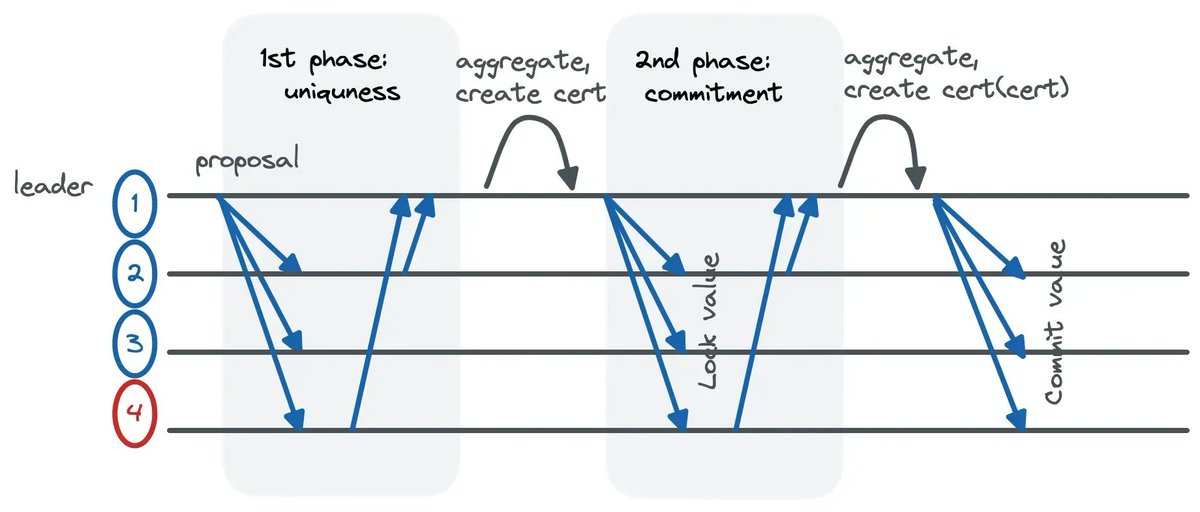

- PlasmaBFT orders and finalizes blocks in parallel, achieving sub-second finality and over 1,000 TPS, making it ideal for high-frequency payments.

- Reth (EVM) handles transaction execution, state management, and smart contract logic, ensuring seamless compatibility with Ethereum tools like MetaMask, Hardhat, and Truffle.

This architecture enables a smooth, familiar experience for both developers and users—maintaining speed, security, and interoperability.

Key Features and Advantages

1. Gasless USDT Transfers

Plasma’s paymaster system enables free USDT transfers by covering gas costs for eligible users. The paymaster, managed by the Plasma Foundation, funds these operations using controlled XPL reserves, maintaining limits to prevent abuse.

2. Custom Gas Tokens

Developers can allow users to pay gas fees using ERC-20 tokens, such as USDT, rather than XPL. This improves accessibility and lowers onboarding friction for payment and DeFi applications.

3. Confidential Payments

Currently under research, the Confidential Payments module aims to provide privacy for stablecoin transactions by concealing transfer details (amounts and recipients) while staying compatible with existing wallets and dApps.

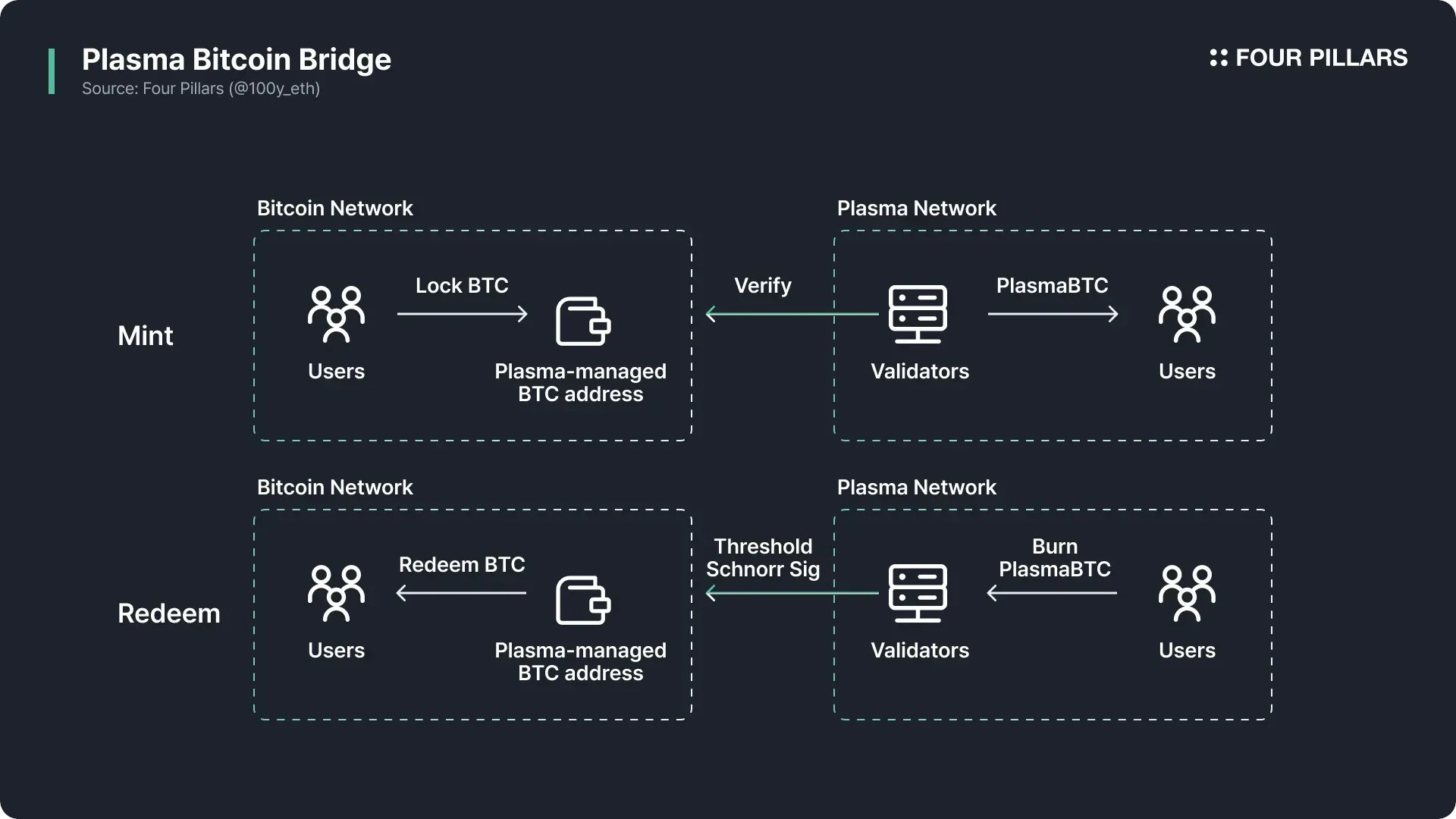

4. Bitcoin Bridge

The Plasma Bitcoin Bridge allows BTC to be moved directly into the Plasma ecosystem as pBTC (1:1 pegged). Transactions are verified by an independent validator network using threshold signatures, ensuring non-custodial, trust-minimized interoperability between Bitcoin and EVM environments.

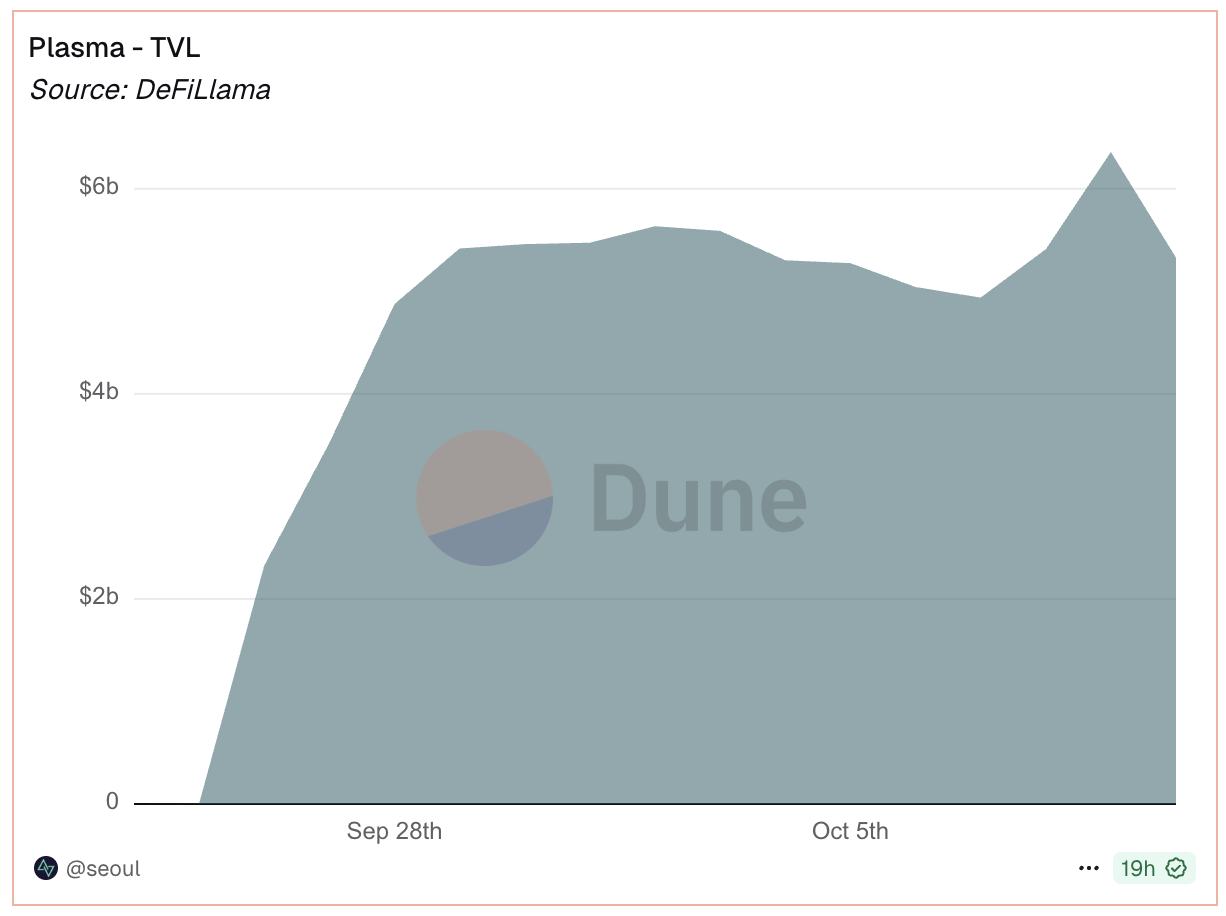

Plasma TVL Surges to $6 Billion in Record Time

According to Dune Analytics and DeFiLlama, Plasma’s Total Value Locked (TVL) soared rapidly from nearly zero in late September 2025 to over $6 billion, signaling major inflows of liquidity and adoption.

Despite minor corrections in early October, TVL has remained steady between $5–6 billion, underscoring active user engagement and strong liquidity within the Plasma ecosystem.

XPL Tokenomics

- Ecosystem & Growth: 40% (DeFi incentives, liquidity, partnerships)

- Investors: 25%

- Team: 25%

- Public Sale: 10%

At the TGE, 13% of tokens were unlocked (8% Ecosystem & Growth + 5% Public Sale). Team and investor tokens are under a 1-year cliff, followed by a 2-year monthly vesting.

Plasma (XPL) Roadmap

- Phase 1 – Mainnet Beta: Launch of PlasmaBFT and Reth execution; onboarding stablecoin issuers, liquidity providers, and fintech partners.

- Phase 2 – Bitcoin Bridge & Settlement: Introduction of the BTC bridge and sidechain settlement mechanics.

- Phase 3 – Core Features: Gas customization, gasless transfers, and confidential transactions.

- Phase 4 – Native Tooling: APIs, SDKs, and developer tools for large-scale stablecoin use.

Plasma One: Stablecoin Debit Card

Plasma One is a digital and physical debit card built specifically for stablecoin payments, offering free USDT transfers, cashback rewards, and cross-border merchant compatibility. Still under development, it aims to showcase Plasma’s real-world payment capabilities and on-chain dollar accessibility.

Analyst Perspectives on XPL

1. Technical Support Test

Analyst @CryptosBatman on X highlights that the XPL/USDT pair has repeatedly tested its upward trendline since August. The price recently touched this support level for the sixth time, signaling a possible rebound—though a confirmed breakdown below it could trigger further downside.

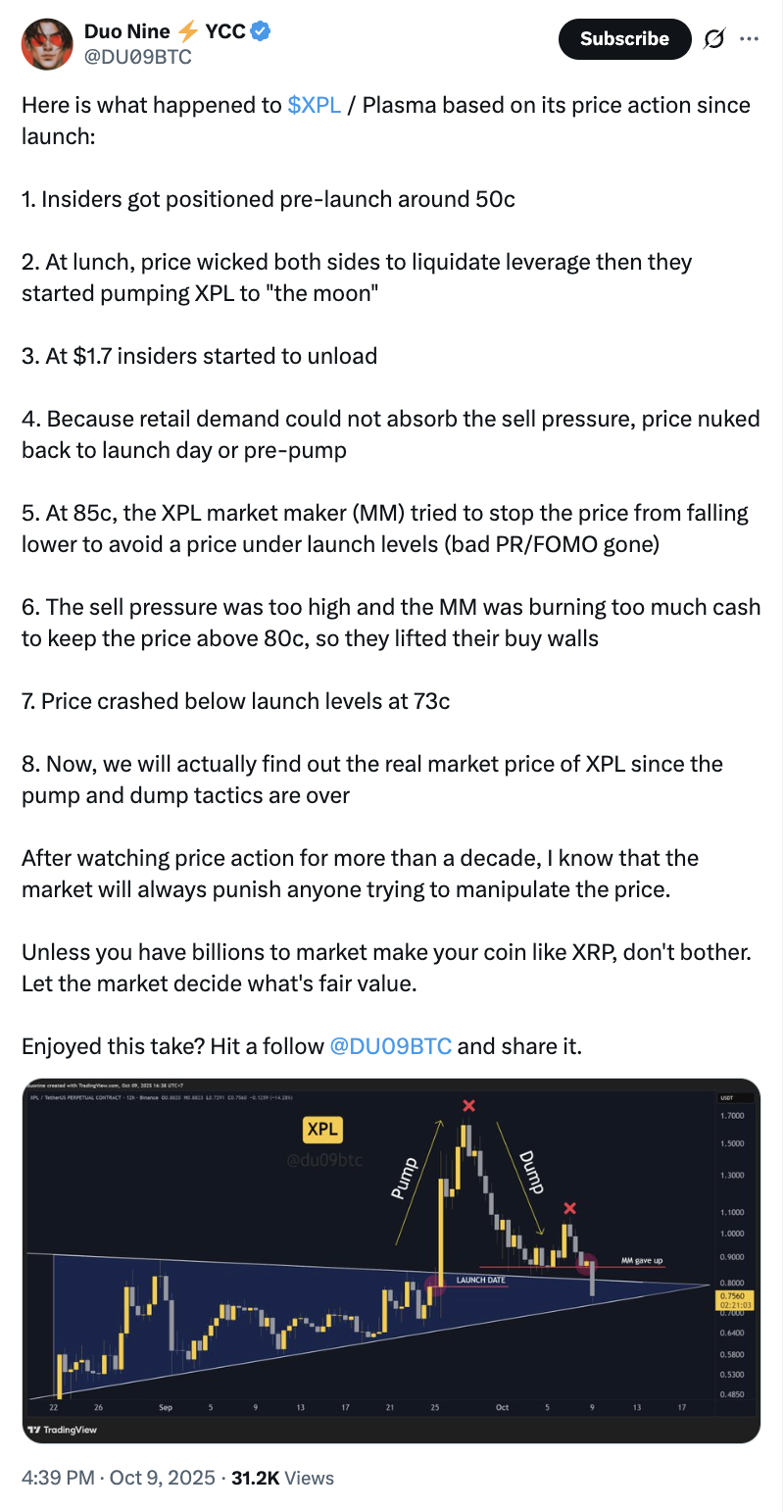

2. Post-Launch Consolidation

According to @DU09BTC, XPL saw early accumulation around $0.50, then surged to $1.70 on launch day before correcting back to $0.73, suggesting that the initial “pump-and-dump” phase may be over and the market is entering a price discovery stage.

3. XPL Public Sale and Market Performance

Plasma’s public sale raised over US$373 million (Rp 6.2 trillion), more than 7x oversubscribed. The mainnet beta launched with US$1 billion (Rp 16.6 trillion) in stablecoin TVL, making Plasma one of the fastest chains to achieve such a milestone.

The public sale price of XPL was US$0.05 (Rp 830), and it later surged to US$0.74 (Rp 12,295) — a 14x increase for early buyers before stabilizing after post-listing corrections.

How to Buy Plasma (XPL) on Pintu

- Open the Pintu app.

- Go to the Market section.

- Search for Plasma (XPL).

- Enter the amount you wish to purchase and confirm your transaction.

Conclusion

Plasma (XPL) positions itself as a stablecoin-focused Layer-1 blockchain featuring fast settlement, low fees, and EVM compatibility. With carefully structured tokenomics, a transparent roadmap, and innovative features like gasless transfers and the Bitcoin bridge, Plasma is building toward mass adoption in global payments.

While short-term price fluctuations continue, analysts suggest that Plasma’s growth trajectory, liquidity strength, and ecosystem expansion could determine its long-term position in the cryptocurrency market.

Disclaimer: All content from Pintu Academy is intended for educational purposes only and should not be considered financial advice.

References:

- Bitget Wallet. What is Plasma (XPL): Stablecoin-Native Blockchain Explained with Tokenomics and Cross-Chain Trading. Accessed Oct 9, 2025.

- Binance. What Is Plasma (XPL)? Accessed Oct 9, 2025.

- Four Pillars on X. Plasma: Everything, Everywhere, All at Once. Accessed Oct 10, 2025.

Share

Related Article

See Assets in This Article

2.0%

0.0%

0.0%

ETH Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-