Market Analysis Jan 23, 2023: Crypto Market Climbed Over 200 Week MA

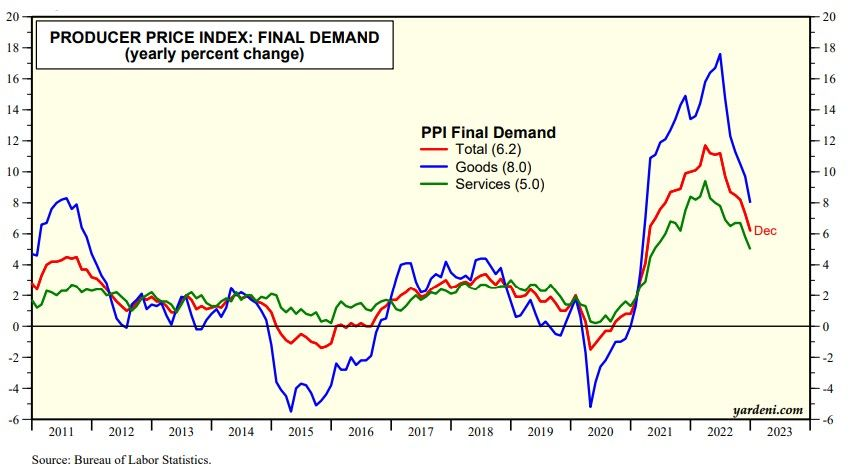

The US Producer Price Index (PPI) is down, which indicates that inflation was receding. The crypto market has climbed over the 200 week MA resistance line.

Pintu’s trader team has collected various important data about macroeconomic analysis and crypto market movement over the past week, summarized in this Market Analysis. However, you should note that all information in this Market Analysis is for educational purposes, not financial advice.

Market Analysis Summary

- 📉 The PPI inflation rate dropped from nearly 18.0% year-over-year in mid-2022 to 6.2% by the end of the year.

- 🏦Most economists predict that the Fed will raise interest rates by 25 bps at its next meetings.

- ⚠️ Reuters poll shows that there is a 60% probability of a U.S. recession occurring within two years.

- 🚀 The crypto market has climbed over the 200 week MA resistance line, while BTC have seen another upward continuation in price action within the week.

- 🔎 In the daily chart, the RSI indicator indicates that BTC is currently overbought.

- 📊 ETH have surpassed the 200 MA line, expect a reversal for support confirmation at the line.

Macroeconomic Analysis

Interest rates dropped significantly mid-week following the announcement that the Producer Price Index (PPI) for December showed a rapid decrease in inflation. The PPI inflation rate dropped from nearly 18.0% year-over-year in mid-2022 to 6.2% by the end of the year. Both the goods and services parts of the PPI are experiencing a decrease in inflation.

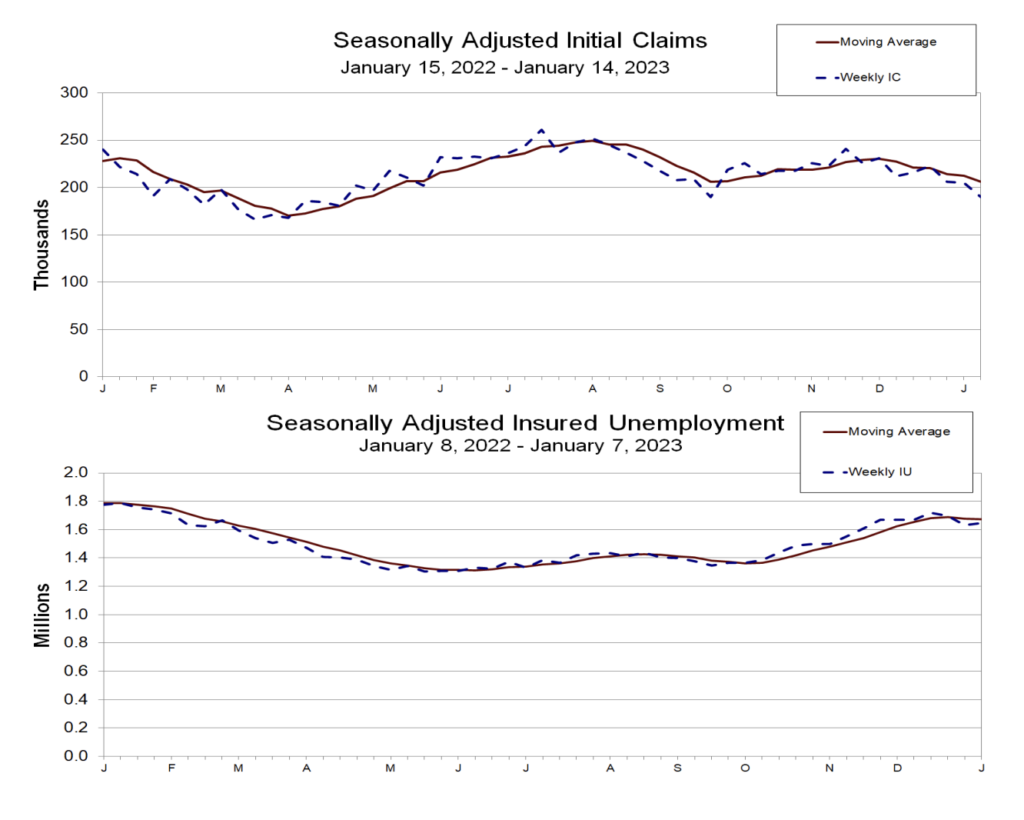

The latest weekly report from the Labor Department indicates that initial claims for state unemployment benefits decreased by 15,000, reaching a total of 190,000 for the week ending January 14th. This is lower than the 214,000 claims predicted by economists. Despite an increase in layoffs in industries such as technology, finance, and housing, the level of unemployment claims still indicates a strong job market. This indicated that the job market is still strong despite the recent increase in interest rates.

Last week in Reuters poll, most economists predict that the Fed will raise interest rates by 25 bps at its next meetings, and then likely keep them steady for the rest of the year, which will end its tightening cycle.

The Fed are somewhat in agreement that they should decrease the speed of interest rate hikes and start to evaluate the effects the hikes had on the whole economy. Last year, the Fed increased its rates by a total of 425 bps.

The poll also shows that there is a 60% probability of a U.S. recession occurring within two years. The economy is expected to grow at a slower rate of 0.5% this year before rebounding to 1.3% growth in 2024, below its long term average of 2%.

We have seen increasing number of companies, in particular in finance and technology sectors cutting jobs. The unemployment rate is expected to rise to 4.3% next year, from the current 3.5%, and then increase again to 4.8% in the following year.

Bitcoin Price Analysis

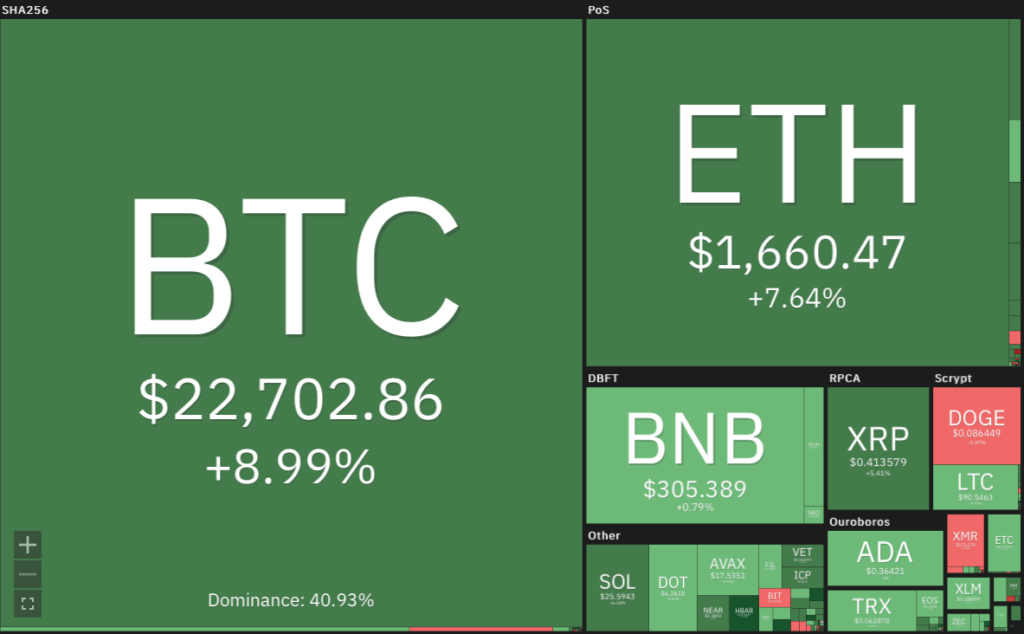

The crypto market has climbed over the 200 week MA resistance line. This is a good sign, after spending close to 4 months below the line. First step is we have to make sure that we close above this line by end of this week and find support for the consequent weeks. 1 Trillion Market cap is a huge resistance, we need to get by this point to confirm the theory that we have bottomed.

BTC have seen another upward continuation in price action within the week. A key resistance will be at 200 weeks MA (25,000), historically a strong indicator and support line. Resistance at 25,000 and 26,000. We’ve seen a drop into the 21,000 territory after an announcement by the US. Departments of Justice and Treasury that they would be taking joint enforcement action against an international cryptocurrency entity. It has since regained some of the ground and is trading at 22,600 at the moment.

In the daily chart, the RSI indicator indicates that BTC is currently overbought, there could be a possible reversal in the short term. We will have to confirm support points at 19,500 and 18,000 before possible rise in price.

ETH Price Analysis

ETH on the other hand, have surpassed the 200 MA line, expect a reversal for support confirmation at the line. This is healthy and expected before blasting further into higher price action. Resistance at 1680, 1880 and 2000.

on-chain-analysis">On Chain Analysis

Exchange: As the exchange reserve continues to fall, it indicates lower selling pressure. Net deposits on exchanges are high compared to the 7-day average. Higher deposits can be interpreted as higher selling pressure.

- Miners: Miners’ are selling more holdings compared to its one-year average. Miner’s revenue is in a moderate range, compared to its one-year average.

- On-Chain: More investors are selling at a profit. In the middle of a bull market, it can indicate a market top. Long term holders’ movement in the last 7days were lower than the average. They have a motive to hold their coins. Investors are in a fear phase where they are currently with unrealized profits that are slightly more than losses.

- Derivatives: Long position traders are dominant and are willing to pay to short traders. Selling sentiment is dominant in the derivatives market. More sell orders are filled by takers. As open interest increases, it indicates more liquidity, volatility, and attention are coming into the derivative market. The increasing trend in open interest could support the current ongoing price trend.

- Technicals: RSI indicates a Overbought condition where 91.00% of price movement in the last 2 weeks have been up and a trend reversal can occur. Stochastic indicates a Oversold condition where the current price is close to its high in the last 2 weeks and a trend reversal can occur.

** Other News from the World Crypto Last Week

- Genesis Global Files for Bankruptcy Protection. Genesis Global Holdco files for bankruptcy protection late Thursday in the US Bankruptcy Court for the Southern District of New York. The company has previously failed to raise funds for its troubled loans unit and has slashed staff by 30% in a new round of layoffs in early January. Genesis took a financial hit after the collapse of crypto hedge fund Three Arrows Capital and exchange FTX last year. Creditors have pursued options to prevent such a move.

- Partners with Polygon Mastercard Launches Incubator For Web3 Artists. Mastercard, one of the world’s largest financial payments providers, launched a web3-focused incubator to help artists connect with fans through new media. Mastercard partners with Polygon, which has previously worked with leading brands such as Starbucks and Disney. After joining the incubator, participating artists are expected to know how to create NFTs, present themselves online, and build their community.

- FTX CEO Explores “Reboot” Plans. Quoted from Cointelegraph, John Ray, who took over as CEO of cryptocurrency exchange FTX prior to bankruptcy proceedings, has reportedly formed a task force to consider reviving FTX. According to a January 19 report from The Wall Street Journal, Ray expressed the potential to reboot the FTX exchange. FTX Trading, doing business as FTX.com, was one of approximately 130 companies under the FTX Group that filed for bankruptcy last November.

Crypto Market Price Over the Past Week

Cryptocurrencies With the Best Performance

- Aptos (APT) +68.6%

- Axie Infinity (AXS) +44.87%

- Hedera (HBAR) +33.00%

- STEPN (GMT) +32.4%

References

- Reuters, U.S. producer prices fall more than expected in December, Reuters, accessed on January 23, 2023

- Turner Wright, FTX CEO says he is exploring rebooting the exchange: Report, Cointelegraph, accessed on January 23, 2023

- Michael McSweeney, Digital Currency Group’s Genesis Global files for bankruptcy protection, The Block, accessed on January 23, 2023

- Jacquelyn Melinek, Mastercard launches web3-focused artist incubator with Polygon, TechCrunch, accessed on January 23, 2023

Share