What is Digital Rupiah? Introduction to Indonesia’s CBDC

whitepaper cbdc indonesia

As the rise of digital technologies continues to change the financial landscape, the concept of Central Bank Digital Currencies (CBDCs) has become increasingly popular. CBDC is a digital version of the official currency issued by a central bank. Indonesia is one of the countries planning to launch CBDC titled Digital Rupiah. Bank Indonesia (BI) as the Central Bank of the Republic of Indonesia has the legal authority to issue the Digital Rupiah. Bank Indonesia has recently released the CBDC initiative whitepaper, Garuda Project, to guide the development of the Digital Rupiah. The whitepaper is still a high-level design, so it needs further adjustments, discussions, and various stages of testing. In this article, we summarize the Digital Rupiah whitepaper to explain what Digital Rupiah is, how it works, and how to get Digital Rupiah.

Article Summary

- 🪙 Indonesian CBDC or Digital Rupiah is digital money officially issued and circulated by Bank Indonesia, the central bank of the Republic of Indonesia.

- 📑 According to the Digital Rupiah whitepaper, Bank Indonesia will issue two types of Digital Rupiah: w-Digital Rupiah (wholesale Digital Rupiah) and r-Digital Rupiah (retail Digital Rupiah).

- 🔗 Digital Rupiah utilizes a combination of Distributed Ledger Technology or DLT and centralized infrastructure. This centralization is done to ensure only Bank Indonesia has the legal authority as the issuer of Digital Rupiah.

- 🛡️ The implementation of the Digital Rupiah could enable BI to enhance the payment system to be more secure, faster, resilient, effective, and efficient. In addition, Digital Rupiah could also cut banking costs and improve cross-border payments.

What is Digital Rupiah?

Digital Rupiah is digital money officially issued and circulated by Bank Indonesia. In other words, it is a digital version of rupiah banknotes and coins.

The issuance of the Digital Rupiah is Bank Indonesia’s response to the development of payment systems in the digital era. The existence of crypto assets that are growing massively in terms of trading volume and technological innovations is seen to have the potential to disrupt the banking sector. Those unbacked crypto assets and technological breakthroughs trigger concerns over the risk of shadow currency and even shadow central banking.

With the Digital Rupiah, BI emphasizes that BI is the only institution authorized to issue rupiah. In addition, BI expects Digital Rupiah could make the payment system more secure, faster, resilient, effective, and efficient. Then, Digital Rupiah could also cut banking costs and improve cross-border payments. In the long run, Digital Rupiah would have use cases to enter the Web3 ecosystem, including DeFi and Metaverse.

Differences between Digital Rupiah, cryptocurrencies, and e-wallets. The fundamental difference between Digital Rupiah, cryptocurrencies, and e-wallets is the issuer. Digital Rupiah is officially issued by Bank Indonesia, while cryptocurrencies are issued by private parties with different functions and uses. Meanwhile, e-wallets are issued by non-bank companies such as Gopay, Dana, Ovo, and others. E-wallets are specifically used for transactions through the intermediaries of the companies that issue them.

How to Buy Digital Rupiah

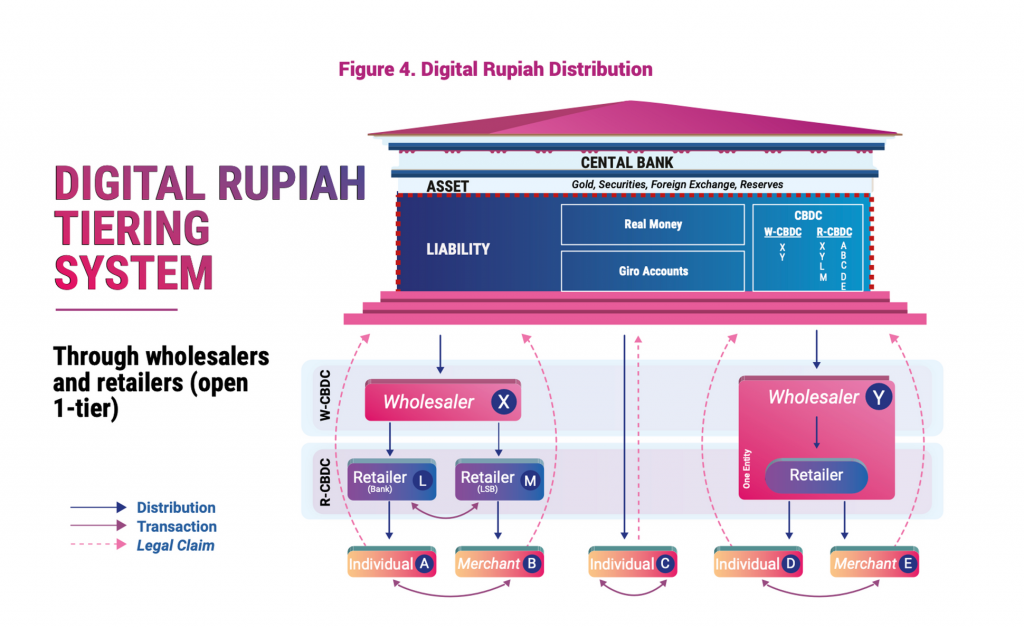

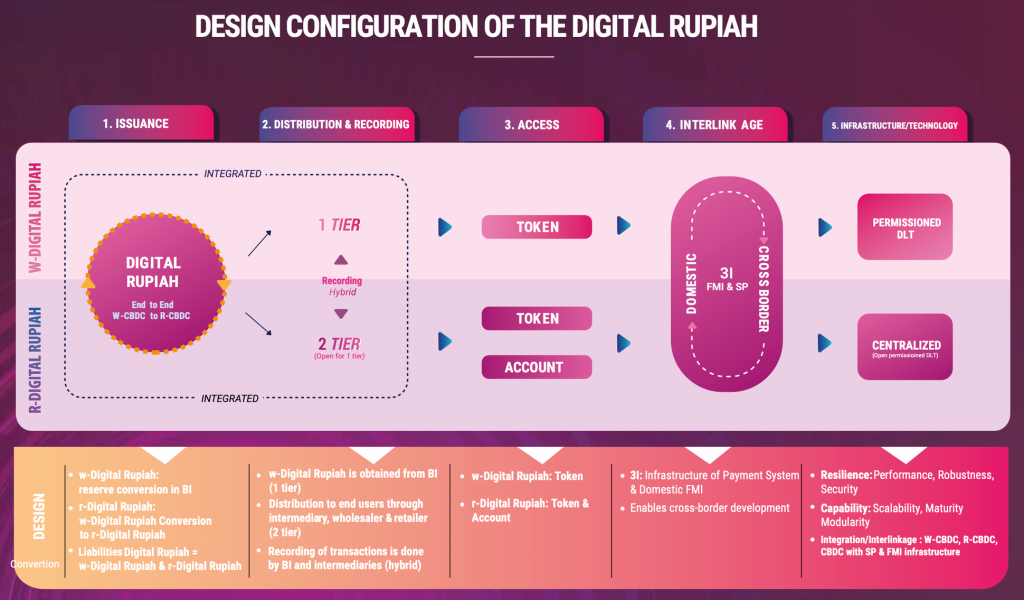

Bank Indonesia will issue two forms of Digital Rupiah: w-Digital Rupiah (wholesale Digital Rupiah) and r-Digital Rupiah (retail Digital Rupiah).

W-Digital Rupiah

Wholesalers or distributors are parties that have the right to access Digital Rupiah directly from Bank Indonesia. The function of wholesalers is to distribute Digital Rupiah as w-Digital Rupiah tokens to retailers and end users. Examples of wholesalers include large banking and non-banking institutions that serve the payment system.

To obtain the w-Digital Rupiah, these institutions must convert their reserves at Bank Indonesia. Thus, the issuance of the w-Digital Rupiah does not impact the size of Bank Indonesia’s balance sheet because it only changes the form of rupiah (banknotes and coins) into Digital Rupiah.

In the future, the w-Digital Rupiah would be leveraged as a settlement asset for monetary operations. Additionally, the use of the w-Digital Rupiah in the wholesale market is expected to support financial markets development and digital economy and financial integration

Access to W-Digital Rupiah are limited to certain parties authorized by Bank Indonesia and would involve a large amount of transactions. The concept is like a reserve account at a commercial bank.

R-Digital Rupiah

Retailers are parties that obtain r-Digital Rupiah from wholesalers and distribute it to the public (individual and merchant). R-Digital Rupiah comes in two forms: token and account. Token-based r-Digital Rupiah facilitates small-value transactions up to a certain amount. In contrast, account-based r-Digital Rupiah facilitates large transactions that exceed the maximum limit of r-Digital Rupiah token transactions.

To get r-Digital Rupiah, you can exchange banknotes or coins, bank deposits, or electronic money balances with r-Digital Rupiah into a digital wallet through an intermediary (wholesaler) appointed by Bank Indonesia. The wholesaler then uses its w-Digital Rupiah reserves to fulfill the demand for r-Digital Rupiah. It means that r-Digital Rupiah is issued through the wholesaler by converting w-Digital Rupiah for r-Digital Rupiah.

The public can use the r-Digital Rupiah for daily transactions, which is expected to accelerate financial inclusion in Indonesia. To overcome internet constraints, BI will create an offline functionality feature that allows CBDC to be accessed without an internet network to reach people in remote areas.

In China's e-CNY or Digital Yuan, offline transactions can be done using a digital wallet in the form of a physical card that uses NFC technology, and users can do tapping when they make transactions.

How Does Digital Rupiah Work?

Bank Indonesia will develop distributed ledger technology (DLT) or blockchain technology in issuing and circulating Digital Rupiah. As we know, there are primarily two types of blockchains; public and private blockchain (there are also several variations like consortium and hybrid blockchain). Unlike crypto assets that use a public blockchain, Bank Indonesia will use a private or permissioned blockchain, to ensure that only Bank Indonesia has authorization to access it.

The application of blockchain technology includes the issuing and burning w-Digital Rupiah tokens through KDR (Khazanah Digital Rupiah). The w-Digital Rupiah token issuance process begins with transferring funds from the reserves account to the technical account (BI’s Digital Rupiah account). When a certain amount of money is deposited into the technical account, it triggers KDR to issue the same amount of w-Digital Rupiah.

For example, when the wholesaler demands 100 w-Digital Rupiah, KDR will issue 100 w-Digital Rupiah and deposit 100 rupiah into the technical account so that the number of tokens issued is equal to the amount of rupiah received.

Likewise, when the wholesaler demands 500 rupiah, KDR will burn 500 w-Digital Rupiah and give 500 rupiah from the technical account to the wholesaler. This mechanism shows that the amount of Digital Rupiah issuance will not increase rupiah circulation in the market.

Unlike the w-Digital Rupiah, the process of issuance and burning r-Digital Rupiah is different. Only wholesalers have the right to convert w-Digital Rupiah into r-Digital Rupiah. It means that r-Digital Rupiah is issued through wholesalers’ conversion of w-Digital Rupiah into r-Digital Rupiah. The r-Digital Rupiah burning mechanism starts with the collection of r-Digital Rupiah by the wholesaler. And then, a wholesaler can convert it for w-Digital Rupiah into a reserve account at Bank Indonesia.

Does Digital Rupiah replace banknotes and coins? The answer is no because physical money still accommodates the existing need for cash transactions. Digital Rupiah does not entirely replace physical money but instead becomes an alternative payment instrument and enhances the role of rupiah in the digital world.

What Technology is behind Digital Rupiah?

Digital Rupiah will leverage a combination of Distributed Ledger Technology or DLT and centralized infrastructure. For this CBDC project, Bank Indonesia will choose permissioned DLT to ensure a higher level of security since access to the DLT platform is not open to all parties (only those authorized by BI). Chairwoman of the Indonesian Blockchain Association, Asih Karnengsih, told Pintu Academy Team, “The use of permissioned DLT can minimize the risk of a single point of failure and has better security than permissionless/public DLT.”

Additionally, DLT leverages decentralized cryptographic technology that is more difficult for hackers to breach. To support this technology, Bank Indonesia will develop a w-Digital Rupiah DLT platform consisting of several nodes: Bank Indonesia nodes, KDR nodes, wholesaler nodes, and non-wholesaler nodes.

A node is a computer that connects to a blockchain network and communicates with other participants to ensure the security and integrity of the system.

Learn more about the Definition of Node and its Function in Blockchain.

On the other hand, it is possible that BI chose a centralized system to facilitate the high volume of retail transactions on the r-Digital Rupiah. This is because permissioned DLT still has scalability issues in processing a high number of transactions. The use of DLT for the CBDC platform is still under consideration and this may change.

According to the whitepaper, some cyber risk still persists in Digital Rupiah due to its unique characteristics. There are still inherent risks in the consensus mechanisms, smart contracts, cryptographic key management, account security, data protection, and privacy. Therefore, Bank Indonesia will implement Digital Rupiah security standards and develop a technology designed to mitigate cybersecurity risks in a comprehensive manner.

Advantages of Digital Rupiah

- 🏦 Lower banking transaction fees. Digital Rupiah could reduce banking transaction fees because banking institutions are connected to the Digital Rupiah system.

- 🌎 Cross-border payment efficiency. The design of the Digital Rupiah is prepared for use in cross-border transactions. People will transact in different currencies directly without intermediaries such as correspondent banks.

- 📈 Increase the capital market growth. More efficient price formation and shorter intermediary chains can increase the circulation of money flow to accelerate the development of the capital market and economy.

- 🤝 Facilitate the implementation of government assistance programs, such as the unconditional cash transfer program (Bantuan Langsung Tunai/BLT). Through the Digital Rupiah wallet, the government can directly distribute BLT to the public without third-party intermediaries.

Conclusion

The issuance of the Digital Rupiah whitepaper is the first step for BI to issue the Indonesian CBDC titled Digital Rupiah. However, the issuance of the Digital Rupiah is not easy for the central bank, and it needs proper preparation from all sectors. Therefore, BI is not in a hurry to launch it, so BI still needs to confirm when Digital Rupiah will be officially implemented.

The implementation of the Digital Rupiah could come with benefits, potentially including a more efficient payment system, lower transfer costs, and higher security. From the monetary side, Digital Rupiah is expected to increase money circulation, which leads to accelerated economic development.

To achieve the Garuda Project’s goals, BI will collaborate with financial authorities, government and private institutions, communities or associations related to the digital industry, and international organizations (IMF, BIS, and World Bank).

How to Buy Cryptocurrency at Pintu?

Now you know what CBDC Digital Rupiah is, you get the idea that Digital Rupiah is different from cryptocurrency. However, you can start investing in cryptocurrencies by buying them on Pintu. Here’s how to buy cryptocurrency on Pintu:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for one of the cryptocurrency.

- Click buy and fill in the amount you want.

- Now you have one of the cryptocurrency !

In addition, Pintu is compatible with various popular digital wallets such as Metamask to facilitate your transactions. Come and download the Pintu cryptocurrency app on Play Store and App Store! Pintu is regulated and supervised by CoFTRA and Kominfo.

You can also learn more crypto through the various Pintu Academy articles which are updated every week! All Pintu Academy articles are for educational purposes, not financial advice.

References

- Bank Indonesia Team, Proyek Garuda: Menavigasi Arsitektur Digital Rupiah, Bank Indonesia, accessed 13 Desember 2022.

- Kemenkeu Team, Mengenal lebih Dekat Central Bank Digital Currency (CBDC), DJBP Kemenkeu, accessed 13 Desember 2022.

- Kompas Reporter, Ini Perbedaan Rupiah Digital dengan Uang Elektronik dan Dompet Digital, Kompas, accessed 13 Desember 2022.

- Kontan Reporter, Kapan Rupiah Digital Diterapkan? Ini Penjelasan BI, Kontan, accessed 13 Desember 2022.

Share