Market Analysis Jan 6th, 2025: BTC Maintains Strength, All-Time High in Sight

Bitcoin is holding steady around $90,000 as we begin the first week of January 2025. Positive macroeconomic data and a generally optimistic market outlook suggest this could be the start of a strong year for BTC and the wider crypto market. Check out the macro and crypto analysis by the Pintu trader team below.

Market Analysis Summary

- 🟢 BTC has faced challenges maintaining levels above $95,000, improving derivatives metrics and reduced bearish sentiment signal a brighter outlook for the cryptocurrency in the near term.

- 🏠 Sales of new single-family homes rose by 5.9% in November, reaching an annualized rate of 664,000.

- 📈 U.S. trade deficit expanded in November to -$102.86 billion.

- 📊 U.S. rate futures indicate an 88.8% probability of no change in interest rates.

- 📉 Initial claims for state unemployment benefits fell by 9,000 to a seasonally adjusted 211,000 for the week ending December 28.

Macroeconomic Analysis

Fed Policy and the Labor Market

In December, the Fed implemented its third consecutive rate cut, reducing the benchmark overnight interest rate by 25 basis points to a range of 4.25%-4.50%. However, the Fed adjusted its outlook, projecting only two rate cuts in 2025 instead of the four predicted in September. This revision reflects the labor market’s and economy’s resilience. The Fed had previously raised rates by a cumulative 5.25 percentage points in 2022 and 2023 to combat inflation.

The labor market remains strong, with layoffs at historically low levels. However, employers are cautious about expanding their workforce following a post-pandemic hiring surge. Consequently, some displaced workers are experiencing longer periods of unemployment, with the median duration of joblessness reaching a three-year high in November.

The number of individuals receiving benefits after their first week of aid, a proxy for hiring activity, dropped by 52,000 to a seasonally adjusted 1.844 million during the week ending December 21. Economists note that seasonal adjustments may be distorting this data and contributing to the elevated levels of continuing claims.

Looking Ahead

Economists anticipate that the unemployment rate likely remained steady at 4.2% in December. The government is set to release its closely watched employment report for December next Friday, which will provide further insight into the health of the labor market.

Other Economic Indicators

- Home Sales: Sales of new single-family homes rose by 5.9% in November, reaching an annualized rate of 664,000, according to government data released Monday. This figure aligns closely with economists’ median estimate of 669,000 in a survey. The supply of new homes for sale climbed to its highest level since late 2007, giving buyers more options. This has helped with affordability, as the median sale price of a new single-family home fell by 6.3% year-over-year to $402,600.

- Goods Trade Balance: Economic data released on Friday revealed that the U.S. trade deficit expanded in November to -$102.86 billion, up from -$98.26 billion in October and exceeding expectations of -$101.30 billion. Additionally, U.S. wholesale inventories unexpectedly declined by -0.2% month-over-month in November, contrary to forecasts of a +0.1% increase. At the same time, U.S. rate futures indicate an 88.8% probability of no change in interest rates and an 11.2% likelihood of a 25 basis point rate cut at the Fed’s next meeting in January.

- Jobless Claims: Initial claims for state unemployment benefits fell by 9,000 to a seasonally adjusted 211,000 for the week ending December 28, the lowest level since April. Economists surveyed had projected 222,000 claims for the week. The four-week moving average of claims, which smooths out weekly fluctuations, declined by 3,500 to 223,250. Although jobless claims often fluctuate around the end of the year, the data remains consistent with a labor market that is slowing gradually without signaling a downturn in economic conditions.

BTC Price Analysis

BTC open interest has dropped to its lowest level in two months, signaling reduced downside risk for the cryptocurrency. Since the end of the year, BTC has struggled to hold above $95,000, with demand for leveraged positions declining. During this period, bulls faced $470 million in liquidations, while bears showed reduced activity, especially when BTC tested levels below $92,000. The total open interest in BTC futures markets — measured by the total number of active contracts — has fallen to BTC 595,700, an 11% drop from its December 20 peak of BTC 668,100. This marks the lowest level since November 4, though it does not necessarily indicate a defeat for the bulls. Despite bears gaining short-term control, their reduced appetite suggests limited downside potential for Bitcoin’s price.

Macroeconomic Factors Boost Bitcoin’s Appeal

Remarks from U.S. Treasury Secretary Janet Yellen on December 27 injected optimism into the crypto market. Yellen warned Congress that the federal government could reach its debt limit as early as January 14 unless swift action is taken. Meanwhile, House Speaker has tied a potential $1.5 trillion debt limit increase to $2.5 trillion in mandatory spending cuts, adding uncertainty to the situation. With at least two dozen hard-line Republicans opposing any increase, a fiscal standoff could arise.

Retail Traders Show Resilience

Perpetual futures contracts, which reflect retail traders’ risk appetites, have shown improvement. Neutral markets typically see buyers paying a monthly funding fee of 0.4% to 1.8%, with higher rates signaling bullish sentiment. The current monthly funding rate of 1.3% is the highest in over two weeks, suggesting increased demand for leverage. This, coupled with declining open interest, indicates that bears lack confidence in adding positions below $95,000, providing a positive outlook for Bitcoin’s price.

In summary, while BTC has faced challenges maintaining levels above $95,000, improving derivatives metrics and reduced bearish sentiment signal a brighter outlook for the cryptocurrency in the near term.

On-Chain Analysis

- 📊 Exchange: As the exchange reserve continues to fall, it indicates lower selling pressure. Net deposits on exchanges are high compared to the 7-day average. Higher deposits can be interpreted as higher selling pressure.

- 💻 Miners: Miners’ are selling more holdings compared to its one-year average. Miner’s revenue is in a moderate range, compared to its one-year average.

- ⛓️ On-chain: More investors are selling at a profit. In the middle of a bull market, it can indicate a market top. Long term holders’ movement in the last 7 days was higher than the average. If they were moved for the purpose of selling, it may have negative impact. Investors are in a belief phase where they are currently in a state of high unrealized profits.

- 🏦 Derivative: More investors are selling at a profit. In the middle of a bull market, it can indicate a market top. Long term holders’ movement in the last 7days were higher than the average. If they were moved for the purpose of selling, it may have negative impact. Investors are in a Belief phase where they are currently in a state of high unrealized profits.

- 🔀 Technicals: RSI indicates a neutral condition. Stochastic indicates a neutral condition where the current price is in a moderate location between the highest-lowest range of the last 2 weeks.

News About Altcoins

- Spirit Blockchain Adopts MicroStrategy’s Strategy, but With Dogecoin Instead of Bitcoin. Spirit Blockchain Capital, a Canadian investment firm, has adopted a Dogecoin treasury reserve strategy similar to MicroStrategy’s Bitcoin approach. The company announced plans to generate yield from its DOGE holdings as an initial step toward enhancing financial efficiency and expanding DeFi product adoption. CEO Lewis Bateman stated that this strategy aims to unlock new revenue streams and position the firm as a market leader in yield generation for Dogecoin and other digital assets, including Bitcoin, Ethereum, Tether, and Solana. Although operational details and launch timelines remain undisclosed, this move forms the foundation of Spirit Capital’s ambition to build a significant Dogecoin portfolio and introduce innovative crypto products to the market.

News from the Crypto World in the Past Week

- AI Tokens Predicted to Outperform Memecoins in 2025. According to Haseeb Qureshi, managing partner at Dragonfly Capital, AI-based agent tokens are expected to continue outperforming memecoins through 2025, driven by a shift from “financial nihilism” to “financial optimism.” This trend, however, is anticipated to fade by 2026 as the market tires of AI chatbots. Despite the growing popularity of AI tokens, highlighted by the strong performance of Virtuals Protocol and Bittensor, Qureshi warns that AI agents remain vulnerable to manipulation and security breaches. Bitwise CEO Hunter Horsley compares this trend to the rise of corporations in the 19th century, reflecting the long-term potential of AI technology.

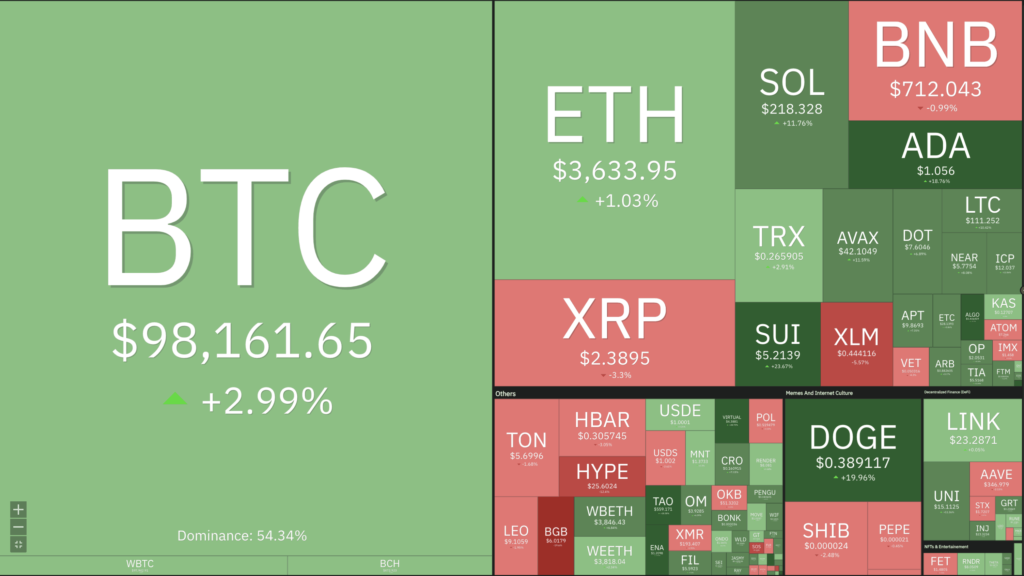

Cryptocurrencies Market Price Over the Past Week

Cryptocurrencies With the Best Performance

- AIOZ Network (AIOZ) +29.54%

- Ethena (ENA) +28.87%

- Virtual Protocols (VIRTUAL) +27.31%

- Stellar +25.59%

Cryptocurrencies With the Worst Performance

- Toncoin -2.08%

- BNB -0.37%

- Tezos -0.04%

- Aerodrome Finance (AERO) -0.01%

References

- Ciaran Lyons, Memecoins will continue to lose market share to AI agent coins: Dragonfly VC, Cointelegraph, accessed on 5 Januari 2025.

- Liz Napolitano, The ‘MicroStrategy of Dogecoin’ Launches DOGE Yield Strategy, Eyes Bitcoin and Solana Expansion, decrypt, accessed on 5 Januari 2025.

Share

Related Article

See Assets in This Article

BTC Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-