Market Analysis Oct 28th, 2024: Bitcoin Shows Resilience at $67K as Tether Investigation Unfolds

Entering the fourth week of October, Bitcoin has yet to reach its all-time high price. Even so, BTC remains strong amid new challenges facing the stablecoin company Tether and the closely contested U.S. presidential election polls, which could influence the future of the crypto market. Check out the full analysis below.

Market Analysis Summary

- 📝 BTC remains stable above $67,500 after briefly dipping to $66,000 earlier this week. Support BTC is at $65,000.

- 🏠 U.S. existing home sales declined to their lowest level in 14 years, weighed down by higher mortgage rates and elevated house prices.

- 🟢 Traders are assigning a 95% probability that the Fed will cut interest rates by 25 basis points at its November meeting.

- 💼 Analysts currently expect that the U.S. economy added 135,000 jobs in October, down from the 254,000 jobs added in September.

Macroeconomic Analysis

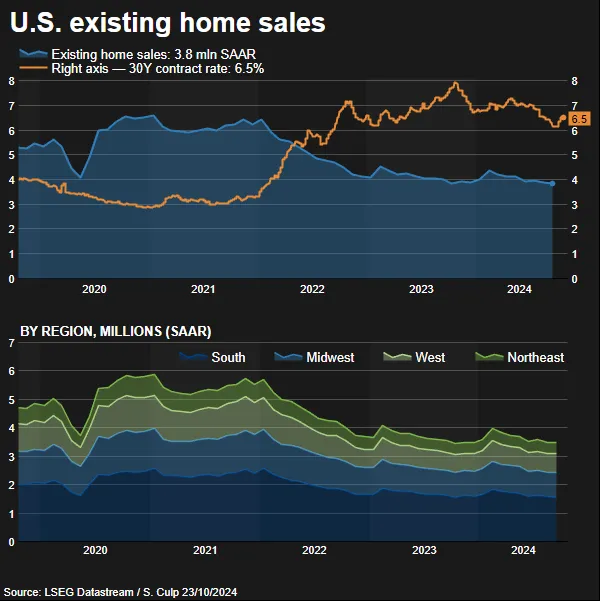

Existing Home Sales

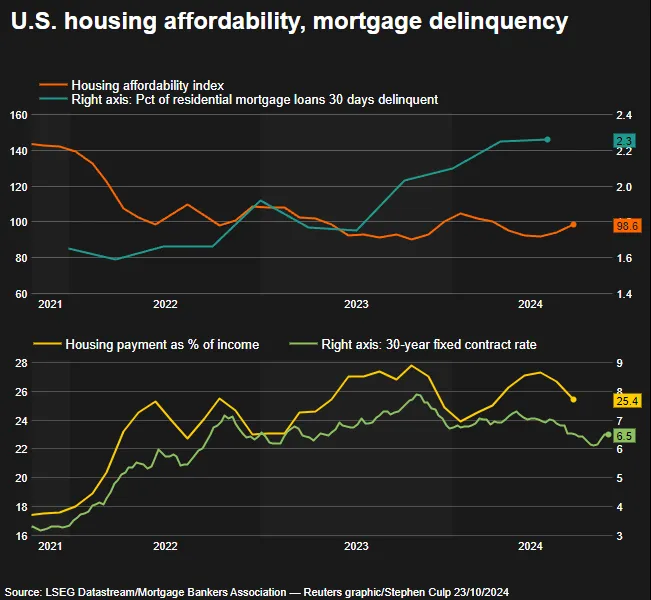

In September, U.S. existing home sales declined to their lowest level in 14 years, weighed down by higher mortgage rates and elevated house prices.

This marks the second consecutive monthly decrease in home resales, reinforcing economists’ views that the downturn in residential investment—including homebuilding—intensified in the third quarter. The housing market has struggled to recover after being hit by a resurgence in mortgage rates during the spring.

Although overall supply has improved, entry-level homes remain scarce in most regions across the country, keeping prices at levels unaffordable for many first-time buyers.

Home sales fell by 1.0% last month to a seasonally adjusted annual rate of 3.84 million units—the lowest since October 2010. Economists had expected home resales to remain unchanged at a rate of 3.86 million units.

Sales likely represent contracts signed one or two months ago when mortgage rates were quite high. Although mortgage rates initially decreased after the Fed began cutting interest rates last month, they have risen over the past three weeks. Strong economic data—including robust retail sales and annual revisions to national accounts—has led traders to abandon expectations of another 50-basis-point rate cut next month.

According to data from the mortgage finance agency, the average rate for the popular 30-year fixed mortgage rose to 6.44% last week, up from 6.08% at the end of September. We have to anticipate that housing market activity will remain subdued well into 2025. The average interest rate on existing mortgages is about 4%, compared to the current 6.5% rate for new mortgages.

Evidence of potential homebuyers staying on the sidelines in anticipation of even lower borrowing costs was seen in government data last week, which showed a marginal increase in single-family building permits in September.

In the second quarter, residential investment subtracted from the gross domestic product (GDP). Growth estimates for the third quarter are as high as a 3.4% rate. The economy expanded at a 3.0% pace during the April-June quarter.

Housing inventory rose by 1.5% to 1.39 million units last month, reaching its highest level since October 2020. Supply surged 23.0% compared to one year ago. However, it remains below the 1.8 million units observed before the COVID-19 pandemic.

Despite the improving inventory, the median existing home price increased by 3.0% from a year earlier to $404,500 in September, the highest figure ever recorded for that month.

Home prices climbed in all four regions, with about 20% of homes selling above their listing price.

Other Economic Indicators

- Initial Jobless: New data from the Department of Labor showed that 227,000 initial jobless claims were filed in the week ending October 19, down from 241,000 the previous week and below the 242,000 economists had anticipated. Thursday’s report indicates that claims have reversed the upward trend seen in September, which had brought the metric to its highest level in more than a year. Thursday’s report also showed that continuing claims rose to 1.89 million in the week ending October 12, up from 1.86 million the previous week, marking the highest level since November 2021.

- Interest Rate Probability: As of Thursday morning, traders are assigning a 95% probability that the Fed will cut interest rates by 25 basis points at its November meeting.

- S&P Global Services: The preliminary US S&P Global Composite PMI for October rose modestly to 54.3, up from a final reading of 54.0 in September. Manufacturing activity saw an improvement, climbing to 47.8 from September’s 47.3, and surpassing the expected figure of 47.5. The services index increased to 55.3, compared to 55.2 in the previous month, exceeding the forecasted 55.

- New Home Sales: According to the U.S. Census Bureau and the U.S. Department of Housing and Urban Development, September’s seasonally adjusted annual rate of sales reached 738,000 units. This marks a 4.1% increase from August’s downwardly revised rate of 709,000 transactions. Year over year, sales were up 6.3% from 694,000 units. The September figure exceeded the consensus estimate of 710,000 sales.

BTC Price Analysis

BTC remains stable above $67,500 after briefly dipping to $66,000 earlier this week. This decline followed a 400-point drop in the Dow Jones, which caused broader selling pressure across financial markets.

Despite negative sentiment driven by a decrease in Trump’s winning presidential odds, BTC has shown resilience by stabilizing around the $66,500 mark, which coincides with the 0.786 Fibonacci retracement line. The current price level suggests potential strength despite external market challenges. Support is at $65,000.

On-Chain Analysis

- 📊 Exchange: As the exchange reserve continues to fall, it indicates lower selling pressure. Net deposits on exchanges are high compared to the 7-day average. Higher deposits can be interpreted as higher selling pressure.

- 💻 Miners: Miners’ are selling holdings in a moderate range compared to its one-year average. Miner’s revenue is in a moderate range, compared to its one-year average.

- ⛓️ On-chain: More investors are selling at a profit. In the middle of a bull market, it can indicate a market top. Long term holders’ movement in the last 7 days was lower than the average. They have a motive to hold their coins. Investors are in a belief phase where they are currently in a state of high unrealized profits.

- 🏦 Derivative: Long position traders are dominant and are willing to pay to short traders. Buying sentiment is dominant in the derivatives market. More buy orders are filled by takers. As open interest increases, it indicates more liquidity, volatility, and attention are coming into the derivative market. The increasing trend in OI could support the current ongoing price trend.

- 🔀 Technicals: RSI indicates a overbought condition where 77.00% of price movement in the last 2 weeks have been up and a trend reversal can occur. Stochastic indicates a overbought condition where the current price is close to its high in the last 2 weeks and a trend reversal can occur.

News About Altcoins

- Tether CEO Denies Company is Under Investigation for U.S. Sanctions Violations. Tether has denied any indication that the company is under investigation, following a Wall Street Journal report suggesting that U.S. authorities are probing potential violations of sanctions or anti-money laundering regulations by the company. The investigation, led by the U.S. Attorney’s Office in Manhattan, is reportedly examining whether Tether’s cryptocurrency has been used by third parties to fund illegal activities such as drug trafficking, terrorism, hacking, or to launder proceeds from such crimes. Tether CEO Paolo Ardoino stated, “There is no indication that Tether is under investigation.” Tether also emphasized its cooperation with law enforcement to address bad actors attempting to misuse cryptocurrency.

News from the Crypto World in the Past Week

- Crypto Investors in the U.S. Split Between Support for Trump and Kamala. A recent Morning Consult survey for Coinbase shows that U.S. cryptocurrency holders are evenly split in their support between Kamala Harris and Donald Trump for the upcoming presidential election, with 47% favoring each candidate. Cryptocurrency has become a significant issue in this election, with Trump positioning himself as a “crypto candidate” and Kamala expressing her support for the crypto and blockchain industry. The report also reveals that the number of crypto holders has risen significantly to 52 million, with many residing in key swing states. Most crypto owners believe the current financial system needs an update and want clearer crypto regulations from Congress. The report highlights that crypto holders are a diverse group, with a majority made up of Gen Z, millennials, and individuals from racially diverse backgrounds compared to the general adult population in the U.S.

Cryptocurrencies Market Price Over the Past Week

Cryptocurrencies With the Best Performance

- Raydium +43,45%

- cat in a dogs world (MEW) +18,71%

- Popcat (POPCAT) +17,88%

- Jupiter +7,96%

Cryptocurrencies With the Worst Performance

- Injective -16,51%

- Wormhole (W) -15,41%

- MANTRA (OM) -15,34%

- Worldcoin -15,26%

References

- Reuters, Tether CEO says he sees no indication of US probe, Reuters, accessed on 27 October 2024.

- Vinamrata Chaturvedi, Donald Trump and Kamala Harris are neck-and-neck with crypto voters, Quartz, accessed on 27 October 2024.

Share

Related Article

See Assets in This Article

BTC Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-