Market Analysis October 13: Potential Trend Reversal

The crypto market has once again demonstrated its dynamic and volatile nature over the past week. On Friday–Saturday, October 10–11, 2025, a massive crash occurred across various crypto assets.

Article Summary:

- The tariff announcement by Donald Trump triggered a correction of more than 20% in the crypto market.

- BTC, ETH, and SOL are showing signs of a significant price rebound.

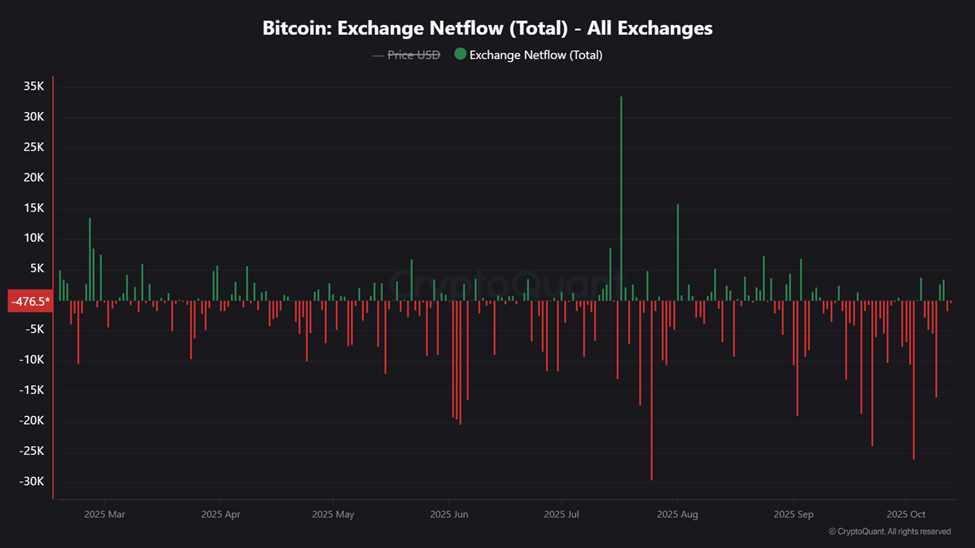

- On-chain data indicates Bitcoin’s outflows are higher than its inflows, signaling accumulation and reflecting a positive market sentiment.

Impact of the Tariff Announcement on the Crypto Market

Large-cap crypto assets such as Bitcoin and Solana dropped by double-digit percentages within just a few hours. However, many other cryptocurrencies experienced even more dramatic declines, such as SUI, which reportedly fell from around $3.42 to $0.5 in an instant, and ATOM, which briefly touched $0.01 on several exchanges.

The extreme downturn, allegedly triggered by U.S. President Donald Trump’s sudden announcement of tariffs on China, marked one of the largest liquidation events in crypto history. Reports indicated that a total of $16 billion—or approximately IDR 260 trillion—worth of futures positions were liquidated. Some sources even estimated that the real figure could be significantly higher.

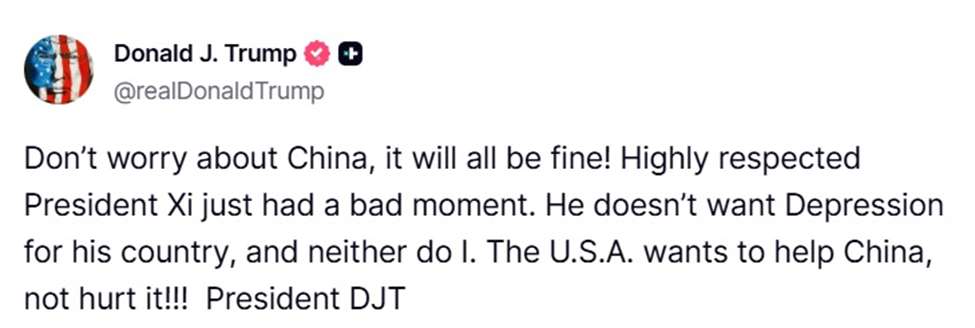

However, less than 48 hours after the announcement, President Trump stated that relations with China were “in good shape,” leading to a noticeable recovery in the market shortly thereafter.

This week, market volatility is expected to remain high—but with a positive bias—as many crypto assets are beginning to show clear signs of recovery.

Bitcoin (BTC) Analysis

Strong Recovery Signal After Holding Above the 200 EMA

Bitcoin has been the center of attention following a strong recovery signal that emerged just before President Trump’s second statement confirming stable relations with China. After briefly touching $102,142, Bitcoin surged more than 10% to $112,744 in less than 24 hours before the daily session ended. Two days later, Bitcoin confirmed this recovery with the formation of a bullish engulfing candle—one of the strongest indicators of a bullish reversal.

The bullish momentum for Bitcoin is supported by several key factors:

- Crucial Support Level (RBS): The $111,980 level, which represents the highest daily closing price on May 22, 2025. This level previously acted as a resistance, and Bitcoin successfully broke above it before the opening of this week’s session.

- Rebound from the 200 EMA: The rebound from the 200 EMA on the daily timeframe—a strong indicator of long-term trends—suggests that Bitcoin may continue its upward movement this week.

- Upside Projection: As long as Bitcoin’s price holds above the $111,980 level, the potential for a continued post-recovery rally remains high, with the nearest target positioned at the $121,000 level.

Ethereum (ETH) Analysis

Recovery Potential

Aside from Bitcoin, Ethereum has also come into the spotlight with a recovery signal that is technically similar to Bitcoin’s. After experiencing a decline of more than 21% during the market crash, Ethereum rebounded by 20% in less than 72 hours. Ethereum also confirmed its recovery through the formation of a bullish engulfing candle — one of the strongest indicators of a bullish reversal.

Ethereum’s recovery potential is supported by several key factors:

- Crucial Support Level (RBS): The $3,815 level, which previously acted as a resistance, was successfully broken by Ethereum before the opening of this week’s session.

- Rebound from the 200 EMA: The rebound from the 200 EMA on the daily timeframe — a strong indicator of long-term market trends — suggests that Ethereum still has room for further upside this week.

- Upside Projection: As long as Ethereum’s price holds above the $3,815 level, the likelihood of a continued post-recovery rally remains high, with the nearest target positioned at $4,447, while minor corrections may occur on the intraday timeframe.

Solana (SOL) Analysis

Recovery Potential

Solana is also showing significant signs of recovery, as indicated by the formation of a bullish engulfing candle — one of the strongest bullish reversal signals — accompanied by a rebound from the 200 EMA indicator.

Solana’s recovery potential is supported by several key factors:

- Crucial Support Level: The $174 level serves as a key support zone that successfully held Solana’s recent price decline.

- Rebound from the 200 EMA: The rebound from the 200 EMA on the daily timeframe — a strong indicator of long-term trend direction — suggests that Solana still has potential for upward movement this week.

- Upside Projection: As long as Solana’s price remains above the $174 level, the likelihood of continuing its post-recovery rally remains high, with the nearest target positioned at $220, while minor corrections may occur on the intraday timeframe.

On-Chain Analysis: Spot Market Indicates Potential for Continued Uptrend

Exchange Netflow data reveals an interesting market sentiment. Throughout October 2025, Bitcoin’s movement has been dominated by outflows from exchanges, indicating accumulation by market participants transferring their assets off-exchange — a positive signal for the market.

The recent volatility and sharp decline observed last week suggest that the large-scale liquidations primarily occurred in derivative (futures) positions. Based on available data, spot market positions in crypto assets remain relatively unaffected.

Macroeconomic Analysis for This Week

The global market’s focus this week will center on the potential recovery and upward movement driven by the ongoing dynamics between U.S. President Donald Trump and China’s President Xi Jinping.

Key Focus:

- Announcement and Potential Cancellation of Tariffs: Posts on Donald Trump’s X profile and Truth Social account indicate that the United States is ready to cooperate with China — a statement that contradicts the 100% tariff announcement made just two days earlier.With these developments, the market is expected to experience a positive momentum for at least the next week.

Another key event to watch is the upcoming speech by Federal Reserve Chair Jerome Powell on Tuesday, October 14, 2025, which could increase market volatility and potentially set the direction for the market in the weeks ahead.

Share