Market Analysis Sep 30th, 2024: BTC on the Rise, Memecoin MOODENG Skyrockets 1300%

The crypto market is wrapping up September with a sense of optimism. Bitcoin has closed the month on a positive note, fueling expectations that the long-awaited bull market could be on the horizon. But first, let’s take a look at a complete analysis to get an idea of where BTC might be headed next.

As usual, the Pintu trading team has gathered critical information and analyzed the general economic situation and the crypto market’s movements over the past week. However, it should be noted that all information in this Market Analysis is intended for educational purposes, not as financial advice.

Market Analysis Summary

- 📝 BTC is currently approaching the critical resistance level at $65,000. If BTC price successfully breaks above this key level, we can anticipate an upward momentum propelling BTC towards the $68,500 region.

- 📈 The S&P Global US Services Purchasing Managers’ Index (PMI), a key measure of economic health in the service sector, has shown a slight uptick.

- 🏠 Sales of newly built homes in the U.S. declined in August, as high interest rates and home prices prompted buyers to step back.

- 📉 Weekly jobless claims fall 4,000 to 218,000.

Macroeconomic Analysis

GDP Growth Rate

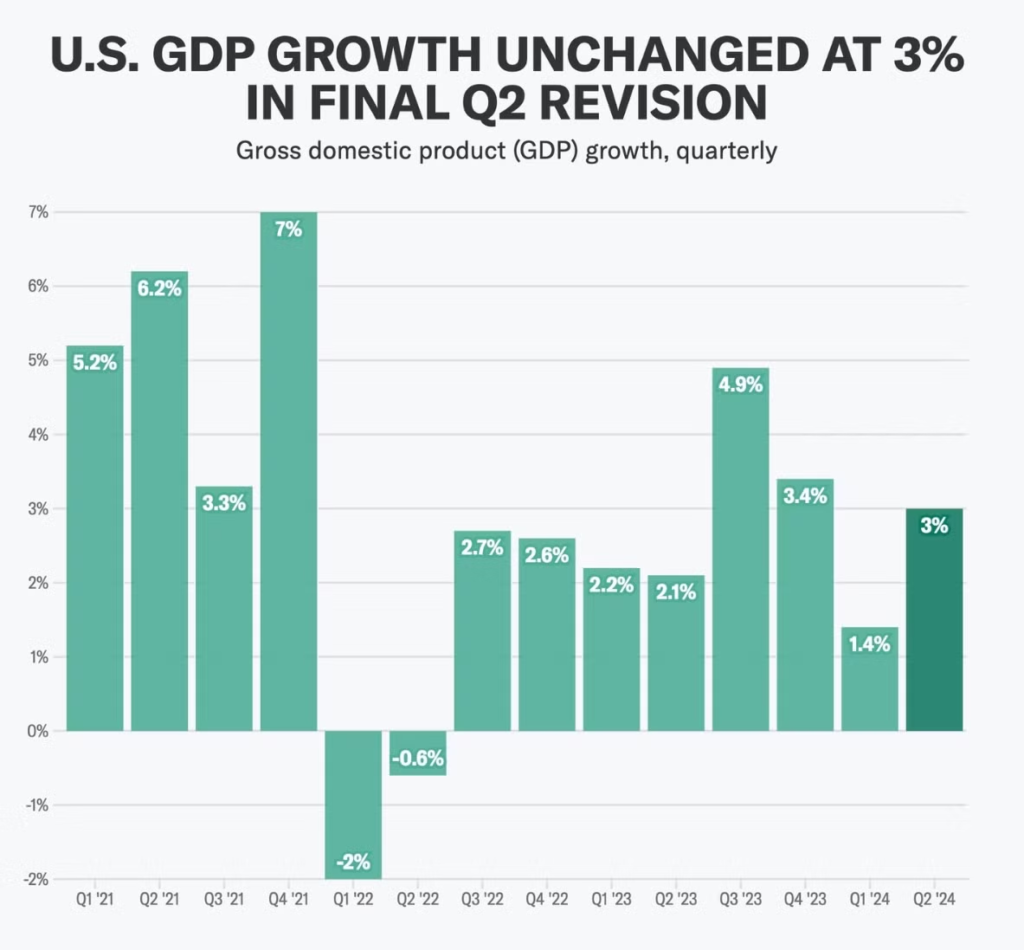

The U.S. economy grew at an annualized rate of 3% in the second quarter, exceeding Wall Street’s expectations.

The Bureau of Economic Analysis reported in its third estimate that the second-quarter U.S. gross domestic product (GDP) remained unchanged from the previous estimate, which also showed a 3% annualized growth. Economists had anticipated a slightly lower growth rate of 2.9%. This confirmation indicates that the economic expansion accelerated from the 1.4% annualized growth observed in the first quarter.

The revisions only strengthen our conviction that the U.S. economy will continue to expand at a decent pace over the coming year, which suggests labor market conditions are unlikely to deteriorate markedly from here.

The GDP report is considered retrospective, as it updates economic growth for the quarter that ended in June. However, projections indicate that the economy has been expanding at a steady pace in the third quarter, which concludes in September.

The Atlanta Fed’s GDPNow tracker currently estimates that the U.S. economy is on track for an annualized growth rate of 2.9%. Meanwhile, the economics team at Goldman Sachs projects that the U.S. economy grew at an annualized pace of 3% in the third quarter.

Other Economic Indicators

- S&P Global Manufacturing PMI Index: The latest data from the S&P Global U.S. Manufacturing Purchasing Managers’ Index (PMI) indicates a sustained contraction in the manufacturing sector. The PMI, which serves as a crucial barometer of economic health, has declined to 47.0, remaining well below the neutral 50-point threshold that differentiates expansion from contraction. The recent PMI figure, which is lower than both the forecast and the previous value, suggests that purchasing managers in the manufacturing sector are experiencing a slowdown in activity.

- S&P Global Service PMI Index: The S&P Global US Services Purchasing Managers’ Index (PMI), a key measure of economic health in the service sector, has shown a slight uptick. The current figure for the month stands at 55.4, indicating modest growth within the sector. However, the current PMI figure of 55.4 is slightly lower than the previous month’s reading of 55.7, indicating a minor slowdown in the sector’s growth rate, despite maintaining an overall positive trend.

- New Home Sales: The Commerce Department reported on Wednesday that sales of newly constructed homes dropped by 4.7% to an annual rate of 716,000 in August, down from a revised rate of 751,000 in the previous month. The new-home sales number surpassed Wall Street expectations, as economists had predicted a sharper fall to 700,000.

- Durable Goods: Orders for U.S. durable goods remained flat in August, the Commerce Department reported on Thursday. This outcome was significantly better than anticipated, as economists had forecast a 3% decline in orders for durable goods—items intended to last at least three years.

- Initial Jobless Claims: The Labor Department reported that initial claims for state unemployment benefits decreased by 4,000 last week, reaching a seasonally adjusted 218,000 for the week ending September 21—the lowest level since mid-May. Economists had forecasted 225,000 claims for the latest week.

BTC Price Analysis

BTC is once again setting its sights on the $65,000 level, a price point not reached since the first week of August with an upcoming speech by Fed chair potentially serving as the next catalyst.

The market will be closely monitoring Powell’s speech for indications of any shifts in sentiment following last Thursday’s FOMC press conference, which signaled the potential for further easing.

The Fed announced its first round of cuts last week leading to a surge in risk assets like BTC and traders are anticipating a 62% chance of an additional 50 basis point reduction in November.

BTC is currently approaching the critical resistance level at $65,000, which aligns with the Fibonacci Golden Ratio in the price range. This area is significant in technical analysis, as the Fibonacci levels often act as strong support or resistance points. If the price successfully breaks above this key level, we can anticipate an upward momentum propelling BTC towards the $68,500 region. Such a breakout would not only confirm the continuation of the bullish trend but could also attract increased investor interest, potentially leading to new all-time highs.

On-Chain Analysis

- 📊 Exchange: As the exchange reserve continues to fall, it indicates lower selling pressure. Net deposits on exchanges are high compared to the 7-day average. Higher deposits can be interpreted as higher selling pressure.

- 💻 Miners: Miners’ are selling less holdings compared to its one-year average. Miner’s revenue is in a moderate range, compared to its one-year average.

- 🔗 On-Chain: More investors are selling at a profit. In the middle of a bull market, it can indicate a market top. Long term holders’ movement in the last 7days were lower than the average. They have a motive to hold their coins. Investors are in a anxiety phase where they are currently in a state of moderate unrealized profits.

- 🏦 Derivatives: Long position traders are dominant and are willing to pay to short traders. Buying sentiment is dominant in the derivatives market. More buy orders are filled by takers. As open interest increases, it indicates more liquidity, volatility, and attention are coming into the derivative market. The increasing trend in open interest could support the current ongoing price trend.

- 🔀 Technicals: RSI indicates a overbought condition where 72.00% of price movement in the last 2 weeks have been up and a trend reversal can occur. Stochastic indicates a overbought condition where the current price is close to its high in the last 2 weeks and a trend reversal can occur.

News About Altcoins

- Moo Deng Coin Soars 1,398% in a Week, Hits $266.7 Million Market Cap Inspired by Viral Baby Hippo. The Solana meme coin, Moo Deng (MOODENG), inspired by the viral baby pygmy hippo at Thailand’s Khao Kheow Open Zoo, has taken the crypto world by storm, soaring by an astonishing 1,398% in just a week. Starting at $0.019 per token on September 20, 2024, MOODENG has reached an all-time high of $0.288 on September 27, making it the 250th largest crypto with a market cap of $266.7 million. With a total supply of 989,968,252.02 coins and 23,151 holders, the top five holders currently control 6.95% of the circulating supply. As the adorable hippo continues to capture hearts worldwide, the meme coin’s popularity might just endure in this competitive crypto space.

News from the Crypto World in the Past Week

- Binance Founder ‘CZ’ Pays $4.3 Billion Fine, Keeps $61 Billion Net Worth Despite U.S. Sentencing. Changpeng “CZ” Zhao, the founder of Binance, was released from U.S. custody after serving a four-month sentence in a low-security facility, following a federal investigation that led to Binance paying a record $4.3 billion settlement—the largest corporate fine in U.S. history. Despite pleading guilty, paying a $50 million personal fine, and agreeing never to return as a Binance executive, CZ retains an estimated 90% stake in Binance, making him the 25th richest person in the world with a net worth of $61 billion. Now a free man, CZ is focusing on his new venture, Giggle Academy, an educational platform that claims to operate without revenue, and is currently hiring.

Cryptocurrencies Market Price Over the Past Week

Cryptocurrencies With the Best Performance

- Shiba Inu +34,58%

- Pepe +33,69%

- Ethena (ENA) +33,22%

- dogwifhat (WIF) 33,15%

Cryptocurrencies With the Worst Performance

- Monero (XMR) -10,41%

- Artificial Superintelligence Alliance -3,93%

- Kaspa -1,96%

References

- James Hunt, Telegram game Catizen’s token goes live for exchange trading amid community airdrop, theblock, accessed on 21 September 2024.

- Ryan S. Gladwin, ‘Catizen’ Telegram Game Reveals Airdrop Pass as CATI Token Launches, decrypt, accessed on 21 September 2024.

Share

Related Article

See Assets in This Article

BTC Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-