Exploring the Real World Asset (RWA) Ecosystem

The real world assets (RWA) sector has emerged as a prominent focus in 2023. Within a brief timeframe, it surged from the 22nd to the 7th among the largest sectors, boasting a Total Value Locked (TVL) of 4.3 billion US dollars. Intense investor interest has catalyzed fast expansion within the RWA ecosystem, paving the way for intriguing advancements, particularly in tokenizing real-world assets within DeFi. This article will examine the decentralized protocols that underpin the emergence of a dynamic and robust RWA ecosystem.

Article Summary

- 🏘️ In 2023, non-stablecoin RWA witnessed a growth of USD 1.05 billion, primarily propelled by assets that generate yield, including treasuries, real estate, and private credits.

- 🪴 The RWA growth is partly influenced by a transition in interest from on-chain yields to conventional instruments, prompted by increased interest rates and the bearish conditions in the cryptocurrency market.

- 🏗️ Centrifuge, Ondo Finance, Clearpool, and MakerDAO lead the RWA market share, showcasing innovation and excellence in delivering services for tokenizing real-world assets.

- 🚨 While embraced by traditional financial entities, RWAs remain tethered to conventional risks and regulations. Conversely, the DeFi sector exhibits significant growth potential through broader adoption and escalating demand, promising a promising future for the RWA ecosystem.

The Development of RWA Tokenization

By 2023, non-stablecoin RWA has expanded by 1.05 billion US dollars. According to Galaxy’s report, 82% of this growth can be attributed to assets that generate yield, including treasuries, real estate, and private credit, all of which have nearly doubled in the past three quarters. However, the market capitalization of RWA remains 9.6% below its peak in 2022.

Shifts in the global economy have spurred the acceleration of this growth. Initially, on-chain yields were propelled by introducing new tokens. Still, a subsequent change in interest led to a preference for traditional instruments, driven by increasing interest rates and a bearish cryptocurrency market. This shift resulted in a decline in demand for DeFi yield-generating instruments and a rise in the demand for off-chain products with high yields facilitated through on-chain channels.

Learn more about RWAs in our article RWA: Bridging Real-World Assets to the Digital World through Blockchain Technology.

Moreover, top global companies are progressively incorporating blockchain technology into their operations. JP Morgan and Citi are notable companies demonstrating interest in utilizing blockchain technology to tokenize RWA through Avalanche facilities.

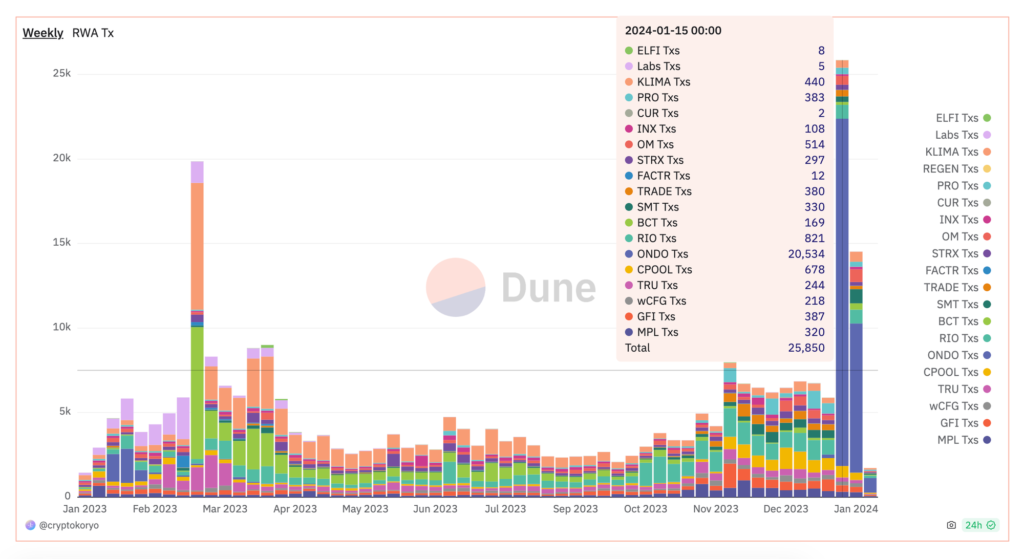

Despite DeFi technology being utilized by only 0.06% of the global population, the RWA sector demonstrates significant growth potential. As the image above shows, over 25,000 RWA transactions occur weekly, predominantly on the Ondo Finance platform.

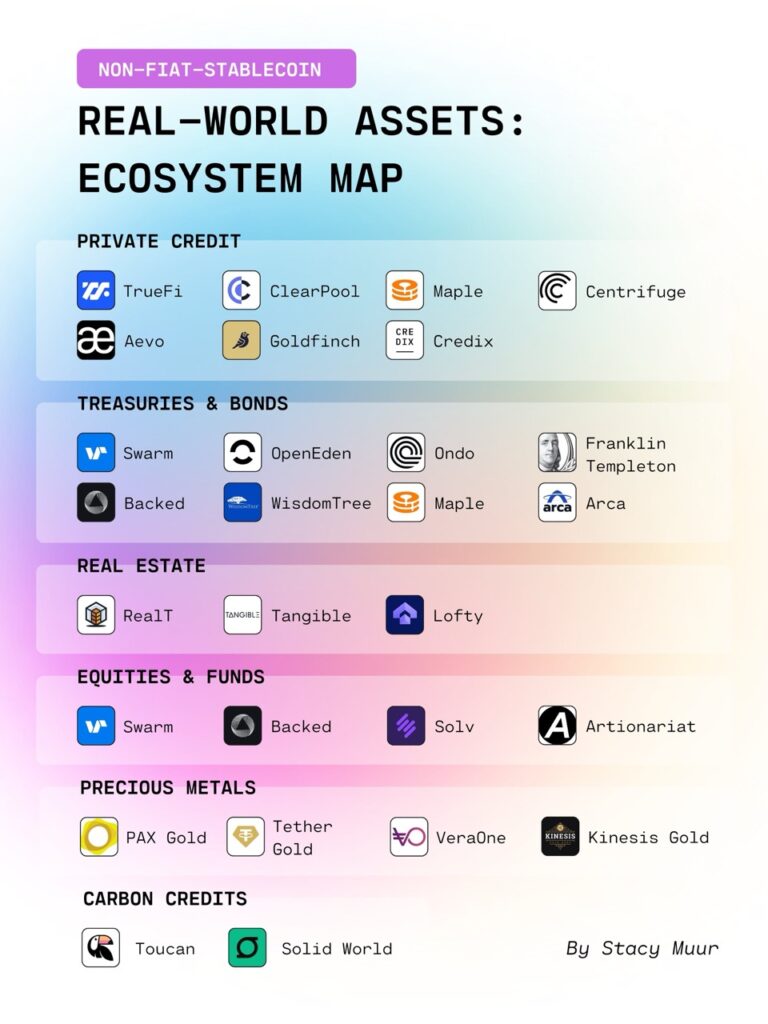

Real World Asset (RWA) Ecosystem

An Issuer, a centralized company, a decentralized protocol, or a hybrid of both generate RWA. The issuance of RWA tokens includes:

- Acquisition of real-world assets.

- Tokenization of those assets on-chain.

- Distribution of RWA tokens to on-chain users.

Advancements and innovations in the blockchain realm have attracted significant participation from major traditional financial entities like Franklin Templeton and Wisdom Tree, using tokenizing financial instruments to cater to user demands. Beyond these entities, existing decentralized protocols also contribute to issuing RWA tokens and establishing a robust RWA ecosystem.

Here are dApps that support the RWA ecosystem:

1. Centrifuge (CFG)

Centrifuge is one of the largest on-chain lending platforms that integrates real-world assets (RWAs) into the DeFi space. This protocol has high security. It applies strict legal standards, KYC checks, and technical audits to ensure user safety and reliability.

Borrowers can mint NFT tokens in Centrifuge, representing the assets they want to use as collateral. The collateral can be mortgages, royalties, rental income, etc.

They then hand over these tokens to the Issuer, a legal entity known as an SPV that manages the pool and issues senior/junior tokens to borrowers. NFTs can have their own private pool or be mixed with other assets to create a single pool.

The latest product from Centrifuge is Centrifuge Prime (beta), which targets the Treasury DAO. Its objective is to help Treasuries improve their returns through RWA investments.

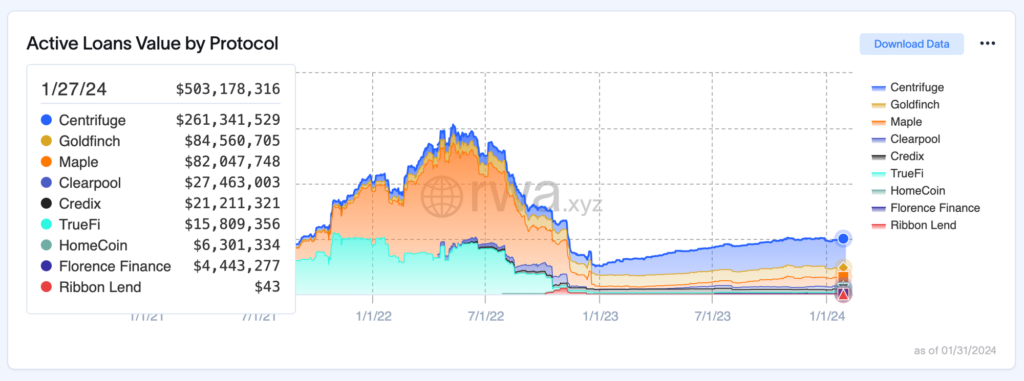

From the figure above, we can see that Centrifuge is the largest protocol in active lending. As of January 27, 2024, the total Active Value Loans in the Centrifuge protocol reached 261 million US dollars, a significant amount compared to other protocols such as Goldfinch, Maple, and TrueFi.

In the final week of January 2024, Centrifuge achieved a milestone by surpassing 500 million US dollars in total real-world assets (RWA), spanning real estate, US treasuries, trade finance, carbon credits, and more. Given the considerable market interest in RWA, it is reasonable for the platform’s RWA volume to potentially reach 1 billion US dollars.

2. Ondo Finance (ONDO)

Ondo Finance is a blockchain-based financial system protocol that provides real-world asset (RWA) tokenization. The mission of Ondo Finance is to make institutional-grade financial products and services available to everyone.

Ondo has four RWA offerings that give investors access to a variety of financial products:

- U.S. Money Markets (OMMF)

- Ondo Short-Term U.S. Government Bond Fund (OUSG)

- Ondo Short-Term Investment Grade Bond Fund (OSTB)

- Ondo High Yield Corporate Bond Fund (OHYG)

One of its flagship products is OUSG, a tokenized version of BlackRock’s iShares Short Treasury Bond ETF. Users must be accredited investors and qualified purchasers to purchase or mint OUSG tokens.

The product purchase process involves depositing USDC to purchase assets such as ETFs (OUSG). In return, new tokens (OUSG) will be minted and deposited into the investor’s wallet. At the time of redemption, the OUSG token is burned, and USDC is returned to the investor’s wallet.

Another popular product is the U.S. Dollar Yield Token (USDY). USDY is a yield-bearing alternative to traditional stablecoins backed by short-term U.S. Treasuries. USDY is accessible to non-US individual and institutional investors and is transferable on-chain 40-50 days after purchase.

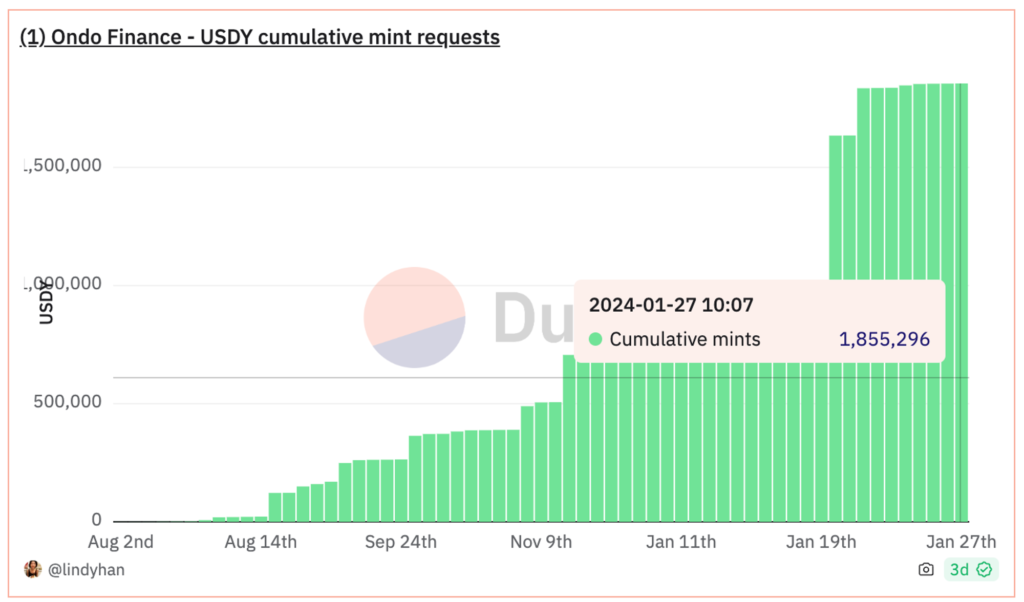

As of January 27, 2024, requests for minting USDY tokens have reached a total of 1.85 million tokens. This figure has consistently risen over the past month, particularly following the announcement of the Spot Bitcoin ETF.

Ondo stands out as a compelling project, holding a prominent position as one of the leaders in the market for tokenized treasuries, notably with its OUSG offering. It secures the second spot, following the traditional asset manager Franklin Templeton. Moreover, Ondo is spearheaded by former Goldman Sachs personnel Nathan Allman and enjoys support from distinguished investors, including Peter Thiel’s Founders Fund, Coinbase Ventures, and Tiger Global.

3. Clearpool (CPOOL)

Clearpool is a blockchain-based credit marketplace that connects asset suppliers and borrowers by creating borrowing pools. The platform is built to meet the growing demand for unsecured liquidity in the DeFi market.

Unlike Aave, which built an overcollaterized lending platform, Clearpool focuses on building an unsecured lending platform to solve another problem for borrowers.

Clearpool unlocks opportunities in credit markets that were traditionally inaccessible to retail investors. It provides institutional borrowers direct access to a diversified and decentralized network of lenders.

The number of RWA transactions on Clearpool increased rapidly in January 2024. One factor was Clearpool’s integration with Optimism Mainnet, which pushed Clearpool’s TVL to over 20 million US dollars.

The CPOOL token price also experienced a remarkable 250% surge in revenue by the end of 2023. It reflects the successful expansion and growing engagement of users across DeFi platforms.

In addition, the launch of Clearpool Prime Marketplace contributed more than 3 million US dollars in TVL. Prime Marketplace is a product for institutional pools following the launch of Clearpool’s first permission pool in partnership with Jane Street and BlockTower last year.

Expectations heightened as Clearpool hinted at introducing new products across various blockchains. This strategic move is geared towards broadening its ecosystem, attracting diverse types of borrowers, and expanding its range of services.

4. MakerDAO (MKR)

MakerDAO is a DAI stablecoin issuer and is the second largest DeFi application by TVL after Lido. It became one of the first DeFi applications to live on the Ethereum network.

In recent years, MakerDAO has been delving into the utilization of RWA. They initiated the active vaulting of funds from the RWA sector in 2022.

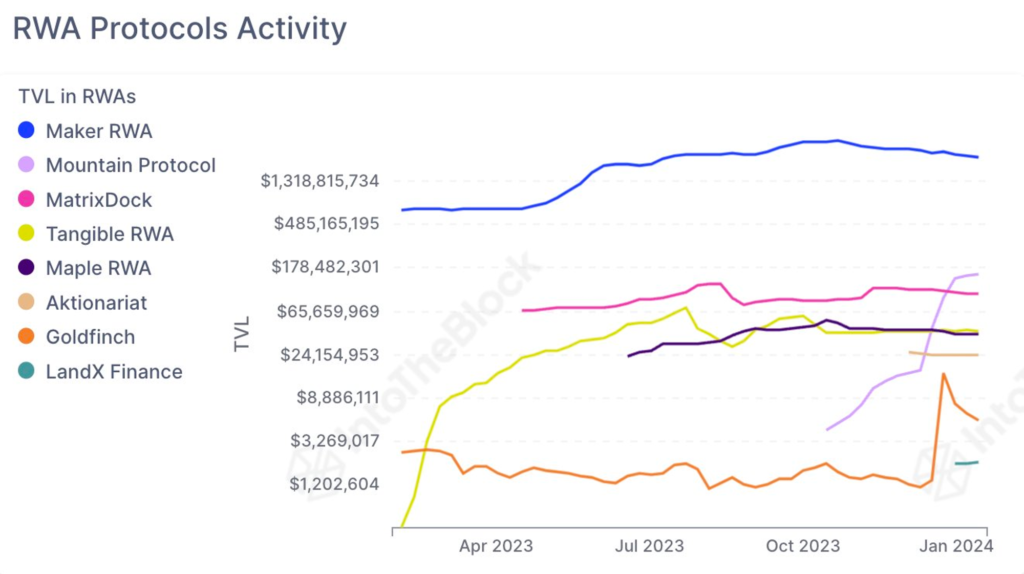

In 2020, MakerDAO began integrating its system into the RWA sector, boosting its Total Value Locked (TVL) to 2 billion US dollars by July 2023. Maker stands as the foremost protocol for RWA tokenization, commanding over 50% of the RWA market share.

Boasting a Total Value Locked (TVL) of around 2.78 billion US dollars, MakerDAO generates 70-80% of its revenue through stability fees linked to RWAs. The varied RWA portfolio encompasses assets like investment-grade bonds, Treasury bill ETFs, and business loans, all of which play a constructive role in enhancing stability and revenue within the MakerDAO ecosystem.

According to Binance research, in June, Maker purchased 700 million US dollars worth of treasury bonds, bringing their total treasury asset holdings to 1.2 billion US dollars.

Leveraging a diversified collateral base and RWA exposure, MakerDAO can capitalize on the prevailing yield conditions while upholding risk diversification. Achieving a Total Value Locked (TVL) of 2 billion US dollars in RWA signifies investor trust in MakerDAO, positioning it as a frontrunner in this expanding sector.

The Future of the RWA Sector

Real-world assets (RWA) entail genuine risks and are subject to conventional financial regulations. Users must regularly undergo KYC/AML processes, and accreditation checks, occasionally meeting minimum balance requirements.

While initially fueled by crypto natives, the RWA sector displays early indicators of adoption by traditional financial entities. Given the ongoing growth in the macroeconomic environment and escalating demand, this DeFi sector has the potential for further expansion.

Conclusion

The expansion of non-stablecoin real-world assets (RWAs) reached 1.05 billion US dollars in 2023, with 82% attributed to yield-generating assets. Despite a pivot in interest toward traditional instruments, the RWA sector demonstrates significant growth potential, particularly within the realm of DeFi.

The outlook for RWAs foresees continued growth with the gradual adoption by traditional financial entities. Nevertheless, RWAs are still subject to conventional risks and regulations, whereas the DeFi sector holds the potential for ongoing expansion through broader adoption and heightened demand.

Buying Real-World Asset (RWA) Tokens on the Pintu App

You can invest in RWA sector tokens such as MKR, ONDO, SNX, and others without worrying about fraud on Pintu. In addition, all crypto assets on Pintu have passed a rigorous assessment process and prioritize the principle of prudence.

The Pintu application is compatible with various popular digital wallets, such as Metamask, to facilitate transactions. Download the Pintu app on the Play Store and App Store! Your safety is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

In addition to making transactions on the Pintu app, you can also learn more about crypto through various Pintu Academy articles that are updated weekly! All Pintu Academy articles are created for educational and knowledge purposes, not as financial advice.

References

- Zack Pokorny, Overview of On-Chain RWAs and the Forces Propelling their Growth, Galaxy, accessed 30 January 2024.

- Julie-Anne Chong, Real-World Assets: Will RWAs Bring the Next Trillion into Crypto? Coin Bureau, accessed 30 January 2024.

- Stacy Muur, The non-stablecoin RWA sector exploded to $2.5B TVL in 2023, X, accessed 30 January 2024.

- Alex Wacy, Major global companies are increasingly integrating blockchain technology, accessed 31 January 2024.

- Trade Dog Team, Crypto Outlook Report 2024, Trade Dog, accessed 31 January 2024.

Share