Unlock Passive Earnings by Depositing on DeFi Platforms

DeFi offers extensive financial accessibility to crypto users. Within the DeFi world, users can instantly borrow crypto assets without the constraints of conventional credit terms. Aave stands out as one of the leading crypto lending platforms on the Ethereum network. To access this service, users require a Web3 wallet, like the Pintu Web3 Wallet. This article aims to guide users on borrowing crypto assets through Pintu Web3 Wallet.

Article Summary

- 💵 Aave is a decentralized lending and borrowing platform that operates on the Ethereum network.

- 💰 Aave utilizes an overcollateralization system, requiring you to provide collateral above the loan amount you seek.

- ✨ Through Aave, you can instantly borrow crypto assets and convert them into rupiah via Pintu. It offers financial flexibility without relying on banks or traditional credit terms.

- 🪴 Aave provides features such as net APY and health factor to help you manage risk and monitor portfolio health.

What is Aave and how can I use it?

Aave is a lending and borrowing platform that operates on the Ethereum network. It is also one of the most trusted crypto lending platforms. It offers instant asset loans with collateral in the form of other assets (tokens). For example, you can borrow USDC with ETH as collateral or vice versa.

Aave is currently available for blockchains other than Ethereum, such as Arbitrum, BNB Smart Chain, Optimism, and others.

Similar to traditional banking, you can save assets to earn interest and borrow assets by paying interest. However, unlike banks, you don’t need to meet credit requirements for loans; instead, you can directly engage with DeFi applications like Aave.

Aave employs an overcollateralized system in its operations, mandating users to offer collateral exceeding their loan amount. Maximum loan amounts for each asset vary, typically ranging from 75% to 85% of the collateral’s value.

In this article, we use Pintu Web3 Wallet to borrow USDT and ETH collateral on Aave.

How to Borrow Crypto Assets via Pintu Web3 Wallet

Connect Pintu Web3 Wallet to Aave

- Visit https://app.aave.com/ on your laptop.

- Connect Pintu Web3 Wallet by clicking ‘Connect wallet’.

- Select ‘WalletConnect’, and a QR code will appear.

- Open the Pintu app, then click ‘Web3’.

- On the Pintu Web3 Wallet, scan the QR code by clicking ‘WalletConnect’.

- Click ‘Connect’.

- Select the blockchain network to use. In this guide, we use the Arbitrum network by clicking the arrow next to ‘Ethereum Market’.

We choose to use Aave V3 because it is the latest version of Aave that provides more blockchain options and deeper liquidity than V2.

Take a Look at the Liquidity Pool of Assets

Before you borrow any tokens, you must first offer collateral. This positions you as a lender or liquidity provider, allowing others, or even yourself, to borrow your collateral assets. In return, you will receive a set interest rate.

As mentioned earlier, we will be supplying ETH and borrowing USDC. Make sure you have enough ETH because the blockchain fee or gas fee on the Arbitrum network uses ETH, but it is cheaper than the Ethereum mainnet.

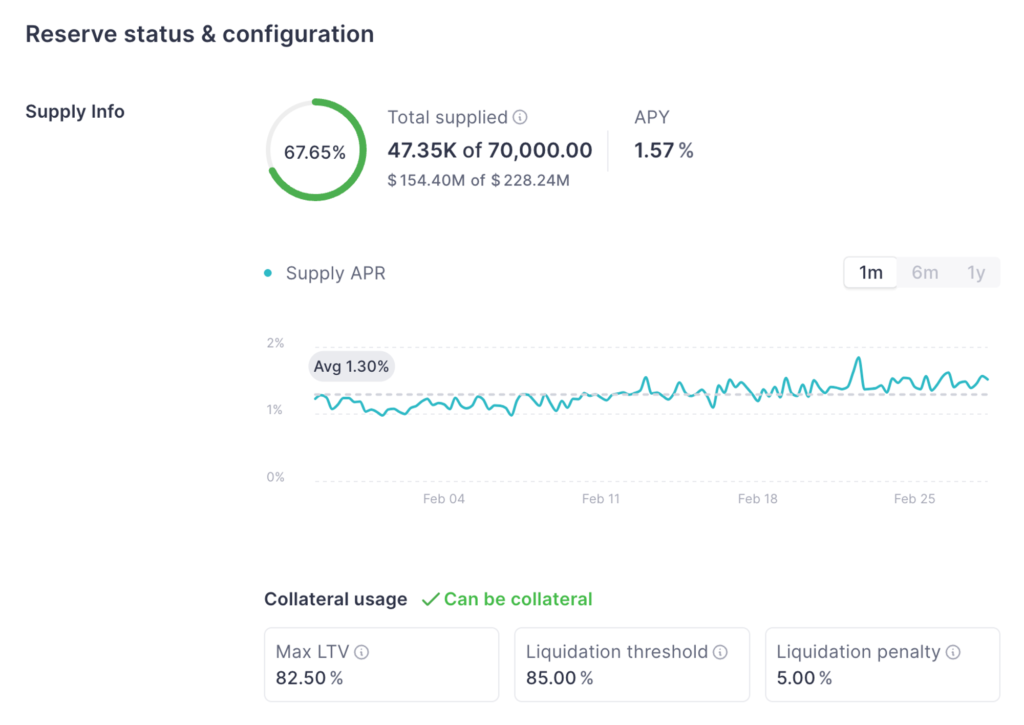

Before choosing ETH as collateral, you can view detailed ETH information by clicking ‘details’ next to ‘Supply’. At the time of writing, 67.65% of the ETH liquidity pool has been filled, with a total supply of 47.35k ETH, equivalent to 154.4 million US dollars. It means you can still add ETH to the liquidity pool.

The interest rate for crypto lending on Aave is shown as APY (Annual Percentage Yield). The APY of 1.57% indicates the interest you will earn in one year. For example, if you supply 100 ETH, you will earn 101.57 ETH in one year.

Moreover, it’s important to consider ETH’s Max LTV. The image above shows 82.5%. This Loan to Value (LTV) ratio represents the proportion of assets you can borrow against. For instance, if you provide 1 ETH as collateral, you can borrow approximately 0.8 ETH.

Then, the liquidation threshold for ETH is 85%. In practical terms, if you provide 1 ETH as collateral, borrow 0.8 ETH, and then the value of your collateral drops to 0.85 ETH (due to a decrease in ETH’s value), your collateral will be liquidated with a 5% penalty. This exemplifies one of the risks associated with crypto lending on overcollateralized lending platforms.

Aave's implementation of the overcollateralized system compels some crypto users to borrow assets at only around 30% to 50% to prevent the liquidation of collateral.

How to Supply Assets on Aave

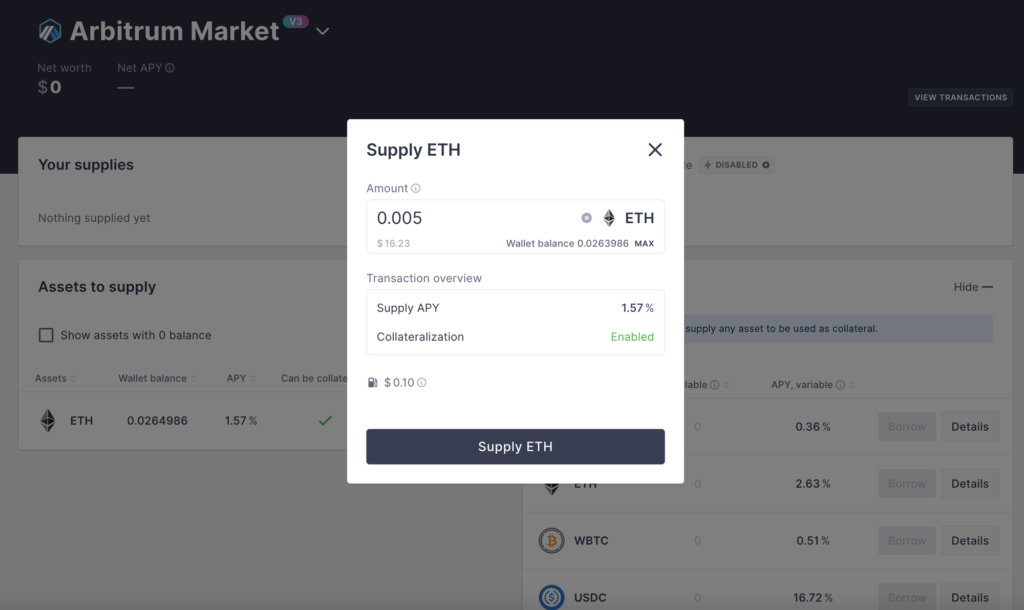

- In the left column, click ‘Supply’ on the ETH row. The assets that appear are based on the availability of assets in your wallet.

- Enter the amount of ETH, then click ‘Supply ETH’.

- Confirm the transaction on the Pintu Web3 Wallet.

Ensure you have enough ETH to pay the blockchain fee to confirm the transaction.

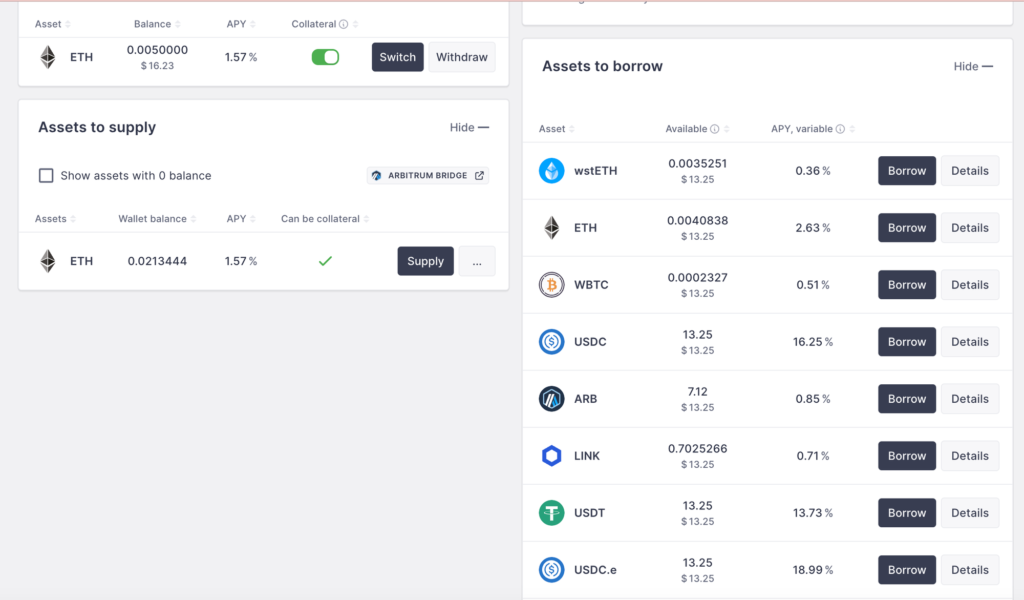

Following a successful transaction, the balance in your wallet will decrease as it transfers to Aave, signifying your transition into a liquidity provider. Subsequently, your ETH assets become available for borrowing by yourself or others.

By supplying ETH to Aave on the Arbitrum network, you’ll earn a 1.57% annual interest rate. The value of the provided ETH will vary with market prices. Should the ETH price rise, you’ll reap the benefits of both the price surge and the ETH APY, highlighting one of the advantages of crypto lending.

How to Borrow Assets on Aave

- On the right column, click ‘Borrow’ on the USDT row.

Sumber: Aave

- Enter the amount of USDT, then click ‘Borrow USDT’.

- Confirm the transaction on the Pintu Web3 Wallet.

Why opt for USDT instead of USDC? In the ‘APY, variable’ column, it shows that the APY for USDT stands at 13.73%, whereas for USDC, it’s 16.4%. This percentage represents the interest rate you’ll pay when borrowing the asset, subject to fluctuations based on market conditions.

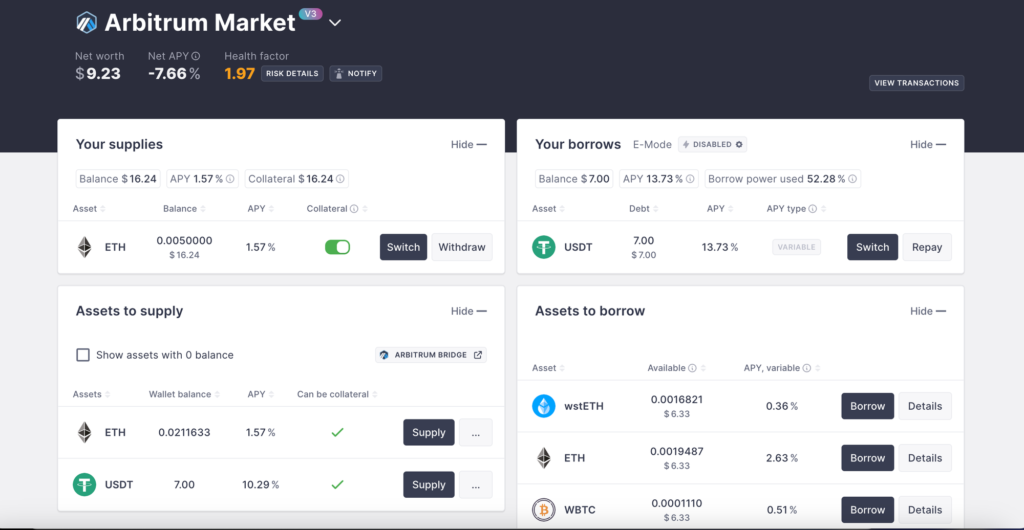

Review Your Aave’s Portfolio

After successfully supplying and borrowing crypto assets, your portfolio shows that you still have 9.23 US dollars in borrowable assets. Your portfolio also shows you have 16 US dollars in ETH supply and 7 US dollars in loans. In addition, you can also take note of the following:

- NET APY: NET APY, which combines the APY of your supply and borrow positions, should be positive. A negative NET APY suggests that the loan interest exceeds the interest earned on supplies.

- Health factor: The health factor signifies the liquidation risk associated with the asset you’ve supplied. A green indicator signals a stable health factor, whereas a red indicator warrants caution due to elevated liquidation risk. To mitigate liquidation risk, you can either increase your collateral or repay the loan.

How to Cash Out Assets from Pintu Web3 Wallet

After borrowing USDT from Aave, it means that you now have USDT in your Pintu Web3 Wallet. You can exchange USDT into IDRT and then into rupiah in your bank account via Pintu. Here are the steps as follows:

- On the Pintu app, click USDT in ‘Wallet’ and then ‘Receive’.

- If you don’t have USDT in your wallet, search for USDT in ‘Market’, then click ‘Tether Balance’. Then, click ‘Receive’.

- Click ‘Wallet Address’, then select the Arbitrum network. Then, copy the address to receive USDT on Arbitrum.

- Return to Pintu’s main home page, then click ‘Web3’.

- Select USDT (on Arbitrum), then click ‘Send’.

- Copy the address, input the USDT amount, and click ‘Continue’.

- Double-check the USDT amount and blockchain fees, then toggle to confirm the transaction.

- After receiving USDT, you can sell it and withdraw it to the bank account registered on your Pintu account.

To send USDT on the Arbitrum network, you must have ETH to pay the blockchain fee. The blockchain fee on Arbitrum is about 0.0002 ETH or 10,000 rupiah, depending on the network activity.

Pintu Web3 Wallet on Pintu App

Pintu has recently launched its Web3 Wallet, seamlessly integrated within the Pintu app. This wallet enables you to send, receive, and store crypto while also providing access to several dApps such as OpenSea, PancakeSwap, Blur, and more.

Pintu Web3 Wallet supports multi-chain networks, including Ethereum, BNB Smart Chain, Polygon, Avalanche and more. This allows you to interact with smart contracts and dApps across various blockchain networks using just one wallet.

With Pintu Web3 Wallet, you can actively engage in the decentralized future of the internet and participate in diverse Web3 projects.

Let’s create your Web3 Wallet on Pintu app. Watch this video to learn how to create one.

Conclusion

Aave provides crypto asset loans and operates on multiple blockchains beyond Ethereum. With Aave, you can both save and borrow crypto assets without the need for banking institutions or meeting traditional credit requirements.

Aave employs an overcollateralized system, necessitating users to offer collateral exceeding their loan amount. To utilize Aave, you must connect to the application using a Web3 wallet like Pintu Web3 Wallet, input collateral, and initiate loans as required.

The portfolio showcases the assets you supply and borrow. As such, you can monitor your portfolio’s health and manage risk by assessing the net APY and health factor.

Referensi

- Aave, Supply and Earning, Docs, diakses 26 Februari 2024.

- Robert Stevens, Aave: Understanding the Crypto Lending Platform, diakses 26 Februari 2024.

Share