The Potential of Cryptocurrency and Web3 in Indonesia

According to data from the Ministry of Home Affairs in June 2022, 69.3% of Indonesia’s population fell into the age range of 15-64 years. More than half of Indonesia’s population falls into the productive age category. Thus, Indonesia is an ideal market for novel technological innovations, including Web3 and cryptocurrencies. In recent years, the ecosystem of the crypto industry and Web3 in Indonesia has experienced rapid growth. The interest of various stakeholders in the crypto asset market in Indonesia can be seen at the Coinfest 2023 event on August 24 and 25, 2023. At the event, various industry stakeholders in Indonesia such as the government, investors, crypto projects, and financial institutions gathered to discuss various topics related to cryptocurrency and Web3.

Article Summary

- 🚀 More than half of Indonesia’s population is in the productive age category, making it an ideal market for the cryptocurrency and Web3 industry.

- 📊 There is healthy growth in Indonesia’s cryptocurrency ecosystem, with an increasing number of investors and local Web3 projects.

- 🏛️ The Indonesian government shows strong support for the industry through progressive regulations and initiatives such as the Commodity Futures Exchange .

- 🧠 Despite showing high interest, Indonesia faces challenges in improving literacy about cryptocurrencies and Web3, especially in preventing potential fraud and hacking. In addition, entering the Web3 world is still very difficult.

- ⚙️ On a regional scale, Indonesia has the potential to become a key player in the Southeast Asian market for cryptocurrencies and Web3, supported by favorable demographics and regulations.

Cryptocurrency and Web3 Ecosystem in Indonesia

Indonesia’s crypto and Web3 ecosystem underwent significant growth in the last two years. Many local Web3 projects have emerged from talented development teams. The Web3 ecosystem in Indonesia is also coming to life with the birth of many communities for many industry participants. In addition, many large crypto projects such as Arbitrum, Solana, and Cardano are starting to expand their communities to Indonesia.

What is Web3? Web3 is the concept of a new decentralized internet era where every user is an active participant with full control over what they own. The Web3 ecosystem relies on algorithms and protocols, not on third parties such as companies or governments.

Based on Bappebti data in May 2023, Indonesia had 17.4 million crypto asset investors. This is a 23.23% increase compared to May 2022. Although the crypto market is in the middle of a bear market, there is healthy growth in the Indonesian crypto market.

Despite the poor market conditions, several blockchain and crypto projects have emerged in Indonesia. Eizperchain, Mythic Protocol, Parallax Network, and Gaspack are some of the local Web3 projects in development. These projects show the potential of Web3 developer’s talent in Indonesia that needs to be explored.

Don’t forget to also read the 4 local crypto projects from Indonesia.

Progressive Cryptocurrency Regulation in Indonesia

In terms of regulation, the Indonesian government is also supportive of the crypto industry. The Indonesian government arguably has very progressive policies and views regarding crypto and the Web3. Compared to countries like Malaysia and even the United States, Indonesia has a very positive approach to the crypto industry.

In addition, the Indonesian government has issued several regulations that provide legal clarity for the crypto industry and its users. Some of them are Bappebti’s regulation on a list of 501 crypto assets that are legal to trade, a list of 30 prospective crypto asset physical traders (CPFAK), and regulation on crypto asset tax.

“With a regulated (crypto) exchange, it will make investors comfortable, (and provide) a sense of security and clarity. Hopefully, it will make them (investors) more comfortable and more certain regarding all crypto-related investments.”

Subani, President Director of Indonesia CFX.

Finally, the Indonesian government formalized the creation of the National Crypto Exchange (BKN) or Commodity Future Exchange (CFX). This policy was also welcomed by various parties in the industry such as the Indonesian Blockchain Association (ABI).

In the Coinfest 2023 event, CFX President Director, Subani, explained that CFX is here to provide convenience for investors. Subani continued that CFX will play a role in overseeing, fostering, and developing Indonesia’s crypto ecosystem. In addition, Subani also believes that CFX will contribute to making Indonesia more competitive with other countries.

The Great Potential of Indonesia and Southeast Asian Markets in the Cryptocurrency World

Chainalysis report on the global crypto adoption rate in 2022 places Indonesia in 20th position with a score of 0.3 out of 1. Indonesia’s position is very high and shows the great interest of the people in cryptocurrency assets and Web3. However, Indonesia is far behind Vietnam and the Philippines which are in 1st and 2nd place respectively. Four countries from Southeast Asia make it into the top 20 countries with the highest crypto adoption (the other one is Thailand).

Also, read the article Why Asia Could Become the Center of the World Crypto Industry.

“I eagerly anticipate the continued growth and collaboration within the Web3 ecosystem of Coinfest Asia that will continue to flourish in the years to come.”

Sandiaga Uno, Minister of Tourism and Creative Economy (Kemenparekraf) at the opening of Coinfest 2023.

In addition, an ADB (Asia Development Bank) report in 2022 also shows that 34% of the population in ASEAN (Association of Southeast Asian Nations) countries are young people. This is the reason why ASEAN countries are ideal for new technology industries such as Web3 and cryptocurrencies. In 2022, the digital economy sector will only contribute 7% to the GDP of ASEAN countries. So, Indonesia and the Southeast Asian market as a whole still have huge untapped potential.

Challenges of the Crypto Asset and Web3 Industry in Indonesia

Indonesia faces several challenges in increasing adoption and capitalizing on the potential of the crypto and Web3 asset industries. These challenges arise because the cryptocurrency industry and blockchain technology are very new to many Indonesians. Moreover, news about cryptocurrencies such as Bitcoin is usually rampant only when there is extreme negative or positive news.

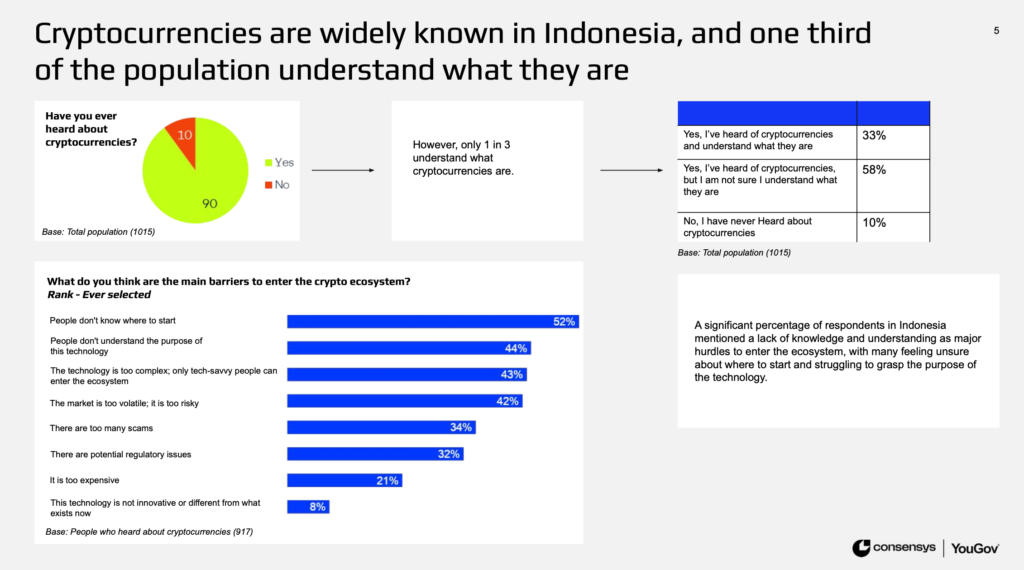

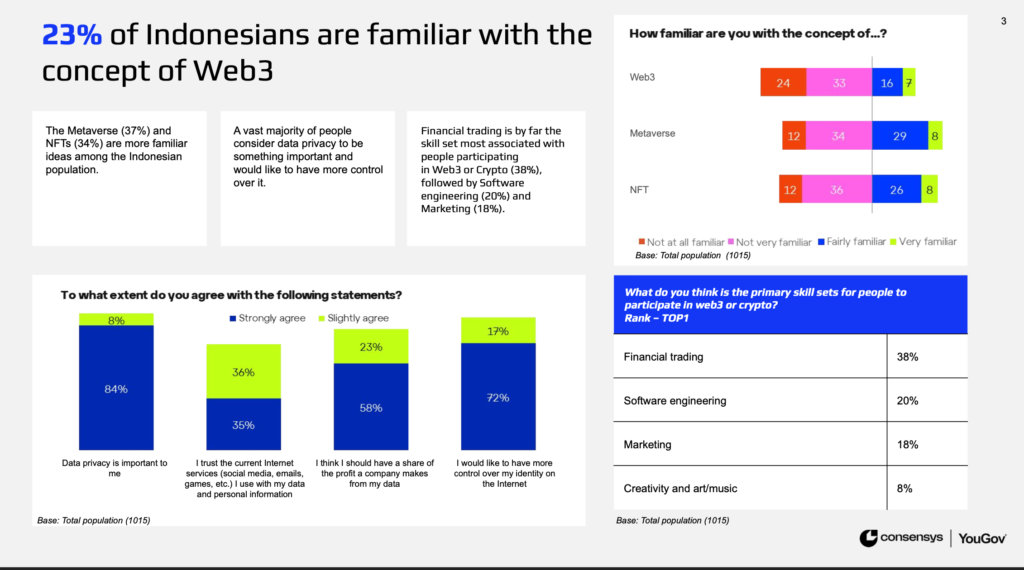

The first challenge of the cryptocurrency and Web3 industry in Indonesia is literacy and understanding. According to a YouGov and ConsenSys survey, 90% of respondents have heard about cryptocurrencies but only 33% understand them. There is a huge gap between having heard of cryptocurrencies and knowing what they are.

“Only with education and dissemination of information, (will we) find the benefits that will be the trigger point for widespread adoption (of Web3 and cryptocurrencies).”

Yos Ginting, Indonesian Chamber of Commerce and Industry

Furthermore, the financial literacy index of Indonesians is still below 40% by 2022. Many people who hear about cryptocurrencies don’t know where to start, don’t understand the functionality of the technology, and are afraid of scams.

The literacy issue relates to the second challenge of fraud and hacking. As we know, hacking is rampant in the crypto industry, especially in the DeFi sector. In addition, many “shitcoin” assets are created only to steal investors’ assets through pump-and-dump schemes.

Indonesians are also dealing with hundreds of fraud cases under the guise of investment schemes that offer unreasonable returns. According to OJK, the loss of Indonesians due to illegal investment during 2017-2022 is Rp139.03 trillion. This challenge of fraud and hacking is closely related to the issue of financial literacy and the fundamental understanding of investing.

Finally, the third challenge is the high barrier to entry into the world of Web3 or cryptocurrency. This challenge arises because most Web3 applications require a deep understanding of technology. To date, there is no blockchain-based application that can be easily used by millions of ordinary people.

The YouGov survey above actually shows that Indonesians understand the concept of Web3 and agree with many of its principles like control over personal data. Currently, crypto needs a local Web3 application or project that many people can use.

Opportunities for the Crypto Asset Industry and Web3 in Indonesia

The first opportunity for the crypto asset industry in Indonesia is of course as an alternative investment asset. According to Bappebti data, the number of crypto asset investors in Indonesia grows yearly. This shows that retail investors’ interest in crypto assets as an investment continues to increase even amid a bear market.

With the plan to create CFX and platforms like Pintu, this number is expected to increase further. The creation of CFX can provide security and clarity for many investors who are still worried about the legality of crypto assets in Indonesia.

Secondly, the opportunity for the Web3 world to create alternative blockchain-based financial applications for many people. The value of the DeFi sector is currently at 38.5 billion dollars (August 31, 2023). DeFi is an innovation that provides users with a novel digital economic ecosystem. What’s more, many DeFi applications only require the internet without the need for a long administration process.

“Unless you have the use case to justify the investment (to crypto and Web3), (such as) the kind of benefits that Banks bring to society in terms of growing and scaling up, (it will be) very difficult (for adoption)”

Bimo Notowidigdo, Managing Director, COO, and Head of Group Strategy, Transformation, Analytics & Research dari DBS Indonesia

Finally, the opportunity of Web3 and crypto technology for businesses, institutions, and governments. Currently, there are already several blockchain companies that have entered the property world by utilizing Fractional NFTs. Tokenization of physical assets into the blockchain is called Real-World-Asset or RWA.

In addition to RWA, a digital identity repository using NFTs and blockchain technology is also being explored by projects like Worldcoin. Blockchain is ideal as a repository for valuable and important data such as personal and sensitive data. Unfortunately, to date, no project can attract large institutions to utilize blockchain as permanent data storage.

The Web3 industry and crypto assets in Indonesia need to create applications that can attract everyday people. If this can happen, mass adoption of Web3 technologies will follow.

Conclusion

Indonesia shows great potential as a market for the crypto industry and Web3 technology. The country is a fertile ground for crypto as it has a population that largely consists of people in the productive age. The Indonesian government has also provided strong support through various progressive regulations, including the launch of the National Crypto Exchange, which adds confidence to investors and other stakeholders.

However, several challenges need to be overcome, including the issue of public literacy and understanding of crypto assets, the risk of fraud and hacking, and the high level of difficulty in entering the Web3 world. However, with high interest and support from various parties, including the government, Indonesia has the opportunity to optimally utilize this potential, in line with the development of the crypto industry and Web3 at the global level.

References

- “Web3 and crypto global survey 2023”, ConsenSys, accessed on 29 August 2023.

- “Preparing Southeast Asia’s Youth to Enter the Digital Economy”, Asian Development Blog, accessed on 29 August 2023.

- Tim Chainalysis, “2022 Global Cryptocurrency Adoption Index”, Chainalysis, accessed on 30 August 2023.

- Crypto Saving Expert, “Cryptocurrency Adoption in Emerging Markets: Indonesia | by Crypto Saving Expert”, Medium, accessed on 31 August 2023.

Share

Related Article

See Assets in This Article

CFX Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-