Tokenizing US Treasuries, What is Ondo Finance (ONDO)?

Stablecoins represent the first step in the tokenization of real-world assets (RWAs), which hold enormous potential with a total value exceeding 867 trillion US dollars in traditional financial assets. Ondo Finance is seizing this opportunity by tokenizing assets such as US Treasuries by offering OUSG, a tokenized version of BlackRock’s iShares Short Treasury Bond ETF. To delve deeper into Ondo Finance and its role in integrating real-world assets into decentralized finance , explore the details in this article.

Article Summary

- 👨💻 Ondo Finance is a blockchain-based decentralized finance (DeFi) protocol that tokenizes real-world assets (RWAs) such as US Treasuries, money market mutual funds, and similar instruments.

- 💵 Ondo Finance’s flagship product is tokenizing assets such as OUSG, representing ownership in BlackRock’s iShares Short Treasury Bond ETF.

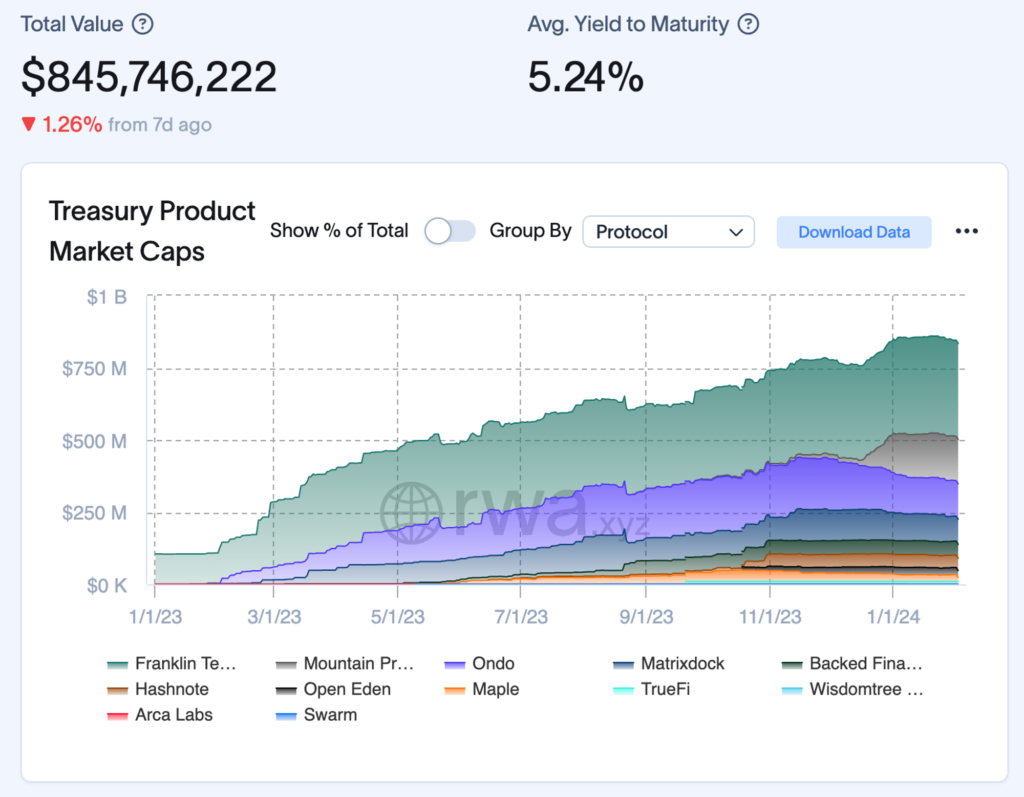

- 🏦 Established in 2021, Ondo Finance became the third-largest protocol specializing in tokenizing US Treasuries (OUSG). It competes with prominent protocols like Franklin Templeton Benji Investments, Mountain Protocol, and Maple Finance.

- 🪙 ONDO tokens serve as governance tokens. It gives its holders the authority to engage in decision-making processes concerning the Ondo Finance protocol via the Ondo DAO.

What is Ondo Finance (ONDO)?

Ondo Finance is a decentralized financial system protocol utilizing blockchain technology specializing in real world asset (RWA) tokenization. Ondo aims to make institutional-grade financial products and services available to everyone, including the Blackrock Short Treasury Bond ETF (NASDAQ: SHV).

In the interview with CNBC, Larry Fink, CEO of Blackrock, said that ETFs are the first step in a technological revolution in the financial markets. The second step is the tokenization of every financial asset.

This statement significantly influenced various Real World Asset (RWA) tokenization platforms, including Ondo Finance. Ondo brings traditional financial products like US Treasuries into the blockchain by tokenizing them.

An example of Ondo’s flagship product is OUSG, a tokenized version of BlackRock’s iShares Short Treasury Bond ETF. You can own this token by depositing USDC on the Ondo platform with a minimum fund of 100,000 USDC. Currently, 1 OUSG = 104.82 USD.

Buying OUSG means you have a type of US Treasury in token form in your wallet. You can utilize OUSG to borrow other crypto assets using Flux Finance, a lending platform within the Ondo ecosystem.

Ondo Finance has secured its position as the third-largest protocol for tokenizing US Treasuries (OUSG), demonstrating a robust market cap surpassing 120 million US dollars. This accomplishment positions Ondo Finance in direct competition with major protocols, including Franklin Templeton Benji Investments, Mountain Protocol, and Maple Finance.

Who is the Founder of Ondo Finance?

Ondo Finance was founded in 2021 by Nathan Allman, a finance expert. Before starting Ondo Finance, he worked at ChainStreet Capital and Goldman Sachs.

Goldman Sachs is a company focused on creating crypto asset market services for institutional investors using blockchain infrastructure to decentralize traditional securities issuance and trading.

He founded Ondo to bridge the traditional financial system with DeFi. His goal attracted the interest of major investors. In April 2022, Ondo successfully secured 20 million US dollars of Serie A funding led by Pantera and Founders Fund. Other major investors involved are Wintermute, Coinbase Venture, Global Tree, Tiger Global, and others.

How Does Ondo Work

Ondo purchases traditional asset securities (such as bonds) and then utilizes its own blockchain system to tokenize them. Each token experiences the same fluctuations in value as the real-world asset it represents.

Ondo offers a wide range of securities and other products for investors. It started with short-term US Treasury bonds through ETFs managed by large financial institutions such as Blackrock and PIMCO.

Ondo Capital Management serves as the investment manager, facilitating the purchase and sale of ETFs within the Ondo Finance platform.

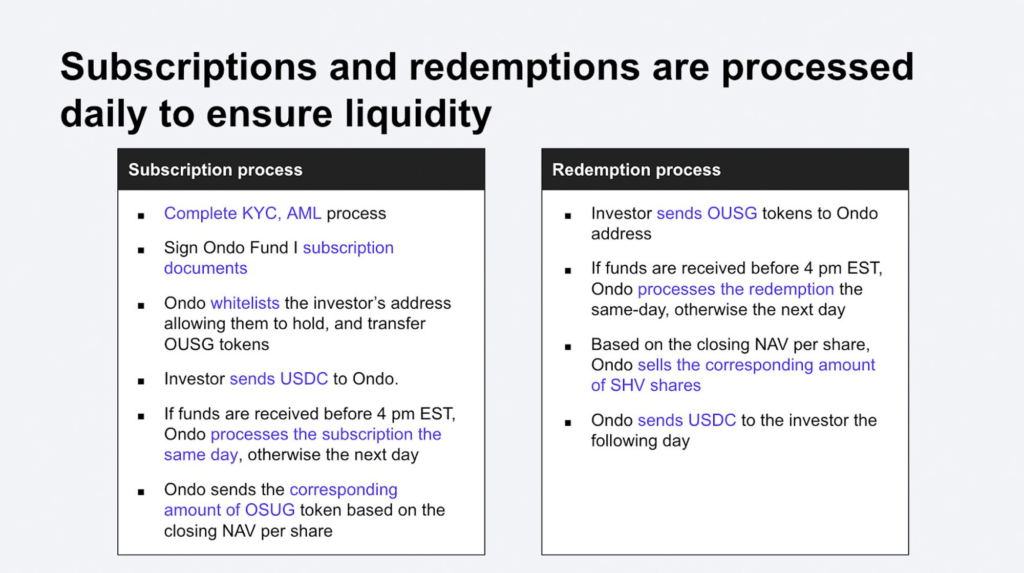

Asset tokenization starts when investors deposit USDC or USD (fiat) into the Ondo platform. Subsequently, investors receive OUSG tokens representing ownership of US government securities assets. The conversion from USDC to OUSG is conducted through the Coinbase service.

Unlike other tokens that can be transferred anywhere, OUSG has transfer restrictions to ensure that it only changes hands between parties that qualify as OUSG investors. It helps maintain compliance with regulatory and financial requirements.

Ondo Finance Flagship Products

1. US Government Bond Fund (OUSG)

OUSG is a tokenized version of BlackRock’s iShares Short Treasury Bond ETF. This asset is a low-risk investment option that provides stable and predictable returns and offers high liquidity. Currently, OUSG’s APY rate is 4.73%, with a TVL of 113 million US dollars.

To purchase OUSG, you must qualify as an accredited investor and qualified purchaser. Ondo has set the minimum OUSG purchase at 100,000 USDC, where 1 OUSG equals 104.82 USD.

Here are the eligibility criteria for investing in OUSG assets. Users can acquire OUSG by meeting at least one of the conditions listed below.

Accredited investor (individual):

- Personal or joint net worth of 1 million US dollars.

- Individual income of more than 200,000 US dollars (joint income of more than 300,000 US dollars) over the past 2 years.

- Professional certification or other credential from an accredited educational institution.

Qualified purchaser:

- Owns more than 5 million US dollars (25 million US dollars for institutions) of investments.

- Professional certification, designation, or other credential from an accredited educational institution.

See the full requirements here.

According to The Block, as of January 2024, OUSG is the largest token ETF for US Short-term Treasuries to reach a market capitalization of over 100 million US dollars. Despite this achievement, OUSG faced challenges in Q4 2023, marked by a decrease in monthly inflows and a decline in market capitalization.

2. US Dollar Yield (USDY)

USDY is a yield-bearing stablecoin secured by short-term US Treasury bonds as collateral. In contrast to USDT or USDC, USDY differs because its backing comes from short-term US Treasury bonds rather than US dollars.

The distinction between USDY and other stablecoins lies in the yield aspect. Holders of USDC or USDT maintain a fixed amount in their wallets, whereas USDY holders receive yields.

You don’t need to fulfil the strict requirements when buying OUSG to buy USDY. USDY is available to anyone, without the need to be an accredited investor, as long as they fulfil onboarding processes such as Know Your Customer (KYC/B) and Anti-Money Laundering (AML) checks.

To comply with relevant regulations, USDY is not accessible to investors based in the United States, both individuals and institutions.

To mint or buy USDY, Ondo applies a minimum 10% overcollateralized system. It means that if you want to buy 100 USDY, you must deposit 110 USDC. This percentage is subject to change at any time.

As of January 1, 2024, USDY is native to the Ethereum, Mantle, and Solana networks.

3. Ondo US Money Markets (OMMF)

OMMF is a tokenized version of a US government money market fund. It is considered one of the lowest-risk and most liquid investment options, with over 5 trillion US dollars of assets under management.

Just like OUSG, Ondo requires accredited investors to purchase OMMF. However, OMMF has yet to be available on the Ondo platform.

4. Flux Finance

Flux Finance is a decentralized lending protocol built by the Ondo Finance team. This protocol is a fork of Compound V2 with the added functionality of supporting permissioned tokens such as OUSG.

Users can deposit OUSG on Flux to get fOUSG and borrow USDC or other assets. Like Compound V2, Flux also implements an overcollateralized system.

However, unlike in Compound, liquidation in Flux respects the permissions of the underlying assets (e.g. KYC). For example, to liquidate an account that uses OUSG as collateral, the liquidator must go through the KYC process and be whitelisted to hold the token.

Advantages of Ondo Finance

- Access to traditional assets: Ondo Finance enables investors to participate in traditional asset investments through tokenization. These unlocking opportunities might have been challenging to access within the decentralized finance (DeFi) landscape.

- Transparency and efficiency: Blockchain technology drives transparency and reduces settlement risks associated with traditional financial systems.

- Tokenization for liquidity: Asset tokenization facilitates token holders in accessing liquidity and streamlining the transfer of ownership between investors.

- Yield on stablecoins: Ondo Finance enables USDY holders to generate a yield while possessing a stable-value token.

ONDO Token

ONDO functions as the governance token for the Ondo Finance platform. It allows token holders to determine the future of Ondo DAO and expand access to institutional-grade finance.

The Ondo DAO affords ONDO token holders specific privileges concerning Ondo and Flux Finance. These include managing the asset treasury, coordinating ONDO token issuance, deciding on collateral assets, and more.

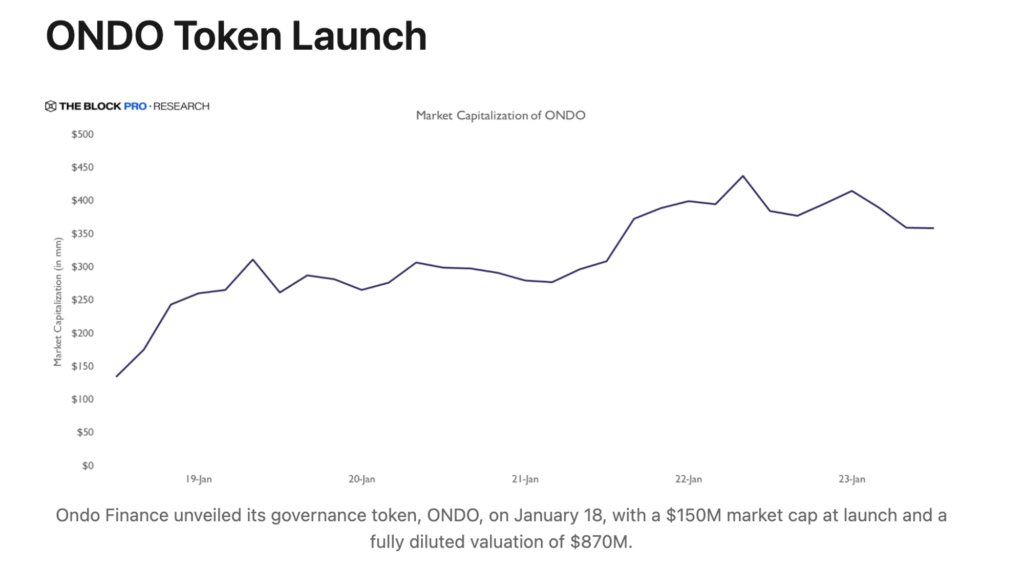

Source: The Block

Ondo launched the ONDO token on January 18, 2024, with a market capitalization of 150 million US dollars at launch. Quoted from The Block, ONDO’s market capitalization nearly tripled just four days after launch, peaking at around 437 million US dollars.

This significant rise of the ONDO token brought Ondo Finance to the forefront as the leading real-world asset protocol (RWA) by market capitalization. As of February 2, 2024, the ONDO token price reached 0.2 US dollars, securing a market capitalization nearing 300 million US dollars and positioning Ondo at the 155th spot on Coinmarketcap.

Conclusion

Ondo Finance is a blockchain-based financial protocol that offers real-world asset tokenization. Focusing on institutional-grade financial products and services, Ondo introduced products such as OUSG, a tokenized version of BlackRock’s iShares Short Treasury Bond ETF.

While Ondo Finance opens the door to investing in traditional assets in a DeFi environment, the platform still faces several challenges. These include complex regulatory issues, limited investor access to OUSG and OMMF assets, and the need to educate users on product usage and the risks associated with assets on Ondo Finance. Therefore, it is crucial to understand the risks and rewards before considering investing in the tokens and products offered by Ondo Finance.

How to Buy ONDO Token on Pintu

After knowing what Ondo is, you can start investing in ONDO by buying it on the Pintu app. Here is how to buy crypto on the Pintu application:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for ONDO.

- Click buy and fill in the amount you want.

- Now you have ONDO!

In addition to ONDO, you can safely and conveniently purchase a wide range of cryptocurrencies such as BTC, ETH, SOL, and others safely and easily on Pintu. Pintu diligently evaluates all its crypto assets, highlighting the significance of being cautious.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download the Pintu app on the Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Aside from buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through various Pintu Academy articles. Updated weekly, all Pintu Academy articles are made for knowledge and educational purposes, not as financial advice.

References

- Ondo Finance, Welcome to Ondo, Docs, accessed 1 February 2024.

- Nathan Allman, Ondo’s Journey: Vision, Achievements, and the Path Forward, Medium, accessed 1 February 2024.

- Ondo Finance, Ondo Monthly Spotlight: January 2024, Blog, accessed 1 February 2024.

- International Token Standardization Association, DeFi Insight: Investing in Bonds and US Treasuries with Ondo Finance, Medium, accessed 1 February 2024.

- The Block, Ondo Finance’s OUSG Emerges as the Premier Tokenized ETF for US Short-Term Treasury Bills, Linkedin, accessed 2 February 2024.

Share

Related Article

See Assets in This Article

DEFI Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-