Weekly Signal Pintu X Volubit – August 20, 2025

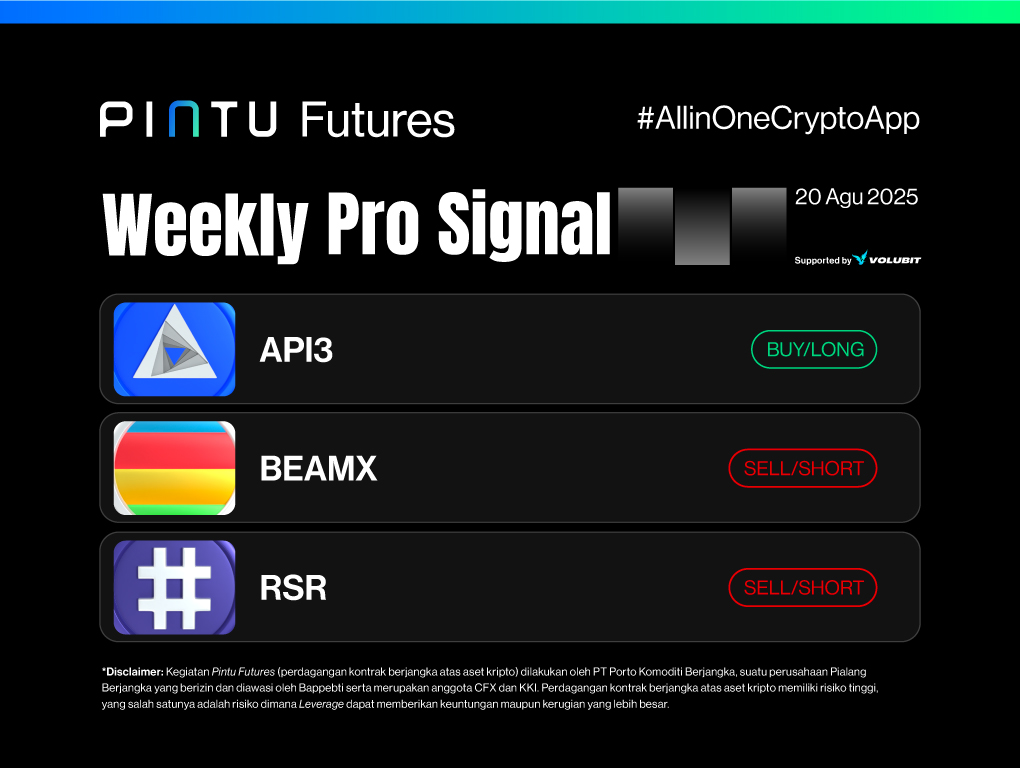

Signal Summary Futures Trading:

- API3

- Entry : $0.9093-$1.0932

- Stop Loss [SL] : $0.8861

- Target Profit [TP] :

- TP1: $1.2913

- TP: $1.5093-$1.7698

- Beam [BEAMX]

- Entry : $0.007105

- Stop Loss [SL] : $0.007461

- Target Profit [TP] :

- TP1: $0.006854

- TP2: $0.006360-$0.006478

- Reserve Rights

- Entry : $0.008668-$0.008916

- Stop Loss [SL] : $0.008968

- Target Profit [TP] :

- TP1: $0.008360

- TP2: $0.007994-$0.007575

1. API3 (API3)

This morning’s daily candle close for API3 sparked positive sentiment among market participants after recording a significant gain of 57.35%.

However, this bullish momentum has not yet been able to break through the key resistance level at the March 23 daily close high of $1.5093, resulting in a rejection.

In the short term, API3’s price is expected to weaken toward the harmonic support area in the range of $0.9093–$1.0932. This zone could become an attractive accumulation area, provided the price is able to demonstrate a valid rebound.

Setup Potensial Buy API3:

Entry : $0.9093-$1.0932

Stop Loss [SL] : $0.8861

Target Profit [TP] : TP1: $1.2913, TP: $1.5093-$1.7698

2. Beam (BEAMX)

The price movement of BEAMX is showing bearish pressure following a breakdown below the 20-Day EMA on August 19. This condition has triggered further downside momentum, with the potential to break through the key support level at $0.007287.

If this level is breached, it could serve as a valid confirmation of a descending triangle pattern, implying the continuation of the downtrend. The nearest downside target lies at the harmonic support of $0.006854, while the main target is projected in the range of $0.006360–$0.006478.

A sell opportunity may be considered if the price breaks below the RBS (Resistance Become Support) area at $0.007156, which would simultaneously confirm the breakdown of the descending triangle pattern.

Setup Potensial Sell BEAMX:

Entry : $0.007105

Stop Loss [SL] : $0.007461

Target Profit [TP] : TP1: $0.006854, TP2: $0.006360-$0.006478

3. Reserve Rights (RSR)

RSR’s bullish momentum has begun to weaken with the formation of a Head & Shoulders pattern, indicating a potential reversal of the main trend. The pattern was validated after the neckline confirmed a breakdown on August 19.

In addition, RSR’s price has been trading below the 20-Day EMA since August 18, which technically adds further bearish pressure.

The zone between $0.008668–$0.008916 is projected as a potential rebound area. However, if a rejection occurs within this zone, a sell opportunity could be considered with lower targets in play.

Setup Potensial Sell RSR:

Entry : $0.008668-$0.008916

Stop Loss [SL] : $0.008968

Target Profit [TP] : TP1: $0.008360, TP2: $0.007994-$0.007575

Important Notes:

Always apply disciplined risk management and capital management. For leveraged trading, it is advisable to risk no more than 1% of total capital per trade.

*Disclaimer: Pintu Futures (cryptocurrency futures trading) is conducted by PT Porto Komoditi Berjangka, a licensed Futures Broker and supervised by Bappebti, and is a member of CFX and KKI. Cryptocurrency futures trading carries high risk, including the risk that leverage can lead to both greater profits and losses.

Share

Related Article

See Assets in This Article

RSR Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-