Weekly Signal Pintu X Volubit – October 1, 2025

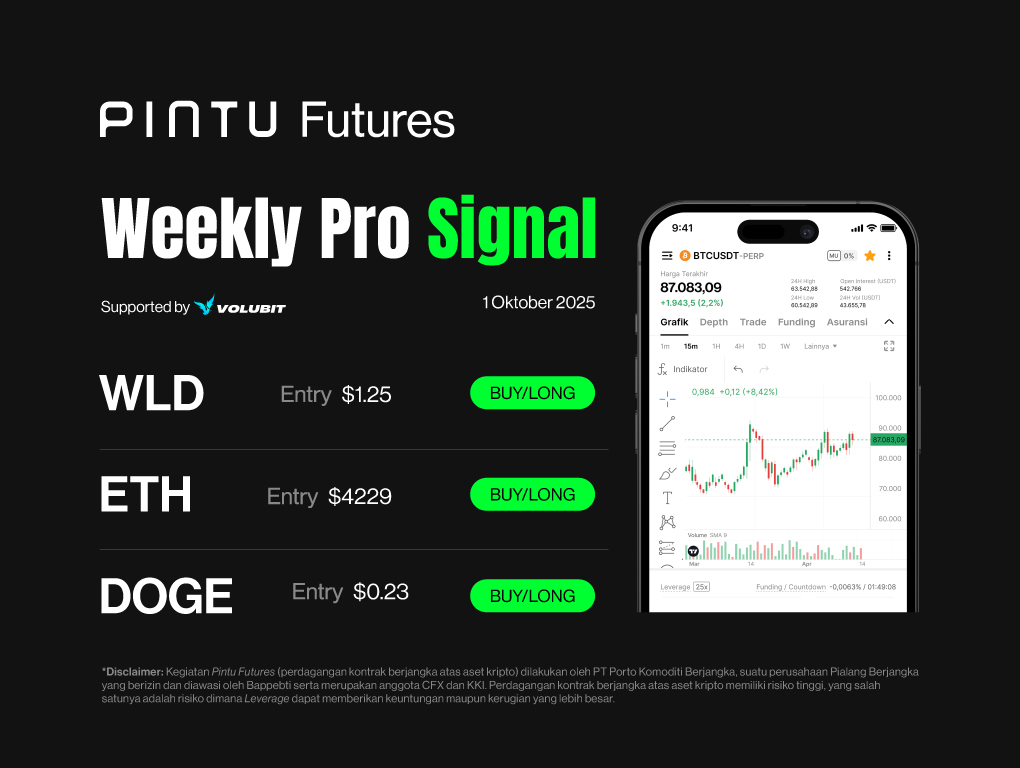

Signal Summary Futures Trading:

- Worldcoin

- Entry : $1.25 or after a breakout above the 21 EMA on the 4-hour timeframe

- Stop Loss [SL] : $1.18

- Take Profit [TP] :

- TP1: $1.392

- TP2: $1.56

- Ethereum

- Entry : $4229 [breakout]

- Stop Loss [SL] : $4030

- Take Profit [TP] :

- TP1: $4455

- TP2: $4749

- Dogecoin

- Entry : $0.23-$0.232

- Stop Loss [SL] : $0.224

- Take Profit [TP] :

- TP1: $0.24

- TP2: $0.263

1. Worldcoin (WLD)

WLD is showing potential for a reversal at its support area around $1.245. In addition, a bullish divergence has formed on the RSI in the 4-hour timeframe, giving WLD a bullish bias.

With the formation of a bullish candle on the 4-hour chart, there is potential for WLD to move higher and test its nearest resistance at $1.392, and further up toward $1.56. This bias will be confirmed if WLD can break above the 21 EMA on the 4-hour timeframe.

Potential Buy/Long Setup for WLD

- Entry: $1.25 or after a breakout above the 21 EMA on the 4-hour timeframe

- Stop Loss [SL]: $1.18

- Take Profit [TP]: TP1: $1.392, TP2: $1.56

2. Ethereum (ETH)

Ethereum has shown a strong recovery after the decline toward the end of September. Currently, ETH is testing its resistance around $4229. With its price positioned above the 21 EMA on the 4-hour chart, ETH is maintaining a bullish bias. Further confirmation will be obtained once ETH breaks above $4229, which could push its price higher toward the $4450 and $4700 levels.

Potential Buy/Long Setup for ETH

- Entry: $4229 [breakout]

- Stop Loss [SL]: $4030

- Take Profit [TP]: TP1: $4455, TP2: $4749

3. Dogecoin (DOGE)

DOGE is showing signs of a potential reversal after a prolonged downtrend starting in mid-September, followed by consolidation at the end of the month. This is highlighted by the formation of a higher low and a bullish engulfing candle on the 4-hour chart.

Further confirmation will be seen if DOGE closes a candle above the 21 EMA. With this bullish confirmation, DOGE has the potential to rise toward its nearest high at $0.25, and further up to the support-turned-resistance area at $0.263.

Potential Buy/Long Setup for DOGE

- Entry: $0.23–$0.232

- Stop Loss [SL]: $0.224

- Take Profit [TP]: TP1: $0.24, TP2: $0.263

Important Note

Always apply proper risk management and disciplined capital allocation. For trading, especially when using leverage, it is recommended to limit the risk per trade to 1% of total capital.

Disclaimer: Pintu Futures trading (crypto futures contracts) is conducted by PT Porto Komoditi Berjangka, a licensed Futures Broker supervised by Bappebti and a member of CFX and KKI. Trading cryptocurrency futures contracts carries high risk, including the risk that leverage may magnify both potential gains and potential losses.

Share

Related Article

See Assets in This Article

ETH Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-