What Are Tokenized Stocks? Full Guide to Investing in Digital Stocks

Tokenization has been one of the most popular topics in the crypto industry since 2023. Tokenized real-world assets such as property, real estate, treasuries, T-Bills, etc, are gaining traction in the crypto community and financial institutions. One of the newest products entering the sector is tokenized stocks. Tokenized US stocks such as Tesla, Robinhood, Apple, and others significantly bridge the gap between crypto and TradFi markets. In this article, we’ll explore tokenized stocks, how they work, and why you should buy them.

Key Takeaways

- Tokenized Stocks Bridge Crypto and TradFi: Tokenized stocks are digital representations of real company shares, backed 1:1 with actual assets. They allow crypto users to access global stock markets like Tesla, Apple, and Robinhood without traditional trading barriers.

- Trade 24/7 with Fractional Ownership: Unlike traditional stocks, tokenized stocks can be bought anytime, with instant settlement, and in fractional amounts. For example, you can buy part of a Tesla share for $100 instead of paying the full share price.

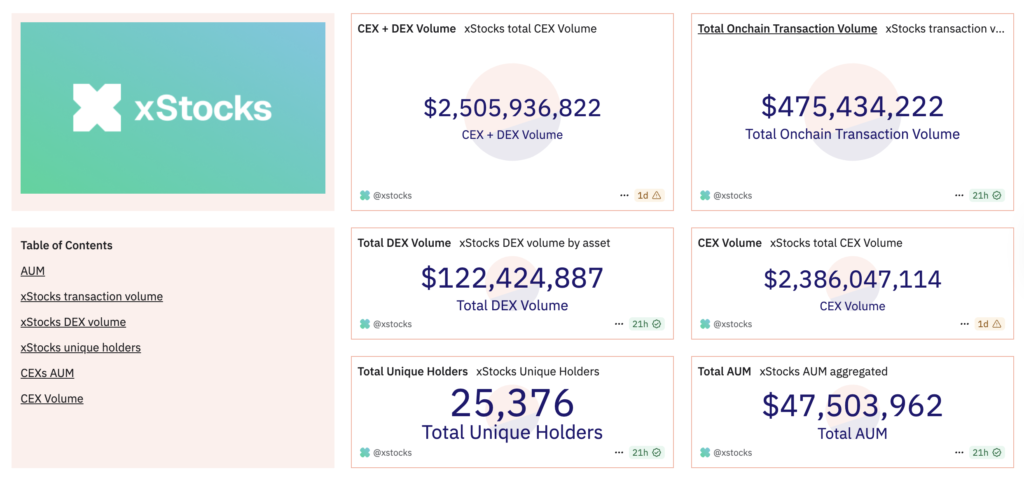

- xStocks Leads the Market: xStocks, built by Backed Finance, is the largest tokenized stock issuer, offering 64 tokenized US stocks across both centralized and decentralized exchanges. Each token is fully collateralized and verified through proof-of-reserve audits.

- Risks and Benefits: Tokenized stocks provide accessibility, instant settlement, and DeFi integration but come with liquidity, regulatory, and centralization risks.

What are Tokenized Stocks?

Tokenized stocks are digital representations of company shares on a blockchain. Each token is pegged to the value of a publicly traded share of a company, backed 1:1 with the equivalent assets managed under licensed custodians. So, tokenized stocks connect the crypto industry to the Traditional finance market or TradFi.

Furthermore, tokenized stocks aren’t restricted by the various limitations of trading traditional stocks. You can buy tokenized stocks 24/7 with instant settlement without getting out of your crypto wallets and crypto exchanges. Additionally, you can trade fractional stock values instead of buying by shares. The unique combination of stock and crypto trading opens up the TradFi market to worldwide users.

Each Tesla share is worth $339,24 as of August 14, 2025. Instead of buying the whole share, you can buy a fractional TeslaX share in Solana for only $100. This opens up a whole new avenue for retail investors to own fractional shares of big companies.

What is xStocks?

XStocks is one of the largest stock tokenization projects built by Backed Finance. The project aims to make stock trading more accessible and flexible. Currently, the project provides tokenized US stocks both for CEXes such as Kraken and onchain traders in Solana.

Every xStocks token represents real assets that are transparently audited with proof of reserve. Additionally, xStocks is created by Backed Finance, an RWA issuer project since 2021. XStocks has already brought 64 stocks onchain and is planning to expand the number of stocks.

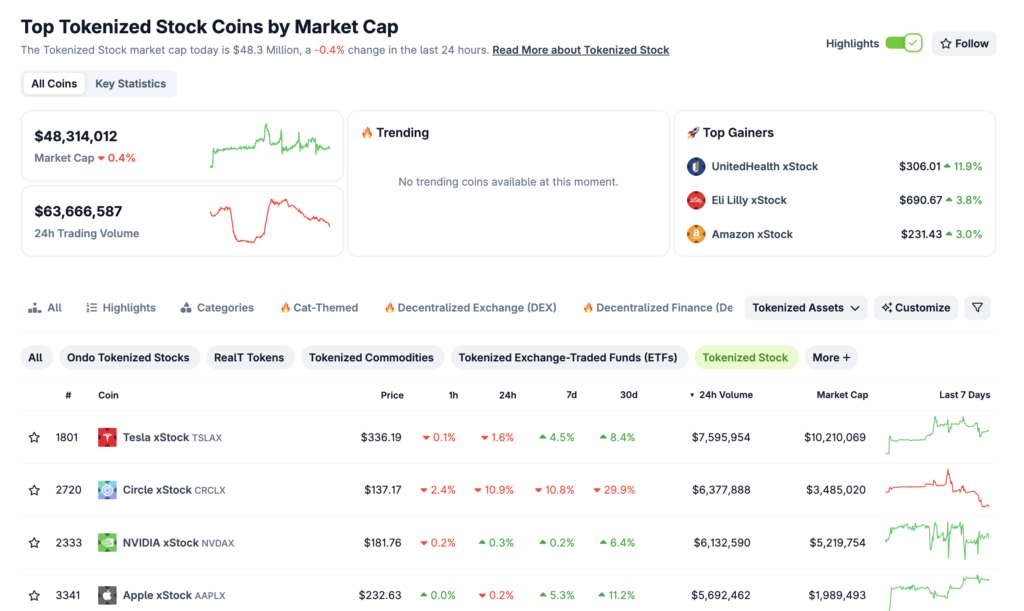

Currently, xStocks is the biggest tokenized stocks issuer in terms of volume. Within around 40 days (as of August 15, 2025), xStocks has already accumulated $2,5B across several DEX and CEX. The majority of tokenized stock traders come from CEX, as DEX users account for less than 10% of the total volume.

Characteristics of Tokenized Stocks

- Always Available: Unlike traditional stock trading, xStocks tokens are always available for traders and investors. You can sell and buy regardless of the days and business hours.

- Global: US stocks are extremely limited for trading in several countries. In contracts, tokenized stocks, such as xStocks, enable anyone in the world to have access to trading and owning US stocks without all the regulatory hassle.

- Backed 1:1: Tokenized stocks are designed to trade and are backed 1:1 with the underlying assets. So, the price uses both on-chain and off-chain oracles, while the underlying assets are periodically checked by proof of reserve.

How Tokenized Stocks Work

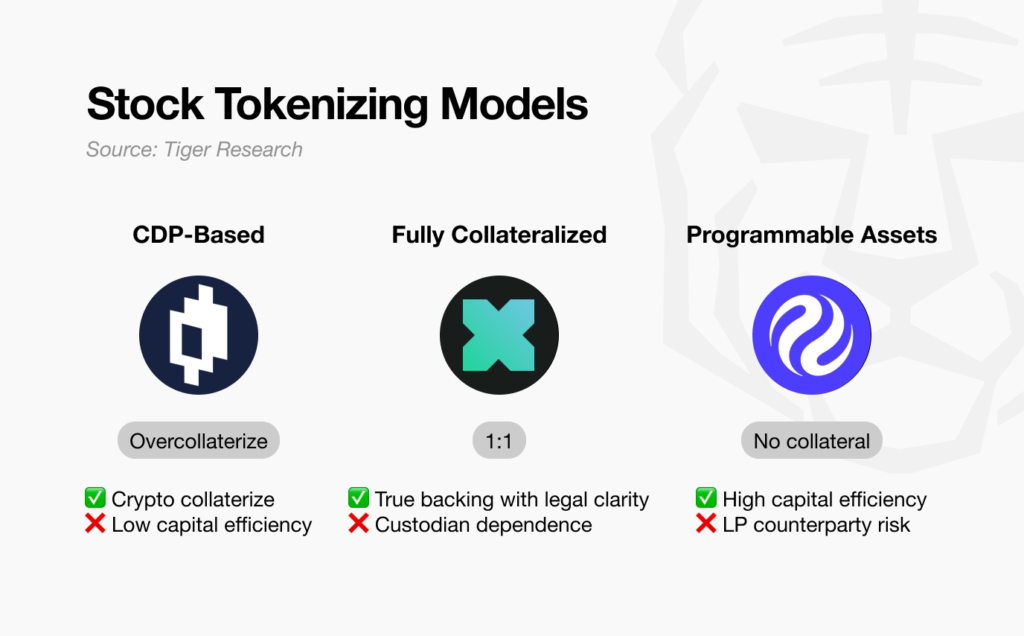

Source: Tiger Research.

Tokenized stocks work based on their collateral model. Currently, the most popular collateral model for tokenized stock is a fully collateralized model. This model ensures every token represents a one-to-one value with the underlying assets. Additionally, tokenized stocks must also connect to onchain and off-chain price oracles to ensure an accurate price for investors.

On a fully collateralized model of tokenized stocks, there are several moving elements. The issuer and custodian are the first and most important elements of a fully backed tokenized stock. In the case of xStocks, they are backed by BackedFi, an RWA issuer operating under Liechtenstein’s Financial Market Authority (FMA).

BackedFi acts as the custodian, the company buying shares for every tokenized asset, and mints the token onchain. Backed ensures each Tesla share equals 1 TSLAx token. This guarantees the supply is tied to real holdings and maintains a strict collateralization ratio.

Lastly, price oracle is the last moving gear for tokenized stocks. Chainlink is one of the biggest and most reliable oracles in crypto. So, many companies such as Fidelity, Sygnum, and UBS choose Chainlink for their tokenized assets. Ondo and xStocks naturally utilize Chainlink as their price oracle for tokenized stocks. Additionally, xStocks also uses its own oracle alongside Chainlink.

Risks and Benefits of Buying Tokenized Stocks

Benefits of Buying Tokenized Stocks

- 24/7: Tokenized stocks are available for trading 24/7 without limited hours and days.

- Fractional: You can buy tokenized stocks in small or large amounts, without the restriction of share price. For example, you can buy TSLAx for only $100 instead of the full share price.

- Settlement: Unlike in TradFi stock trading, the settlement process is instant, thanks to constant liquidity and the nature of crypto trading.

- Crypto Integration: You can now have multiple types of assets within one crypto wallet, without the need to go off-chain. Additionally, some stocks are integrated into DeFi apps such as Kamino in Solana.

Risks of Tokenized Stocks

- Liquidity: Currently, the tokenized stock market still has limited liquidity. This can lead to higher slippage and a wider bid-ask range for larger trades. However, this will improve as liquidity and volumes gradually pick up.

- Regulatory Risk: Tokenized stock is a relatively new asset class. Future regulatory changes can impact how platforms operate and what assets are tradable.

- Centralization Risk: Tokenized stocks trading involves many moving parts, such as the issuer, custodian, and platform facilitating the trade. So, this creates multiple potential points of failure.

Tokenized Stocks vs Traditional Stocks

| Characteristics | Tokenized Stocks | Traditional Stocks |

|---|---|---|

| Availability | 24/7 without business hours | Working days and hours |

| Cost | No minimum cost | The share price restricts costs. |

| Accessibility | Global and easily accessible | Complex and limited by the regulations of each country. |

| Liquidity | Limited; lower compared to the traditional stock market | Extremely high; one of the biggest markets in the world. |

| Voting Rights and Divident | No, as you don’t have direct ownership. | Yes |

How to Buy Tokenized US Stocks on the Pintu App

To start investing in tokenized stocks like Tesla, Nvidia, Apple, and Microstrategy directly in the Pintu app. The steps are simple:

- Open the Pintu App.

- Navigate to the Market section and search for the stocks (TSLAx, AAPLx, NVDAx, MSTRx).

- Enter the amount you wish to purchase after you log in.

- You can follow the same steps to buy other tokenized stocks on the Pintu app.

Pintu is also compatible with popular digital wallets like Phantom and MetaMask, making your transactions even more convenient. Download the Pintu app now on the Play Store or App Store! Your security is ensured, as Pintu is regulated by OJK (Indonesia’s Financial Services Authority) and CFX (Commodity Futures Trading Regulatory Agency).

In addition to trading, Pintu also enables you to learn more about crypto through a wide range of educational articles on Pintu Academy, updated weekly. All articles published by Pintu Academy are intended for educational purposes only and do not constitute financial advice.

Conclusion

Tokenized stocks are reshaping how investors access traditional markets through crypto. By combining blockchain technology, tokenized stocks enable fractional ownership and 24/7 trading, making previously restricted US stocks accessible to a global audience. Platforms like xStocks are leading this transformation, offering secure, fully backed tokens and seamless wallet integration. While risks like liquidity and regulation exist, the potential to democratize stock ownership marks a significant step forward for both crypto and traditional finance investors.

References

- “What are Xstocks Tokenized Stocks?”, OSL, accessed on August 19, 2025.

- Ebo Victor, “What is XStocks?”, Atomic Wallet, accessed on August 20, 2025.

- Wu Blockchain, “xStocks: Unlocking Global Equity Access through Tokenization”, Substack, accessed on August 20, 2025.

- “Tokenized Stocks & Equities Explained”, Chainlink, accessed on August 21, 2025.

- Peter Gratton, “Robinhood’s Token Versions of Stocks Could Change How You Buy Stocks Forever”, Investopedia, accessed on August 22, 2025.

- Joel Agbo, “What Are Tokenized Stocks and Top Platforms to Get Started”, Coingecko, accessed on August 22, 2025.

- Ryan Yoon, “Tokenized Stock Market Map: How Tokenized Stock is Reshaping Global Finance?”, Tiger Research, accessed on August 26, 2025.

- Solana Foundation, “Case Study: A Deep Dive on xStocks, tokenized equities on Solana”, Solana, accessed on August 26, 2025.

Share