What Happens When All Bitcoins Are Mined?

Bitcoin is the first asset to have absolute scarcity. And this scarcity is governed by an algorithm in the Bitcoin source code. Only 21 million Bitcoins will ever be created, and once they are all mined, no more will ever enter the market. In this post, we’ll look closely at a number of scenarios that could arise once all of the Bitcoin has been mined.

block-heading joli-heading" id="article-summary">Article Summary

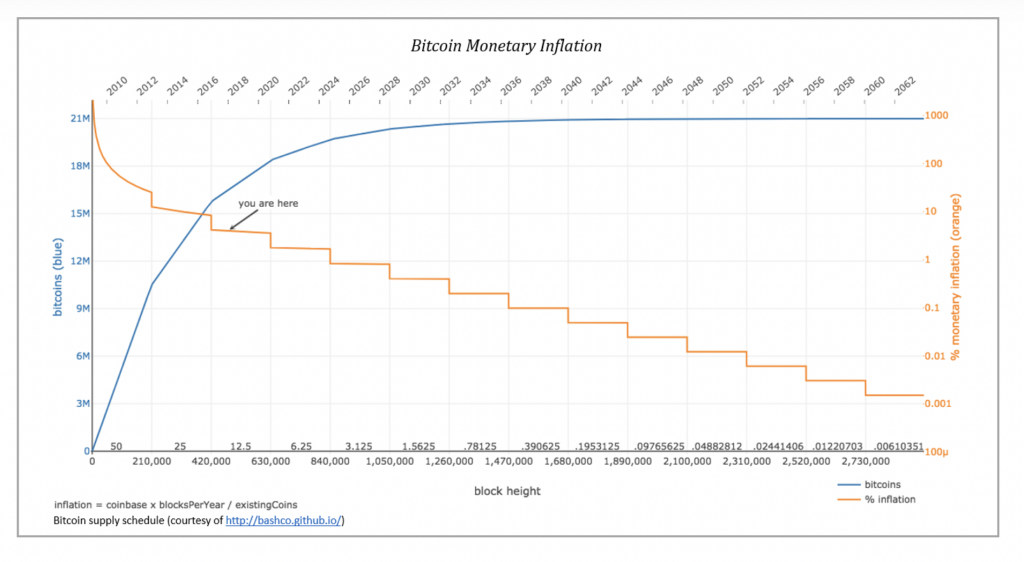

- ⛏ Bitcoin has a limited supply of only 21 million coins. Nearly 19 million Bitcoins, or 90% of bitcoins have been mined since Bitcoin was launched in 2009. Even so, the last Bitcoin will likely not be mined until around 2140, according to current estimates.

- 💰 Once the circulating supply reaches the maximum, Bitcoin miners will no longer be rewarded with new Bitcoins. They will be rewarded with a transaction fee, assuming there are no major protocol changes to Bitcoin between now and then.

Can Bitcoin Ever Run Out?

Bitcoin’s blockchain is designed on the principle of a controlled supply, with only 21 million coins that can be mined and circulated on the market. The miners receive the newly minted Bitcoin in exchange for expending energy to confirm transactions entered into the block and secure the Bitcoin network. Currently, miners earn 6.25 BTC for every verified block.

But every four years, this Bitcoin reward will be cut in half. This process called “halving”, will continue until the year 2140. With the diminishing returns of Bitcoin, it is certain that only 21,000,000 BTC will exist in the world. So what will happen in 2140 when all bitcoins will be mined? Satoshi Nakamoto predicted this and wrote it in the Bitcoin Whitepaper:

Once a predetermined number of coins has entered circulation, the incentive can switch completely to transaction fees and is completely inflation free. – Satoshi Nakamoto

What Happens When Bitcoin Runs Out?

As we know, when someone makes a Bitcoin transaction, the transaction is grouped into one block, broadcast into the Bitcoin network, and confirmed by a series of computers scattered around the world, which are called miners.

After the miner solves the puzzle and creates a new block, the miner will get two types of rewards. First, rewards are in the form of transaction fees paid by bitcoin owners who make transactions. Second, the reward is in the form of new Bitcoins. This process is the only way to get new Bitcoins into circulation.

Here are some of the things that will happen and also be impacted when Bitcoin is completely mined.

Miners are rewarded in the form of a Transaction Fee

When all bitcoins have been mined, the miner’s reward model will change. Miners will continue to have their role to create blocks and confirm transactions, but when there are no more block rewards, then miners can only benefit from the transaction fees embedded in each transaction. One thing we know is that when the price of Bitcoin goes up, the transaction fees also go up.

Changed Role of Bitcoin

It’s hard to know what will happen in 2140 (almost a hundred years from now). If Bitcoin continues to survive until 2140 there are two possibilities that can happen to the function of Bitcoin itself. First, Bitcoin can be a means of payment, where transactions will continue to run. In this case, the bitcoin mining industry will continue to be in demand and miners will earn income from Bitcoin transaction fees.

The second possibility, many miners are unable to cover their costs so many miners will stop mining. Thus Bitcoin will be more attractive as a reserve asset such as gold.

Mining Innovation

Every halving cycle, the mining innovation continues. In the early days of Bitcoin mining, miners could use computers to run proof-of-work. However, in each cycle, the mining machine continues to innovate. Currently, Bitcoin miners use ASIC engines, which are special machines used for efficient hashing. At least in 2140 the mining industry will continue to innovate and will produce more energy-efficient machines because energy is the biggest expense of Bitcoin mining.

In addition to technological innovations, each Bitcoin halving cycle continues to spur more efficient use of energy. If miners want to continue to survive, they must be able to find the cheapest and most renewable energy sources.

Bitcoin Deflationary Concerns

Bitcoin uses a system where bitcoin inflation decreases every halving cycle, when Bitcoin rewards drop from 12.5 BTC to 6.25 BTC in 2020, the Bitcoin inflation rate decreases from 3.7% to 1.8%. This decreasing rate of inflation is known as deflation. Economists think that Bitcoin’s deflationary tendency makes it insufficient for use in the financial system, and will result in very high interest rates.

However, there is one thing Bitcoin has that can prevent this from happening. Bitcoins can be split into 1/100 million Bitcoins. So even though there will be no new Bitcoins, there will still be Bitcoin shards. This can trigger prices to be cheaper when compared to Bitcoin.

Buy Bitcoin

You can start investing in Bitcoin by buying it in the Pintu app. Through Pintu, you can buy Bitcoin and other crypto assets in a safe and easy way.

In addition, the Pintu application is compatible with various popular digital wallets such as Metamask to facilitate your transactions. Download cryptocurrency app Pintu on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by CoFTRA and Kominfo.

Reference

- What Happens When All Bitcoins Are Mined, Energimine, accessed on June 28, 2022

- Benedict George, What Happens When All Bitcoin Are Mined?, CoinDesk, accessed on June 28, 2022

- What Will Happen After All Bitcoin Are Mined?, River.com, accessed on June 28, 2022

Share

Related Article

See Assets in This Article

BTC Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-