What is Chainlink CCIP?

Interoperability is still a significant issue in the crypto industry. Solutions like protocol bridges are facing potential limitations due to the inherent risks of exploitation and hacking. Chainlink CCIP comes as a solution to the problem. Apart from connecting various blockchains, it also provides better security than protocol bridges. So, what is Chainlink CCIP? How does it work? Find out in this article.

Article Summary

- 📄 Chainlink CCIP serves as a protocol enabling secure and dependable transmission of data and its value between diverse blockchain networks, addressing the pressing issue of interoperability within the crypto industry.

- 🌉 Chainlink CCIP is built on top of Chainlink’s Oracle network, making it inherit Oracle’s security aspects. CCIP also uses the Decentralized Oracle Network (DON) and Active Risk Management Network (ARM) to strengthen its security.

- 🗝️ Some advantages of Chainlink CCIP over other cross-chain protocols are wider interoperability, security, ease of use, and plug-and-play concept.

- 🏦 Using Chainlink CCIP, users can perform cross-chain transactions, get low-cost transactions, access cross-chain DeFi, and bridge the DeFi industry with TradFi.

What is Chainlink CCIP?

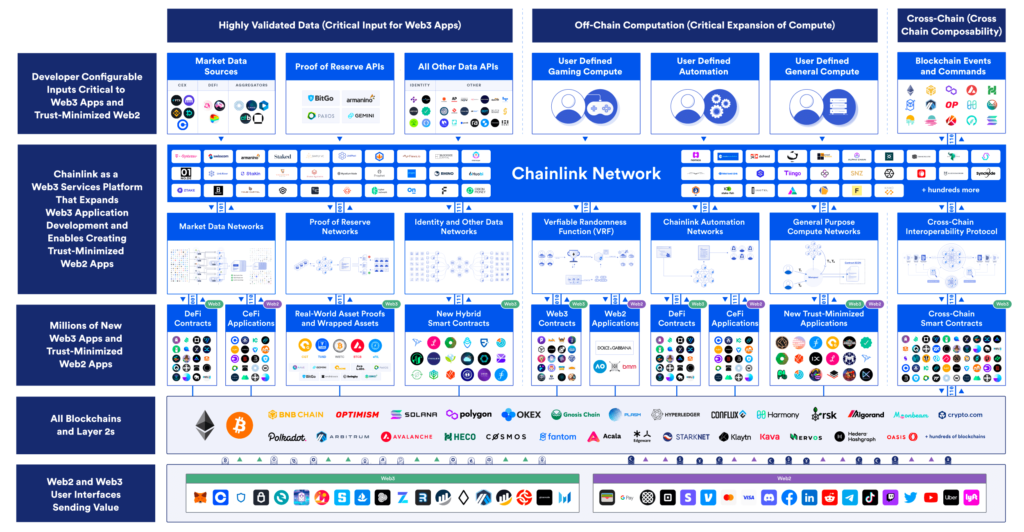

Chainlink CCIP is a protocol that allows transmitting data and its value securely and reliably between different blockchain networks. It is built on top of Chainlink’s Oracle network, which provides a way to connect real-world data (off-chain) to blockchain networks (on-chain).

You can learn more about Chainlink and its Oracle technology in the following article.

Through CCIP, blockchains can be connected and utilize each other’s facilities. With such interoperability, Web3 developers can overcome the limitations of blockchain, enable the specialization of a Web3 application, and allow dApps to gain liquidity and benefits from various blockchain ecosystems. Developers can also utilize CCIP to send tokens and arbitrary messaging.

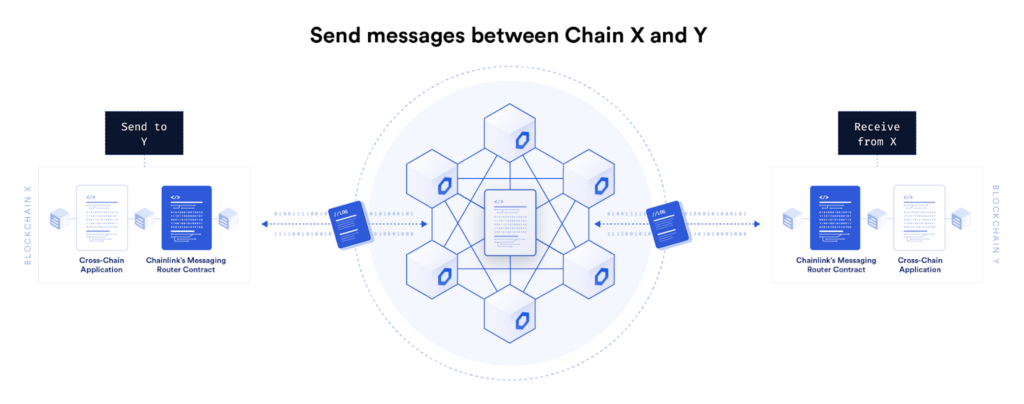

Arbitrary messaging is the ability to send arbitrary data to a receiving smart contract on a different blockchain. Typically, it triggers specific actions when receiving a smart contract, such as index rebalancing or minting specific NFTs. Development teams can also encode multiple instructions in a single message, making it possible to perform complex, multi-chain tasks.

Chainlink has launched CCIP to the Mainnet since July 18, 2023, but it is still in the “early access” stage of development. Since its launch, CCIP has been usable and supports Avalanche, Ethereum, Optimism, and Polygon blockchains. In addition, there are also DeFi Lending protocols, Aave and Synthetix.

How does CCIP Chainlink Work?

One of the major issues facing the crypto industry is interoperability. Bridge protocols are used to solve the interoperability problem. However, it is quite prone to hacking due to its centralized nature. According to a Chainalysis report, there have been hacks on protocol bridges worth US$ 2 billion in 2022.

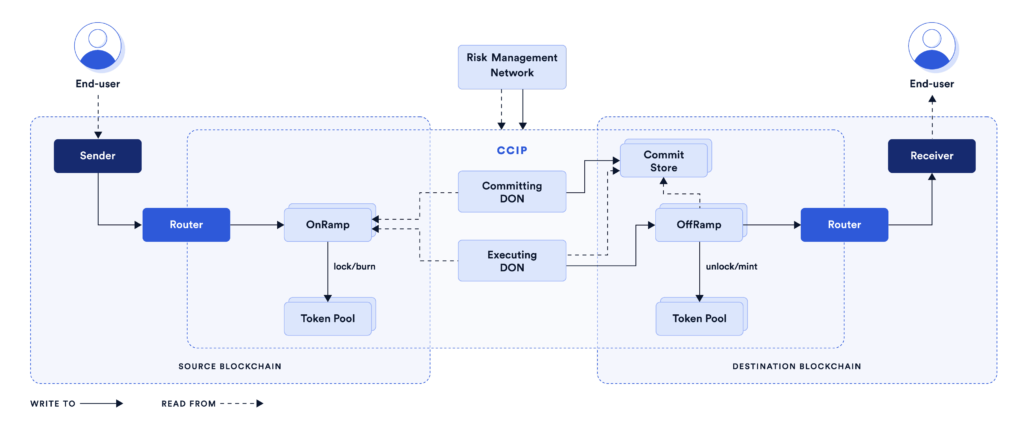

Chainlink CCIP comes as a solution to the cross-chain problem. Instead of using a single intermediary like bridges, transaction data transmission will utilize Chainlink’s decentralized Decentralized Oracle Network (DON). DON is a protocol that supports the creation of hybrid smart contracts responsible for creating secure communication between on-chain and off-chain.

Learn about the technology and role of smart contracts in the blockchain industry in this Pintu Academy article.

Chainlink CCIP strengthened its security system through the Active Risk Management Network (ARM). It is an independent network of nodes that enhances CCIP security by acting as a secondary validation service and detecting or stopping anomalous activity.

When a user sends a message, the router of the sending party will use Chainlik’s DON to relay the message to the destination chain. However, the message will first go through the Committing DON to be validated. During the process, ARM will monitor and ensure no wrong transactions. Once validated, the message will be converted according to the language of the destination chain through the Executing DON. Finally, it will be sent to the destination chain and received by other users.

Meanwhile, developers who want to create cross-chain solutions can build their products on top of CCIP through arbitrary messaging. This means that smart contracts from chain X will utilize Chainlinks’ messaging router to send messages to the DON. Later, the DON will communicate securely and privately to the messaging router in the receiving chain. After that, the message will be validated and sent to the smart contract of chain Y.

The Superiority of Chainlink CCIP over Other Cross-Chain Protocols

The advantages of Chainlink CCIP over other cross-chain protocols:

- 🌐 Broader Interoperability. CCIP goes beyond simply connecting different blockchains and making token delivery easier. It can also allow each chain to utilize the utilities of the connected chains.

- 🔐 Security. CCIP built on the Oracle Chainlink network will inherit Oracle’s security. Chainlink is a protocol that has been around for over five years, and hundreds of DeFi have used Oracle. Moreover, CCIP has DON technology and ARM networking, further enhancing decentralization, monitoring, and security.

- ⚡ Easy to use. Chainlink Founder Sergey Nazarov revealed that applications created using CCIP would be compatible with Web2 systems, existing interfaces, and digital wallets. The development team doesn’t need to create a new system supporting CCIP-based dApps.

- 🎮 Plug and play. CCIP offers a practical solution for sending all tokens cross-chain. It supports using burn-and-mint (native transfer) or lock-and-mint (wrapped tokens) mechanisms.

Another protocol that offers a cross-chain solution is Layer-0. Find out more about Layer-0 in the following article.

Potential Uses of CCIP Chainlink

As a breakthrough technology, here are the potential uses of CCIP Chainlink:

- ⛓️ Cross-chain transactions. Users can use CCIP to borrow and lend crypto assets on various DeFi platforms running on independent chains. In addition, users can also trade crypto assets on different blockchains.

- 💰 Low-cost transaction computation. CCIP allows a blockchain to utilize the facilities of other blockchains to process transactions and simultaneously bridge the data for settlement. This way, transactions can be processed on a lower-cost blockchain and confirmed on the main blockchain.

- ⚙️ Cross-chain DeFi. CCIP can be used to build cross-chain DeFi applications. For developers, this means they can create DeFi that takes advantage of the strengths of one chain while utilizing the strengths of another. For users, it means they can access DeFi services that may not be available on their preferred blockchain.

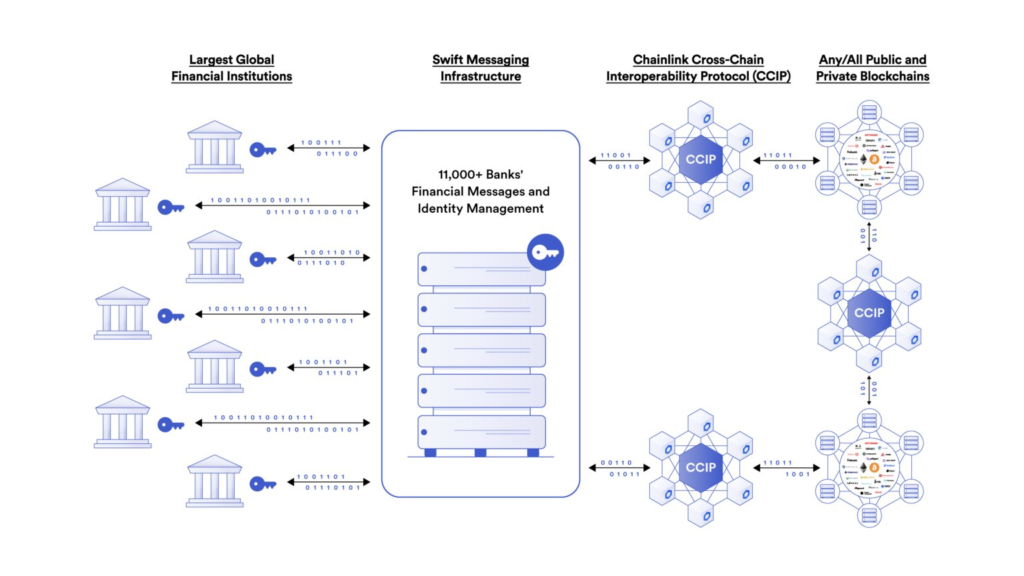

- ↔️ The combination of DeFi and TradFi. Swift (Society for Worldwide Interbank Financial Telecommunication) plans to use CCIP to work with multinational banks worldwide to bring billions of dollars worth of Real World Asset (RWA) tokens into the DeFi world.

Conclusion

Interoperability is still a significant problem for the blockchain industry. The features and advantages of each blockchain become meaningless if they cannot be connected. Cross-chain bridges as an interoperability solution have proven vulnerable to exploitation and hacking.

As a new protocol, CCIP Chainlink has the potential to revolutionize the way data and transactions are transmitted between different blockchains. It also inherits the security level of the Oracle Chainlink network and features DON and ARM to enhance its security aspects.

Although it is still in the early stages of development, CCIP holds the promise of addressing the blockchain industry’s pressing interoperability issues, offering a potential solution to bridge the existing gaps.

How to Buy LINK on Pintu

After learning more about Chainlik CCIP and its potential, you can start investing in Chainlink tokens by buying them on the Pintu app. Here’s how to buy LINK on the Pintu app:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for LINK.

- Click buy and fill in the amount you want.

- Now you have LINK as an asset!

In addition to LINK, you can invest in other cryptocurrencies such as BTC, ETH, SOL, and others safely and easily at Pintu. Pintu diligently evaluates all its crypto assets, highlighting the significance of being cautious.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Aside from buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through various Pintu Academy articles. Updated weekly, all Pintu Academy articles are made for knowledge and educational purposes, not as financial advice.

Reference

- Chainlink Docs, Chainlink CCIP Documentation accessed on 3 August 2023.

- Joel Agbo, What Is Chainlink CCIP? Guide To Cross-Chain Interoperability Protocol, CoinGecko, accessed on 3 August 2023.

- Pedro Salimano, Chainlink Launches Cross-Chain Protocol to Bridge Blockchains With Traditional Capital Markets, DeCrypt, accessed on 3 August 2023.

- Bessie Liu, Chainlink founder says CCIP opens DeFi for business, Blockworks, accessed on 3 August 2023.

- ChainlinkGod, Chainlink’s Cross-Chain Interoperability Protocol (CCIP) is officially live on mainnet, Twitter, accessed on 3 August 2023.

- Hitesh.eth, Chainlink Launched CCIP and Why Its a HUGE Deal for Web3, Twitter, accessed on 3 August 2023.

Share

Related Article

See Assets in This Article

0.0%

Chainlink Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-