Crypto Card: Definition, How It Works, and Types for Transactions

Crypto as a means of payment is showing a growing trend in popularity globally. The use of crypto is considered to facilitate transactions because it can be done directly without going through a complex process. Although in Indonesia crypto is not yet allowed as a legal means of payment, the adoption of crypto-based payment support technology continues to grow globally, one of which is through the use of crypto cards.

In this article, we will discuss what crypto cards are, how they work, their role in adoption, as well as the different types of crypto cards available.

Article Summary

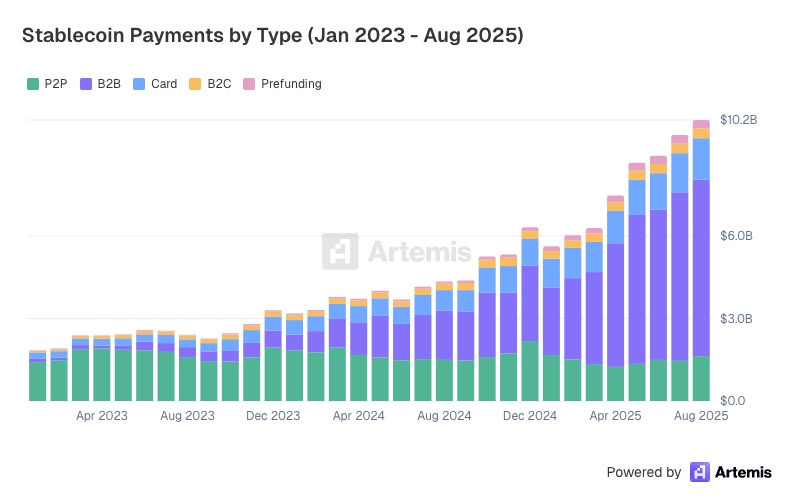

- 📈 Growth of stablecoin payments: Stablecoin payments continued to grow from April 2023 to August 2025, with a total recorded transaction value of USD 10.2 billion coming from P2P, B2B, card, B2C, and prefunding segments.

- 💳 Definition of Crypto Card: an electronic crypto payment card that works just like a regular debit card.

- 🔧 How Crypto Cards Work: Crypto cards have an infrastructure that can vary depending on the type. However, transactions on crypto debit cards, the most common type of crypto card, involve two main parties, the card issuer and payment networks such as Visa and Mastercard.

- 💵 Payments using crypto cards essentially involve the process of converting crypto assets to local currency, while their availability depends on the regulations in place in each country.

The Phenomenon and Introduction of Crypto Assets as Payment

Based on data from Artemis, the use of stablecoins as a means of payment has continued to grow since 2023 across various segments. In August 2025, the largest stablecoin payments were recorded in the B2B (Business-to-Business) segment with a transaction value of USD 6.4 billion. Meanwhile, thecard-based payment segment recorded a transaction value of USD 1.6 billion in the same period.

When compared to the various uses of stablecoins as a means of payment, the crypto card segment is the most relevant in opening up access to the general public. Through this use case, crypto will no longer be viewed solely as an investment or trading instrument, as its uses can align with everyday life.

What is a Crypto Card?

Crypto cards are electronic crypto payment cards that function like conventional debit or credit cards. Unlike debit or credit cards that are generally issued by banks, crypto cards incirculation today are generally issued by crypto exchange platforms, Web3 projects focused on this business model, or non-custodial wallets.

The use of cards can include a variety of things such as making point-of-sale (POS) transactions at merchants in real-time, online payments, and withdrawing crypto assets to fiat currency in cash through ATMs.

This innovation provides a seamless payment experience . In the process, the merchant or store does not receive crypto assets directly, but the transaction will be automatically converted first to local currency according to the region where the crypto card is used.

Apart from providing ease of transactions, crypto cards also offer a variety of features that attract users, ranging from integration with crypto wallets, transaction management, to integration with Apple Pay and Google Pay.

How Crypto Card Works

Crypto payment cards have a working mechanism that can differ depending on the card provider or infrastructure. However, in general, there are two main parties involved in the process:

- Card Provider

Its role includes balance checking, card configuration, custody, real-time conversion of crypto assets to local currency when used at merchants, display of transaction history, and setting transaction fees.

- Payment Network

Visa and Mastercard, perform transaction authorization, clearing and settlement to enable crypto cards to be used across merchant networks that support them. Typically, crypto cards work with these two payment networks.

In general, how crypto cards work includes the following steps:

- Configuration: The cardholder configures the transaction limit and the primary asset used for the transaction.

- Fund: The cardholder loads crypto balance onto a card-backed crypto card either in the form of BTC, ETH, or stablecoins such as USDC or USDT.

- Charged Card: The crypto balance is stored and ready to be used for transactions.

- Usage: When transacting at merchants, the cardholder uses the crypto card like a normal debit or credit card.

- Nominal Input: Merchants enter the transaction amount in local currency at the EDC machine.

- Payment: The cardholder makes payment by swiping, tapping, or inserting the crypto card into the EDC machine and entering the crypto card PIN.

- Request: The EDC machine sends an authorization request to the payment network.

- Verification: The payment network will proceed to the card provider to check the transaction from balance ownership and crypto conversion to local currency.

- The merchant receives payment in local currency, and the transaction is declared successful.

The use of crypto cards connected to Visa and Mastercard networks generally requires users to undergo a KYC (Know Your Customer) process and must comply with the regulations that apply in each country.

Types of Crypto Cards

The method described in the previous section is an example of a crypto debit card. In addition, there are several other types of cards that are commonly used, including:

Crypto Debit Card

Crypto debit cards are the most common type of crypto payment card and are easy to use because they have a direct pay scheme, which is a direct and automatic conversion of crypto assets to local currency during payment transactions. Example of a crypto debit card:

- KAST Card

KAST is a Visa-based crypto debit card that supports stablecoins such as USDC, USDT, and USDe as the primary crypto assets. The card has an ATM cash withdrawal limit of up to USD 20,000 per day. In addition, there is no annual fee for regular cards but it depends on the tier of the card.

- Cypher

Cypher offers a wide selection of crypto assets that can be used as primary assets for payments at Visa-enabled merchants. In addition, they provide virtual cards that make it easy for users to manage and use crypto assets for transactions, with a free card creation process.

For physical card delivery, they charge a delivery fee of USD 50 for standard cards, while premium cards are free of charge. In terms of transaction fees, Cypher charges aforeign exchange (FX) fee of around 1.75% as well as a cash withdrawal fee at ATMs of 3%.

- Metamask Card

MetaMask features a Mastercard-based payment card as well as a self-custody platform for storing and managing crypto assets.

The availability of MetaMask Cards depends on the regulations in each country. Currently, supported networks include Linea, Solana, and Base. Tokens that can be used include mUSD, USDC, USDT, wETH (wrapped Ether), EURe, GBPe, aUSDC, aBasUSDC, and amUSD. For cash withdrawals at ATMs, a transaction fee of 2% is charged. Meanwhile, the daily transaction limit varies depending on the card type, with the limit for regular cards reaching USD 15,000 per day.

Crypto Credit Card

Crypto credit card is an innovation in the crypto card ecosystem that allows users to make payments without having to exchange or sell their crypto assets.

- Ether.fi Cash

Ether.fi Cash provides debit and credit cards in one app with a collateral-based loan flow. Users can pledge stablecoins or crypto assets such as ETH and BTC.

The cardholder will get a credit limit based on the value of the collateral deposited and can use the credit without a cut-off date. This means that the cardholder has the flexibility to repay the credit at any time as needed.

The annual credit interest charged is 4%. For example, if a user utilizes a credit of USD 100 and does not make payments for almost a year, the total debt to be paid at the end of that year will be USD 104.

Crypto Card’s Role in Adoption

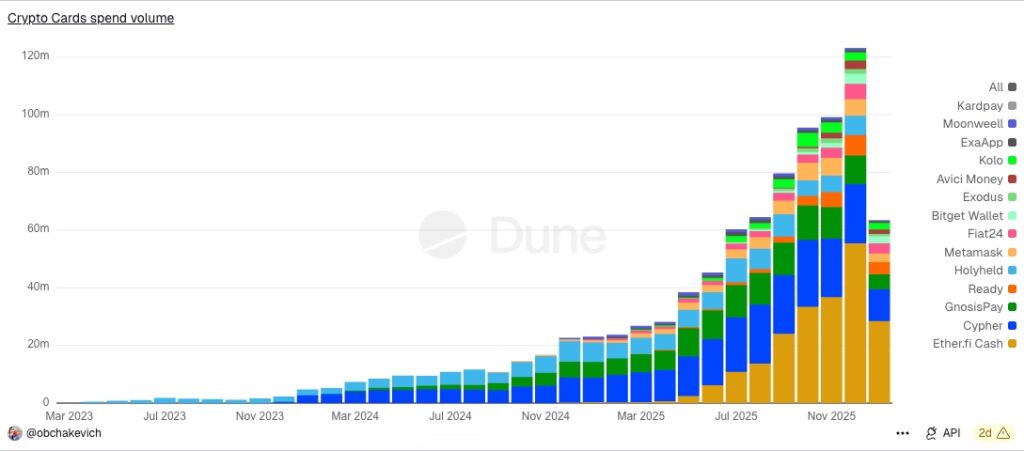

Ether.fi Cash is the most dominating card provider in terms of spend volume through 2025. The high usage of these two platforms is influenced by various factors, ranging from the transaction fee structure to the completeness of the features offered.

Both also carry an easy-to-understand interface (UI), and provide various incentive programs to attract users, such as cashback and rewards. In addition, integration with the DeFi ecosystem opens up the potential for users to earn passive income. As the volume leader, Ether.fi Cash offers debit and credit modes that can be used by all cardholders without any special requirements, providing more flexibility in daily use.

Stablecoins such as USDC and USDT are the most common choices as the primary assets in crypto cards. Their advantage lies in price stability compared to other crypto assets, so users don’t have to worry about volatility when transacting which can result in high price spreads.

Visa and Mastercard have also played a role in supporting the growth of crypto cards. Artemis Analytics data shows that stablecoin-linked crypto cards on the Visa network experienced a year-over-year growth spike of hundreds of percent, with an estimated 460%.

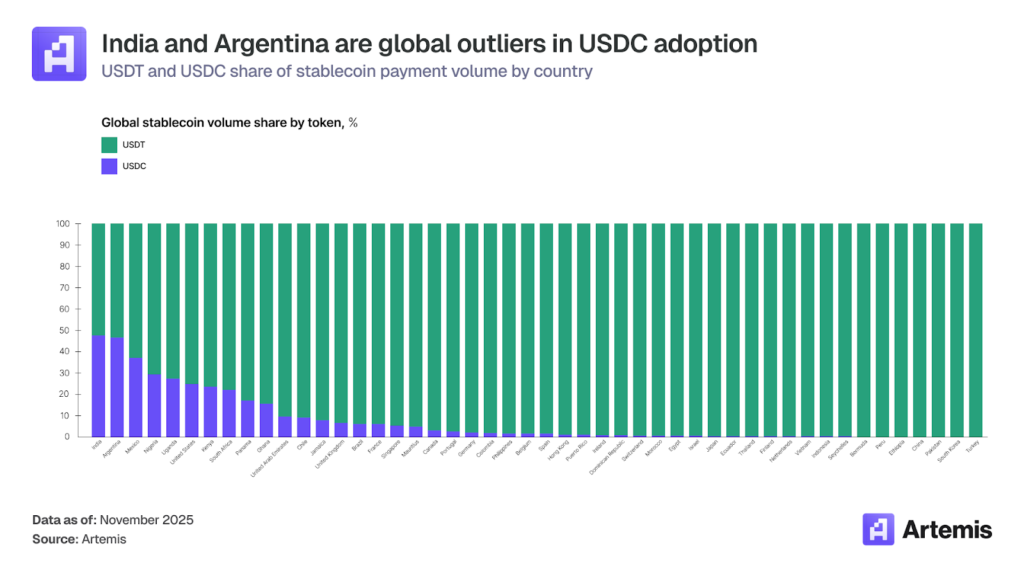

The majority of countries are still dominated by USDT usage, but India and Argentina are exceptions as USDC adoption in both countries is relatively balanced compared to USDT. In addition, high-inflation countries such as Argentina, Turkey, and Nigeria also show notable levels of stablecoin adoption.

Realistically, the acceptance of crypto assets as direct payment in many countries still faces major challenges. Apart from the limitations of different regulations in each country, the level of understanding of crypto by the general public or merchants is also uneven.

Through crypto cards, these barriers are reduced as users can transact as if they were using a conventional payment card, without requiring merchants to understand or accept crypto assets directly.

However, this approach still provides flexibility for crypto asset owners to use them without having to interact directly with fiat currencies. Ideologically, this mechanism is in line with the original purpose of creating crypto as an alternative to the traditional financial system, although in practice it still faces various challenges such as regulation.

Advantages of Crypto Card vs Regular Debit Card

The advantage of crypto cards lies in the flexibility of using crypto assets globally through payment networks such as Visa and Mastercard. The ease of crypto asset management provides convenience in transactions, including FnB payments for travelers without manual money exchange.

Meanwhile, regular debit cards are more powerful for domestic or local transaction needs. As long as it is used in the same country as the issuer, debit cards are more efficient as they are devoid of currency conversion and additional fees.

Disadvantages of Crypto Card

- The use of crypto cards is not yet supported or regulated in all countries.

- Acceptance of crypto cards is still limited as not all merchants support them yet. It also depends on the EDC machine used.

- Transaction fees are relatively higher for both payments and cash withdrawals, including crypto to local currency conversion spreads and other additional fees.

How to Trade Crypto on Pintu

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up your Pintu balance using your preferred payment method.

- Go to the market page and search for your favorite asset!

- Click buy and fill in the amount you want.

- Now you have crypto assets!

Download Pintu crypto app on Play Store and App Store! Your safety is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

In addition to making transactions, on Pintu app, you can also learn more about crypto through various Pintu Academy articles that are updated weekly!

Disclaimer: All articles from Pintu Academy are intended for educational purposes and do not constitute financial advice.

Crypto Card FAQ

Are crypto cards legal in Indonesia?

While Visa or Mastercard-based crypto cards can be used globally at merchant networks that support them, Indonesia does not yet allow the use of any other means of payment other than Rupiah. Therefore, the use of crypto cards in each country remains dependent on the policies of the card issuer as well as the applicable regulations in each jurisdiction.

What are the cryptos that can be used?

Card providers generally favor stablecoins such as USDT or USDC as the primary asset for card payments because of their relatively stable value and ease of conversion to local currency during transactions.

How much does it cost to convert crypto to rupiah?

The cost of converting crypto assets to local currency varies widely with some starting at 0.5%. In addition, there is a spread from the conversion process.

Can crypto cards be withdrawn at ATMs?

The answer is, you can. Crypto card holders have the facility to make cash withdrawals at ATMs.

What is the cashback percentage of crypto cards?

Cashback varies widely from 3% to 10%, depending on the card provider and the program.

Reference

- Piotr Kabaciński, “The Crypto Payment Card Market: An In-Depth Analysis of its Role in Bridging Digital Assets and Global Commerce“, stablewatch, accessed on January 20, 2026.

- ChainUp, “Crypto Debit Cards Explained: How They Work for Businesses and Fintechs“, accessed on January 20, 2026.

- Coingecko “Top 10 Crypto Cards for 2026 (Updated)“, accessed on January 21, 2026.

- Ether.fi, “Understanding your Cash card: Borrow Mode vs Direct Pay Mode“, accessed on January 22, 2026.

Share