What is Frax Finance (FXS) and How Does it Work?

The DeFi industry is already filled with multiple applications that serve various DeFi purposes. Curve is a destination for investors and crypto projects that need liquidity, UniSwap is the largest DEX in the DeFi industry, and AAVE is the premier lending protocol on Ethereum. So, what if there was one protocol that integrates all three applications into a single platform? Meet Frax Finance, a protocol with a decentralized governance system that wants to create a DeFi ecosystem in one application. This article will try to explain the Frax Finance ecosystem, what is Frax Share (FXS), and how the protocol works.

Article Summary

- 🏦Frax Finance is a multi-chain stablecoin protocol. Frax Finance is also the first protocol capable of providing all three DeFi financial services in an all-in-one platform.

- 🧠 Frax initially works using a fractional algorithm system where a portion of the FRAX stablecoin is collateralized by the dynamic ratio of FXS token. Currently, the Frax protocol is starting to migrate to a 100% collateralization for FRAX, similar to USDC or USDT.

- 💵 FXS is the governance token of Frax Finance, which plays an important role in maintaining the stability of the Frax stablecoin and earning profits for the protocol.

- ⚙️ One of the unique features of Frax is AMO or Algorithmic Market Operations which autonomously performs various open market operations according to its algorithm. AMO aims to benefit the protocol and maintain the stability of FRAX. FXS token holders have the power to control what AMO does and determine the allocation of its profits.

- 💸 The Frax Finance ecosystem is divided into several financial products: Fraxswap, Fraxlend, Fraxperry, and Frax ETH.

What is Frax Finance (FXS)?

Frax Finance is a multi-chain stablecoin protocol. It is currently compatible with the Ethereum, Dogechain, Avalanche, Fantom, BSC, Polygon, Arbitrum, and Moonbeam blockchains. Frax Finance is the first platform that can offer three DeFi financial services: stablecoins, liquidity, and lending markets.

Sam Kazemian, the co-founder of Frax Finance, explained that he wanted the Frax ecosystem to cover all three sectors of the DeFi industry. Instead of focusing on just one (like UniSwap, Curve, and AAVE), Sam wants Frax to combine them all in one integrated platform.

Frax’s stablecoin is FRAX which is pegged to the US dollar and is (formerly) a fractional algorithmic stablecoin. Since the end of February 2023, the Frax community through FIP-188 decided to eventually make FRAX 100% collateralized instead of algorithmically collateralized eventually.

Previously, FRAX was secured by 2 assets: USDC and also Frax Share (FXS), the governance token of Frax Finance. Beyond just the stablecoin protocol, the Frax Finance ecosystem has various sub-protocols that support using FRAX.

The underlying asset of Frax Finance is the Frax Share (FXS), a Frax governance token that captures yield, revenue, and excess collateral value from the Frax ecosystem. In addition, there is the Frax Price Index Share (FPIS), an FPI governance token whose value capture scheme is shared with FXS token holders. The current FXS price (March 1, 2023) is $11.5 with a Frax Share market cap of $860 million dollars. This puts FXS at position 63 on Coinmarketcap.

How Frax Finance Works

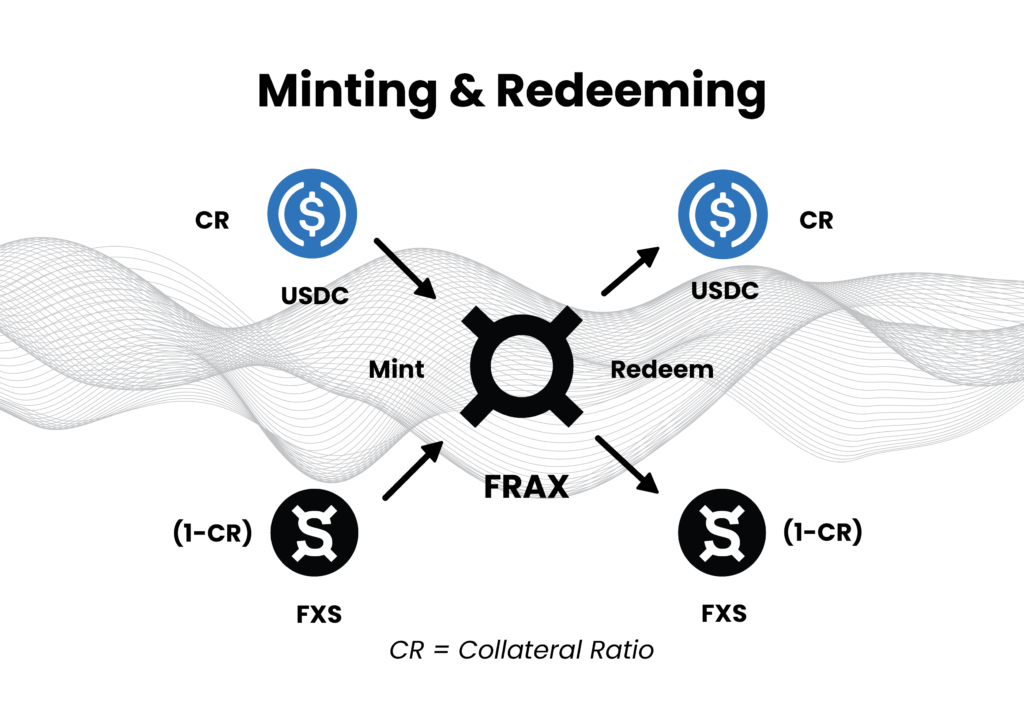

In version 1 (v1), FRAX operates using a fractional algorithmic mechanism. This means that the FRAX stabilization mechanism relies on 2 assets, USDC and FXS. Users who want to print FRAX must provide the collateral equivalent to the desired amount. The difference is that the ratio of FXS entered will vary from time to time, depending on market conditions. When in a fractional situation (collateral is below 100%), Frax will mint FXS every time FRAX is sold. Meanwhile, when FRAX is bought, the system will burn FXS.

block-preformatted">For example, Nadya mint 100 FRAX at a collateral ratio (CR) of 80%. This means she need to put in $80 USDC and $20 worth of FXS. When she want to sold FRAX a few days later, the CR is reduced to 70%. She will still get the equivalent value of 100 FRAX but behind the scenes the value and supply of FXS has changed.

In addition, the CR or collateral ratio also changes dynamically with the FRAX market. The number of Frax Shares minted and burned follows the collateral ratio. Simply put, during an expansion the CR is reduced and FXS mint goes up while during a contraction the CR is increased and FXS printing is reduced.

In this way, FXS does not face a death spirals problem like LUNA and UST. Instead, FXS will be burned every time a user sells FRAX so that the value of FXS continues to maintain equilibrium.

However, FRAX v1 mechanism will be disabled as the community decided to gradually increase the CR of FRAX to 100%. So, FRAX will eventually become a 100% collateralized stablecoin, just like USDT or USDC.

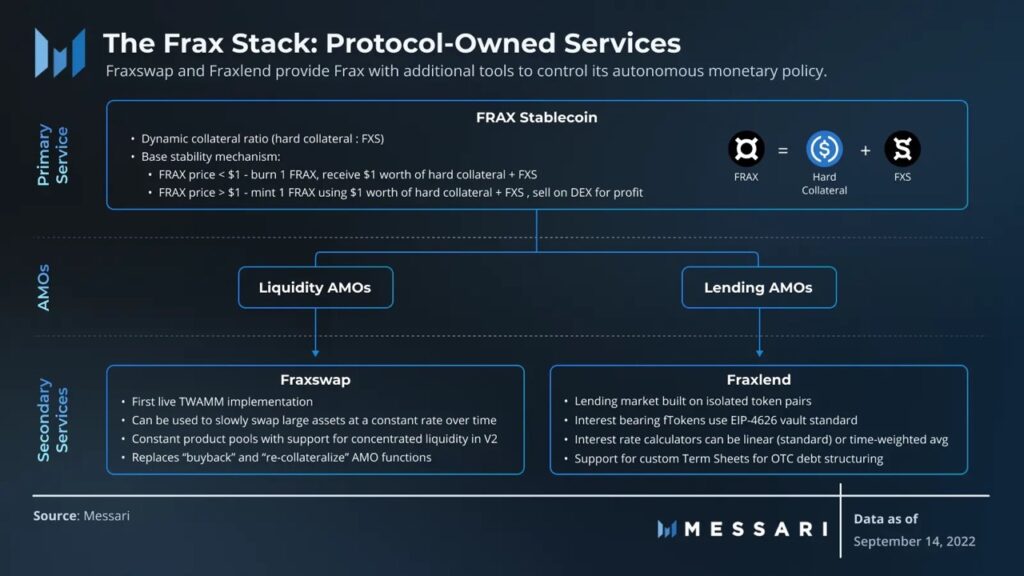

In the development of version two (v2), Frax Finance introduces the Algorithmic Market Operations (AMO) Controller. The AMO module is a set of autonomous contracts that perform a series of monetary actions on the condition that it does not have FRAX price stability. So, AMO performs open market operations algorithmically (as the name suggests) to ensure the continuity of the Frax protocol.

AMO

Frax v2 creates several AMO modules with their own tasks. These AMO modules aim to balance the value of FRAX, seek profit and revenue for the protocol, and allow Frax to dynamically adapt to market conditions.

Frax Finance's AMO essentially seeks profits for all FXS holders as the profits it makes are mostly returned to FXS token holders. In addition, FXS token holders have the power to control what the AMO does and determine the allocation of profits.

- Investor AMO: Seeking stable interest in AAVE, Yearn, etc protocols using idle USDC collateral. Frax governance can choose the protocols that the Investor AMO can use to earn interest.

- Curve AMO: Deploy USDC and/or Frax collateral to Curve, Convex, and StakeDAO to deepen the liquidity pool for Frax-based assets. Currently, the Curve AMO also runs bribe operations on Curve involving CVX tokens. This operation generates profits for FXS holders.

- Liquidity AMO: Provides liquidity for FRAX-based pairs on Fraxswap, Uniswap, and other AMMs. This operation also accumulates a small profit through interest from being a liquidity provider on AMMs such as Uniswap.

- Lending AMO: Mint FRAX into loan market applications with over-collateralization (collateral that exceeds the borrowed value) requirements so that the CR of FRAX is not affected.

Frax Finance Subprotocols

Fraxswap

Fraxswap was the first AMM with a time-weighted average market maker (TWAMM). TWAMM is very useful for large purchases or sales because it spreads them out over a long period of time so that they do not affect the price significantly. Additionally, Fraxswap is based on the Uniswap V2 code. TWAMM makes large orders more efficient and the Frax protocol uses this feature to balance the FRAX peg and return protocol profits to FXS holders through TWAMM purchases.

Specifically, Frax Protocol will use Fraxswap to buy back and burn FXS from AMO profit, print new FXS to stabilize FRAX, and make purchases or sales according to market conditions.

Fraxlend

Fraxlend is a lending service for several ERC-20 assets in the Frax ecosystem. The platform provides a non-custodial lending platform and lenders will get a ftoken whose value accumulates interest from the loan. The Fraxlend platform also utilizes oracle technology to provide optimal pricing for borrowers and lenders. The interest rate is also set by algorithmic calculation.

Fraxferry

Fraxferry is a platform that can move Frax-based tokens issued natively on multiple blockchains. Fraxferry’s bridging technology is more secure than many other technologies but takes longer to process token transfers. So, Frax created this platform out of concern for bridge exploits that often occur in the crypto industry.

Frax ETH

Frax began facilitating ETH staking in October 2022. frxETH is a stablecoin that pegs its price to the ETH asset. However, you will not receive ETH staking interest unless you lock frxETH and exchange it for sfrxETH. The sfrxETH token is an ERC-4626 standard token that earns interest from the Frax ETH validator and other additional profits. Through its incentive system, sfrxETH can give higher APR than other liquid staking platforms.

Frax Finance Unique Value Propositions

- The platform provides three types of stablecoins and has various incentives for participating users.

- Frax Finance has several protocols that can meet the needs of DeFi users such as stablecoin protocol, AMM, and lending protocols.

- Incentive mechanisms that benefit FXS and FRAX token holders through various AMO operations. FXS token holders can also manage all operations performed by the Frax AMO through a decentralized governance system.

- Frax Finance provides users with a wide range of profit-making options, including frxETH, which can earn more liquid staking interest than other platforms.

How to Buy FXS at Pintu

You can start investing in FXS tokens by buying them in the Pintu App. Here’s how to buy crypto on the Pintu application:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for the FXS token.

- Click buy and fill in the amount you want.

- Now you have FXS token as an asset!

Besides FXS tokens, you can also invest in various crypto assets such as BTC, BNB, ETH, and others safely and easily through Pintu.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download the Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

In addition to executing transactions, in the Pintu Apps, you can also learn crypto through various Pintu Academy articles which are updated every week! All Pintu Academy articles are made for educational purposes, not financial advice.

References

- Frax Finance Stablecoin Protocol – Frax Finance, accessed on 27 February 2023.

- Technical Specifications – Frax Finance, accessed on 28 February 2023.

- Chase Devens, DeFi Sector Brief: Frax Enters the Liquid Staking Arena, Messari, accessed on 1 March 2023.

- Chase Devens, The DeFi Trinity: Frax Finance’s Quest for DeFi Dominance, Messari, accessed on 1 March 2023.

- Ryguy, FRAX: A Fractional-Algorithmic Stablecoin, Messari, accessed on 2 March 2023.

Share