What Is Maple Finance (SYRUP)?

Decentralized Finance has transformed how lending and asset management work across the world. In this transformation, Maple Finance has emerged as one of the leading protocols providing on-chain institutional lending solutions. As global demand for transparent and efficient credit systems continues to rise, investors and market analysts are paying close attention to SYRUP as a benchmark for the future of institutional DeFi.

Article Summary

- 📌 Maple Finance (SYRUP): An on-chain lending platform for institutions, launched in 2021 with a focus on transparent, efficient, and regulation-compliant credit markets.

- 💰 SYRUP Token: Officially replaced MPL at the end of 2024; serves as a governance and staking token with an annual inflation rate of 5% to support ecosystem growth.

- 📊 TVL Growth: As of October 1, 2025, Maple’s Total Value Locked (TVL) reached $4.18 billion, generating stable monthly revenue exceeding $1.3 million, driven mainly by SyrupUSDC and SyrupUSDT.

What Is Maple Finance (SYRUP)?

Maple Finance is a decentralized lending platform founded in May 2021 by Sid Powell and Joe Flanagan, who both have extensive experience in banking, finance, and blockchain. The project was created to provide a secure, scalable, and regulation-compliant credit infrastructure for institutional borrowers. Unlike traditional DeFi protocols that rely heavily on overcollateralized peer-to-peer loans, Maple focuses on unlocking real-world capital access, improving transparency, and bridging institutional finance with decentralized networks.

From the beginning, Maple prioritized security, transparency, and regulatory compliance. The team conducts regular smart contract audits, implements risk management systems, and collaborates with global financial institutions. Today, Maple continues to expand its ecosystem by adding new lending pools, onboarding diverse assets, and integrating with major blockchains such as Ethereum and Solana .

The SYRUP token is the centerpiece of Maple’s ecosystem, replacing the old MPL token at the end of 2024. Beyond serving as a governance token, SYRUP also offers staking rewards, enabling holders to actively participate in shaping Maple’s future direction.

Mission, Vision, and Core Solutions

Maple Finance’s mission is to build a credit market that is efficient, transparent, and decentralized for institutions and investors. Its vision is to become the leading global platform for undercollateralized on-chain lending, connecting reputable lenders and borrowers in a secure, automated environment.

Maple addresses three major challenges in the DeFi lending landscape:

- Institutional Access – Opening on-chain lending opportunities for corporations, investment funds, trading firms, and DAOs with verified track records.

- Transparency & Efficiency – All loans operate through publicly verifiable smart contracts, ensuring faster execution, no intermediaries, and transparent returns.

- Protocol Composability – Maple’s modular architecture allows easy integration with other DeFi protocols and supports multi-chain lending products.

Recent updates introduced enhanced credit scoring systems, detailed performance dashboards, and advanced risk management tools — reaffirming Maple’s commitment to innovation and industry standards.

Key Growth Drivers of SYRUP

The increasing demand for SYRUP is supported by strong incentive mechanisms that reward token holders and sustain Maple’s ecosystem.

| Mechanism | Description |

|---|---|

| Staking Rewards | Over 11.6 million SYRUP distributed as staking rewards with ~3.1% APY. Currently, 32% of the circulating supply is staked, reflecting strong community trust. |

| Buyback Program | A portion of Maple’s institutional lending revenue is used to repurchase SYRUP. 20% of revenue was allocated for buybacks in Q1–Q2 2025 (MIP-013 & MIP-016), increasing to 25% in Q3 2025 (MIP-018). |

| Protocol Governance | Only holders of stSYRUP have voting rights, encouraging users to stake their tokens to participate in governance decisions. |

| Controlled Inflation | An annual inflation rate of 5% helps maintain a balance between reward distribution and long-term token sustainability. |

SYRUP Tokenomics

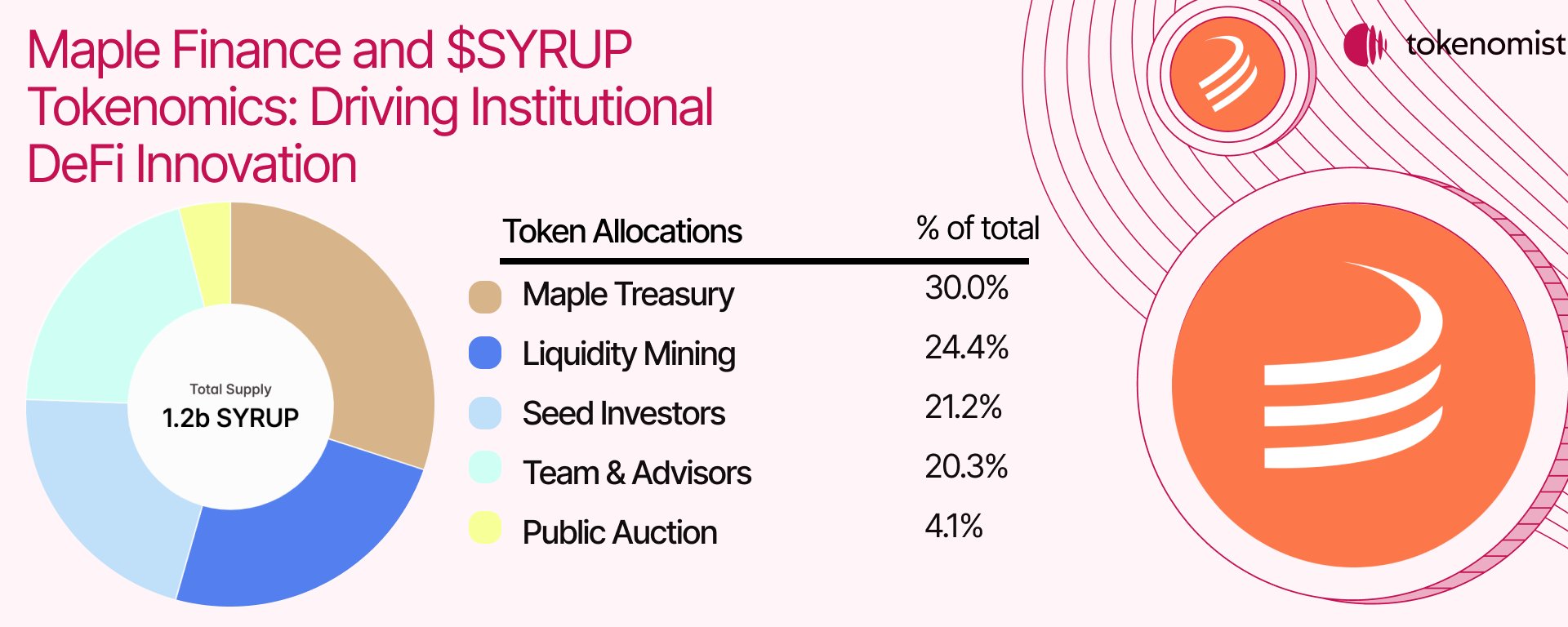

The SYRUP token was introduced through Maple Finance Foundation’s governance proposal MIP-010 in August 2024, replacing the previous MPL token at a 1:100 ratio, ensuring value preservation for existing holders.

Currently, SYRUP’s circulating supply is around 1.19–1.20 billion tokens, with a controlled 5% annual inflation. The total supply is projected to reach approximately 1.228 billion tokens by 2026. Holders can stake their SYRUP to receive stSYRUP, a yield-bearing ERC-4626 derivative token that grants governance rights and continuous rewards while allowing flexible withdrawals.

Initial Allocation Breakdown:

- Maple Treasury: 368.74 million (30%)

- Liquidity Mining: 300 million (24.4%)

- Seed Investors: 260 million (21.2%)

- Team & Advisors: 250 million (20.3%)

- Public Sale: 50 million (4.1%)

Both seed and team allocations have been fully unlocked since 2023, while liquidity mining and treasury funds continue to be managed via community governance.

Institutional Adoption and Maple’s Growth

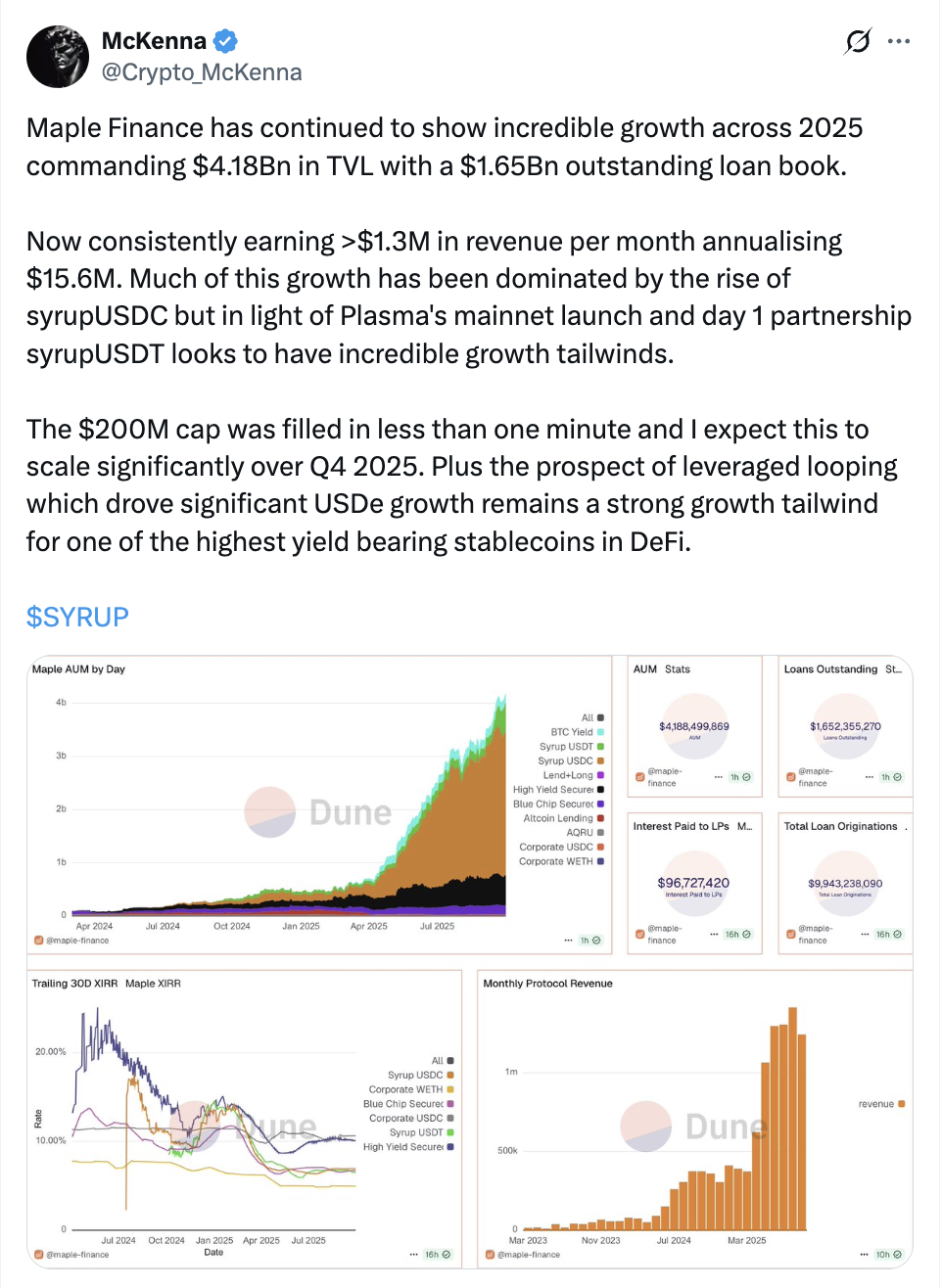

According to Dune Analytics, Maple’s Total Value Locked (TVL) reached $4.18 billion as of October 1, 2025, with $1.65 billion in active loans. The protocol generates over $1.3 million in monthly revenue, primarily from SyrupUSDC and the newly launched SyrupUSDT.

Market analyst McKenna noted on X (formerly Twitter) that investor demand remains exceptionally strong, with over $200 million in deposits filled within a minute. Strategies such as leveraged looping continue to accelerate Maple’s momentum, positioning it as a leader in institutional DeFi lending.

Strategic Partnership with Elwood Technologies

Through its collaboration with Elwood Technologies, Maple aims to expand on-chain credit services by leveraging institutional-grade risk management and trading infrastructure. This partnership focuses on offering tokenized credit portfolios that combine yield generation with regulatory compliance and transparency.

Maple plans to integrate Elwood’s portfolio execution framework to meet growing institutional capital needs. This initiative brings a more structured, risk-managed approach to on-chain lending—bridging the gap between traditional finance (TradFi) and decentralized finance (DeFi).

Price Outlook: Expert Analysis

Rendoshi Ondomoto: Oversold Signal Suggests Rebound Potential

Crypto analyst Rendoshi Ondomoto observed that SYRUP is currently forming a descending channel pattern, with the RSI indicator sitting in oversold territory — similar to conditions seen in April 2025, when SYRUP later surged 8x. He argues that the consistent TVL growth within the Maple ecosystem may drive a rebound once selling pressure eases.

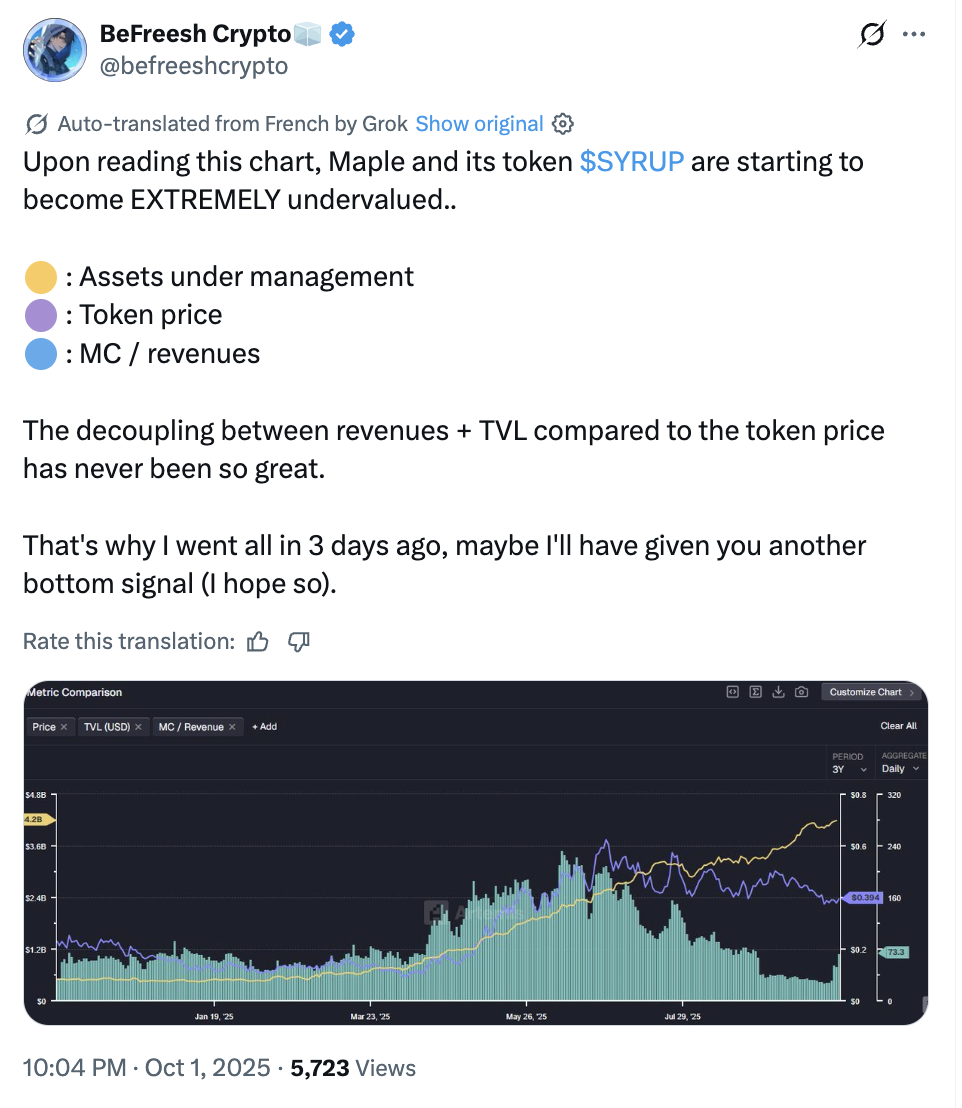

BeFreesh Crypto: SYRUP Appears Undervalued

Analyst BeFreesh Crypto highlighted a growing gap between Maple’s rapidly rising TVL (over $4.2 billion) and SYRUP’s stagnant price (~$0.39). This “decoupling” indicates that the protocol’s fundamentals are improving faster than market valuation, suggesting that SYRUP may be undervalued. BeFreesh believes this divergence could mark a market bottom and potentially trigger a price recovery aligned with Maple’s strong fundamentals.

How to Buy Maple Finance (SYRUP) on Pintu

You can buy Maple Finance (SYRUP) easily through the Pintu app:

- Open the Pintu homepage.

- Go to the Market section.

- Search for Maple Finance (SYRUP).

- Enter the desired purchase amount and follow the next steps to complete your transaction.

Conclusion

SYRUP is a governance token within the DeFi ecosystem built around sustainability, aligned governance, and institutional-grade credibility. The transition from MPL to SYRUP modernized Maple’s economic model, balancing liquidity, incentives, and ownership.

With roughly one-third of tokens currently staked and buyback programs funded by lending revenues, SYRUP’s design supports both value stability and long-term ecosystem health. Backed by strong TVL growth, strategic partnerships, and rising institutional adoption, Maple Finance continues to stand out as one of the key players shaping the future of institutional DeFi.

*Disclaimer: All content from Pintu Academy is intended for educational purposes only and should not be considered financial advice.

References:

- Binance. What Is Maple Finance (SYRUP)? Accessed October 2, 2025.

- Bitget Wallet. What Is Maple Finance ($SYRUP)? Institutional Credit and Price Growth in DeFi 2025. Accessed October 2, 2025.

- Bitget. What Is Maple Finance (SYRUP)? A Comprehensive Guide. Accessed October 2, 2025.

- Coin Central. Maple Finance and Elwood Technologies Create New Pathway for Institutional Crypto Credit. Accessed October 2, 2025.

- NFT Evening. What Is Maple Finance? The Next DeFi Lending Protocol. Accessed October 2, 2025.

- Tokenomist (X). Maple Finance and $SYRUP Tokenomics: Driving Institutional DeFi Innovation. Accessed October 2, 2025.

Share

Table of contents

Related Article

See Assets in This Article

ETH Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-