What is Meta (METAX)?

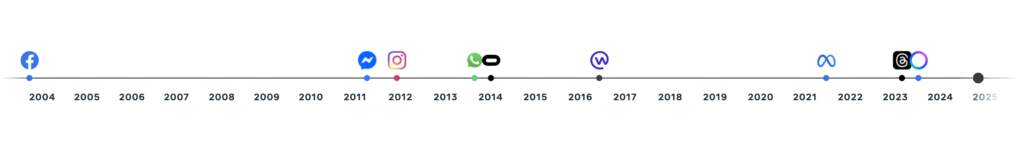

Meta, formerly known as Facebook, started as a small project at Harvard University in 2004 by Mark Zuckerberg and his friends. From a limited social networking platform, Meta evolved into a global digital giant that now leads in social media, AI, and the metaverse. This article will discuss Meta’s long journey from the beginning to a huge company with an ever-growing share price.

Article Summary

- 👥 Facebook was launched by Harvard students Mark Zuckerberg, Eduardo Saverin, Dustin Moskovitz, and Chris Hughes.

- 📰 Facebook went public with an initial public offering (IPO) on May 18, 2012.

- ♾️ In 2021, Facebook rebranded as Meta Platforms, Inc.

- 💰 According to the October 29, 2025 report, Meta’s total revenue reached $51.24 billion in Q3 this year.

History of Meta

Meta, now known as a major tech company, is inextricably linked to Facebook’s long history. The company started as a small project on the campus of Harvard University, which later grew into a global digital giant.

In February 2004, four Harvard students-Mark Zuckerberg, Eduardo Saverin, Dustin Moskovitz, and Chris Hughes-launched a platform called TheFacebook. The goal was simple: to help Harvard students connect with each other online. In just one month, half of Harvard students had joined.

In late 2004, TheFacebook received its first investment from Peter Thiel, an investor, of $500,000 dollars. A year later, venture capital firm Accel Partners also invested $12.7 million dollars, making Facebook’s valuation jump to $98 million dollars. In the same year, Facebook also changed its name by removing the word “The”, after purchasing the facebook.com domain for $200 thousand dollars.

With the fresh funds, Facebook began to open up access outside of Harvard. From 2006 to 2025, Facebook has gone through and achieved many things such as:

| Year | Main Events | Meaning / Significance |

|---|---|---|

| 2006 | Opened to general public and launched News Feed | Transforming from an exclusive platform for students to a mass platform, it managed to register 12 million users by the end of the year. |

| 2012 | Instagram IPO and Acquisition | Go public with a valuation of over $100 billion; buy Instagram for about $1 billion, as a future growth engine. |

| 2014 | Acquired WhatsApp and Oculus VR | Strengthened global dominance in messaging with a $19 billion buyout; invested $2.3 billion in VR(Virtual Reality), signaling a long-term shift to immersive technology. |

| 2021 | Rebranding to Meta Platforms, Inc. | Marking a massive billion-dollar change in strategy to build the metaverse. |

| 2023 | Launching Threads | It entered the text-based public conversation market, directly challenging Twitter (now X). |

| 2025 | Launch of Meta AI with Llama 3 model | A big focus on integrating AI into the company’s core strategy. These large infrastructure investments drove Q3 2025 total costs and expenses to reach $30.71 billion. |

Meta Products

Meta has a very broad portfolio of digital products and services, reaching various market segments ranging from global internet users to business people and technology developers. Here are some of Meta’s flagship products along with their target markets and key features:

1. Family of Apps (FoA) Advertising

Meta’s digital advertising service targets small to large businesses and digital marketers. The service enables targeted advertising across Meta’s ecosystem of apps such as Facebook, Instagram, WhatsApp and Messenger.

Powered by AI technology (such as the Advantage+ feature) and interactive ads like Click-to-Message ads, the system helps businesses reach audiences efficiently.

2. Facebook & Messenger

Aimed at global internet users of different age groups. Facebook and Messenger remain at the core of online social activity, allowing users to connect, share content, join groups and have private conversations.

The Marketplace feature is also present to support buying and selling activities between users. To date, its combined monthly active users reach more than 3.07 billion people.

3. Instagram & Threads

It targets young people, content creators, and e-commerce brands. Instagram offers visual content such as Reels and Stories, as well as direct integration for online shopping. Meanwhile, Threads – Meta’s microblogging platform – is growing rapidly and will reach 320 million monthly active users by early 2025.

4. WhatsApp

Intended for global mobile users, SMEs, and large enterprises. WhatsApp is known for its encrypted cross-platform messaging service, as well as voice and video calling features.

For businesses, the WhatsApp Business Platform supports customer service and transactions. Currently, the number of monthly active users reaches 2 billion people.

5. Reality Labs (RL) Hardware & Software

Aimed at consumers, developers and companies in the field ofspatial computing. Reality Labs develops hardware and software for immersive technologies, such as:

- Meta Quest VR Headset (with dominant market share)

- Ray-Ban Meta smart glasses with AI-based features

- As well as the Horizon Worlds metaverse platform that allows users to interact in virtual worlds.

What is METAx?

METAx is a tokenized version of Meta Platforms (META) shares traded on the Solana (SPL) and Ethereum (ERC-20) networks. The token gives crypto users easy access to stock exposure with 24/7 trading and fractional purchases, although it does not grant direct ownership rights.

METAx prices are pegged to the market value of Meta Platforms shares and backed by native shares held by regulated custodial institutions. This tokenization model combines traditional financial infrastructure with the flexibility of crypto assets, making it an alternative for investors looking to gain global stock exposure on-chain.

So, what is the difference between METAx and ordinary Meta shares?

| Features | METAx (Tokenized Shares) | META (Traditional Stock) |

|---|---|---|

| Trading Hours | 24/7 | 9:30 AM – 4:00 PM ET |

| Minimum Investment | Can start from IDR 11,000 at the Door | Approximately IDR 11,000,000 (for one share) |

| Platform | Crypto platforms that support METAx (e.g., Pintu) | Brokers (e.g., Fidelity) |

| Regulation | Varies by platform | Regulated by the SEC |

How Meta Works (METAx)

METAx connects Meta Platforms’ share prices into a digital token through blockchain technology. The token is designed so that its value follows the real-time price movements of Meta shares. The original Meta shares are held by regulated custodians to ensure price matching. As such, METAx reflects the overall performance of Meta stock.

So, what are the advantages and disadvantages of METAx?

Some of the advantages of METAx include:

- 24/7 access: METAx can be traded anytime, even outside of market hours.

- Low Fees: You can start investing with as little as $1, making Meta’s growth accessible to everyone.

- Global Reach – Investors from around the world can gain exposure to Meta stocks.

- Fast Settlement – Blockchain makes the process of settling and storing METAx assets happen in record time.

Like all crypto assets, METAx comes with risks. Although it follows the price movements of Meta stocks, market volatility can cause price fluctuations. Depegging, which is when the METAx price differs slightly from the Meta stock price, can occur due to low liquidity.

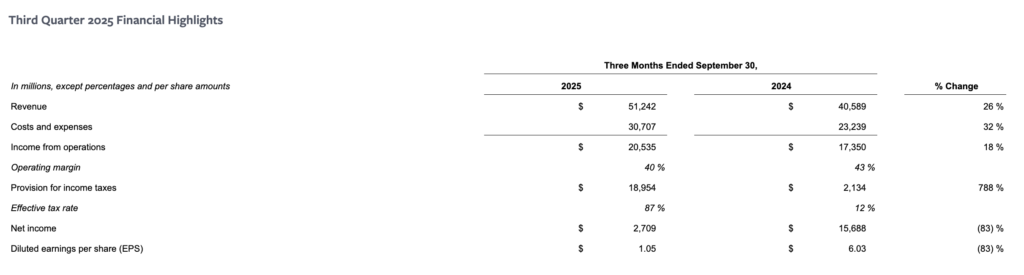

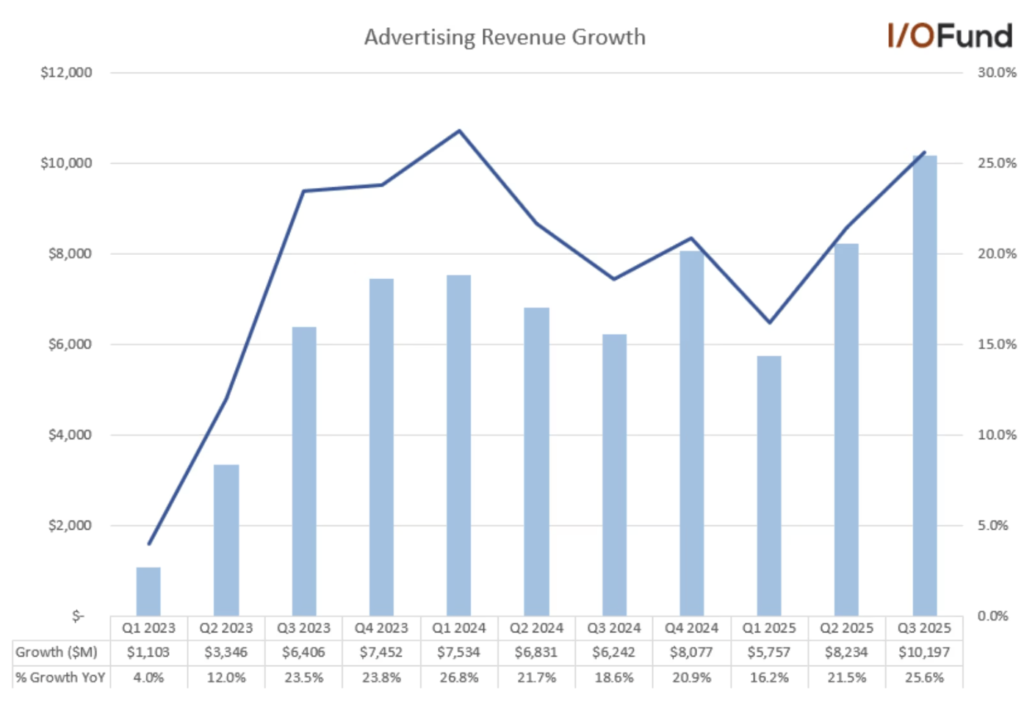

Meta’s Ad Revenue Up 25%

In the third quarter (Q3), Meta’s advertising revenue grew by 25.6% year-on-year (YoY), an increase of more than nine points compared to the first quarter (Q1) and recorded the fastest growth in the last six quarters.

The number of ad impressions increased 14% YoY in Q3, faster compared to 11% in Q2, and showing significant improvement from only 5% in Q1. Prices remained stable, with a one-point increase to 10% YoY.

More striking, however, was the growth in dollar figures from advertising. Meta recorded the two quarters with the largest YoY growth in dollars in Q2 and Q3, at $8.23 billion and $10.2 billion, surpassing even the holiday-driven fourth quarter 2024 growth of $8.08 billion.

This high dollar growth is expected to continue in Q4 2025, with estimated QoQ dollar growth between ~$9.3 billion and $10.7 billion.

In other words, Meta generated greater YoY dollar growth in ad revenue from a larger base – in Q3 2025, it grew to $10 billion YoY from a base of $40 billion, compared to $7.5 billion growth in Q3 2024 from a base of $33.6 billion.

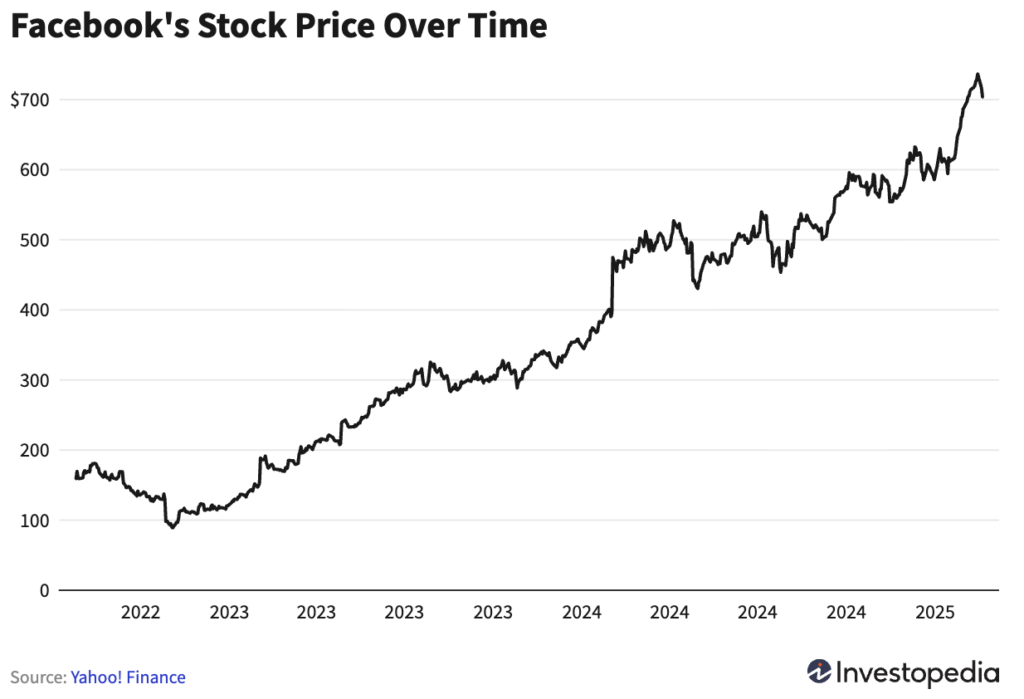

META Stock Analysis

Meta Financial Performance (TTM)

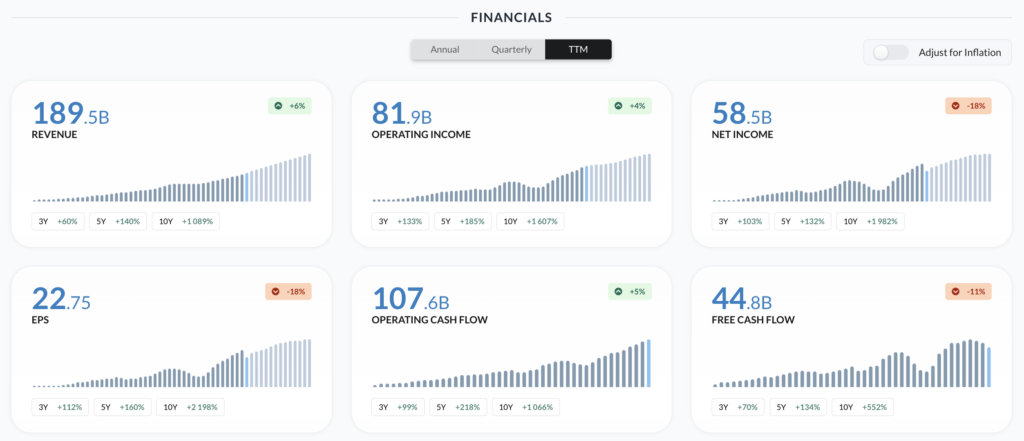

Based on the data displayed on Alphaspread, Meta Platforms has shown impressive performance in recent years although there are some discrepancies in the specific figures.

- Revenue

In the last 3 years, the company’s revenue increased by 60%, and in the last five years, revenue increased by 140%. Even in the last ten years, Meta recorded a 108% increase in revenue, with total revenue of $189.5 billion.

- Operating Income

In the last 3 years, the company’s operating profit increased by 133%, with an increase of 185% in five years and 607% in the last ten years. With an operating profit of $81.9 billion, Meta has demonstrated solid operational efficiency.

- Net Income

The company’s net profit has slightly decreased by 18% in the last 3 months, but in the long term, Meta has recorded an increase in net profit of 103% in 3 years and 132% in 5 years. With a total net profit of $58.5 billion, the company remains in a strong financial position despite short-term fluctuations.

- Earnings per Share (EPS)

Meta recorded an EPS of $22.75, despite an 18% decline in the last three months, the company’s EPS grew rapidly in the long term, with increases of 112% in 3 years, 160% in 5 years, and 2,198% in the last 10 years.

- Operating Cash Flow

Meta also saw a 99% increase in the last 3 years, 185% in 5 years, and 1,066% in 10 years in its operating cash flow, which reached $107.6 billion.

- Free Cash Flow

Meanwhile, free cash flow has slightly decreased by 11% in the last three months, but over a longer period, Meta has recorded an increase of 70% in 3 years and 134% in 5 years. With $44.8 billion in free cash flow, Meta remains in a strong cash position.

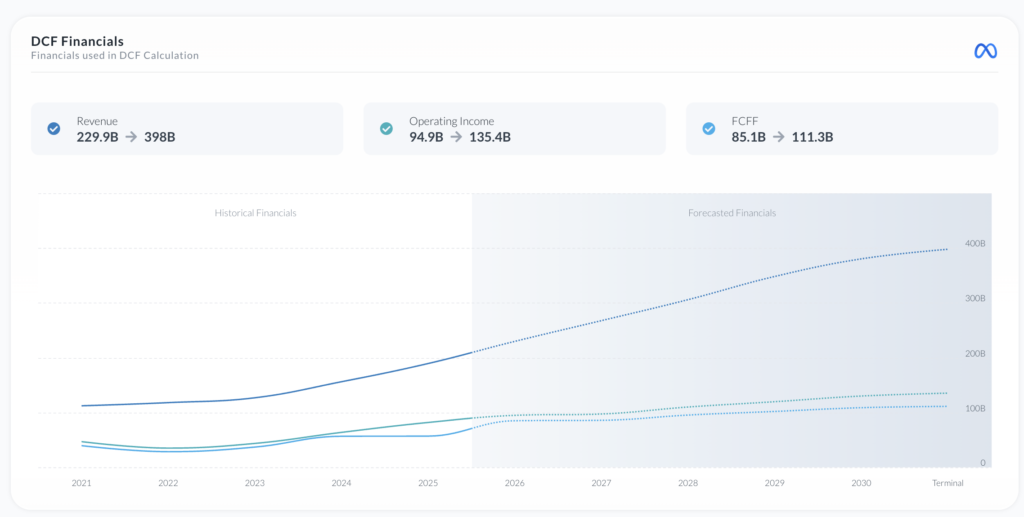

Meta Growth Projection Based on DCF Method

Based on calculations using the Discounted Cash Flow (DCF) method, Meta’s growth projections show a very positive trend for the next few years. In the period between 2021 and 2030, the company is expected to experience significant improvements in three key financial indicators:Revenue,Operating Income, and Free Cash Flow to Firm (FCFF).

- Revenue: From $229.9 billion in 2021, Meta’s revenue is projected to increase further to reach $398 billion by 2030.

- Operating Income: Meta’s operating profit is also experiencing a steady growth trend, with a forecast increase from $94.9 billion in 2021 to $135.4 billion in 2030.

- FCFF (Free Cash Flow to Firm): For FCFF, which is an important indicator in DCF analysis, projections show an increase from $85.1 billion in 2021 to $111.3 billion in 2030.

Meta Stock P/E Ratio Reaches 28.74

As of December 19, 2025, Meta Platforms (META) showed a stable performance despite minor fluctuations throughout the year. With a market value of $1.67 trillion and an enterprise value of $1.64 trillion, Meta remains one of the big players in the tech industry, although it pales in comparison to Microsoft which has a much larger market capitalization.

Meta’s price-to-earnings (P/E) ratio stands at 28.74, which is halfway between Alphabet (GOOGL) which has a lower P/E ratio at 29.29 and Microsoft with the highest P/E ratio at 33.86.

The P/E ratio (Price-to-Earnings Ratio) is one of the indicators used to assess the valuation of a stock. It measures a company's share price compared to its earnings per share (EPS - Earnings Per Share).

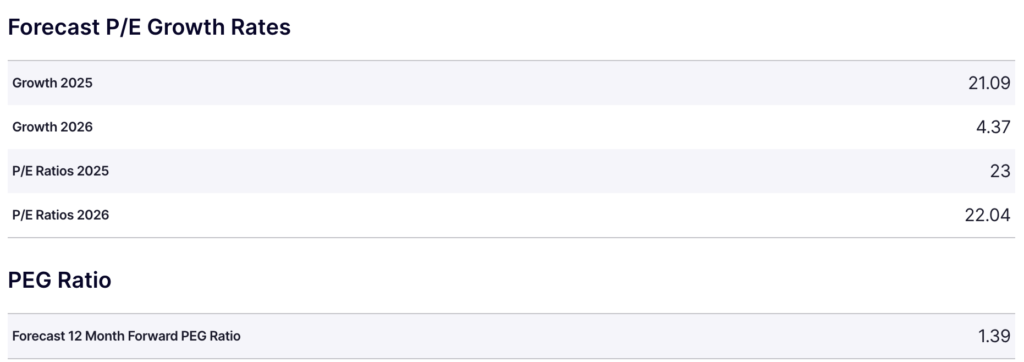

PEG Ratio Analysis and Meta Valuation Projections

Based on existing projections, Meta’s growth in 2025 is expected to reach 21.09%, indicating the potential for quite rapid growth. However, by 2026, its growth rate is expected to slow down to 4.37%, reflecting a possible stabilization after a period of faster expansion.

By 2026, Meta’s P/E ratio is expected to decrease slightly to 22.04, indicating a decrease in the market valuation of the company. In addition, the PEG ratio for the next 12 months is expected to reach 1.39, indicating that despite Meta’s significant growth, its stock valuation is still comparable to its growth rate.

Technical Analysis of Meta Stocks Based on Trader X

On December 19, 2025, Heisenberg, a market analyst, shared technical analysis on Meta Platforms (META) stock via his Twitter account. He noted that META’s share price managed to reach the $670 level again, approaching the higher target of $700.

In a previous analysis, on December 4, 2025, Heisenberg stated that if META could break two major resistance levels, namely the 50-day (50DMA) and 200-day (200DMA) moving average lines, the stock could potentially reach $700, even with a possible overshoot to $710.

On the shared chart, Heisenberg pointed out a “death cross” (the intersection of the declining 50DMA and 200DMA lines), but he noted that while this phenomenon often indicates a decline, in the previous case it did not lead to a decline, but to a further rise.

He also highlighted significant resistance around $690, which was previously a support level. To move towards the $700 target, META needs to be able to break and hold above the descending 50DMA and 200DMA levels with strong conviction.

Meanwhile, the X Flux Charts account also provided technical analysis on Meta Platforms (META) stock. In its tweet, the account pointed out that Meta stock is now back trading inside a key demand zone on the daily chart after experiencing a sharp decline. This demand zone, which is visible on the chart, serves as an important support area where buyers are responding to try to reclaim the price structure from below.

Flux Charts notes that if META can hold above this zone, the opportunity for a continued rebound remains. However, failure to hold the zone could signal further downside risks, which could take META stock down to lower levels.

On the included chart, the significant demand zone, depicted by the yellow-colored area, is around the $650 to $700 price range. If META manages to hold this level, it could be a turning point for price recovery, while if it doesn’t, the stock is at risk of resuming its decline.

How to Buy METAx at the Door

As interest in blockchain-based real-world assets increases, popular US stocks like Meta, Nvidia, Tesla, and Apple are now being tokenized in the crypto ecosystem. The good news is that you can start investing in tokenized stocks like Meta right in the Pintu app very easily. Here are the steps:

- Open the Doors app.

- Go to the Market section and search for Meta .

- Enter the amount you wish to purchase after logging in.

- You can follow the same steps to buy other tokenized stocks in the Pintu app.

In addition to trading, Pintu also allows you to learn more about crypto through various educational articles on Pintu Academy which are updated weekly. All articles published on Pintu Academy are for educational purposes only and are not financial advice.

Conclusion

Meta Platforms, formerly known as Facebook, continues to grow rapidly in line with its strategic innovations and transformations. From its inception to the present, Meta has successfully expanded its influence by venturing into new technologies, such as the metaverse and AI, which are proven to change the way the company operates and interacts with its users.

Financially, Meta continues to show significant growth, both in revenue, operating profit and cash flow, despite some short-term challenges due to major investments being made. Financial projections for 2025 and 2026 show that Meta has the potential to continue to grow.

Reference:

- Beth Kindig. The AI Revenue Leader Nobody Is Talking About-Second Only to Nvidia Stock. Accessed on December 19, 2025

- Big3. A Brief History of Meta and The Evolution of Facebook. Accessed on December 19, 2025

- Culture of the Internet. Meta’sFuture of Connection. Accessed on December 19, 2025

- DCF. Meta Platforms, Inc (META): History, Ownership, Mission, How It Works & Makes Money. Accessed on December 19, 2025

- Justin Walton. When Did Facebook (Meta) Go Public? Accessed on December 19, 2025

- Meta. Meta Reports Third Quarter 2025 Results. Accessed on December 19, 2025

- Quarter. The Rise of Meta: From Dorm Room to Global Dominance. Accessed on December 19, 2025

- Yahoo Finance. Meta Platforms, Inc (META). Accessed on December 19, 2025

Share

Related Article

See Assets in This Article

0.0%

METAX Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-