What is Smart Money in Crypto and How to Track It

Based on CoinGecko data, there are currently more than 18 thousand cryptos that have been created and this number has the potential to continue to grow. This condition requires investors and traders to carefully consider various aspects in choosing assets like smart money.

In practice, there are various analytical approaches that can be used, ranging from fundamental analysis to technical analysis. Market participants often monitor assets selected by smart money as an additional strategic reference for decision-making. This article explores smart money, its impact on crypto markets, its characteristics, and methods to track its movements.

Article Summary

- 🧠 Smart money is a fund managed by individuals or groups of people experienced in dealing in crypto assets, with a strategic approach supported by analysis, experience, and market understanding that is generally unknown to retail investors.

- 💽 Retail investors can be influenced by smart money movements as these players are considered to have resource advantages, such as connections, experience, and access to more comprehensive data and analysis than retail investors.

- 📈 An individual or group can be categorized as smart money if it shows consistency and the ability to outperform the performance of most traders over a certain period.

Definition of Smart Money

Smart money is funds that come from an experienced individual or group of people, who make investment or trading decisions based on sound strategy, analysis and market understanding. This concept is not only applicable in the crypto market, but is also found in various other financial markets such as stocks and gold.

In the context of the crypto market, smart money is identified through accounts or wallets that show consistent gains over a period of time. This can be analogized to someone throwing darts at a target board. It’s not one throw that happens to be right in the center of the bull’s-eye, but rather the ability to consistently and repeatedly hit the target.

Keep in mind, the amount of capital you have does not necessarily make an account or wallet smart money. Rather, it reflects the quality of decision-making that does not rely solely on speculation or luck, but rather on a measured strategy.

In practice, smart money uses a variety of approaches in trading and investing, including the application of the Wyckoff pattern as part of a market analysis strategy. This pattern can be used not only by smart money, but also by many traders to help identify trends and price movement phases.

Learn more: Smart Money Trading with the Wyckoff Pattern

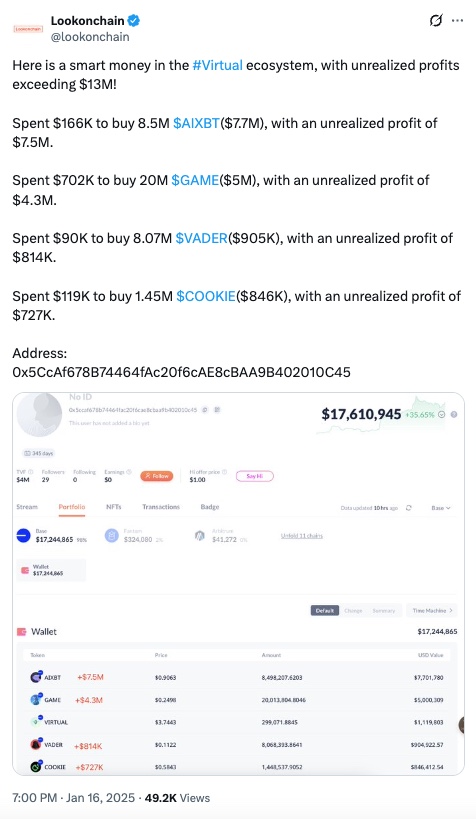

Smart Money Example

Individuals or groups categorized as smart money are generally characterized by the ability to generate profits consistently on more than one asset, rather than relying solely on the performance of one particular position.

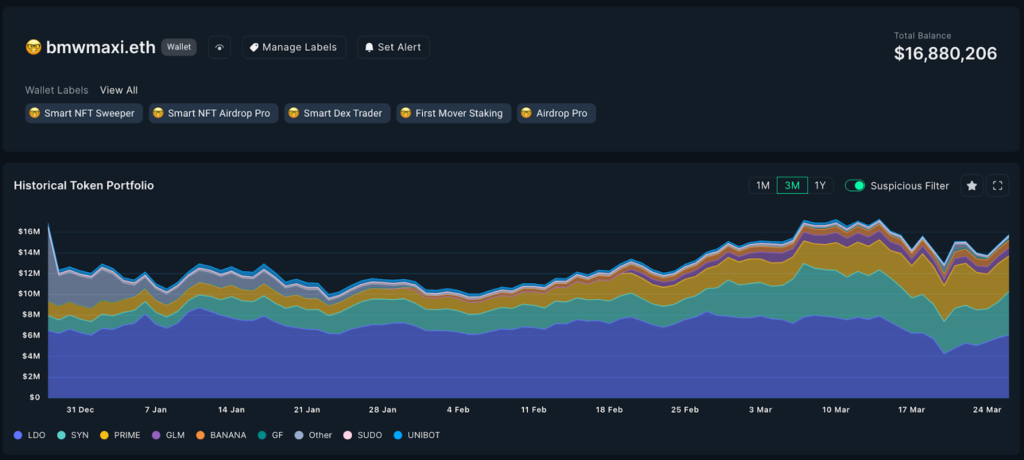

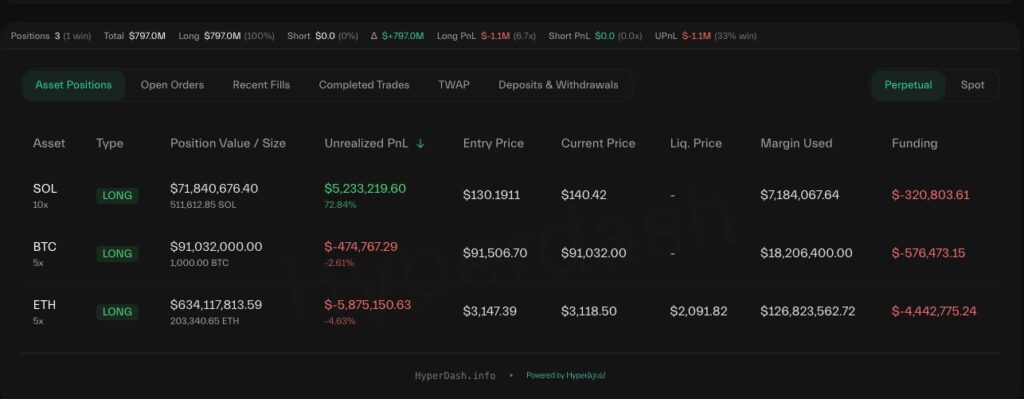

In the example above, the smart money is recorded as opening several positions on different assets with significant unrealized profits. This pattern shows that the profits are not derived from a single transaction, but rather from a measured capital management strategy, where capital is allocated to multiple assets rather than being focused on a single asset.

Smart Money Influence

Large purchases of crypto assets can indeed influence price movements. However, not all large-scale transactions come from smart money, as some of them can be made by whales.

While whales and smart money can both be identified through transaction history, they have different characteristics. An individual can be categorized as a whale based on the size of their asset holdings. Meanwhile, smart money is generally characterized by the consistent quality of transaction decision-making, with large capital holdings acting as a supporting factor rather than the main determinant.

Smart money can influence price movements through two main mechanisms:

- Large-scale transaction actions, such as buying or selling in significant volumes, which can directly affect liquidity and asset price movements.

- Market signal formation, where smart money actions such as accumulation are responded to massively by retail investors, thus reinforcing the direction of price movement.

Smart money is believed to have greater resources, such as capital, connections, experience and access to information. These advantages create market signals that boost investor confidence, encouraging them to follow transactions initiated by smart money.

Characteristics of Smart Money

Retail investors can identify smart money through various methods, including on-chain analysis to observe institutional and informed trading activity. Here are some of the main characteristics that are often observed:

- Smart money tends to purchase assets during relatively quiet market phases, such as when trading volumes are low or retail investor sentiment is not widely formed.

- Generally, assets accumulated by smart money have the potential to increase in price, either due to increased participation of retail investors or the emergence of certain catalysts related to the asset after it has been purchased.

- Smart money accounts usually have significant and relatively consistent profit growth over a period of time.

- Do not always make large purchases of assets, but rather adjust them according to the strategy and condition of the asset.

- Generally, smart money usually closes positions or exits the market faster than regular traders or investors.

- Smart money generally purchases assets gradually and avoids placing all funds in one asset as part of its risk management strategy.

How to Track Smart Money

Onchain analysis is one approach that can be used to track smart money activity by utilizing various supporting platforms. The following tools are commonly used to identify smart money movements:

Platform used:

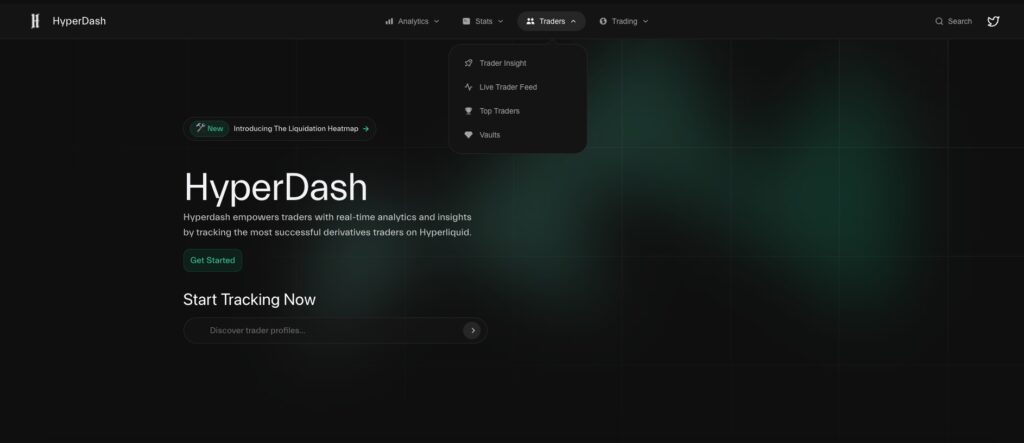

- HyperDash

- Access HyperDash: https://legacy.hyperdash.com/

- Select “Traders > Traders Insight”.

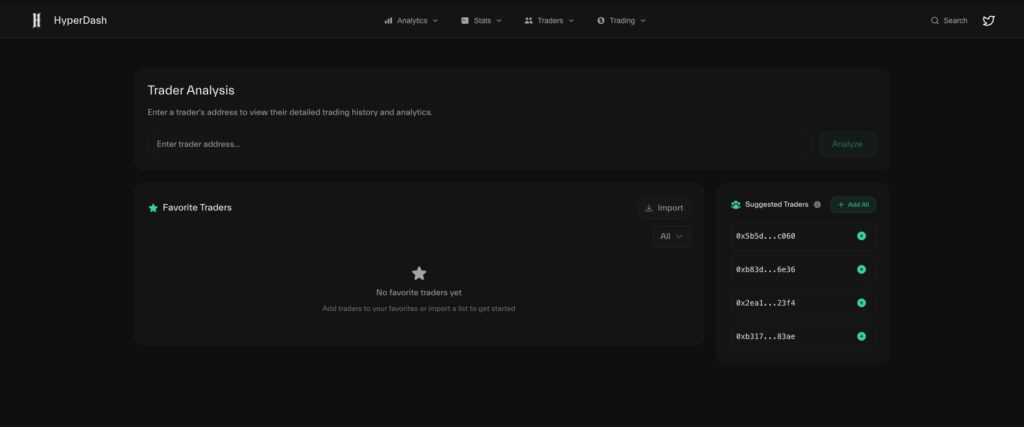

3. You can enter the addresses you want to track, either based on the addresses with the largest PnL on a particular token or trader addresses recommended by HyperDash.

4. For example, we can choose one of the trader addresses recommended by HyperDash. Then, select the right arrow.

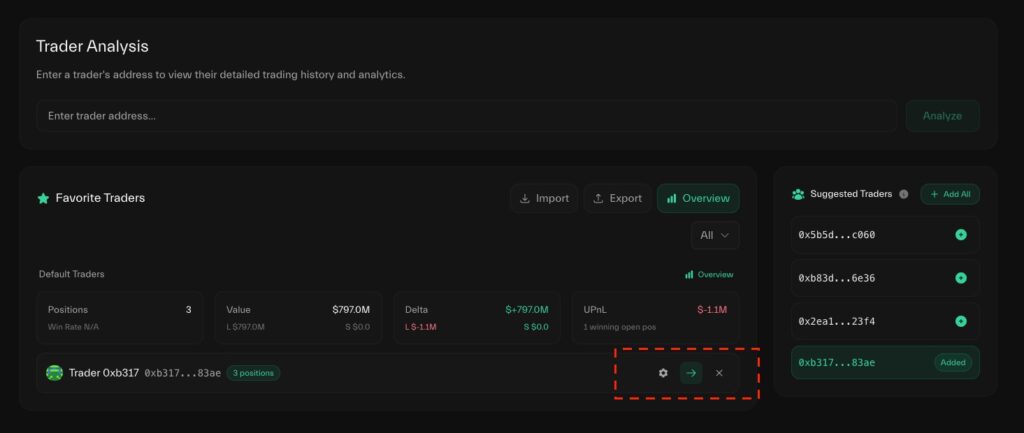

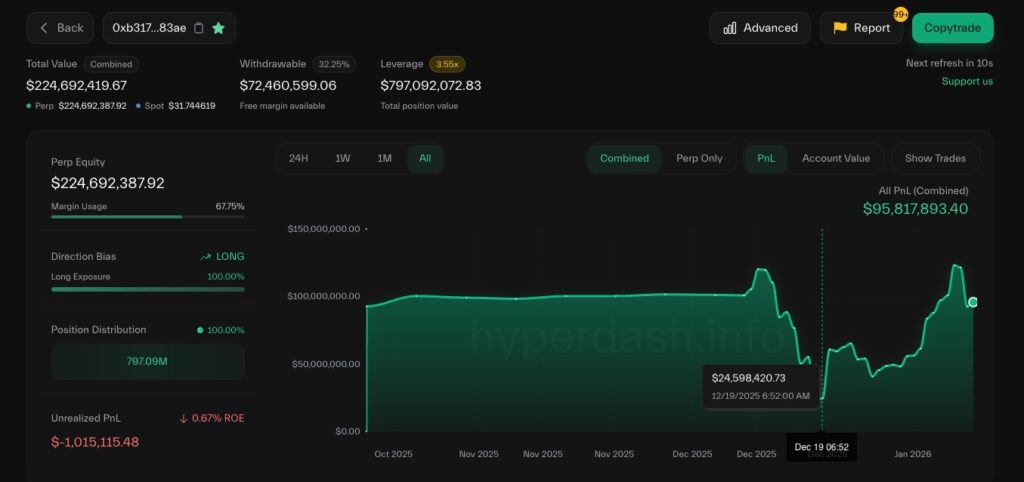

5. Analyzing PnL, positions, asset holdings, and transaction timeframes provides a more comprehensive view of performance. For example, the following wallet addresses show significant and consistent positive PnL.

6. This information allows users to analyze positions, including entry price, position value, current price, and ongoing unrealized PnL.

The example above shows the characteristics often associated with smart money. Although currently unrealized at a loss, his PnL over recent months has remained consistently positive.

How to Buy Crypto Assets on Pintu

After getting to know smart money, you can start investing in crypto such as BTC by buying them on Pintu. Here are the easy steps to invest in the Pintu app:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up your Pintu balance using your preferred payment method.

- Go to the market page and search for BTC, SOL, ETH.

- Click buy and fill in the amount you want.

- Now you’re invested in crypto assets!

In addition, all crypto assets on Pintu have gone through a rigorous assessment process and prioritize the principle of prudence.

Download Pintu crypto app on Play Store and App Store! Your safety is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

In addition to making transactions, on Pintu app, you can also learn more about crypto through various Pintu Academy articles that are updated weekly!

Conclusion

Understanding the movement of smart money can provide traders with additional information for making trading decisions. By observing capital capacity and positions, traders can analyze smart money entries and validate them with technical and fundamental analysis. However, the movement of smart money cannot be used as the only reference or basis for making trading decisions. Decision-making still requires more in-depth analysis and careful consideration.

Disclaimer: All articles from Pintu Academy are intended for educational purposes and do not constitute financial advice.

References

- Caroline Banton, “Understanding Smart Money: Insights for Investors and Traders“, Investopedia, accessed on January 7, 2026.

- Martin Lee, “What is Smart Money in Crypto? A Detailed Look into Our Methodology”, nansen.ai, accessed on January 8, 2026.

Share