What is Sushiswap (SUSHI)?

Sushiswap

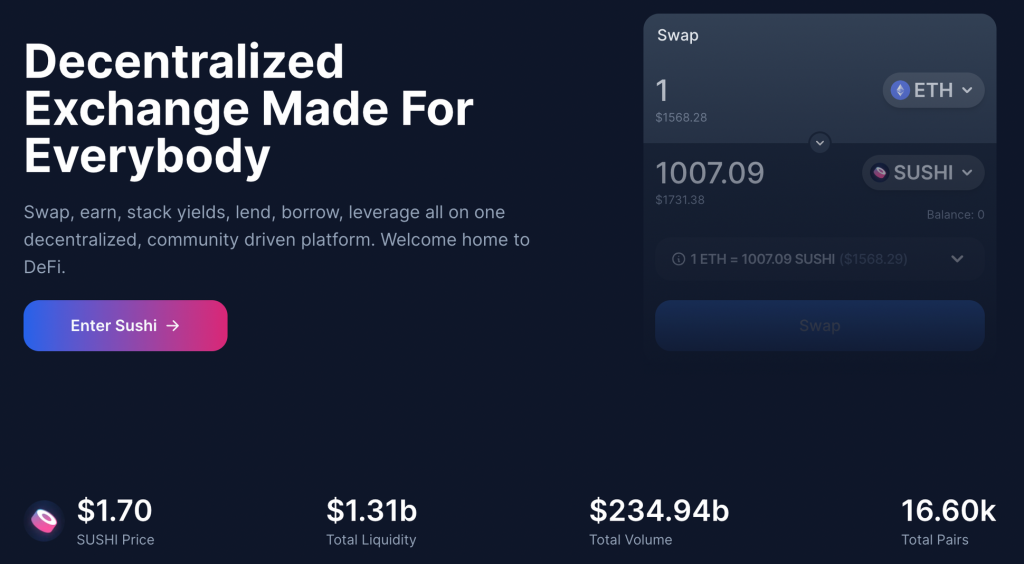

Launched during the DeFi Summer of 2020, Sushiswap is one of the most popular DeFi products that operate on the Ethereum network. Sushiwap was able to amass a sizable amount of liquidity at the start of its introduction, totaling 1.3 billion US dollars, and it shocked the crypto industry. So, what is Sushiswap? What are the advantages of using Sushiswap? This article will explain about the platform in detail.

Article summary

- 👋 Sushiswap is a decentralized crypto exchange that runs on the Ethereum network and is community-oriented.

- 💻 Sushiswap utilizes Automated Market Maker (AMM) technology through smart contracts to exchange crypto assets. With AMM, also known as peer-to-contract trading, buyers are directly connected to smart contracts that execute transactions using the liquidity pool.

- 🍣 SUSHI is the native token of Sushiswap, which is an ERC-20 standard token. As a liquidity provider, you can earn SUSHI tokens for free.

- 💹 There are several exciting products you can use on Sushiswap, namely staking, farming, lending and borrowing.

What is Sushiswap?

Before we talk about Sushiswap, let’s learn about decentralized exchange (DEX). A decentralized exchange (DEX) is a crypto exchange where trades are conducted directly between users. DEX uses Automated Market Maker (AMM) technology to perform the cryptocurrency trades through smart contracts.

AMM technology requires a liquidity pool as a source of liquidity to exchange crypto assets. A liquidity pool is a ‘place’ where crypto investors deposit their funds to provide liquidity to a pair or pool of crypto asset. Liquidity providers are investors or users who provide liquidity. By depositing their assets, liquidity providers will receive a small fee for each swap transaction carried out for that specific pool.

Click this link for further explanation about Automated Market Maker (AMM).

So, what is Sushiswap? Sushiswap is a DEX that runs on the Ethereum network and is a community-oriented organization. The platform facilitates users to exchange crypto assets without any intermediaries and is non-custodial. When a transaction occurs, Sushiswap processes it directly by utilizing a smart contract and does not store the user’s funds. SUSHI is Sushiswap’s native token which is ERC-20 standard.

Sushiswap features a functioning system similar to Uniswap. Sushiswap, however, added new features to its protocol in the form of community governance and a reward system using SUSHI tokens, setting it apart from Uniswap.

💡 Sushiswap transferred liquidity funds from Uniswap to provide liquidity. Uniswap users earn tokens in return for being liquidity providers. The group of reward tokens is then swapped for crypto assets at Sushiswap by the Sushiswap developers. Thus, Uniswap’s liquidity becomes Sushiswap’s liquidity. This system is known as Vampire Mining because it ‘sucks’ Uniswap liquidity.

Who is the Developer of Sushiswap?

Sushiswap was launched in August 2020 by two pseudonymous developers, Chef Nomi and 0xMaki. The launch took place during the “DeFi Summer”, a time when DeFi projects experienced rapid growth.

The project caused controversy when Chef Nomi, the project’s founder, was accused of committing an exit scam. This incident caused SUSHI token price to decrease by 75%. He exchanged SUSHI tokens for ETH worth 14 million USD on September 5, 2020.

The following day, Chef Nomi offered to transfer all keys to the project to the CEO of FTX exchange, Sam Bankman-Fried (SBF). SBF accepted the offer and then Sushiswap successfully migrated funds from Uniswap to Sushiswap’s liquidity pool and won back the trust of the community.

On September 11, 2020, Chef Nomi returned 30.000 ETH to Sushiswap developers and he apologized on his Tweet.

How Does Sushiswap Work?

Sushiswap utilizes AMM technology through smart contracts to exchange crypto assets. When using a centralized exchange, you must deposit tokens into the exchange, make an order on the order book, and then withdraw the tokens that have been swapped. On Sushiswap, you can just swap your tokens directly from your wallet without having to go through the steps above.\

With AMM, crypto prices are determined by mathematical formulas and does not use an order book as used by a centralized exchange (CEX).

You are undoubtedly familiar with a peer-to-peer trading, which connects sellers and buyers directly. Automated Market Makers can be viewed as peer-to-contract solutions, because trades take place between users and a smart contract. The users execute the trade against the liquidity in the liquidity pool with smart contracts. So, the buyers only need a liquidity pool with sufficient tokens.

Each transaction on this platform will be charged a fee of 0.3%, with the following distributions:

0.25% for liquidity providers

0.05% for SUSHI token holders.

Read more about What is DeFi?

The scheme of distributing SUSHI tokens as a reward to liquidity providers is called liquidity mining. The more crypto assets you deposit, the more SUSHI tokens you will get.

💡 Liquidity mining is a DeFi mechanism when users get new tokens by depositing crypto assets in a liquidity pool.

One of the popular DEX is Pancakeswap. You can read the article here.

What Features Are in Sushiswap?

SushiSwap Exchange

Sushiswap Exchange is the basic product of Sushiswap. It eases users to swap or exchange crypto assets. To use this feature, users must have some ETH on hand to cover the gas fees. And then, users need a crypto wallet to connect with Sushiswap Exchange. Afterwards, users can exchange tokens just as in other DEXs.

💡 Crypto wallets that integrate with Sushiswap: Metamask, Coinbase Wallet, Binance Wallet, Portis, Fortmatic, Clover, Gamestop, and Walletconnect.

For example, you have ETH in your wallet and you want to buy SUSHI on Sushiswap. You purchase SUSHI with the ETH you have by swapping ETH into SUSHI. Also note that for swapping crypto assets, Sushiswap applies a fee of 0.3% per transaction.

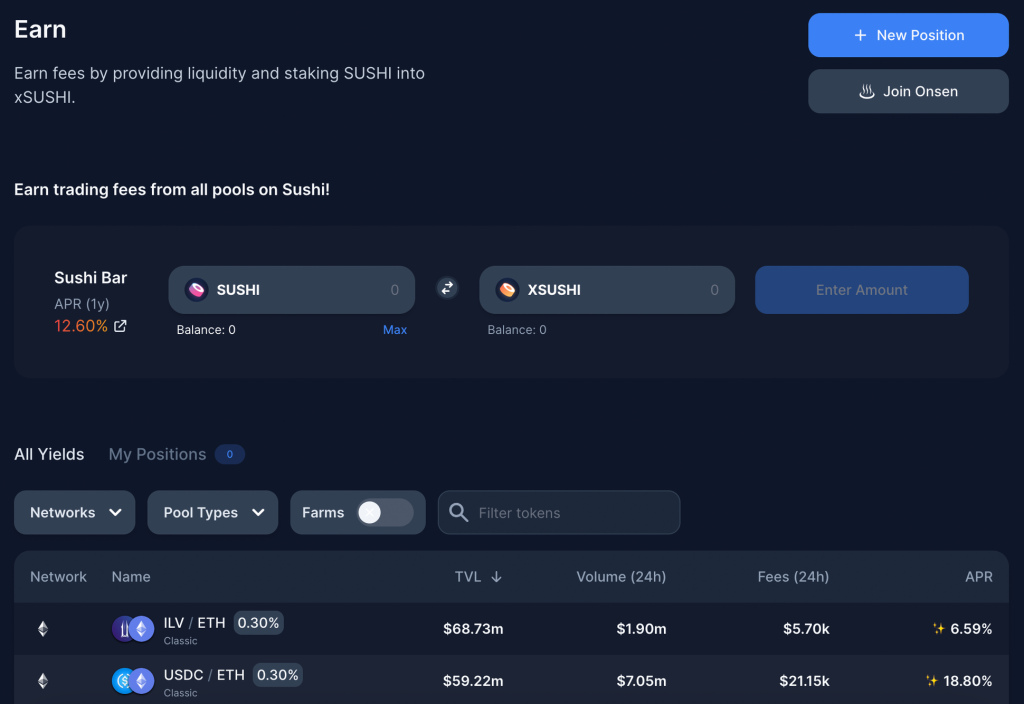

Sushi Bar Staking

Sushi Bar is a staking feature on Sushiswap. Users can stake SUSHI tokens to earn xSUSHI. By holding xSUSHI tokens, users can take part in the Sushiswap community, such as voting, and get 0.05% of the swap fee.

As previously mentioned, when users swap tokens on Sushiswap Exchange, they will be charged 0.3% fee. Further, a 0.05% fee is added to the Sushi Bar to create new tokens. As of this writing, the SUSHI staking reward is 12.60% APY.

Kashi

Kashi is one of the features on Sushiswap that offers lending and borrowing crypto assets for isolated margin trading.

Isolated margin trading in crypto is a crypto trading that uses funds from a third party (from Sushiswap’s liquidity pool), with predefined funds to open a long or short position. In other words, users guess the crypto price movement will go up or down.

Users can deposit crypto assets into the liquidity pool to take part as a lender. Afterward, they will get a reward from the fee of the borrower who borrows the crypto asset. In comparison, the borrowers must provide collateral in crypto assets and pay interest on the loan.

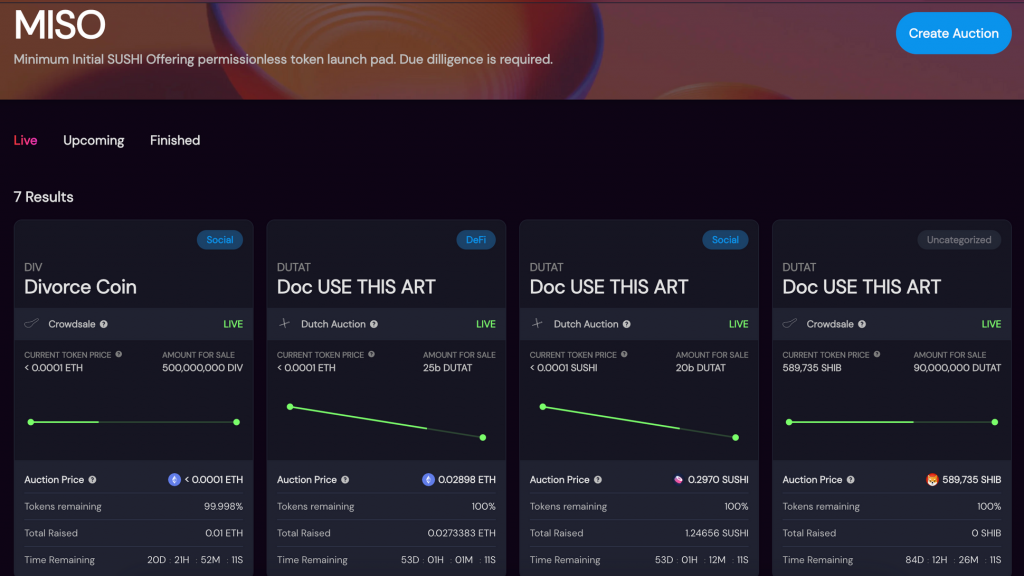

MISO (Minimum Initial SUSHI Offering)

MISO is a Sushiswap product like a launchpad to launch new tokens on Sushiswap Exchange. This platform works to generate liquidity for new tokens and implements ‘new token offerings.’

In other words, MISO eases token creators to launch new tokens on the Sushiswap platform.

💡 Launchpad is a platform that token creators use to introduce new tokens and accumulate liquidity. Crypto investors also use Launchpad to get lower starting prices.

Advantages of Sushiswap

- 🍣 Sushiswap applies a flat fee for all transactions, which is 0.30%. Of this fee, 0.25% goes to liquidity providers, and the rest goes to SUSHI token holders.

- 🌏 Users can buy crypto assets using fiat money (not available in Indonesia yet) on Sushiswap. It supports more than 21 local payment methods across the country.

- 🌐 Sushiswap is a community-oriented DEX. The community can determine the development and future of the Sushiswap protocol.

- 🔗 Sushiswap uses multichain to support activities in its system. It collaborates with fourteen blockchains, including Ethereum, BSC, Polygon, Avalanche, Harmony, Fantom, and other blockchains.

- 🛡️ Sushi Guard protects you from MEV (Maximal Extractable Value) attacks using OpenMEV.

💡 MEV (Maximal Extractable Value) is the profit miners or validators make from pending transactions by entering, excluding, or rearranging transactions in blocks. This process usually uses bot to detect MEV opportunities automatically.

SUSHI as Investment

As of this writing (November 11, 2022), the price of SUSHI token is at 1.21 US dollars with a 24-hour trading volume of 137.100.396 US dollars. The chart above shows that the price of SUSHI tokens decreased at the end of 2021 and had a reversal in mid-December 2021. Along with the bearish condition in the crypto market, SUSHI tokens price fell from January 2022 and moved sideways from May to now.

Initially, SUSHI did not have an unlimited supply of tokens. However, the community suggested limiting the token supply to 250 million SUSHI tokens. Currently (November 11, 2022), a total of 244.542.059 SUSHI is already circulating in the market.

Before investing on Sushiswap, you may want to take the Sushiswap roadmap into consideration. It is planning to focus on developing Shoyu 2.0 Beta (NFT Marketplace), improving Kashi, increasing budget transparency through community oversight, among other developments.

However, investing in crypto products, including Sushiswap, carries significant risk. So, make sure you do your research before making an investment.

How to Buy SUSHI at Pintu

You can start investing in SUSHI tokens by buying them on Pintu. Here’s how to buy SUSHI on Pintu:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for the SUSHI token.

- Click buy and fill in the amount you want.

- Now you have SUSHI tokens!

In addition, Pintu is compatible with various popular digital wallets such as Metamask to facilitate your transactions. Come and download the Pintu cryptocurrency app on Play Store and App Store! Pintu is regulated and supervised by CoFTRA and Kominfo.

You can also learn more crypto through the various Pintu Academy articles which are updated every week! All Pintu Academy articles are for educational purposes, not financial advice.

References

- Sushi, The Sushiswap Project, Medium, diakses 25 Oktober 2022

- Ayoki, Introducing Kashi Lending & Margin Trading on SushiSwap’s BentoBox, Medium, diakses 25 Oktober 2022

- Ayushi Abrol, Uniswap VS Sushiswap: A Detailed Comparison, Blockchain Council, diakses 25 Oktober 2022

- Griffin Mcshane, What Is SushiSwap? How to Get Started on the Crypto Exchange, Coindesk, diakses 25 Oktober 2022

- Sushiswap, Minimal Initial SushiSwap Offering, Gitbook, diakses 26 Oktober 2022

- Jiro, Sushi 2.0: A Restructure For The Road Ahead, Mirror, diakses 1 November 2022

Share

Related Article

See Assets in This Article

SLP Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-