What is the Funding Rate? Why is it Important?

Trading crypto comes in various forms such as spot and futures trading. Within futures trading, there are two types: traditional futures contracts and perpetual futures contracts. Most retail traders typically use perpetual futures contracts because they have a mechanism called the funding rate that doesn’t require a settlement process. In this article, we’ll discuss what the funding rate is and why it’s important for futures traders. Read on for more details.

Article Summary

- ✍🏻 The funding rate is the difference between the price of a perpetual futures contract and the index price that corresponds to the spot market price of the underlying asset.

- 📓 Funding rates are used when trading perpetual futures contracts because these contracts don’t require settlement.

- 🔑 By understanding the funding rate, traders or investors can get a glimpse of the market’s movement. If it’s positive, it indicates bullish market sentiment. If the refinancing rate is negative, it indicates a bearish trend.

Understanding Traditional Futures Contracts and Perpetual Futures Contracts

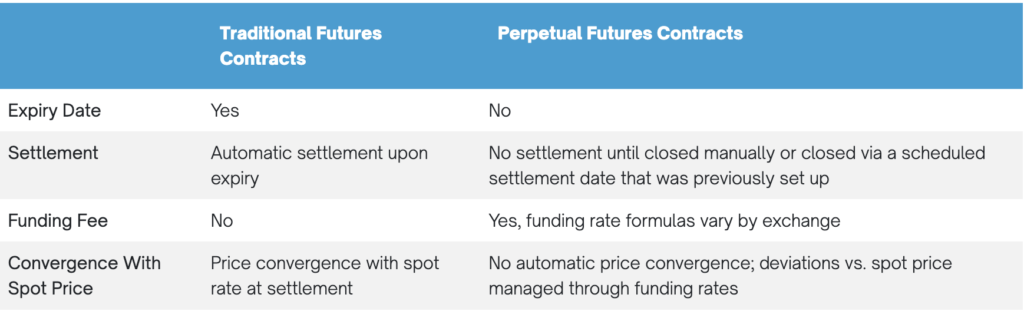

Before discussing what the crypto funding rate is, the introduction above briefly mentioned traditional futures contracts & perpetual futures contracts, both of which are related to the funding rate.

Traditional Futures Contracts

Traditional futures contracts are where buyers and sellers of future contracts meet and drive the contract price toward the spot market price by taking long or short positions. This trading occurs throughout the day in traditional financial markets. Traditional futures contracts typically have a settlement process where the trade becomes final on the settlement date and the buyer must pay the seller. This settlement process is usually completed on a monthly or quarterly basis.

Perpetual Futures Contracts

Unlike traditional futures contracts, perpetual futures contracts are trades based on the same principles as traditional futures. The main difference is that crypto exchanges such as Binance and Bitfinex offer perpetual contracts, allowing traders to hold a position without an expiration date. This can eliminate the need to worry about settling the contract on a specific date.

Because perpetual futures contracts don’t have an expiration date, some exchanges use a mechanism to ensure that the future price and the index price meet periodically. This method is known as a funding rate.

What is the Funding Rate?

Now that we understand the two types of futures contracts, we will discuss what the funding rate is. The funding rate is the difference between the price of a perpetual futures contract and the index price that corresponds to the spot market price of the underlying asset. The funding rate ensures that the funding mechanism aligns the price of the perpetual futures contract with the index price. This alignment is intended to prevent prolonged price divergence between the two markets.

How to Calculate the Funding Rate

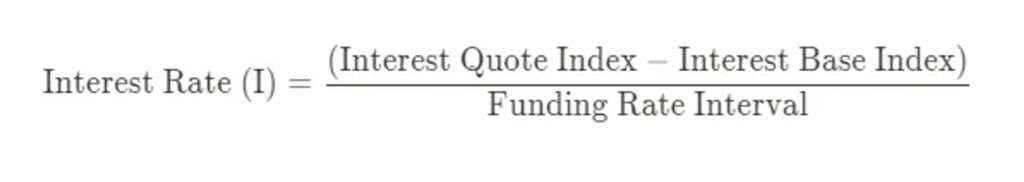

The funding rate can be said to have a straightforward calculation method in most exchanges. The way to calculate the funding rate is as follows:

Funding rate = Premium Index (P) + clamp (Interest Rate (I) — Premium Index (P), 0.05%, -0.05%)

Clamp is used with a ceiling and floor of 0.05% and -0.05%, respectively. Thus, if (I – P) falls within +/- 0.05%, then F = P + (I – P) = I.

- The interest quote index is the lending interest rate for the quote currency.

- The interest base index is the lending interest rate for the base currency.

- The funding rate interval is the periodic interval where interest rates are recalculated.

To better understand this formula, consider the following: Interest rate contracts are traded with a base currency and a comparison currency (e.g., BTC – base, USD – comparator), and the interest rate is a simple calculation between the two that applies as follows:

For example, exchanges like Binance and Bybit have a USD interest rate of 0.06% and a BTC interest rate of 0.03%, so there’s a difference of about 0.03%. The funding rate interval for most exchanges is 8 hours, so the interest rate is as follows= (0.06-0.03) / (24/8) = 0.01% (magic number).

What Determines the Funding Rate?

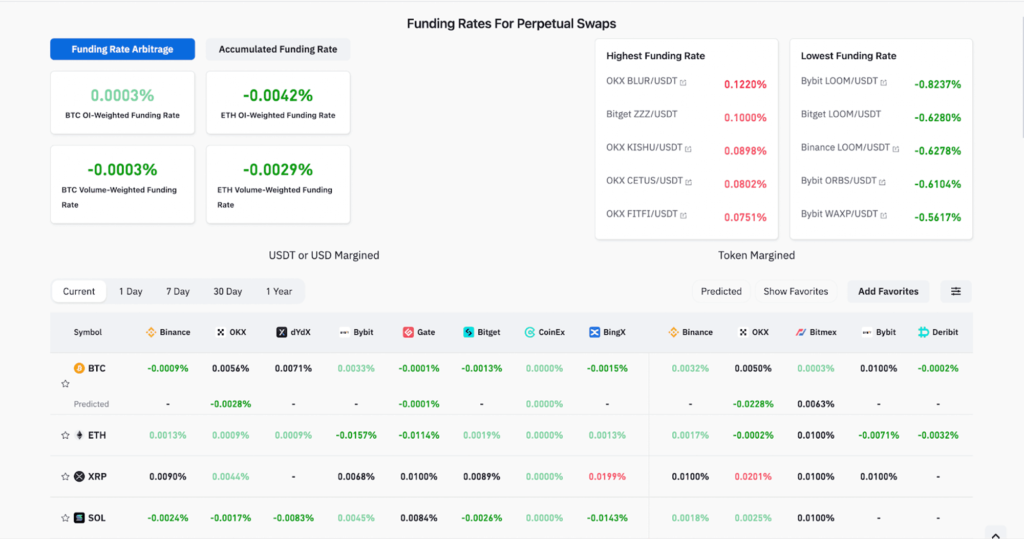

The funding rate has two components, the interest rate and the premium. The interest rate is fixed, while the premium can vary based on the price difference between the perpetual futures contract and the market price.

- The interest rate is fixed and set by the exchange (it can vary for each crypto asset).

- The premium (or discount) changes based on how far the price of the perpetual futures contract is from the spot price.

Essentially, the funding rate creates a cost for one side of the trade and a discount for the other side. It acts as an incentive to keep the perpetual futures contract close to the spot price.

Why is the Funding Rate Important?

The funding rate can be positive or negative, affecting the sentiments derived from these values, including

- A positive funding rate is when the perpetual is trading above the spot price. Long traders are willing to pay a fee to short traders.

- A negative funding rate is when the perpetual is trading below the spot price. In this case, short traders pay a fee to long traders.

By knowing the funding rate, we can gauge the state of the market. The funding rate often reflects the state of the market, with a higher positive funding rate indicating bullish market sentiment. Conversely, negative funding rate indicates a bearish trend.

How to Use the Funding Rate For Trading

There are four types of strategies that involve the use of the funding rate in trading, which are

- Sentiment Reading: The funding rate is an indicator to measure market sentiment. This indicator reflects the behavior and psychology of the market and indicates whether long or short positions are more aggressive. By understanding the funding rate, especially in sentiment reading, traders can gain insights that help them make more accurate trading decisions.

- Divergence: The Funding Rate can also be used in conjunction with market trends. When there is a divergence between the price trend and the funding rate, such as when the price moves up while the funding rate remains negative, it can signal market pressure that’s going against the trend. On the other hand, convergence between the two can provide more confidence in trend analysis.

- Funding Rate Trading: This strategy aims to profit from funding rate payments without speculating on the direction of the asset’s movement. Traders simultaneously buy in the spot market and sell in the perpetual market. Although these two positions offset each other in terms of asset direction, the selling position in the perpetual market provides profit from the funding rate payment.

- Trade against the funding rate: This strategy involves trading against the short-term market trend to take advantage of the funding fees. By taking a position against the trend just before the funding fee update, traders can capture these fees as profit. However, this strategy is risky and is best suited for those who are willing to pay funding fees. Using automated bots is the best way to implement this.

Conclusion

The funding rate can help align the perpetual rate with the spot price of crypto. By studying the funding rate, you can understand the elements that can affect the rate without having to calculate the rate for each transaction, as the exchange will do that for you.

The funding rate can be a powerful metric to determine the future price of a crypto asset. However, the funding rate should be used in conjunction with other metrics to more accurately predict market direction. That’s where the role of traders and investors comes in, to do more research before deciding to invest.

Read more: Decentralized Perpetual Trading: The Future of Derivatives?

References

- Eric Huffman, What Are Crypto Funding Rates?, Milkroad, accessed on 18 October 2023.

- Kyrian Alex, Newbie’s Guide to Understanding Crypto Funding Rates, accessed on 18 October 2023.

- Cnbctv18.com, What is Bitcoin funding rate and why does it matter, accessed on 18 October 2023.

- Steve Obasi, Understanding and Utilizing the Funding Rate in Crypto Trading, Medium, accessed on 18 October 2023.

Share