What is the Tokenized Silver ETF (SLVon)?

The tokenized Silver ETF is a blockchain-based investment asset designed to provide exposure to silver without having to directly own physical silver. Amid limited liquidity in traditional markets, SLVON is a digital alternative that allows investors to access silver on-chain, is more flexible, and can be traded 24 hours through the crypto ecosystem. This article will discuss how SLVon works, advantages and disadvantages, regulations, and how to invest in SLVon!

Article Summary

- 🥈 SLVON is a tokenized Silver ETF that provides exposure to on-chain silver without physical ownership.

- 🔗 Traded 24/7 on the blockchain, transferable, stored in wallets, and used in DeFi.

- ⚙️ Supported by regulated custodians with mint and redeem mechanisms to align with NAV.

- 📊 A ttract investor attention in 2026, as silver prices rally and market cap increases.

- ⚖️ Regulations are still evolving, so it is important to understand the legal and technological risks.

Definition of the Silver Tokenized ETF (SLVon)

SLVon is a blockchain-based asset that represents the iShares Silver Trust, one of the largest silver ETFs in the world. The token was issued by Ondo Global Markets with the aim of bringing silver exposure to the on-chain ecosystem. Each SLVon reflects the price movement and net asset value (NAV) of the underlying silver trust. However, ownership of this token does not grant rights to physical silver and is backed by a regulated custodial infrastructure.

Unlike conventional silver ETFs, SLVon can be traded 24/7 on crypto exchanges and transferred directly via blockchain. Moreover, the token can be used in various DeFi applications, thus providing more flexible and liquid access to silver in the digital asset ecosystem.

How SLVon Works

Here’s how the SLVon Tokenized Silver ETF published by Ondo Global Markets works:

- SLVon’sasset and custodial structure is backed by assets tied to silver and held through regulated custodians. This structure ensures each SLVon token represents a comparable economic exposure to the value of the silver on which it is based.

- Issue and redemption process Eligible users can mint or redeem SLVON through Ondo’s infrastructure using stablecoins. This mechanism is designed to keep the market price of SLVon aligned with the net asset value (NAV) of the underlying silver.

- On-chain trading Once issued, SLVon can be freely traded on blockchain networks and supporting crypto exchanges. Investors can buy, sell or transfer SLVon at any time without being limited to traditional commodity market hours.

Pros and Cons of SLVon

Here are the advantages and disadvantages of SLVON:

SLVON Pros

- 24/7 and Global Access: SLVON can be traded on-chain around the clock and is available to non-US investors without the constraints of traditional exchange hours, providing more flexibility than conventional silver ETFs.

- On-Chain Liquidity and Fast Settlement: SLVON transactions are settled almost instantly on the blockchain network, in contrast to the T+2 settlement cycle of traditional markets.

- Silver Price Exposure & Dividend Reinvestment: The token mirrors the performance of iShares Silver Trust (SLV) and allows dividends to be automatically reinvested.

- Fractional Ownership and DeFi Integration: Investors can own a small portion of silver exposure and use SLVON in decentralized finance applications for broader strategies.

Disadvantages of SLVON

- No Physical Ownership Rights: SLVON holders do not have rights to physical silver or shareholder votes as with traditional ETFs.

- Smart Contract and Infrastructure Risks: As it operates on the blockchain, SLVON is vulnerable to technological bugs or security holes in smart contracts.

- Dependence on Issuer and Custodian: SLVON’s value and access depend on Ondo Finance and the custodians managing the underlying assets, which carries operational risks.

- Changing Regulations: Commodity asset tokenization falls under an evolving legal framework, potentially presenting regulatory uncertainty in the future.

Why SLVon is Starting to Attract Investor Attention in 2026?

The increased attention to SLVon in 2026 was triggered by a combination of global macroeconomic pressures and the widening adoption of on-chain assets. In a short period of time, token-based silver trading activity surged sharply, as SLVon’s asset value breached tens of millions of dollars and the number of holders grew significantly.

This trend is in line with the silver price rally that surpassed $80 per ounce, influenced by the limited supply structure. About 70-80% of the world’s silver is produced as a by-product of lead, zinc, copper and gold mining, making its supply highly dependent on the mining activities of other metals. This dependence makes silver supply relatively rigid when demand increases.

Under these conditions, SLVon becomes an efficient on-chain alternative to gain silver exposure. Investors can access the 24-hour market without traditional intermediaries, supported by on-chain liquidity, instant transactions and fractional ownership. SLVON’s growth reflects the growing interest in tokenized commodities as a more flexible option than conventional precious metals markets.

Significant Growth in SLVON Asset Value

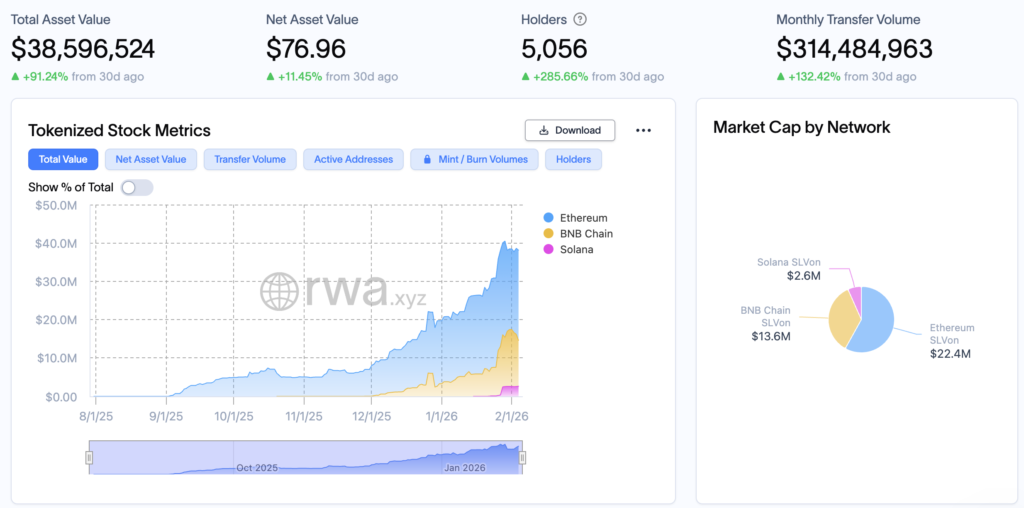

The latest data shows that SLVON’s total asset value has reached $38.59 million, registering an increase of about 91% compared to the previous 30 days. This surge reflects strong capital flows into the tokenized silver instrument, as investors’ interest in commodity-based assets in the crypto ecosystem grows. The increase in asset value also signifies a growing supply of tokens circulating on-chain. Overall, this trend reflects an aggressive expansion phase from late 2025 to early 2026.

Increase in Net Asset Value and Holder Activity

SLVON’s Net Asset Value (NAV) stood at $76.96, an increase of approximately 11.45% in the last 30 days. This increase in NAV is in line with the rally in global silver prices and reinforces SLVON’s appeal as a digital silver exposure instrument. The number of holders also jumped sharply to 5,056 addresses, growing by over 285% on a monthly basis. This growth in the number of holders is indicative of wider adoption from both retail investors and crypto users seeking asset diversification.

Surge in On-Chain Transfer Volume

SLVON’s on-chain activity is reflected in the monthly transfer volume which reached USD 314.48 million, up more than 132% compared to the previous month. The high transfer volume indicates increased liquidity and frequency of transactions on various blockchain networks. This strengthens SLVON’s position as an actively traded asset, not just a passive instrument. This increased activity also reflects the market’s confidence in the tokenization mechanism and its supporting infrastructure.

Example of Tokenized Silver Products (ETF and Non-ETF)

The following are examples of tokenized silver products (ETFs and non-ETFs) that are already available or being developed in the on-chain market:

- iShares Silver Trust Tokenized ETF (SLVON) – This is an on-chain token representing iShares Silver Trust (SLV), one of the largest silver ETFs in the world. The product is issued by Ondo Global Markets and allows investors to gain exposure to silver prices digitally on the blockchain, including 24/7 trading capabilities and DeFi integration, without physical ownership of the metal.

- Silver Token (XAGX) – A silver token alternative backed directly by physical silver, popular for low cost trading on the Avalanche network. This product represents actual ownership of silver in a certain ratio and is positioned as an easy to trade silver tokenization option for retail investors.

- Kinesis Silver (KAG) – A tokenized silver product that provides potential returns as well as a one-ounce physical silver representation, with a yield-bearing focus through ownership of regularly audited bullion.

- Wealth99 Silver – A silver token instrument that provides physical silver investment options that are fully insured and stored in secure vaults while still being traded on the blockchain.

These products represent the shift of traditional silver assets to digital formats with high on-chain liquidity, fractional ownership, and wider global access than conventional ETF instruments.

The Difference between a Tokenized Silver ETF and a Traditional ETF

Here are the key differences between SLVon and traditional silver ETFs such as iShares Silver Trust (SLV):

- SLVon’s tradinghours can be traded 24/7 via the blockchain network, while conventional silver ETFs are only available during stock exchange hours and are affected by market holidays.

- Transactionsettlement speed SLVon transactions are settled almost instantly on-chain, unlike traditional ETFs which generally use a T+2 settlement system.

- SLVon’sglobal accessibility is accessible to qualified global users without the need for a brokerage account, whereas traditional silver ETFs are limited to specific equity markets and jurisdictions.

- SLVon’s on-chain flexibility can be stored in personal wallets, transferred directly, and used in various DeFi applications, a feature not available with conventional ETF shares.

- SLVon’srisk profile has additional risks related to smart contracts and token issuers, while traditional ETFs are more exposed to custodial risks and centralized financial institution structures.

These differences make SLVon a more suitable silver ETF alternative for investors who prioritize 24/7 liquidity and integration with the crypto ecosystem.

Regulation of Tokenized Silver ETFs Globally

Here is an overview of the regulations governing tokenized silver ETFs such as SLVon and the legal challenges that still surround them:

Regulation in the United States and Guidelines for Tokenized Securities

US financial regulators such as the U.S. Securities and Exchange Commission (SEC) have issued guidelines regarding tokenized securities, including assets represented on the blockchain (e.g. commodity tokens or securities tokens).

The guidance helps determine whether a token should be treated as a security under federal law and confirms registration, disclosure, and investor protection obligations if the token is categorized as a security. The adoption of these guidelines will affect the legal structure and compliance for products such as tokenized silver ETFs to comply with applicable capital markets regulations.

Regulatory Framework in Indonesia

In Indonesia, the Financial Services Authority (OJK) is developing rules fordigital financial asset offerings, including tokenized assets offered to the public. This draft regulation covers the definition of digital assets, classification, issuance requirements, as well as license requirements and offering processes that must be met before they can be marketed to domestic investors. These provisions will provide legal certainty and oversight over the marketing and distribution of asset tokens in the Indonesian market.

International Framework and Legal Challenges

In a global context, organizations such as the International Organization of Securities Commissions (IOSCO) note that the tokenization of financial assets presents its own regulatory challenges, including legal recognition of tokens as representations of assets, investor rights, and technological risks such as smart contracts.

In general, the regulation of tokenized silver ETFs is still evolving and largely depends on the jurisdiction where the token is offered, how the token is classified (securities, commodities, or other), as well as the mechanisms for compliance with capital market rules, investor protection, and the security of the blockchain technology used.

How to Invest in the Tokenized Silver ETF (SLVon) on Doorstep

On Pintu, SLVon assets are already available and you can invest in SLVon with a nominal starting from Rp11,000. Here’s how to easily buy SLVon at Pintu:

- Enter the Pintu homepage.

- Go to the Market page .

- Search and select the Silver ETF Tokenized (SLVon)

Conclusion

The tokenized Silver ETF (SLVON) provides a new way to gain silver price exposure through blockchain technology with 24/7 access, on-chain liquidity and DeFi integration. Amidst physical silver supply pressures and growing interest in inflation hedging assets, SLVON is a more flexible alternative to traditional ETFs.

Disclaimer: All articles from Pintu Academy are intended for educational purposes and do not constitute financial advice.

Reference:

- BingX Academy. What Is Ondo’s iShares Silver Trust Tokenized ETF (SLVON) and How to Buy It? Accessed February 5, 2026

- WEEX. What is iShares Silver Trust Tokenized ETF (SLVon) Coin?. Accessed February 5, 2026

- Bittime. What is the iShares Silver Trust Tokenized ETF (SLVon)? Accessed February 5, 2026

- Coinfomania. Tokenized Silver SLVon Hits $18M Market Cap Amid Strong Rally. Accessed February 5, 2026

- Data Wallet. Best Tokenized Silver Assets (Most Trusted). Accessed February 5, 2026

Share

Table of contents

Related Article

See Assets in This Article

SLVON Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-