Mainstream Crypto Adoption: How and When Will it Happen?

The cryptocurrency industry and blockchain technology is now in its 14th year since Satoshi created Bitcoin in 2009. Despite showing a lot of innovation and potential, mass adoption of cryptocurrencies has yet to be achieved and is constrained by various factors. So, how can we encourage massive crypto adoption? What are the challenges we need to face before crypto adoption occurs? This article discusses the dynamics of crypto asset adoption, the challenges, and what it takes to achieve mass adoption.

Article Summary

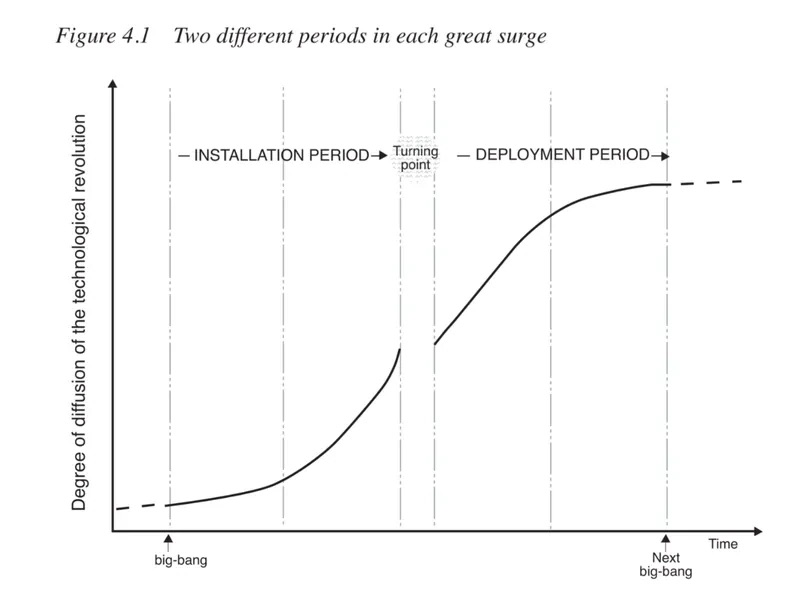

- 🧠 Professor Carlota Perez explains that technology adoption happens in waves that include booms and busts. Approximately every 20 years, there is a change from the early stage to the mass adoption stage.

- ⚙️ Currently, the cryptocurrency industry is still in the installation stage, with adoption occurring in discrete clusters in different parts of the world.

- ⚖️ The three main challenges to crypto adoption are lack of education, inconsistent regulation, and very low accessibility or ease of use of crypto-based applications.

- 📱 One of the key things needed to achieve crypto adoption is an app that can attract millions of users, similar to how Google, Amazon, Facebook, and YouTube played a role in the mass adoption of the internet.

Two Stages of New Technology Adoption

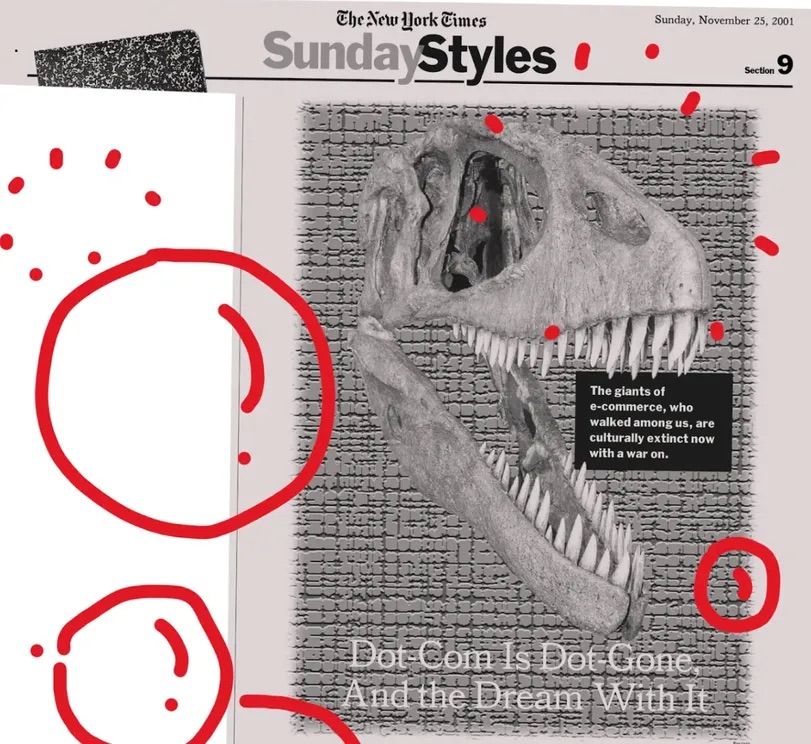

Professor Carlota Perez explains that technology adoption occurs in several “waves” consisting of boom and bust cycles. Professor Perez’s argument is clear in the growth of the internet, with the dot com crash in 2001. At the time, everyone was quick to argue that the internet was dead. 20 years later, we live in an era where almost everything is connected to the internet, including money.

Professor Perez also explains that this wave of technology adoption occurs approximately every 20 years. As in the picture above, there is an early stage and a second stage adoption period. In addition, there is a transition period that marks the move from early stage to mass adoption by the public.

Current Adoption of Crypto and Blockchain Technology

Cryptocurrency technology was first created in 2009 and is now in its 14th year. In 14 years, the crypto industry has given birth to many innovations such as the DeFi sector which creates a new financial system, and the NFT sector with its digital artist ecosystem. According to TripleA research, worldwide crypto asset ownership is currently around 4.2% or more than 420 million people.

However, crypto adoption has occurred in separate clusters, each with its own market. According to Perez, this is normal and indicates that cryptocurrency is in a period of installation.

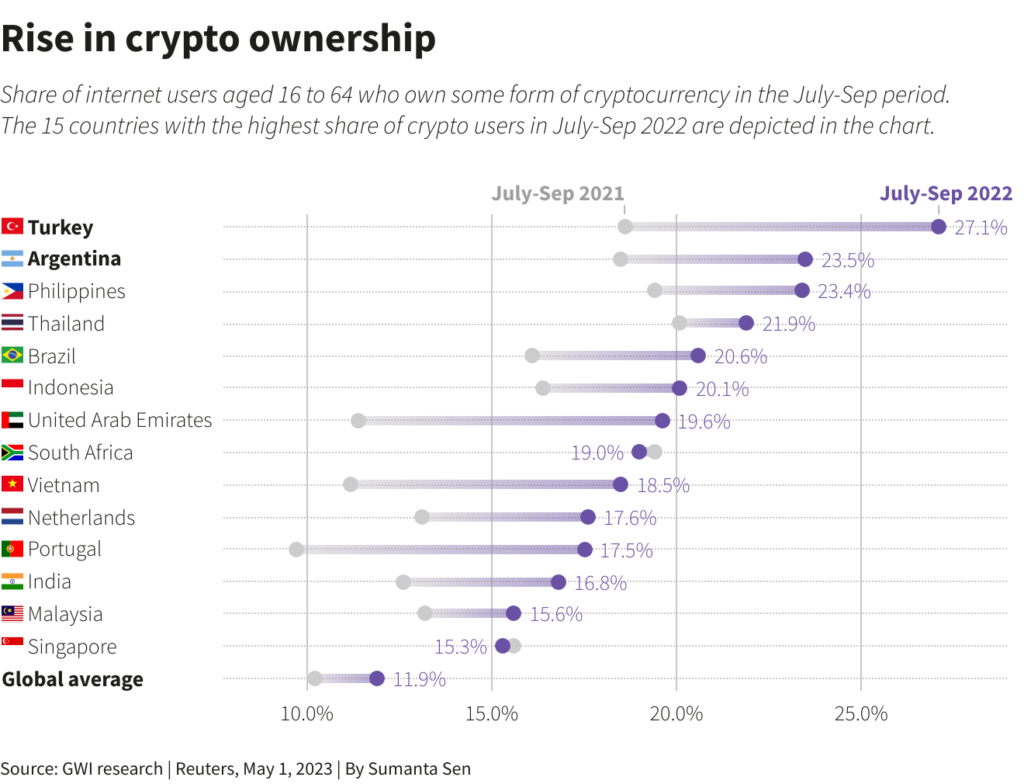

Many cryptocurrency adoption clusters are forming in different parts of the world with different use cases. For example, we can see the use of cryptocurrencies as an asset to send remittances in countries such as Egypt, the Philippines, Mexico, and Nigeria.

In Indonesia, the adoption of cryptocurrencies is advancing with government regulations that are very supportive of the growth of the industry. This regulatory clarity supports an industry with 17.5 million users who show consistent growth every year. Currently, the adoption of crypto assets in Indonesia is still limited as an investment asset, NFT, and DeFi sectors.

“Web3 paves the way for Indonesians, for example, Indonesian developers or entrepreneurs to build products that are global in scale.”

Jeth Soetoyo, CEO of Pintu.

Read more: Exploring the Great Potential of Indonesia’s Crypto Asset and Web3 Industry.

The many crypto adoption clusters around the world reinforce the perspective of cryptocurrency as a global asset. Various new sectors have emerged from the industry in recent years and development teams are constantly looking for ways to create innovations.

What does cryptocurrency need to achieve mass adoption?

In theory, we can look to the internet to see what the crypto industry needs to achieve mass adoption. The internet’s mass adoption era happened because of several applications with hundreds of millions of users creating an entirely new economy. Apps like Google, Amazon, Facebook, and YouTube have a snowball effect, attracting even more users.

To date, the cryptocurrency industry does not have a Web3 version of Amazon, Facebook, or YouTube. There is no crypto-based application that can attract millions of people to try it out.

In the 2021 bull market, this potential seemed to belong to Axie Infinity, Sandbox, and Stepn. However, a year later all three apps lost more than 80% of their users and turned out to be a one-off trend. These apps had unsustainable models that were heavily impacted by the bear market.

So, the cryptocurrency market needs a group of “killer apps” to attract new users who are not crypto-savvy. Such apps could come from old sectors like DeFi or new ones like decentralized social media. The DeFi sector also has the potential to attract millions of new users, especially if the process of using it is made easy. In addition, digital wallets that can be instantly connected to many applications and blockchains also have enormous potential.

Cryptocurrency and Blockchain Adoption Challenges

Currently, cryptocurrencies face many challenges before they can reach mass adoption. Like the New York Times magazine poster above, these challenges to adoption are natural. The New York Times poster was published during the Dot-Com Bust in 2001. As we know, the internet era has only grown more rapidly after 2001. The cryptocurrency industry is also going through a similar phase. We will focus on the three main challenges of crypto adoption: education, regulation, and accessibility.

The biggest challenge to cryptocurrency adoption in many parts of the world is education. Blockchain technology and cryptocurrencies are fairly new and complex, making them difficult to understand for people without a technical background. Like in the early days of the internet, cryptocurrency users need to understand the jargon and technical terms of blockchain. This educational aspect is especially important to avoid the hacks and scams that are rampant in the industry.

The second issue that is being widely discussed is the regulation of cryptocurrencies and blockchain. In some countries such as the United States, the regulation of crypto is unclear and the attitude of policymakers towards the crypto industry is very negative. The US is one of the countries with a negative view towards crypto and often takes harsh actions against players in the industry.

On the contrary, Indonesia, Japan, Vietnam, and Thailand are some of the countries with a positive perspective on the crypto industry. These countries already have legal clarity for crypto retail investors and businesses. Positive regulations like these bring the cryptocurrency industry one step closer to wider adoption.

“The number one country in the world for crypto adoption is Vietnam, number two is Philippines, and Indonesia is number 20. In this part of the world (Asia), both from the regulatory perspective but also grassroots, it’s going to be the vanguard of the adoption of crypto.”

Diederik van Wersch, Director of International Mid-Market Sales Chainalysis.

The last crypto adoption challenge is about the accessibility and ease of use for crypto applications. Currently, access to crypto as investment assets is quite easy. However, when it comes to using crypto applications, it’s a different matter.

The majority of decentralized apps (DApps) are very difficult to use and the language of the interface is very technical. If you’re someone who’s just starting with crypto, you’re bound to struggle.

The process of making a transaction on a DeFi app like UniSwap is unnecessarily complex. Typically, you need to connect your wallet to UniSwap, give your permission, grant access to your assets, approve the transaction gas price, and finally approve the exchange of assets. A single DEX transaction usually requires 3-5 approval processes in a digital wallet. This makes using crypto asset apps very complicated and not user-friendly.

What is the Future of Mass Adoption of Crypto Assets?

Like the current situation, the future of cryptocurrency adoption will be as broad as its potential uses. Mass adoption of cryptocurrencies is likely to happen simultaneously in different parts of the world with different use cases.

In Latin and Central America, cryptocurrencies may be more quickly adopted as a currency to avoid inflation and send remittances. Meanwhile, in African countries such as Nigeria, the adoption of cryptocurrencies may be related to cross-border payments through stablecoins.

Cryptocurrency adoption in Indonesia could also branch out to various sectors. It could relate to the remittance sector due to its huge untapped market (worth 9.71 billion dollars by 2022). Indonesia’s digital creative economy sector could also create many digital artists who increasingly utilize NFT technology and crypto. In addition, the tokenization of physical assets (RWA) and an easy-to-use DeFi sector could also open up opportunities for Indonesians to access the global financial system.

“I am very optimistic because I believe web3 innovation has transformative potential, including in the tourism sector. Through blockchain technology we can foster trust and secure transactions between tourists and tourism service providers, creating more inclusive and transparent services. Moreover, DeFi can empower local communities by expanding access to finance within the web3 sector.”

Muhammad Neil El Himam, Deputy for Digital Economy and Creative Products, Ministry of Tourism.

Mastercard VP, Harold Bosse, explains that cryptocurrency adoption happens when blockchain technology and crypto become everyday infrastructure. In this context, Bosse explains that people will use blockchain and cryptocurrencies without realizing it and without needing to understand the technology. This situation is similar to what happened with the internet, where we don’t need to understand how the technology works to use it.

The future of mass adoption of cryptocurrencies will happen when the complicated processes become simple. A transaction that currently requires four approval processes can be done with just one click. What is sure is that the industry will reach the stage of mass adoption, especially with the many technologies such as account abstraction. The question is when and how soon we can get there.

Conclusion

Professor Carlota Perez details the stages of technology adoption that occur in two stages: installation and deployment. This theory explains that technology adoption moves in waves that include ups and downs or boom and bust cycles. The cryptocurrency industry itself, currently in its 14th year since its creation, is showing significant growth although it has yet to reach the mass adoption stage. The main obstacles towards mass adoption include lack of education, inconsistent regulations, and the accessibility and ease of use of crypto applications. Despite the challenges, cryptocurrency adoption has great potential in the future, with opportunities to influence various sectors and geographies.

How to Buy Cryptocurrencies on the Pintu App

You can start investing in cryptocurrencies by buying them on the Pintu app. Here is how to buy crypto on Pintu:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for your favorite asset.

- Click buy and fill in the amount you want.

- Now you are a crypto investor!

In addition, the Pintu application is compatible with various popular digital wallets such as Metamask to facilitate your transactions. Go and download the Pintu cryptocurrency app on the Play Store and App Store! Pintu is regulated and supervised by Bappebti and Kominfo.

You can also learn crypto through the various Pintu Academy articles which are updated every week! All Pintu Academy articles are for educational purposes, not financial advice

References

- Bella Protocol, “Mass Adoption in Crypto: What Is It and What Will It Take?”, Medium, accessed on 10 September 2023.

- Lucas Baker, “Mapping Markets: Evaluating Blockchain’s Mass Adoption Potential“, Jump Crypto, accessed on 10 September 2023.

- Cuemby, “The mass adoption of cryptocurrency in countries: Why is it happening and how is it possible?“, Medium, accessed on 10 September 2023.

- Will Kendall, “How Can We Achieve Crypto Mainstream Adoption?”, CoinMarketCap, accessed on 11 September 2023.

- Justin Banon, “The Trillion Dollar Crypto Opportunity: Real World Asset (RWA) Tokenization”, CoinDesk, accessed on 11 September 2023.

- Jacquelyn Melinek, “Mastercard exec is bullish on crypto, sees mass adoption ‘sooner rather than later’”, Tech Crunch, accessed on 11 September 2023.

Share