Blockstream Secures Billion Dollar Investment to Launch Bitcoin Loan Fund!

Jakarta, Pintu News – Blockstream, a financial infrastructure company powered by Bitcoin , recently announced success in securing a multi-billion dollar investment. The investment is aimed at launching a crypto lending fund that will be operational soon.

With strong financial backing, Blockstream plans to introduce three new funds, two of which focus on crypto loans, marking a major step in the evolution of Bitcoin (BTC)-based finance.

Strategic Expansion and Collaboration

In its global expansion efforts, Blockstream has opened a new office in Tokyo, Japan. The move is part of a strategy to expand the reach of Bitcoin (BTC)-backed solutions in the Asian market.

Read also: Bitcoin to $100K or a Crash to $70K? Analysts Uncover Key Order Book Signals!

The partnership with Diamond Hands, Japan’s leading Bitcoin strategic consultancy, and Fulgur Ventures, demonstrates Blockstream’s commitment to accelerating the adoption of Bitcoin (BTC) layer 2 and self-custody solutions.

Blockstream is not only expanding its geography, but also focusing on product innovation. The company is exploring the tokenization of real assets, which will enable further integration between traditional assets and the digital economy.

This approach is expected to open up new opportunities and strengthen Blockstream’s position as a leader in Bitcoin (BTC) based financial infrastructure.

Fund Launch and Asset Management

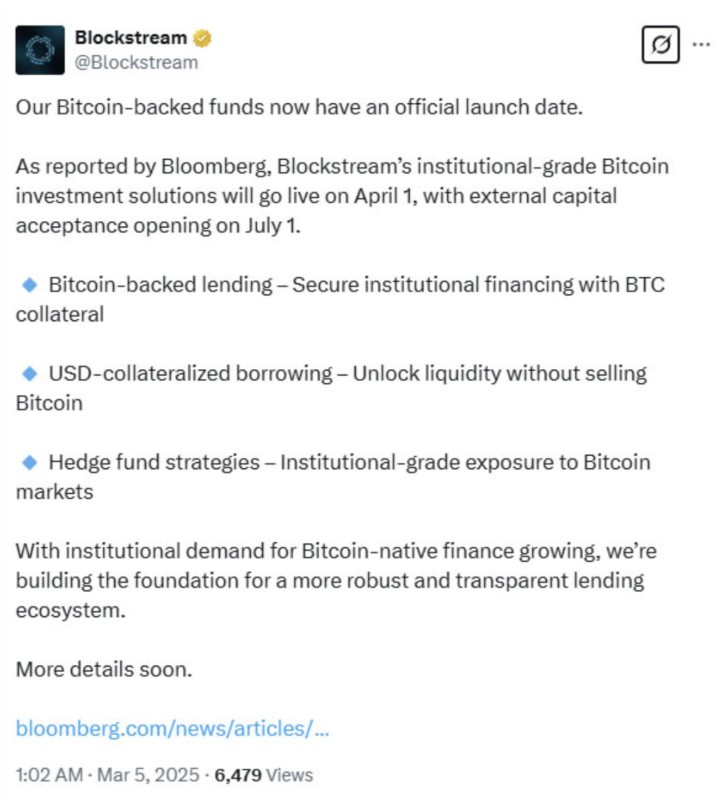

Blockstream has announced the formation of Blockstream Asset Management, an asset management arm that will manage funds backed by Bitcoin (BTC). These funds, including the Blockstream Income Fund and Blockstream Alpha Fund, are targeted at institutional investors and will be available from April 1.

A third fund, the Blockstream Yield Fund, is scheduled to launch later this year. With a US dollar-collateralized lending model, these funds offer institutional financing solutions that allow users to borrow using Bitcoin (BTC) as collateral.

This allows investors to gain liquidity without having to sell their crypto assets, while providing exposure to the Bitcoin (BTC) market that conforms to institutional standards.

Future Vision and Transparency

Led by Adam Back, co-founder and CEO of Blockstream, the company is committed to building a more robust and transparent lending ecosystem.

Read also: This Mexican Billionaire Invested 70% of His Wealth in Bitcoin – Here’s Why!

The investment raised will be used to further develop the technology and services that support the operations of the lending fund. This reflects the growing demand from institutions for robust Bitcoin (BTC) native finance.

Not only that, Blockstream also emphasizes the importance of transparency in its operations. By providing financial infrastructure based on blockchain technology, Blockstream seeks to ensure that every transaction and fund operation can be tracked and verified, offering a higher level of security and trust for investors and users of its services.

Overall, with strategic moves and continuous innovation, Blockstream is poised to change the global financial landscape.

This billion-dollar investment not only strengthens Blockstream’s position in the market, but also marks a new era in the provision of financial solutions powered by Bitcoin (BTC).

Going forward, Blockstream will continue to be a key player in integrating crypto with the mainstream economy.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Benson Toti. Blockstream Secures Multi-Billion Investment for Bitcoin Lending Funds. Accessed on March 6, 2025

- Cointelegraph. Blockstream to Launch Bitcoin Lending Funds With Multi-Billion Investment. Accessed on March 6, 2025

- Crypto News. Blockstream to Launch Bitcoin Lending Funds. Accessed on March 6, 2025