Asian Stock Movements and Their Impact on Global Markets

Jakarta, Pintu News – Asian stock markets showed mixed performance in the middle of this week, with most regional indices advancing after positive comments from Federal Reserve (Fed) Chairman Jerome Powell.

However, stocks in China declined amid investor concerns over the impact of tariffs and a domestic technology slowdown. These dynamics demonstrate the complex relationship between global monetary policy, geopolitical tensions and regional market performance.

Asian Stock Performance and Fed Policy Impact

MSCI’s regional stock index recorded its highest gain since early November. Stocks in Taiwan, Australia, and South Korea gained, driven by positive sentiment over Jerome Powell’s statement that the risk of recession is not high. Powell also emphasized that the potential rise in inflation is temporary, giving global investors peace of mind.

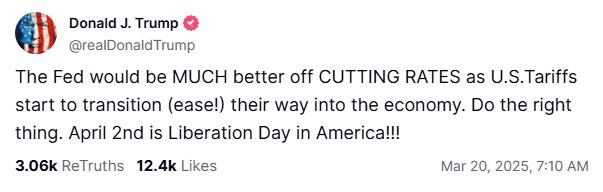

Meanwhile, the Fed’s decision to keep the benchmark interest rate on hold also boosted the bond rally, reinforcing expectations of a rate cut in the near future. The US dollar exchange rate remained stable, despite President Donald Trump’s call for further interest rate cuts via the Truth Social platform. This decision reflects the Fed’s caution in responding to political pressures and market conditions.

Also Read: Bitcoin (BTC) Hasn’t Responded to Wall Street’s Demands, BlackRock Executive Warns

China stocks decline amid regional optimism

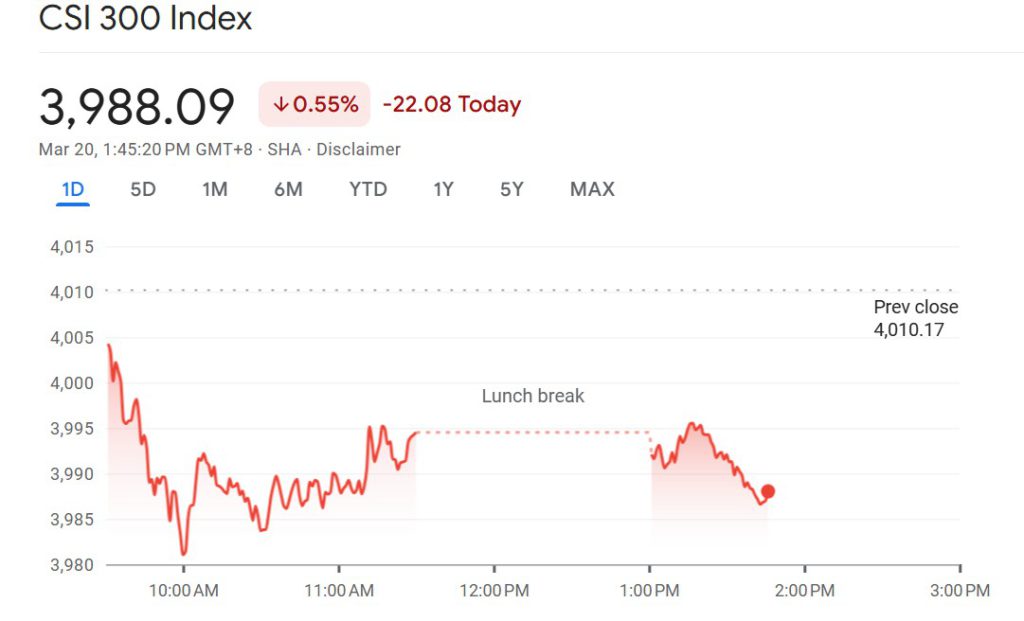

In contrast to other Asian stock markets, China’s main stock index, the CSI 300, actually declined after rallying in the previous few days. The decline was driven by weakness in the technology sector, which was previously the main driver of market growth. Several technology companies experienced profit-taking by investors, triggering a price correction.

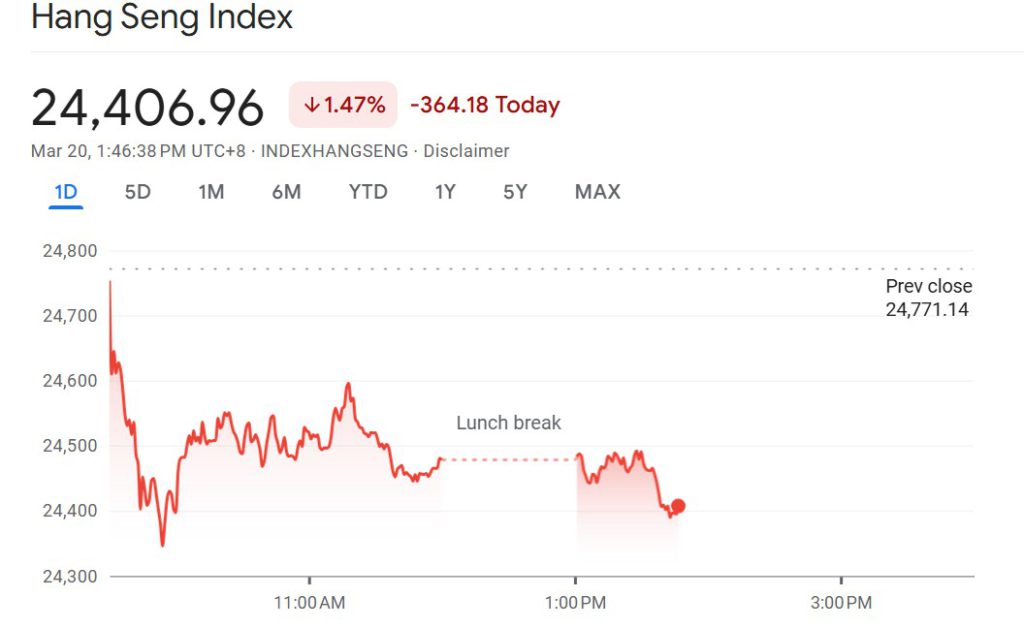

In Hong Kong, the Hang Seng Index fell by 1.7%, reflecting investors’ concerns over China’s economic growth prospects. According to analysts from UBS Global Wealth Management, the risk-reward outlook of the Chinese market appears less attractive than the US technology sector, which is considered to have better potential after the correction. This indicates a shift in global investor sentiment towards more stable and promising markets.

Large Company Performance and Market Reaction

Chinese tech giant Tencent Holdings Ltd. saw its share price fall despite recording the fastest revenue growth since 2023. This suggests that positive financial data has not been enough to offset investors’ concerns about the overall market. The sell-off comes on the back of uncertainty over the direction of government policy and a potential economic slowdown.

On the other hand, South Korea’s Samsung Electronics Co. actually recorded an increase in share price. This increase came after the company stated its commitment to strengthen its position in the high-speed memory chip market. This commitment was welcomed by the market, especially since it came amid criticism from shareholders regarding the company’s strategy amid intense global competition.

Other Global Issues and Relevance to Cryptocurrency

Besides the Fed, other central banks such as the Bank of England and the Swiss National Bank are also scheduled to announce interest rate decisions. The Bank of England is expected to keep interest rates on hold, while the Swiss National Bank is projected to cut interest rates by 25 basis points. These policies reflect the global trend towards gradual monetary easing.

These global market dynamics have also influenced investor interest in alternative assets such as crypto. When traditional markets show volatility or uncertainty, cryptocurrencies are often seen as portfolio diversification. In this context, education about crypto and the development of decentralized finance technology is becoming increasingly relevant, especially for 2025, which is full of challenges and new investment opportunities.

Cover

Recent movements in Asian stocks reflect the uncertainty in global markets influenced by interest rate policies, trade tariffs, and the performance of the tech sector. Amidst these global pressures, it is important for investors to understand the relationships between markets and their potential impact on other financial instruments, including cryptocurrencies. Despite China’s weakness, other Asian markets continue to provide opportunities for investors who are keen on reading policy direction and global economic trends.

Also Read: This is Arhur Hayes’ BTC Price Prediction Based on April 2025 Fed Rate!

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cryptopolitan. Chinese shares dip despite Fed easing tariff concerns. Accessed March 21, 2025.

- Featured Image: (This image is generated by AI)