100 Million Dogecoin (DOGE) Bought by Whales, but Price Stagnates: What’s Next?

Jakarta, Pintu News – A number of large holders of Dogecoin , often referred to as whales, have shown significant buying activity in recent weeks. They have accumulated around 100 million DOGE, with a total value of $17.5 million. This phenomenon caught the attention of the market, but did not have a significant impact on the price movement of Dogecoin (DOGE), which remained stagnant.

This behavior raises questions about market dynamics and market participants’ expectations for the future of Dogecoin (DOGE). Despite massive accumulation, the cold price response suggests that there may be other factors influencing the value of this cryptocurrency.

Market Dynamics and Trader Sentiment

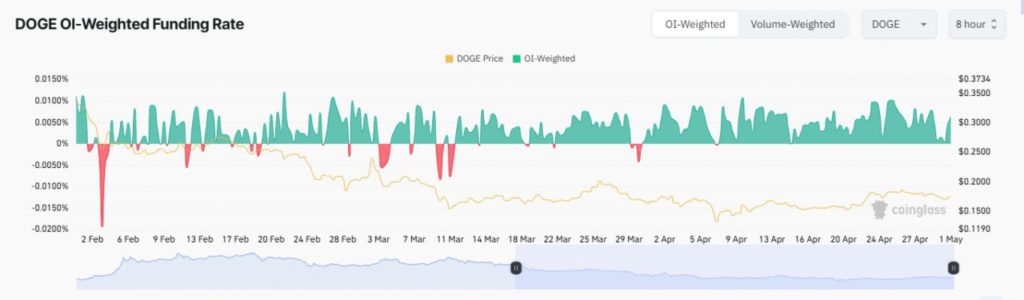

An analysis of derivatives metrics showed a marked increase, indicating bullish sentiment among traders. The Open Interest-Weighted Funding Rate saw a more than tenfold jump, from 0.0004% to 0.0044%. This increase signaled growing optimism among market participants.

However, despite bullish indications from the derivatives side, long-term traders of Dogecoin (DOGE) have suffered considerable losses. In the last 24 hours, the losses amounted to $4.51 million. This situation suggests that bearish pressure is still quite strong and may prevent Dogecoin (DOGE) from rising in price in the near future.

Also Read: Ripple (XRP) Moves $1.1 Billion, What Happened?

Potential Pullback Before Upgrade

The losses experienced by long-term traders indicate an imbalance between expectations and market reality. Despite accumulation by whales, lingering selling pressure may cause a price pullback before a surge. This is a common market dynamic when there is a discrepancy between accumulation activity and price response.

Market analysts advise investors to look at further technical and fundamental indicators before making an investment decision. Understanding the reasons behind whale activity and broader market dynamics will be crucial in determining the right trading strategy for Dogecoin (DOGE).

Investor Strategies for Dealing with Uncertainty

In this uncertain market situation, it is crucial for investors to diversify their portfolio and not rely too heavily on a single asset. This strategy can help reduce the risk of large losses if the market moves against expectations. In addition, regularly monitoring market news and analysis will provide better insights into emerging trends.

Investors are also advised to use strict risk management, including realistic stop-loss and take-profit settings. With a cautious and informed approach, investors can minimize the negative impact of unexpected market fluctuations and take advantage of opportunities that arise.

Dogecoin’s future in Whale’s hands?

Accumulation activity by Dogecoin (DOGE) whales has attracted a lot of attention, but the market is still showing limited reaction. Going forward, it will be interesting to see how this dynamic will affect the price and market sentiment. Will the whales continue to dominate market direction, or will other factors emerge and surprise market participants?

Also Read: Worldcoin: Innovating Digital Identity Verification Through Iris Scanning

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Dogecoin whales scoop 100 mln DOGE but price is unaffected; what now?. Accessed on May 2, 2025

- Featured Image: AMBCrypto