Bitcoin (BTC) Price Breaks $97,000, But Network Activity Stagnates: What’s Up?

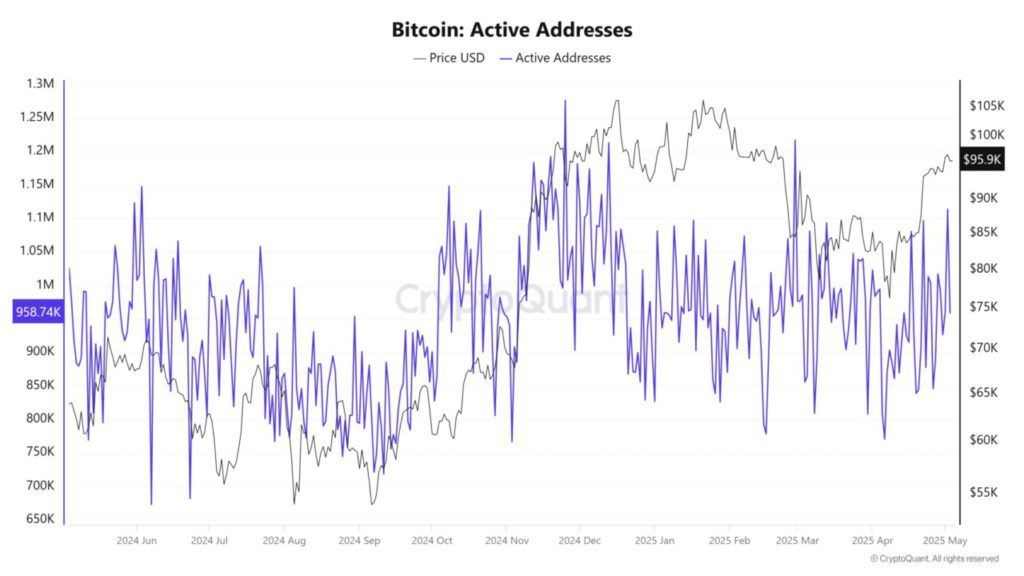

Jakarta, Pintu News – Although Bitcoin has reached a new peak of $97,000, activity on its blockchain network remains low. This phenomenon raises questions about the dynamics taking place behind the scenes and the implications for the future of Bitcoin (BTC) as a digital asset.

External Influences and Price Volatility

The current price growth of Bitcoin (BTC) is heavily influenced by external factors that are not directly related to the use of blockchain. For example, monetary policies from various countries and high institutional interest have pushed the price up. On the other hand, Bitcoin (BTC)’s recent low price volatility indicates a lack of market speculation that usually drives network activity.

This imbalance creates a situation where the price no longer reflects the real usage of the network. Long-term investors and users may need to reconsider their expectations of Bitcoin (BTC) if this trend continues.

Also Read: BONK Freefalls 8% in 24 Hours: Check out the Price Levels that Can Prevent Further Declines!

Second Layer Change of Use and Adoption

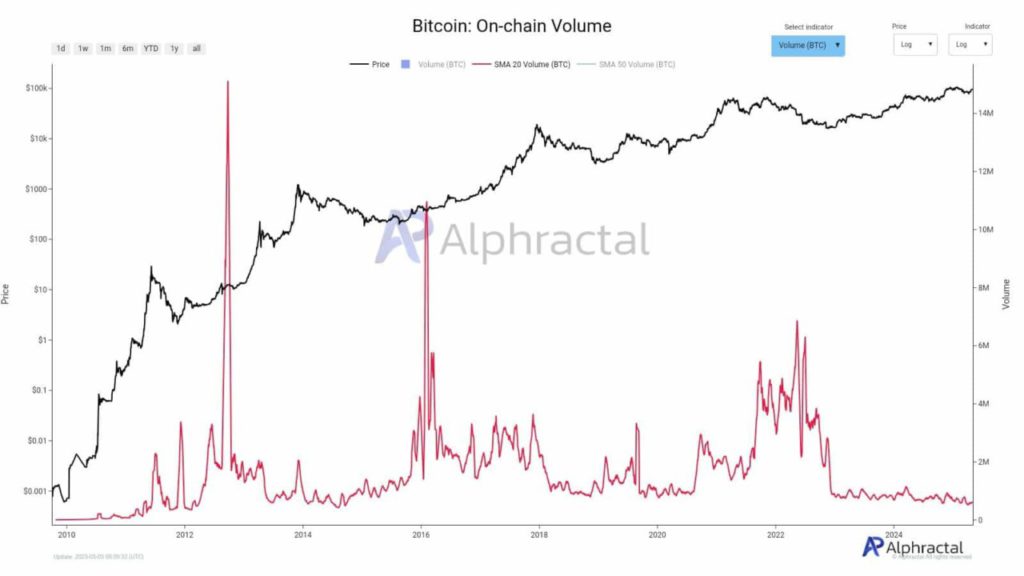

One of the main reasons for the decline in on-chain activity is the shift in the use of Bitcoin (BTC) from a means of payment to a financial asset. More users now see Bitcoin (BTC) as a store of value rather than a digital currency for everyday transactions.

In addition, the rapid growth of networks like the Lightning Network that support Bitcoin (BTC) transactions at lower fees and higher speeds is also reducing the load on the main blockchain. The adoption of these second-layer technologies shows an evolution in the way Bitcoin (BTC) is being used, but also raises questions about the future of the main network if this trend continues.

Implications for the Future of Bitcoin (BTC)

As institutions dominate investment flows and retail participation declines, momentum for Bitcoin (BTC) price growth could become harder to sustain. Historically, network growth, especially from retail users, has been critical to supporting Bitcoin (BTC) price increases.

However, without an increase in on-chain demand, Bitcoin (BTC) price growth may face structural limitations. Investors and market watchers should pay attention to this indicator as a potential signal to evaluate their position in the Bitcoin (BTC) market.

Conclusion

Although the price of Bitcoin (BTC) is reaching record highs, this does not necessarily reflect the increased use of blockchain. The changing perception of Bitcoin (BTC) as a financial asset rather than a digital currency raises new questions about its value and usefulness in the long run. Market watchers and investors should be aware of these dynamics when making investment decisions.

Also Read: Ethereum Hangs Above $1,770: Can It Reach $2,030 Next?

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Bitcoin’s price hits $97k but network activity stalls; key reasons are…. Accessed on May 5, 2025

- Featured Image: Generated by AI