Figma Prepares to IPO with Bitcoin Assets, a New Trend in the Stock Market?

Jakarta, Pintu News – Figma, a San Francisco-based design software company, recently filed IPO documents with the SEC.

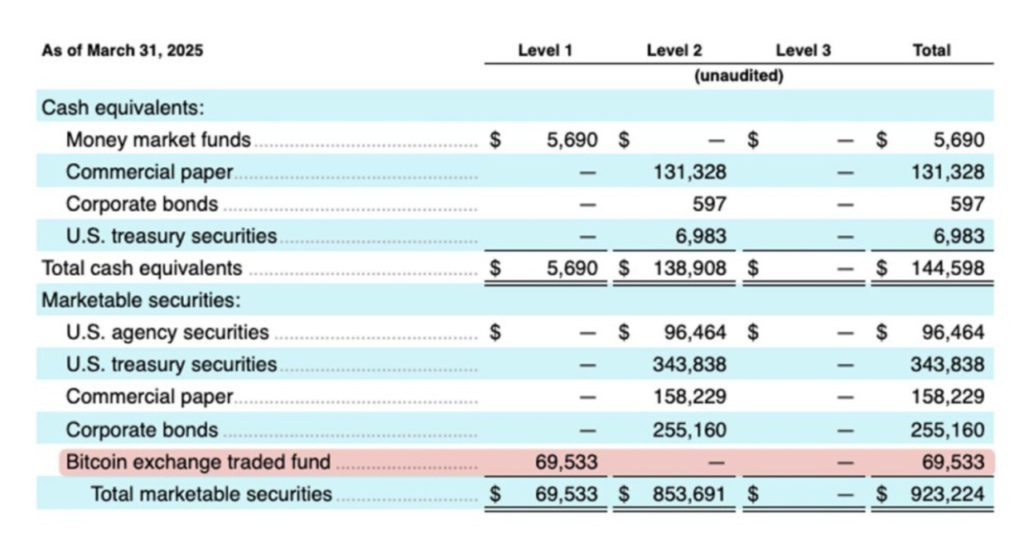

In the filing, Figma revealed that it held $69.5 million worth of Bitcoin assets in the form of spot ETFs as of March 31. This move marks a new trend where crypto-involved companies are starting to enter the United States public markets.

Check out the full information here!

About Figma

Figma was founded in 2016 and has become a popular browser-based design collaboration tool in the tech industry. The company is famous for its ability to enable real-time design collaboration, which is especially useful for professionals in the field of interface and product design.

Figma’s rapid growth in recent years attracted the attention of Adobe, which in 2022 planned to acquire Figma for $20 billion. However, the acquisition plan was challenged by regulators in the United States and Europe, so both parties canceled the plan at the end of 2023.

This decision paves the way for Figma to pursue alternative plans, including listing on the stock exchange as an independent entity. This move is expected to provide more flexibility and resources for Figma to develop its products and services.

Read also: Digital Gold Price Today July 2, 2025, Up or Down?

BTC Investment Plan

On May 8, Figma’s board of directors approved a $30 million Bitcoin (BTC) investment plan. As part of this strategy, Figma also purchased an equivalent amount of USDC, which was then converted into Bitcoin (BTC).

The decision to invest in Bitcoin (BTC) and include it as a strategic asset demonstrates Figma’s long-term view of the value and stability of this cryptocurrency.

This investment puts Figma on the list of companies holding Bitcoin (BTC) and reflects a broader trend where public companies are starting to see Bitcoin (BTC) as a strategic reserve asset.

With more and more companies disclosing their crypto positions, investors are showing strong interest. This can be seen from the stock performance of companies like Coinbase, Circle, and Robinhood which have recently outpaced the performance of most altcoins.

Read also: Price of 1 Pi Network (PI) in Indonesia Today (2/7/25)

Performance of stocks that have BTC

The stock performance of companies that have Bitcoin (BTC) reserves such as MicroStrategy is also showing a positive trend. Their shares are up 25% this year, and analysts estimate there is a 91% chance that MicroStrategy will be added to the S&P 500, based on revenue projections and Bitcoin (BTC) price support holding at $95,240.

This phenomenon suggests that the stock market is beginning to be responsive to the integration of cryptocurrencies in the portfolios of large companies. Moreover, the success of these companies in the stock market can be an important indicator for other companies that may consider adopting a similar strategy.

While there are concerns about centralization and the influence of large holders on price movements, this is a clear signal of institutional acceptance of crypto.

Conclusion

With Figma’s move towards an IPO and their disclosure of Bitcoin (BTC) assets, the trend of US-listed companies investing in and holding Bitcoin (BTC) as a cash asset is strengthening.

This not only demonstrates wider acceptance of cryptocurrencies among institutions, but also opens up new opportunities for growth and innovation in the technology and finance sectors.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Figma Bitcoin Holdings US IPO Filing. Accessed on July 2, 2025

- Featured Image: Bitcoin Magazine