‘Big Beautiful Bill’ Passed by the Senate: What Is the Fate of Crypto Assets?

Jakarta, Pintu News – The $3.3 trillion fiscal package proposed by former President Donald Trump, known as the “Big Beautiful Bill,” has just been approved by the US Senate and now heads to the House of Representatives for final approval.

The crypto market is closely watching the potential impact of this law, especially on Bitcoin and Ethereum which have remained stable despite the general market decline.

Check out the full information here!

Bitcoin (BTC): A Potential Fiscal Hedge

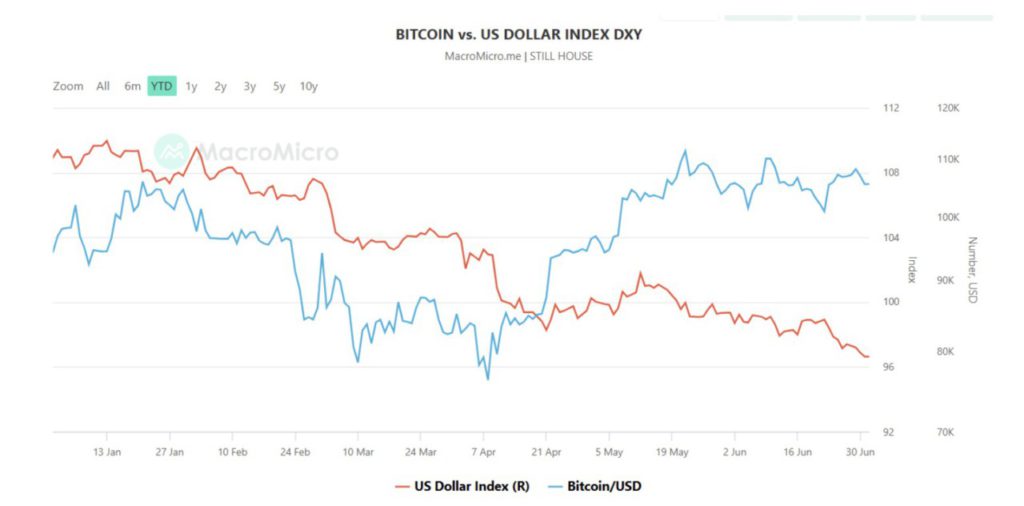

The fiscal package, which is expected to increase the national debt by more than $3 trillion, could bring long-term inflationary pressures. Bitcoin (BTC), which is often considered a hedge against declining fiat currency values, may see increased demand.

Declining confidence in US fiscal management and a weakening dollar are likely to reinforce the narrative of Bitcoin (BTC) as “digital gold”. This could be a motivating factor for investors looking for alternative assets to hedge their wealth.

Also read: Figma Prepares to IPO with Bitcoin Assets, a New Trend in the Stock Market?

Altcoins: Uneven Benefits

Ethereum (ETH) and other large altcoins may also find short-term support. Risk rotation from bonds to alternative assets often increases crypto value in general.

However, not all tokens are in the same position. Infrastructure and utility tokens may benefit from increased activity and capital flows. This rise will not only affect Ethereum (ETH) but also other tokens that have strong use cases and mature infrastructure.

Read also: Digital Gold Price Today July 2, 2025, Up or Down?

Investor Sentiment: Retail and Institutional

Retail investors may react positively to the reduction of personal taxes and simplification of crypto reporting. If the final bill includes crypto-friendly tax reforms, such as de minimis exemptions and clarity on staking income, it could reduce barriers for small traders and DeFi users.

On the other hand, institutional sentiment may be more cautious. Rapid debt accumulation and the prospect of potential inflation could make institutional investors adopt a wait-and-see approach, especially if the Federal Reserve tightens policy in response.

Conclusion

The Senate’s approval of the “Big Beautiful Bill” represents a significant fiscal shift. If this bill passes in the House, cryptoassets, especially Bitcoin (BTC), will likely benefit from heightened fiscal concerns and investors’ desire for alternative hedges. However, volatility remains a risk. Fed policy, inflation data, and legislative negotiations will determine how sustainable these crypto price gains are.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Trump’s Big Beautiful Bill: Crypto and Bitcoin Impact. Accessed on July 2, 2025

- Featured Image: Thomson Reuters