5 Ways to Use GROK for Crypto Trading: A Practical Guide for Modern Investors

Jakarta, Pintu News – Amid the increasingly dynamic cryptocurrency (crypto) market competition, the presence of artificial intelligence such as GROK brings fresh air to traders and investors.

GROK, the AI popularized by Elon Musk through the xAI platform, can now be used to help analyze and execute crypto trading strategies automatically and more efficiently. Here are five key ways to use GROK to maximize profit potential and minimize risk in your cryptocurrency trading activities.

1. Real-Time Market Sentiment Analysis

GROK can be used to analyze crypto market sentiment by monitoring thousands of news stories, tweets, and discussion forums in real-time. By utilizing NLP (Natural Language Processing) capabilities, GROK is able to detect changes in sentiment that could be a buy or sell signal for assets such as Bitcoin , Ethereum , or Ripple .

This advantage allows traders to more quickly respond to changes in trends or important news that may affect prices. You can set up automatic notifications so that any significant changes in sentiment instantly appear as alerts on your trading dashboard.

Also Read: Cardano (ADA) 2025 Price Prediction: Governance Drama and Investor Fate, What Happened?

2. Accurate Altcoin Price Research and Prediction

One of GROK’s strengths is its ability to analyze historical price data, transaction volume, and chart patterns to provide price predictions for altcoins such as Cardano , Solana , and meme coins such as Pepe Coin (PEPE). With machine learning algorithms, GROK is able to process big data and find patterns that are often missed by manual analysis.

Traders can use these price prediction recommendations to make more rational and measurable buy or sell decisions. The combination of on-chain data and AI-based technical analysis is GROK’s main advantage in improving the accuracy of trading decisions.

3. Trading Strategy Automation with GROK Bot

GROK also provides integration with automated trading bots that can be customized according to personal strategies. You can set parameters such as profit target, stop loss, trailing stop, or perform automatic DCA (Dollar Cost Averaging) on selected crypto assets.

With this feature, traders do not need to constantly monitor the screen, as trade execution will run automatically based on predetermined criteria. Time efficiency and reduced risk of human error are the main added values of using GROK AI-based bots.

4. Identifying Unique Trading Patterns and Signals

Through big data analysis and machine learning, GROK is able to detect unique trading patterns or price movement anomalies that are not detected by ordinary technical indicators. For example, price consolidation patterns before breakouts, unusual transaction volumes, or large wallet movements on the blockchain.

Traders can gain insight into trading signals that the general market may not know about, allowing them to enter or exit positions earlier than the majority of market participants. This information is especially useful for scalpers, day traders, and swing traders in the volatile crypto market.

5. More Controlled Portfolio and Risk Management

In addition to analysis and execution, GROK can help investors with proactive risk management. By integrating portfolio data and risk parameters, GROK can provide recommendations on when to rebalance, lock in profits, or reduce exposure to high-risk assets.

Investors can also request portfolio progress reports, asset performance evaluation, and optimal allocation suggestions based on the latest data. This helps users stay disciplined, reduce emotional decisions, and keep crypto assets safe and productive.

Conclusion

The utilization of GROK AI in crypto trading is increasingly important in the fast-paced and competitive digital era. With sentiment analysis, price prediction, strategy automation, unique pattern detection, and integrated risk management, traders and investors can make smarter and more informed decisions in the cryptocurrency market.

Also Read: 3 Cryptos to Buy Before Trump’s New Tariffs in August 2025!

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

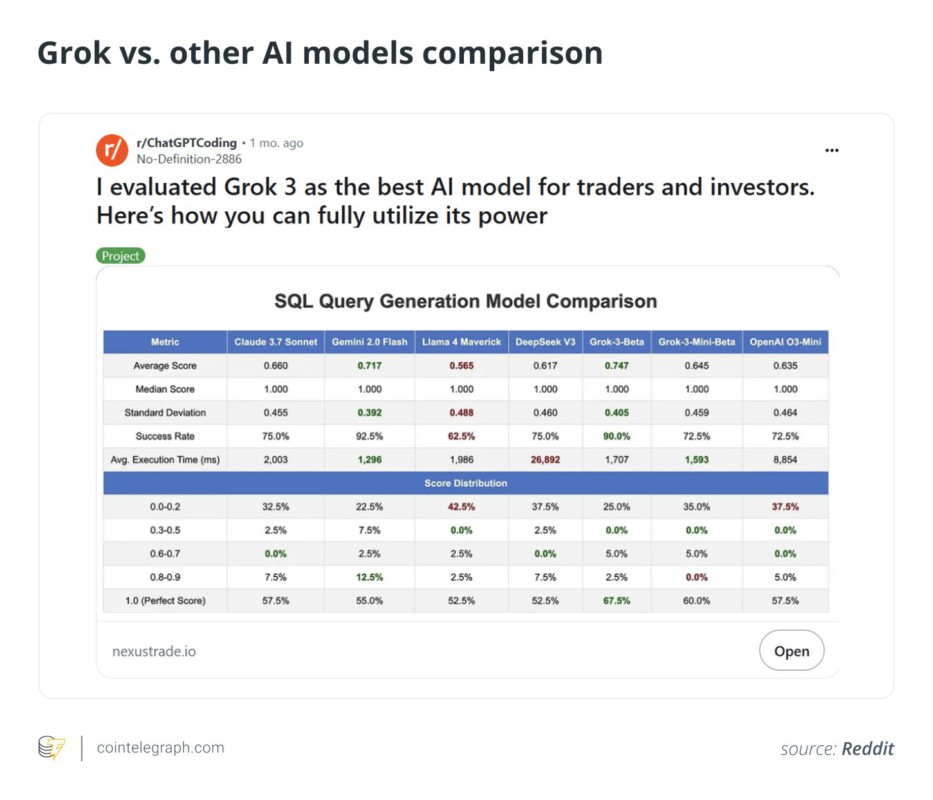

- Cointelegraph. How to use Grok for crypto trading. Accessed July 24, 2025.