6 Visions of Ethereum’s (ETH) Future in 2035: Blockchain is the Foundation of the Global Economy!

Jakarta, Pintu News – Entering its second decade, Ethereum is not just a smart contract platform-it is projected to become the global economic infrastructure and internet backbone of the future. Crypto industry players, from Consensys, GameSquare, RedStone, to Coinbase, agree that the next 10 years will bring fundamental changes in the Ethereum ecosystem and the cryptocurrency world. Here are the full predictions and opportunities for Ethereum heading into 2035!

1. From “Smart Contract Platform” to World Economic Infrastructure

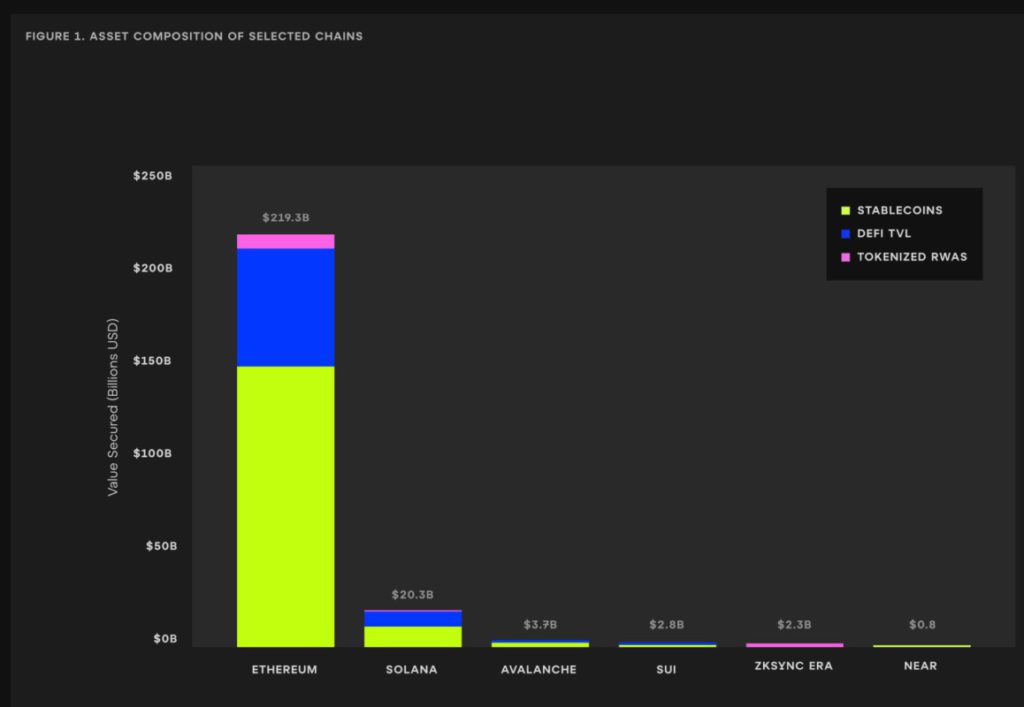

According to Consensys, Ethereum will transform from a smart contract platform to “trustware”-the primary trust layer of the digital economy. Digitization of assets such as stablecoins, real estate, and other financial assets will migrate onchain, making Ethereum a global transaction base.

This growth will only be achieved if there is collaboration between the old contributors and the new generation of institutional and commercial builders.

Also Read: 5 Shocking Predictions: Pi Network (PI) Price in August 2025, Potential to Soar or Plummet?

2. Institutions Begin to Consider Ethereum a Long-Term Asset

Many companies are starting to include ETH in their treasuries, believing Ethereum to be the most credible long-term digital asset. GameSquare, for example, chose ETH because of its community and ability to build an ecosystem that can be integrated across sectors, from global payments and asset management to gaming and digital identity.

Ethereum is projected to become the financial and cultural backbone of the internet, connecting global brands with their communities.

3. The Era of Real-World Asset Tokenization

RedStone highlights Ethereum’s potential as the main layer of tokenization of real-world assets (RWA), such as bonds, property, and commodities. With modular oracles and real-world data integration, Ethereum’s DeFi ecosystem is predicted to become more mature and relevant for the needs of financial institutions.

Ethereum’s success will be measured by how “invisible” yet essential it becomes as part of the world’s financial infrastructure.

4. Optimism & L2: Global Companies Migrate to Blockchain

According to the Optimism team, Layer-2 Ethereum will make it easier for large enterprises to build their digital infrastructure “vertically”-reducing costs, increasing security, and providing flexibility in innovation.

With increasingly clear regulations, financial companies, fintech, and payment companies are predicted to migrate onchain in the next 10 years.

5. Ethereum’s Future Is Defined by Builders

Coinbase emphasizes that the future of Ethereum is largely determined by its developer community. With builders actively innovating, Ethereum will be the foundation for new use cases to emerge: from AI agents that can transact automatically, to richer onchain social communities, to blockchain-based gaming ecosystems.

The builders’ commitment to innovation is the main reason why Ethereum will continue to grow.

6. From Experiment to Infrastructure

One common thread in all the predictions: Ethereum’s second decade will mark its transformation from blockchain experiment to vital digital infrastructure for the world. The Ethereum blockchain is projected to “disappear” from the surface-used by billions of people without them realizing it, becoming the heart of the future of finance, commerce, and digital interaction.

Conclusion

If the first 10 years were a time of exploration, the next decade is the era of Ethereum as the economic foundation of the digital world, spanning industries, institutions and society at large. Are you ready to be part of the next blockchain revolution?

Also Read: 7 Facts How Ethereum Changed the World of Crypto & Cryptocurrency Over 10 Years!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Cointelegraph. Ethereum 2035: How the next 10 years might look. Accessed July 31, 2025.