August Decides: Will HBAR Continue Its Uptrend? Here’s the Price Prediction!

Jakarta, Pintu News – Hedera just closed the month of July with an astounding gain of 85%, recording its strongest monthly performance this year. However, August is often not in HBAR’s favor. In the last five years, HBAR’s average return in August is minus 3.26%, with a median of just 0.31%. This makes August one of the least favorable months for this asset.

With a less than encouraging history, many traders entered this month with caution. Although July showed significant spikes, history suggests that HBAR’s price gains may be about to subside, especially if profit-taking sets in. With only one strong monthly close in August 2021, while other years have been flat or negative, the chances of a repeat of July’s performance seem slim.

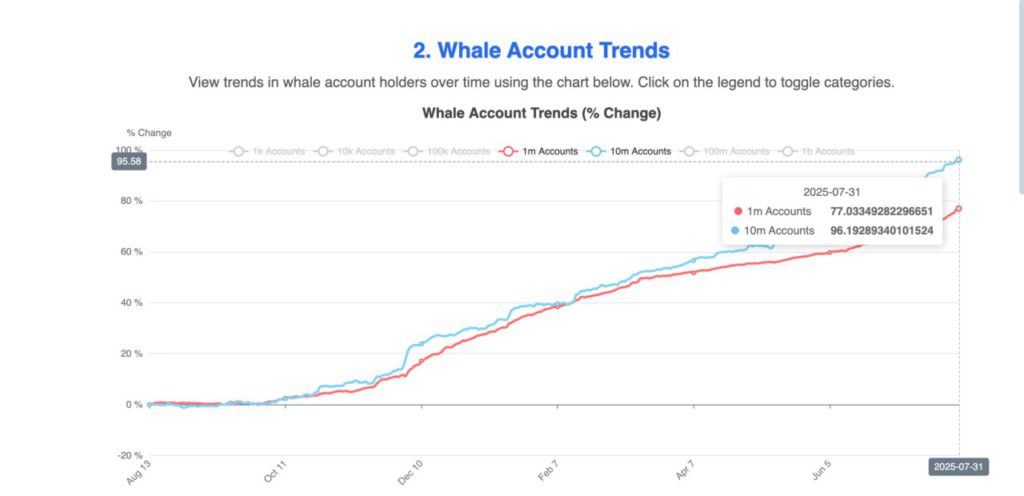

Injury whales continue to buy, but room for upside is limited

On-chain data shows that large holders with more than 1 million HBAR tokens increased their share from 64% to 77% in July. Meanwhile, holders with more than 10 million tokens accounted for 96% of the total supply. This steady accumulation was the main driver of the gains in July. However, with whale dominance already very high, the possibilities are limited for fresh capital that can maintain the same pace in August.

If whale buying slows down, this could open the door for a pullback. This adds uncertainty to the market and could signal investors to be more conservative in their investment decisions this month.

Also Read: 5 Shocking Predictions: Pi Network (PI) Price in August 2025, Potential to Soar or Plummet?

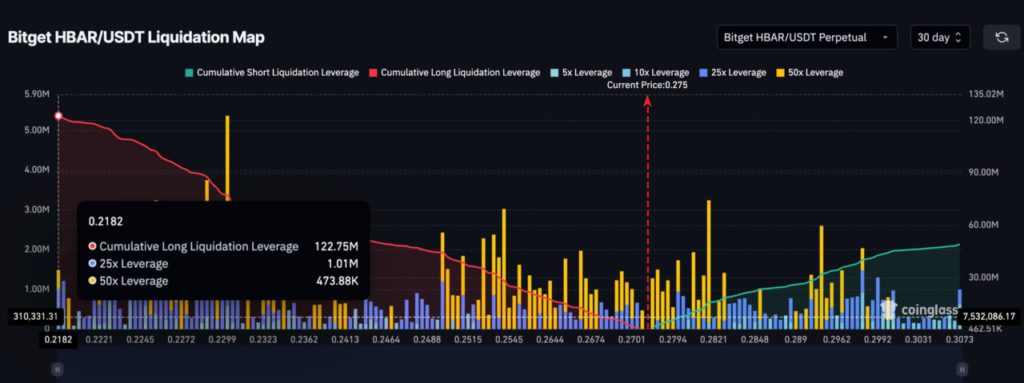

Derivative Positioning and Market Sentiment Still Show Optimism

Bitget’s liquidation map shows that long leverage still far exceeds short positions, with $122.75 million compared to $49 million. This signals that the market is still gearing up for a potential bull run. The Balance Volume (OBV) continues to show an upward trend confirming that buying activity is still outperforming selling activity overall. The Bull-Bear Strength Indicator (BBP) briefly turned negative but quickly returned to the green zone, indicating that the bulls are still in control.

HBAR’s price structure is currently in a dilemma between the descending triangle on the weekly chart and daily support. If the price fails to break the upper trend line of the triangle near $0.30, it is expected that August will bring a correction. Immediate support is at $0.26, followed by $0.23 and $0.21. If this zone is successfully defended by the bulls, a retest in the $0.29-$0.30 range is likely.

Conclusion: Outlook for HBAR in August

Although Hedera (HBAR) showed strong performance in July, history and current market conditions suggest that August may not be as bright as the previous month. Investors and traders should consider these factors when making investment decisions. It is always important to do your own research and consult a professional before making any financial decisions.

Also Read: 7 Facts How Ethereum Changed the World of Crypto & Cryptocurrency Over 10 Years!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. HBAR Price August Outlook. Accessed on August 1, 2025