Pi Network (PI) Plummets to IDR5,242: Check out these 5 facts that will determine the crypto’s fate!

Jakarta, Pintu News – Pi Network (PI) started August 2025 on a bitter note: the token price plummeted to an all-time low of US$0.32 (~Rp5,242). Although it had corrected upwards to US$0.36 (IDR5,897), the bearish sentiment is still looming. So, will Pi Network be able to recover or will it slump further? Here are five crucial facts that you must know before deciding to invest in this crypto.

1. Pi Rises 4%, but Negative Divergence Threatens

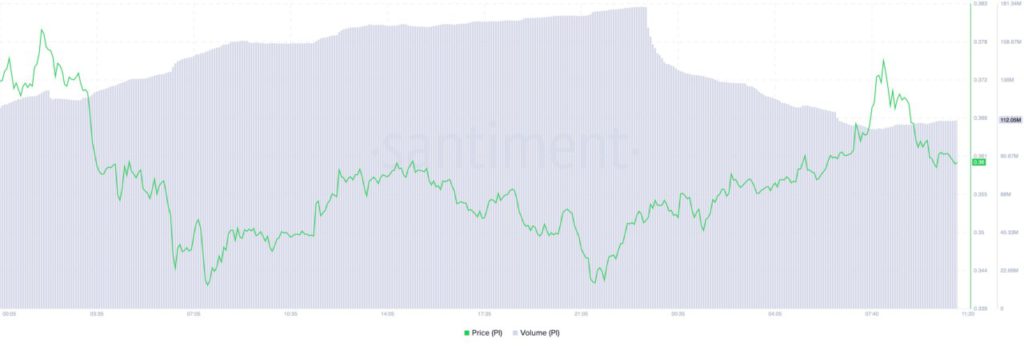

After falling to US$0.32 (IDR5,242), PI rebounded 4% to US$0.36 (IDR5,897) in the last 24 hours. However, behind this brief surge, there was a 30% drop in trading volume to around US$112 million (IDR1.83 trillion).

A decrease in volume when the price is rising is referred to as negative divergence-an indication that the price increase lacks strong buying interest. If this situation persists, the Pi Network’s rebound potential is very fragile and easily reversed by a new sell-off.

Also Read: 5 Crypto that Can Bring Bigger ROI than Bitcoin: Analysts’ Picks?

2. Parabolic SAR Indicator Still Bearish

The Parabolic Stop and Reverse (SAR) technical indicator is showing a bearish signal for PI. Currently, the SAR dots are above the PI price at around US$0.47 (IDR7,697), being a dynamic resistance level.

In simple terms, if the SAR dots are above the price, it means that the downtrend is still dominant. Until this indicator reverses below the price, traders need to be wary as selling pressure could potentially push the PI price further down.

3. Support and Resistance Ranges: Crucial Area Near All-Time Low

On the daily chart, PI is moving between strong support at the all-time low of US$0.32 (IDR5,242) and resistance at US$0.40 (IDR6,552). If the selling pressure continues, the price could return to the low or even set a new record lower.

However, if fresh demand emerges, PI prices could potentially break the resistance above US$0.40 and even try to reach US$0.46 (IDR7,535). Without an increase in volume and real demand, a bearish scenario is still more likely.

4. Short Term Rebound or Still Bearish? Check Volume Signals!

PI’s price surge in the last 24 hours was not followed by an increase in trading volume, in fact, it fell sharply. This indicates that buyers are not really convinced yet and the sell-off from the bear market is still looming.

In crypto analysis, volume is one of the key confirmations of a trend. If the price rises without volume, it is usually temporary and prone to reversal. Therefore, PI investors must pay attention to the development of volume before making entry decisions.

5. What Does PI Need to Rise?

The key to Pi Network’s comeback is the emergence of new demand and positive market sentiment. If PI projects are able to bring real utility or gain mass adoption, the chances of a rebound are stronger.

Conversely, without any new positive innovations or catalysts, PI risks falling back below support and extending the downtrend. Investors must be wise and do in-depth research before buying crypto with such high volatility.

Conclusion

In conclusion, Pi Network (PI) is in a crucial phase after plummeting to an all-time low. Despite a brief rebound, technical indicators and volume are not solid enough to confirm a trend reversal. Only innovation and real demand can lift PI prices from the current bearish pressure. Watch out before FOMO!

Also Read: 5 Crypto Ready to Pump After Bitcoin Consolidates in August 2025, Don’t Miss Out!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. What Pi Network Needs To Comeback From Its All-Time Low. Accessed August 4, 2025.