Ethereum Price Drop: Latest Market Analysis and Predictions Early August 2025

Jakarta, Pintu News – Ethereum has experienced high volatility in recent weeks, with a significant price drop from its recent local peak of $3,940 to $3,360. After a period of aggressive buying, the market is now showing signs of exhaustion. Market analysts are starting to exercise caution, warning that a deeper correction is possible if Ethereum (ETH) fails to defend key support zones.

Ethereum Market Dynamics Change

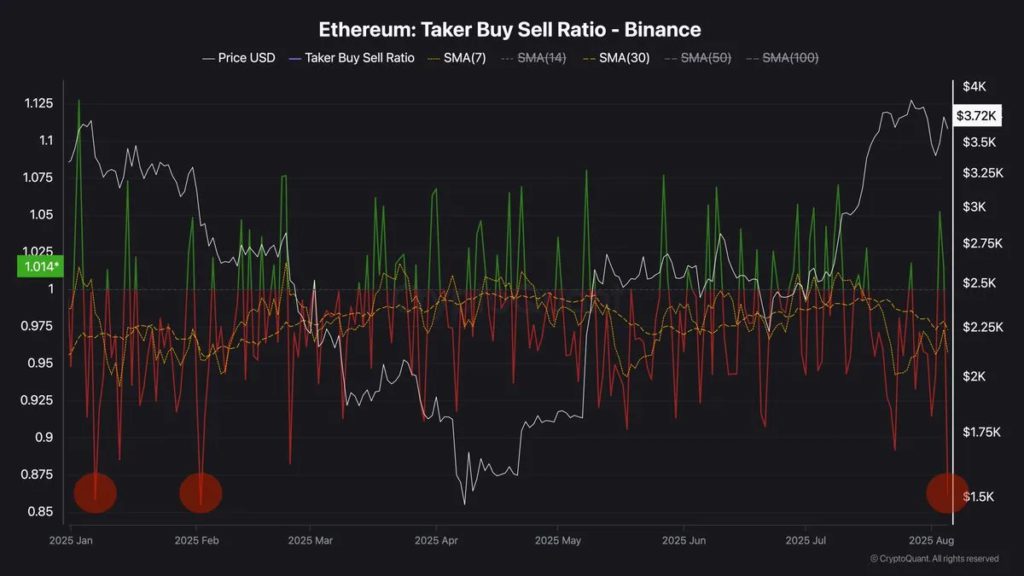

Recent data suggests a significant shift in the dynamics of the Ethereum (ETH) market. The taker buy/sell ratio, which is an important indicator in measuring the aggressiveness of buyers versus sellers, has declined sharply into negative territory today. This signals that sellers are currently dominating the order book, putting continued pressure on Ethereum (ETH) price action.

While some consider this a typical cooling phase after a big rally, others argue that Ethereum (ETH) is entering a riskier phase. Bearish sentiment could increase if key supports don’t hold. The coming days will be crucial in determining whether Ethereum (ETH) will stabilize at current levels or continue to slide into correction territory.

Also Read: Top 3 Crypto that Grew Up to 120% in the First Week of August, Got Your Token?

Short-Term Selling Pressure on Ethereum

According to leading analyst Darkfost, Ethereum’s (ETH) buy/sell taker ratio today plummeted into negative territory, reaching 0.87-one of the lowest levels recorded since the beginning of the year. This metric, which measures the ratio of aggressive buyers to sellers in the futures market, suggests that selling pressure is currently controlling the Ethereum (ETH) order book.

Although today’s data is still incomplete, current readings are already showing a predominance of sell orders on Ethereum (ETH) futures. Darkfost notes that this shift has been developing for several weeks. Since July 18, the buy/sell taker ratio has been generally negative, which correlates with Ethereum’s (ETH) inability to break through key resistance levels and its transition into a short-term consolidation phase.

Price Analysis: Recovery Efforts After Sharp Decline

Ethereum (ETH) is currently trading at $3,654.60, trying to stabilize after a sharp correction from its latest peak around $3,940. The 4 hours chart shows a recovery bounce that converges with resistance near its 50-period SMA (currently at $3,668.28), signaling that buyers are facing strong selling pressure at this level.

Despite the bounce, Ethereum (ETH) is still below the key horizontal resistance at $3,860.80, which has stymied several upside attempts in recent weeks. Bullish attempts to reclaim momentum earlier today were rejected near this level, resulting in a quick retracement back to the $3,600-$3,650 zone.

Conclusion: The Future of Ethereum is in the Hands of the Market

Although Ethereum (ETH) is facing short-term selling pressure, its long-term foundations still point to upside potential once this phase of selling pressure subsides. Stabilization and consolidation above the critical support zone could offer a healthy basis for the next leg up. However, failure to sustain levels above $3,600 could open up opportunities for a retest of lower support levels around $3,300-$3,350.

Also Read: Are These 3 Altcoins Likely to Print All-Time High in August 2025?

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Ethereum Consolidation Deepens as Taker Buy-Sell Ratio Hits One of the Lowest Levels This Year. Accessed on August 6, 2025