The Price of Ethereum (ETH) Since Its Launch, All-Time High (ATH), and Yearly Progress

Jakarta, Pintu News – Ethereum is one of the world’s largest cryptocurrencies that has experienced a remarkable price journey since its launch in 2015.

From a starting price of under $1 to breaking into the thousands of dollars, ETH has gone through various market phases, technological innovations, and adoption momentum that influenced its value movement.

Studying Ethereum’s price year over year can provide a clear picture of how technological developments, crypto market trends, and major events affect the valuation of this asset.

This article looks at the year-to-year development of Ethereum’s price and the background of the key events that drove those changes.

Ethereum Price 2015 – The Beginning of the Journey

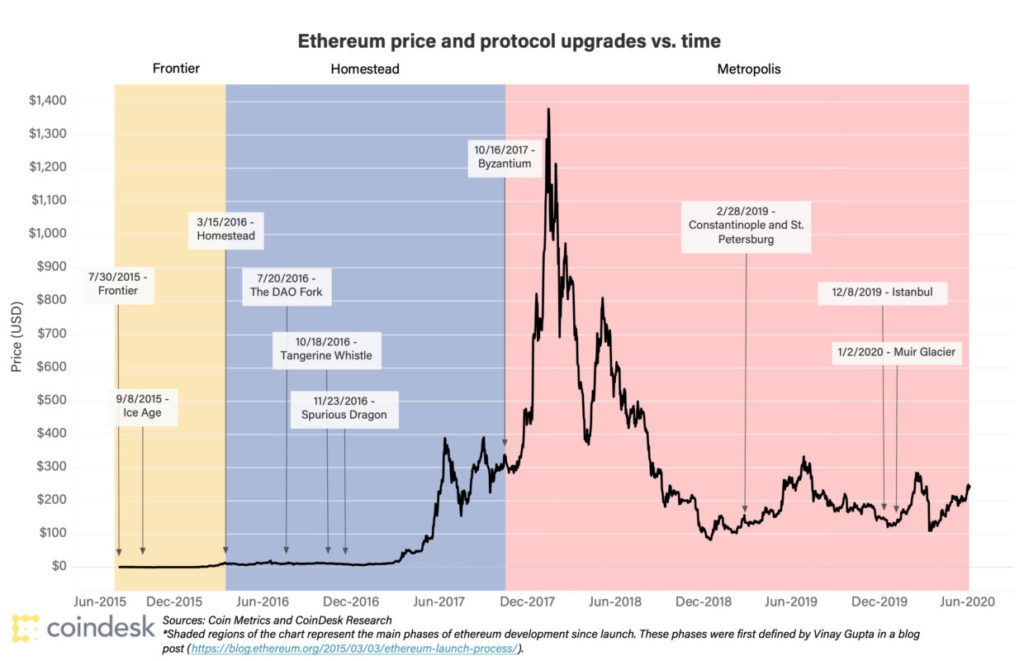

In 2015, Ethereum was officially launched and marked a new era in the blockchain world. The first Ethereum mainnet came out or was released on July 30, 2015, bringing the concept of smart contracts and the Ethereum virtual machine (EVM) that allows developers to create decentralized applications(dApps) on top of the blockchain.

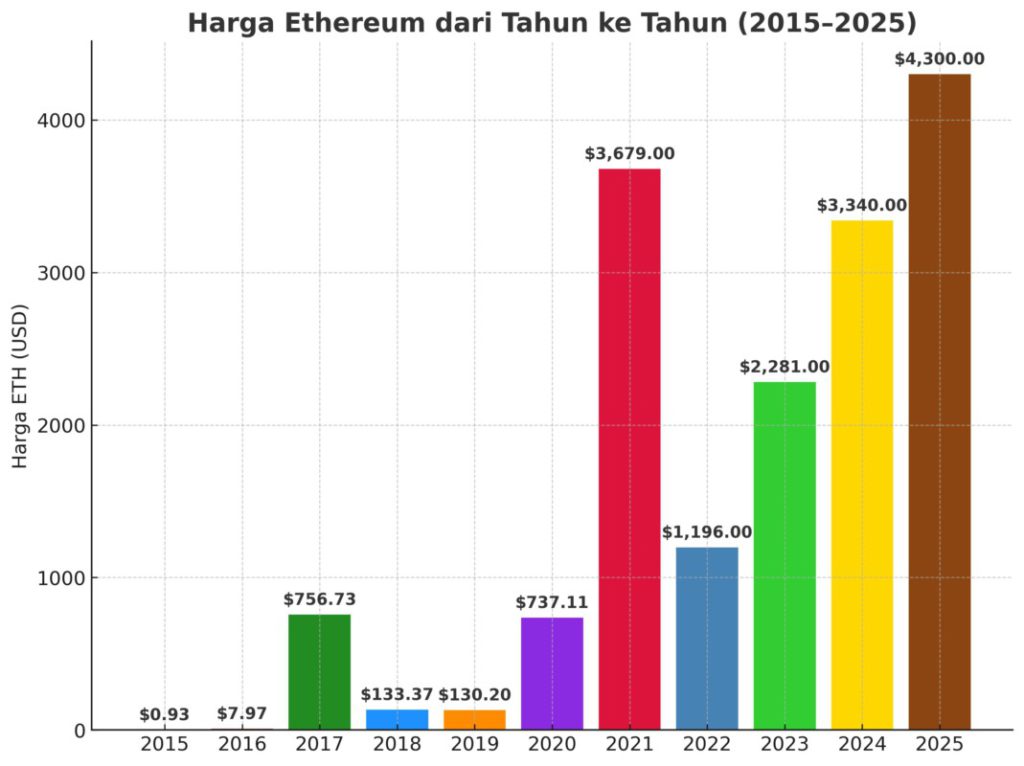

The 2015 Ethereum price was $0.93 as of July 30, 2015 which is equivalent to IDR15,118 (exchange rate of $1 = IDR16,255) according to Coinlore historical data. At that time, trading volume was minimal as the asset was newly introduced and the supporting infrastructure was not widely available on global exchanges.

This early phase was a pivotal moment for building the community and ecosystem. Many early investors bought ETH as a show of faith in the long-term vision of Vitalik Buterin and his development team.

Ethereum Price 2016 – Early Challenges and The DAO Hack

The year 2016 was a big test for Ethereum in maintaining community trust. Ethereum’s 2016 price was $7.97 at the end of 2016 which is equivalent to Rp129,560 (exchange rate $1 = Rp16,255), up significantly from the previous year thanks to increased public awareness of the potential of smart contracts.

However, in June 2016, The DAO project-a decentralized autonomous organization built on Ethereum-suffered a major hack that led to the loss of approximately 3.6 million ETH.

The value of the loss at the time was equivalent to tens of millions of US dollars, sparking a heated debate about the security of smart contracts and the future of the Ethereum network.

To address the incident, the Ethereum community decided to hard fork on July 20, 2016, splitting the blockchain into Ethereum (ETH) and Ethereum Classic (ETC). This decision was taken to recover the stolen funds, but it also caused controversy because it touched on the “code is law” principle that has been upheld in the crypto world.

Also read: 6 Countries that Hold the Most Bitcoin by 2025

Ethereum Price 2017 – ICO Explosion

The year 2017 was a historic moment for Ethereum as the price of ETH experienced a tremendous surge. The ERC-20 token standard introduced on the Ethereum network made it easier to launch Initial Coin Offering (ICO) projects, a fundraising method that allows investors to purchase new tokens using ETH.

The surge in interest in ICOs sent demand for ETH soaring, pushing the price of Ethereum up from around $8 at the beginning of the year to hundreds of dollars within a few months. The 2017 Ethereum price was $756.73 at the end of 2017 which is equivalent to Rp12,298,748 (exchange rate $1 = Rp16,255). The peak of euphoria occurred in January 2018, when ETH almost touched the $1,400 level before experiencing a correction.

Beyond the ICO trend, 2017 also marked a huge increase in development activity in the Ethereum ecosystem. Many large projects like EOS, TRON, and Binance started their journey with ERC-20 tokens on the Ethereum network before building their own blockchains. However, the high transaction activity also brought new challenges such as network congestion and spikes in gas fees.

Ethereum Price 2018 – Post-ICO Bear Market

2018 was a period of major correction for Ethereum after the euphoria of 2017. After reaching almost $1,400 in January 2018, the price of ETH experienced a drastic drop due to the bursting of the ICO bubble. Many projects launched at the height of the hype failed to fulfill their promises or were even abandoned, triggering massive capital outflows from the crypto market.

The 2018 Ethereum price was $133.37 at the end of 2018 which is equivalent to IDR 2,167,144 (exchange rate $1 = IDR 16,255). This decline was also influenced by unfavorable macroeconomic conditions and negative sentiment throughout the digital asset industry.

Despite the price drop, the Ethereum development team remains focused on the long-term roadmap. This year has been a period of preparation towards major updates such as Ethereum 2.0 with Proof-of-Stake and increased scalability.

Many developers and the core community are utilizing the bear market to strengthen the network’s foundations, build new protocols, and test various layer-2 solutions that will become an important part of the Ethereum ecosystem in the future.

Read also: 5 Phases of Altcoin Season

Ethereum Price 2019 – Consolidation Phase

The year 2019 was a transitional period for Ethereum after the crypto market turmoil of 2018. ETH price moved relatively stable throughout the year with moderate fluctuations, signaling a consolidation phase in the market.

The 2019 Ethereum price was $130.20 at the end of 2019 which is equivalent to IDR 2,116,851 (exchange rate $1 = IDR 16,255). Although there hasn’t been a significant price spike, development activity in the Ethereum ecosystem has been consistent.

Decentralized finance projects are starting to gain attention, with MakerDAO, Compound, and Uniswap being the pioneers that built the early foundations of the DeFi sector.

In addition, 2019 was also the year that the community began to seriously discuss plans to transition to Ethereum 2.0. Proof-of-Stake early-phase trials began on testnet, and various network improvement proposals continued to be explored to increase scalability and efficiency.

Ethereum Price 2020 – DeFi Summer

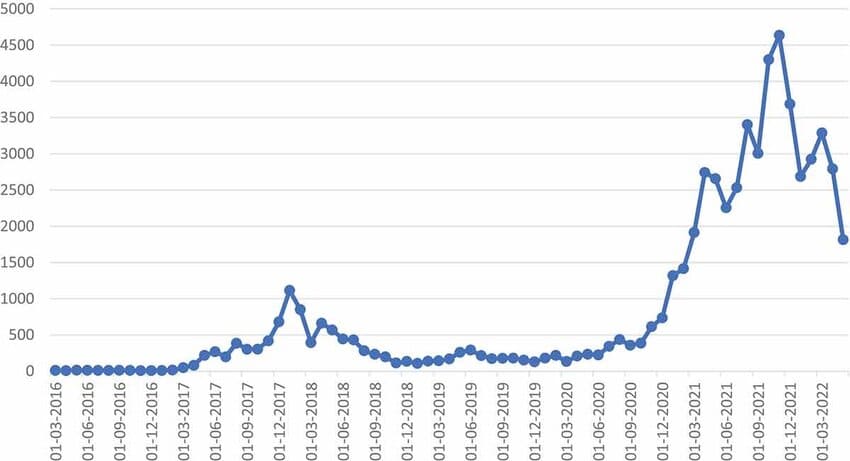

2020 was a turning point for Ethereum after a long period of consolidation. A phenomenon known as DeFi Summer sent demand for ETH soaring. Decentralized finance protocols like Aave, Curve, Uniswap, and Yearn Finance flourished, attracting billions of dollars into the Ethereum ecosystem.

ETH is the main asset for transaction fees and collateral on various DeFi platforms. The price of Ethereum 2020 is $737.11 at the end of 2020, which is equivalent to IDR 11,982,719 (exchange rate $1 = IDR 16,255).

In addition to the boost from DeFi, external factors also influenced ETH’s performance in 2020. Increased institutional interest in crypto assets, loose monetary policy due to the COVID-19 pandemic, and yield farming trends pushed on-chain activity to historic highs.

Ethereum Price 2021 – EIP-1559 and the New ATH

2021 has been one of the most historic periods for Ethereum. The surge in DeFi adoption, the rise of the NFT trend, and the growth of the Layer-2 ecosystem drove ETH demand to new heights.

The peak came in August 2021 when the London hard fork was launched, bringing the EIP-1559 proposal that changed the transaction fee mechanism. With theburning of a portion of thebase fee, ETH supply began to experience deflationary pressure during periods of high network activity.

The 2021 Ethereum price is $3,679 at the end of 2021 which is equivalent to IDR 59,783,245 (exchange rate $1 = IDR 16,255). Not only that, on November 10, 2021, Ethereum set an all-time record high (ATH) in the range of $4,878 which is equivalent to IDR 79.2 million (exchange rate $1 = IDR 16,255) before correcting.

In addition to technical innovations, external factors are also driving ETH prices. Institutional investors’ interest in NFTs and DeFi is growing, while Bitcoin’s early minting of ATH is helping to boost the overall crypto market capitalization.

The growth of on-chain activity saw Ethereum increasingly recognized not only as an investment asset, but also as a key infrastructure for Web3 innovation. 2021 is also remembered as a phase of massive expansion for the Ethereum ecosystem before entering the market challenges of the following year.

Also read: How to Use Pump.fun to Create Memecoins

Ethereum Price 2022 – The Merge

The year 2022 is one of the most historic moments in Ethereum’s journey, despite the overall crypto market being in a bear market phase.

On September 15, 2022, Ethereum officially went live with The Merge, a major update that changed the consensus mechanism from Proof-of-Work (PoW) to Proof-of-Stake (PoS).

This transition lowered the network’s energy consumption by about 99.95%, while significantly reducing the rate of new ETH issuance. However, macroeconomic conditions depressing risk asset markets, plus the collapse of several large projects in the crypto industry, kept prices depressed. The price of Ethereum 2022 is $1,196 at the end of 2022, which is equivalent to IDR 19,443,980 (exchange rate $1 = IDR 16,255).

Despite the price drop compared to the previous year, The Merge brought fundamental changes that strengthened Ethereum’s long-term narrative. The PoS model made the network more environmentally friendly and opened up staking yield opportunities for ETH holders. These changes also improved network security and prepared Ethereum for the next stage of development, such as sharding and Layer-2 optimization.

Ethereum 2023 Price – Shapella Upgrade

The year 2023 was a pivotal point for Ethereum in developing its staking ecosystem post-The Merge. On April 12, 2023, Ethereum launched the Shapella Upgrade (a hybrid of Shanghai and Capella) that allowed validators to withdraw the ETH they were staking.

This feature was previously unavailable since Ethereum switched to Proof-of-Stake, so its launch provides greater flexibility for investors and validators. The market responded positively to this update, where instead of a massive sell-off, much of the withdrawn ETH was re-staked or used in the DeFi ecosystem. The price of Ethereum 2023 is $2,281 at the end of 2023 which is equivalent to IDR 37,065,655 (exchange rate $1 = IDR 16,255).

In addition to the direct impact on staking, Shapella also increases investor confidence in Ethereum’s security and liquidity. This year, Layer-2 ecosystems such as Arbitrum, Optimism, and zkSync experienced significant growth, reducing transaction fees and expanding network usage.

Ethereum 2024 Price – Dencun & ETF Spot

The year 2024 has been a period full of positive catalysts for Ethereum. On March 13, 2024, the Ethereum network ran the Dencun Upgrade which brought the EIP-4844 or proto-danksharding proposal.

This update significantly lowers data fees for Layer-2s like Arbitrum, Optimism, and Base, making transactions cheaper and more efficient. In effect, application adoption at Layer-2 surged, strengthening Ethereum’s position as a scalable blockchain ecosystem.

Shortly after, big news came from the United States: The Spot Ethereum ETF was officially approved by the SEC and began trading on July 23, 2024. This event opened the door for institutional investors to invest directly in ETH without having to physically hold the asset. The price of Ethereum 2024 is $3,340 at the end of 2024 which is equivalent to IDR 54,306,700 (exchange rate $1 = IDR 16,255).

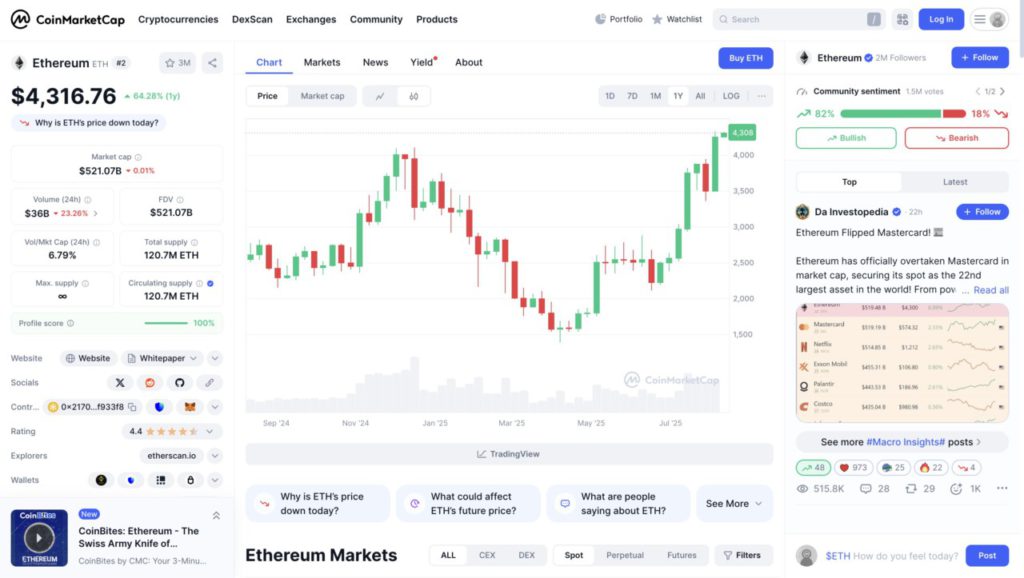

Ethereum 2025 Price – Momentum Post ETF

Entering 2025, Ethereum continued the positive trend that began with the launch of the Spot ETF in mid-2024. Capital flows from institutional investors continued to flow, creating a steady demand for ETH in the market.

In addition, the development of the Layer-2 ecosystem after the Dencun Upgrade has led to lower transaction costs and increased network throughput, resulting in the massive adoption of decentralized applications (dApps).

The price of Ethereum 2025 in Indonesia is $4,300 as of August 11, 2025 which is equivalent to Rp69,900,741 (exchange rate $1 = Rp16,255). This achievement shows that Ethereum has managed to maintain market interest despite high crypto volatility.

This year, the focus of the Ethereum community and developers has been on increasing network capacity through research and development of full and sharding, which is expected to further increase scalability without compromising security.

Conclusion

To summarize the Ethereum price year-on-year, here’s an infographic:

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- TradingView

- Mudrex. Ethereum Price History Explained: 6 Key Facts You Need to Know in 2024. Accessed August 11, 2025

- Featured Image: Decrypt